false

0001001601

0001001601

2023-12-18

2023-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): December 18, 2023

MGT

Capital Investments, Inc.

| Delaware |

|

001-32698 |

|

13-4148725 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2076

Foster Mill Drive

LaFayette,

GA |

|

27601 |

|

(914)

630-7430 |

(Address

of principal

executive

offices) |

|

(Zip

Code) |

|

(Registrant’s

telephone number,

including

area code) |

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

December 19, 2023, MGT Capital Investments, Inc. (the “Company”) entered into an agreement (the “Agreement”)

with Project Nickel LLC, the holder of that certain Original Issue Discount Secured Convertible Promissory Note dated September 12, 2022

in the principal amount of $1,500,000 (the “Note”), pursuant to which the holder exchanged the Note for a new Note having

substantially similar terms to the prior Note except with a maturity date of December 31, 2024 and with a conversion feature based on

40% of the Company’s outstanding Common Stock on a fully-diluted basis (not including warrants or shares of common stock underlying

warrants issued or issuable to the holder), rather than 30%. The terms of the prior Note are disclosed in the Company’s

Current Report on Form 8-K filed on September 14, 2022.

The

foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement

and the new Note, copies of which are filed herewith as Exhibits 10.1 and 4.1, respectively, to this Current Report on Form 8-K.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosure set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. In addition to the exchange

described above, on December 18, 2023, the Company issued 40,000,000 shares of common stock in connection with a cashless exercise of

outstanding warrants. The transactions were exempt from registration under Section 3(a)(9) of the

Securities Act of 1933. Following this issuance, the Company has 845,170,903 shares outstanding.

Item

9.01 Financial Statements and Exhibits

**

Certain schedules, appendices and exhibits to this agreement have been omitted in accordance with

Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished supplementally to the Securities and

Exchange Commission staff upon request.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

MGT

Capital Investments, Inc. |

| |

|

|

|

| Date:

|

December

20, 2023 |

By:

|

/s/

Robert B. Ladd |

| |

|

Name: |

Robert

B. Ladd |

| |

|

Title: |

Chief

Executive Officer and Acting Chief Financial Officer |

Exhibit

4.1

EXHIBIT

A

Form

of Note

NEITHER

THIS SECURITY NOR THE SECURITIES INTO WHICH THIS SECURITY IS CONVERTIBLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION

OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS

OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR

TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THIS SECURITY AND THE SECURITIES ISSUABLE UPON

CONVERSION OF THIS SECURITY MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN SECURED BY SUCH SECURITIES.

$1,578,840

Principal

original

issue discount

SECURED

Convertible PROMISSORY NOTE

THIS

ORIGINAL ISSUE DISCOUNT SECURED CONVERTIBLE PROMISSORY NOTE is duly authorized and validly issued at an original issue discount by MGT

Capital Investments, Inc., a Delaware corporation (the “Company”) (the “Note”).

FOR

VALUE RECEIVED, the Company promises to pay to Project Nickel LLC or its permitted assigns (the “Holder”), the principal

sum of $1,578,840 on December 31, 2024 (the “Maturity Date”) or such earlier date as this Note is required or permitted to

be repaid as provided hereunder, and to pay interest to the Holder on the aggregate unconverted and then outstanding principal amount

of this Note in accordance with the provisions hereof. This Note is subject to the following additional provisions:

Section

1. Definitions. For the purposes hereof, (a) capitalized terms not otherwise defined herein shall have the meanings set forth

in the Purchase Agreement and (b) the following words and phrases shall have the following meanings:

“Alternate

Consideration” shall have the meaning set forth in Section 5(e).

“Bankruptcy

Event” means any of the following events: (a) the Company or any Subsidiary thereof commences a case or other proceeding under

any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar

law of any jurisdiction relating to the Company or any Subsidiary thereof, (b) there is commenced against the Company or any Subsidiary

thereof any such case or proceeding that is not dismissed within 30 days after commencement, (c) the Company or any Subsidiary thereof

is adjudicated insolvent or bankrupt or any order of relief or other order approving any such case or proceeding is entered, (d) the

Company or any Subsidiary thereof suffers any appointment of any custodian or the like for it or any substantial part of its property

that is not discharged or stayed within 30 calendar days after such appointment, (e) the Company or any Subsidiary thereof makes a general

assignment for the benefit of creditors, (f) the Company or any Subsidiary thereof calls a meeting of its creditors with a view to arranging

a composition, adjustment or restructuring of its debts or (g) the Company or any Subsidiary thereof, by any act or failure to act, expressly

indicates its consent to, approval of or acquiescence in any of the foregoing or takes any corporate or other action for the purpose

of effecting any of the foregoing.

