Amended Current Report Filing (8-k/a)

June 07 2023 - 10:20AM

Edgar (US Regulatory)

0000845819

true

Amendment No. 1

0000845819

2022-06-14

2022-06-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: June 14, 2022

KonaTel, Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Former name or address, if changed since last report)

| Delaware |

|

001-10171 |

|

80-0973608 |

|

(State or Other Jurisdiction

Of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

500 N. Central Expressway, Suite 202

Plano, Texas 75074

(Address of Principal

Executive Offices, Including Zip Code)

(214) 323-8410

(Registrant’s

Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the Registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter or Rule 12b-2 of the Securities

and Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

FORWARD LOOKING STATEMENTS

This Current Report contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements

by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would,” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future

performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will

be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown

risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different

from the information expressed or implied by the forward-looking statements in this Current Report. We cannot assure you that the forward-looking

statements in this Current Report will prove to be accurate, and therefore, prospective investors are encouraged not to place undue reliance

on forward-looking statements. You should carefully read this Current Report completely, and it should be read and considered with all

other reports filed by us with the United States Securities and Exchange Commission (the “SEC”). Other than as required by

law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

EXPLANATORY NOTES

Except as otherwise indicated by context, references

to the “Company,” “we,” “our,” “us” and words of similar import refer to “KonaTel,

Inc.,” a Delaware corporation, formerly named Dala Petroleum Corp., which is the Registrant (“KonaTel”), and our wholly-owned

subsidiaries, KonaTel, Inc., a Nevada corporation (“KonaTel Nevada”), Apeiron Systems, Inc., a Nevada corporation (“Apeiron

Systems”), and IM Telecom, LLC, an Oklahoma limited liability company doing business as “Infiniti Mobile” (“IM

Telecom” or “Infiniti Mobile”).

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On June 14, 2022, we and our wholly-owned subsidiary

companies, Apeiron Systems and IM Telecom, entered into a Note Purchase Agreement (the “NPA”) with CCUR Holdings, Inc., a

Delaware corporation (respectively, “CCUR” and the “CCUR Loan”), as “Collateral Agent”; and CCUR and

Symbolic Logic, Inc., a Delaware corporation (“Symbolic”), as “Purchasers,” along with a related Guarantee and

Security Agreement (the “GSA”) with CCUR as the Collateral Agent, whereby the Company and its subsidiary companies pledged

all of their assets to secure $3,150,000 (the “Principal Amount”) in debt financing payable in one (1) year (could not be

repaid prior to nine (9) months), together with interest at the rate of 15% per annum (the “Interest Rate”), with two (2)

successive six (6) month optional extensions.

On April 28, 2023, the Company provided notice to

CCUR of its election to utilize the “First Extension Option” by an additional six (6) months. As part of the condition to

extend, the Company paid $47,250 to CCUR, which is equal to one and a half percent (1.5%) of the outstanding principal amount of the CCUR

Loan. A summary of these agreements, along with copies of the NPA and GSA are contained in the 8-K Current Report of the Company dated

June 14, 2022, and filed with the SEC on June 21, 2022, which can be accessed by Hyperlink in Part II, Item 6 hereof.

Pursuant to the terms of the NPA, the Company has

provided notice to CCUR that it intends to exercise the second of its two (2) optional six (6) month extensions beginning on June 14,

2023.

On June 1, 2023, we entered into a “First Amendment

to the NPA” with CCUR and Symbolic. The purpose for the amendment was to add further growth capital to the Company in the form of

“Delayed Draw Notes” in an aggregate principal amount of up to $2,000,000; and in consideration therefor, we provided additional

collateral for the NPA by the assignment of our Purchase of Contract Rights Agreement between us and Insight Mobile (the “Assignment

Agreement”) under a Collateral Assignment of Acquisition Documents (the “Collateral Assignment of Acquisition Documents”),

the terms of which are summarized below, with all summaries being subject to the referenced Exhibits that are attached hereto in Part

II, Item 6 hereof. A copy of the initial Assignment Agreement is contained in the 8-K Current Report of the Company dated April 6, 2023,

and filed with the SEC on April 17, 2023, which can be accessed by Hyperlink in Part II, Item 6 hereof.

On June 1, 2023, the Company exercised the first draw

under the First Amendment to the NPA of $500,000. Notable items associated with the First Amendment to NPA are the following:

● Delayed

Draw Notes shall be in increments of $500,000 and shall not to exceed $2,000,000;

● The

“Origination Fee” for each $500,000 increment shall be three percent (3%);

● The

initial interest rate established in the NPA shall be increased by three percent (3%);

●

The First Amendment to NPA provides for a third six (6) month extension of the term, provided that the Company remains compliant

with its obligations contained within the NPA; and

● No

prepayment penalty exists as the Company has completed the initial nine (9) month CCUR Loan minimum period.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

Incorporated by reference:

8-K Current Report dated June 14, 2022, and filed with the SEC on June 21, 2022.

8-K Current Report dated April 6, 2023, and filed with the SEC on April 17, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

KonaTel, Inc. |

| |

|

| Date: June 6, 2023 |

By: |

/s/ D. Sean McEwen |

| |

|

D. Sean McEwen |

| |

|

Chairman and Chief Executive Officer |

3

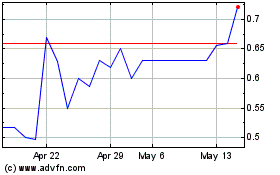

KonaTel (QB) (USOTC:KTEL)

Historical Stock Chart

From May 2024 to Jun 2024

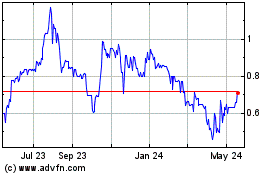

KonaTel (QB) (USOTC:KTEL)

Historical Stock Chart

From Jun 2023 to Jun 2024