“Base

Conversion Price” shall have the meaning set forth in Section 5(b).

“Beneficial

Ownership Limitation” shall have the meaning set forth in Section 4(e).

“Buy-In”

shall have the meaning set forth in Section 4(c)(vii).

“Change

of Control Transaction” means the occurrence after the date hereof of any of (a) an acquisition after the date hereof by an individual

or legal entity or “group” (as described in Rule 13d-5(b)(1) promulgated under the Exchange Act) of effective control (whether

through legal or beneficial ownership of capital stock of the Company, by contract or otherwise) of in excess of 50% of the voting securities

of the Company (other than by means of conversion, exercise or exchange of this Note or the Warrants issued together with this Note),

(b) the Company merges into or consolidates with any other Person, or any Person merges into or consolidates with the Company and, after

giving effect to such transaction, the shareholders of the Company immediately prior to such transaction own less than 50% of the aggregate

voting power of the Company or the successor entity of such transaction, (c) the Company sells or transfers all or substantially all

of its assets to another Person, (d) a replacement at one time or within a three year period of more than one-half of the members of

the Board of Directors which is not approved by a majority of those individuals who are members of the Board of Directors on the Original

Issue Date (or by those individuals who are serving as members of the Board of Directors on any date whose nomination to the Board of

Directors was approved by a majority of the members of the Board of Directors who are members on the date hereof), or (e) the execution

by the Company of an agreement to which the Company is a party or by which it is bound, providing for any of the events set forth in

clauses (a) through (d) above.

“Common

Stock Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire at

any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at

any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion”

shall have the meaning ascribed to such term in Section 4.

“Conversion

Date” shall have the meaning set forth in Section 4(a).

“Conversion

Shares” means, collectively, the shares of Common Stock issuable upon conversion of this Note in accordance with the terms hereof.

“Default

Interest Rate” shall have the meaning set forth in Section 2(a).

“DWAC”

means the Deposit or Withdrawal at Custodian system at The Depository Trust Company.

“Event

of Default” shall have the meaning set forth in Section 7(a).

“Exchange

Act” means the Securities Exchange Act of 1934, and the rules and regulations promulgated thereunder.

“Exempt

Issuance” shall have the meaning set forth in the Purchase Agreement.

“Indebtedness”

shall have the meaning set forth in the Purchase Agreement.

“Liens”

shall have the meaning set forth in the Purchase Agreement.

“Mandatory

Default Amount” means the sum of 110% of the aggregate of (i) the outstanding principal amount of this Note and the accrued

and unpaid interest thereon, including default interest, and (b) all other amounts, costs, expenses and liquidated damages due in respect

of this Note.

“Note

Register” shall have the meaning set forth in Section 3(c).

“Notice

of Conversion” shall have the meaning set forth in Section 4(a).

“Original

Issue Date” means the date of the first issuance of this Note, regardless of any transfers of this Note and regardless of the number

of instruments which may be issued to evidence this Note.

“Permitted

Indebtedness” means (a) the indebtedness evidenced by this Note and the other Original Issue Discount Senior Convertible Promissory

Notes sold to purchasers on the date hereof, (b) capital lease obligations and purchase money indebtedness incurred in connection with

the acquisition of machinery and equipment, (c) Indebtedness incurred after the date hereof provided that the net amount of the Indebtedness

incurred is used to immediately pay amounts due under the Notes and (d) the Indebtedness set forth on Schedule 3.1(v) to the Purchase

Agreement.

“Permitted

Lien” means the individual and collective reference to the following: (a) Liens for taxes, assessments and other governmental charges

or levies not yet due or Liens for taxes, assessments and other governmental charges or levies being contested in good faith and by appropriate

proceedings for which adequate reserves (in the good faith judgment of the management of the Company) have been established in accordance

with GAAP, (b) Liens imposed by law which were incurred in the ordinary course of the Company’s business, such as carriers’,

warehousemen’s and mechanics’ Liens, statutory landlords’ Liens, and other similar Liens arising in the ordinary course

of the Company’s business, and which (x) do not individually or in the aggregate materially detract from the value of such property

or assets or materially impair the use thereof in the operation of the business of the Company and its consolidated Subsidiaries or (y)

are being contested in good faith by appropriate proceedings, which proceedings have the effect of preventing for the foreseeable future

the forfeiture or sale of the property or asset subject to such Lien, (c) Liens incurred in connection with Permitted Indebtedness under

clauses (a) through (d) thereunder, and Liens set forth on Schedule 3.1(v) to the Purchase Agreement.

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability

company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Purchase

Agreement” means the Securities Purchase Agreement, dated as of August 24, 2022, by and among the Company and the original Holders,

as amended, modified or supplemented from time to time in accordance with its terms.

“SEC”

means the Securities and Exchange Commission.

“Securities

Act” means the Securities Act of 1933, and the rules and regulations promulgated thereunder.

“Share

Delivery Date” shall have the meaning set forth in Section 4(c)(ii).

“Standard

Settlement Period” shall have the meaning set forth in Section 4(c)(i).

“Successor

Entity” shall have the meaning set forth in Section 5(e).

“Trading

Day” means a day on which the principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in

question: the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, the NYSE

American, or any market, including the Pink Sheets, of the OTC Markets, Inc. (or any successors to any of the foregoing).

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30

a.m. (New York City time) to 4:02 p.m. (New York City time)) (or a similar organization or agency succeeding to its functions of reporting

prices), (b) if no volume weighted average price of the Common Stock is reported for the Trading Market, the most recent bid price per

share of the Common Stock so reported, or (c) in all other cases, the fair market value of a share of Common Stock as determined by an

independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which shall

be paid by the Company.

Section

2. Interest. Interest shall accrue to the Holder on the aggregate unconverted and then outstanding principal amount of this

Note at the rate of 6% per annum, calculated on the basis of a 360-day year and shall accrue daily commencing on the Original Issue Date

until payment in full of the outstanding principal (or conversion to the extent applicable), together with all accrued and unpaid interest,

liquidated damages and other amounts which may become due hereunder, has been made. Interest shall be paid on a monthly basis, the first

payment on September 30, 2022. During the existence of an Event of Default, interest shall accrue at the lesser of (i) the rate of 12%

per annum, or (ii) the maximum amount permitted by law (the lesser of clause (i) or (ii), the “Default Interest Rate”). Interest

shall be due on the first Trading Day of each calendar month during the existence of an Event of Default. Once an Event of Default is

cured, the interest rate shall return to 6%. The Company shall have the option to pay the interest in cash or Common Stock. If the Company

elects to pay the interest in Common Stock, the number of shares to be issued shall be equal to the quotient of the amount of interest

due to the Holder divided by the average of the VWAP of the Common Stock for the five (5) consecutive trading days immediately preceding

the due date thereof.

Section

3. Registration of Transfers and Exchanges.

(a)

Different Denominations. This Note is exchangeable for an equal aggregate principal amount of Notes of different authorized denominations,

as requested by the Holder surrendering the same. No service charge or other fees will be payable for such registration of transfer or

exchange.

(b)

Investor Representations. This Note has been issued subject to certain investment representations of the original Holder set forth

in the Purchase Agreement and may be transferred or exchanged only in compliance with the Purchase Agreement and applicable federal and

state securities laws and regulations.

(c)

Reliance on Note Register. Prior to due presentment for transfer to the Company of this Note, the Company and any agent of the

Company may treat the Person in whose name this Note is duly registered on the Note Register as the owner hereof for the purpose of receiving

payment as herein provided and for all other purposes, whether or not this Note is overdue, and neither the Company nor any such agent

shall be affected by notice to the contrary.

Section

4. Conversion.

(a)

Conversion. Any time prior to the effectuation of a Change of Control Transaction until this Note is no longer outstanding, this

Note shall be convertible, in whole or in part, at any time, and from time to time, into Conversion Shares at the option of the Holder.

The Holder shall effect the conversion by delivering to the Company a Notice of Conversion, the form of which is attached hereto as Annex

A (each, a “Notice of Conversion”), specifying therein the date on which such conversion shall be effected (such date,

the “Conversion Date”). If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall be the date

that such Notice of Conversion is deemed delivered hereunder. No ink-original Notice of Conversion shall be required, nor shall any medallion

guarantee (or other type of guarantee or notarization) of any Notice of Conversion form be required. To effect the conversion hereunder,

the Holder shall not be required to physically surrender this Note to the Company unless the entire principal amount of this Note, plus

all accrued and unpaid interest thereon and other charges, has been so converted.

(b)

Conversion Amount. Subject to the limitations herein, this Note shall be convertible into 40% of the outstanding shares of the Company’s

Common Stock on the Conversion Date on a post-conversion, fully-diluted basis (not including Warrants or Warrant Shares issued or issuable

to the Holder) (the “Conversion Percentage”). For example, if the Company has 600 million shares outstanding on a fully-diluted

basis on the date of conversion, the Note will be convertible into 400 million shares. For the avoidance of doubt the formula set forth

above shall not include Warrants or Warrant Shares issued or issuable to the Holder, but shall include all other Common Stock Equivalents

outstanding on the Conversion Date.

Notwithstanding

anything herein to the contrary, if the Holder elects to convert less than all of this Note, then in lieu of the Conversion Percentage,

the percentage to be used in determining the number of shares of Common Stock issuable in such conversion based on the formula set forth

above shall be determined by dividing (A) the portion of the Note being converted by (B) the total outstanding principal of the Note,

and multiplying such quotient by (C) 40% (such percentage, the “Partial Conversion Percentage”). For example, if $1,000,000

of principal remains outstanding on the Note and the Holder elects to convert $100,000, the Partial Conversion Percentage will be 4%

for such partial conversion, such that if 96 million shares of Common Stock were outstanding on a fully-diluted basis, the Holder would

be entitled to receive 4 million shares of Common Stock in such partial conversion. Following each such partial conversion, the Conversion

Percentage shall be reduced by the Partial Conversion Percentage.

(c)

Mechanics of Conversion or Repayment.

(i)

Delivery of Certificate Upon Conversion. Not later than the earlier of (i) two Trading Days after each Conversion Date or (ii)

the Standard Settlement Period (either, the “Share Delivery Date”), the Company shall deliver, or cause to be delivered,

to the Holder any certificate or certificates required to be delivered by the Company under this Section 4(c) which shall be free of

restrictive legends and trading restrictions except as provided by the Securities Act (other than those which may then be required by

the Purchase Agreement) and such shares shall be delivered electronically through the Depository Trust Company or another established

clearing corporation performing similar functions. As used herein, “Standard Settlement Period” means the standard settlement

period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect

on the date of delivery of the Notice of Conversion.

(ii)

Failure to Deliver Conversion Shares. If, in the case of any Notice of Conversion, such Conversion Shares are not delivered to

or as directed by the applicable Holder by the Share Delivery Date, the Holder shall be entitled to elect by written notice to the Company

at any time on or before its receipt of such Conversion Shares, to rescind such conversion, in which event the Company shall promptly

return to the Holder any original Note delivered to the Company.

(iii)

Obligation Absolute; Partial Liquidated Damages. The Company’s obligations to issue and deliver the Conversion Shares upon

conversion of this Note in accordance with the terms hereof, are absolute and unconditional, irrespective of any action or inaction by

the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any

Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged

breach by the Holder or any other Person of any obligation to the Company or any violation or alleged violation of law by the Holder

or any other Person, and irrespective of any other circumstance which might otherwise limit such obligation of the Company to the Holder

in connection with the issuance of such Conversion Shares. In the event the Holder of this Note shall elect to convert any or all of

the outstanding principal amount hereof, the Company may not refuse conversion based on any claim that the Holder or anyone associated

or affiliated with the Holder has been engaged in any violation of law, agreement or for any other reason, unless an injunction from

a court, on notice to Holder, restraining and or enjoining conversion of all or part of this Note shall have been sought and obtained,

and the Company posts a surety bond for the benefit of the Holder. The exercise of any such rights shall not prohibit the Holder from

seeking to collect damages under this Note, the Purchase Agreement or under applicable law.

(iv)

Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of this Note.

As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Company shall at its

election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion

Price or round up the fraction to the next whole share as long as it does not violate the Beneficial Ownership Limitation in which case

the fractional share shall be disregarded to the next whole share.

(v)

Transfer Taxes and Expenses. The issuance of Conversion Shares on conversion of this Note shall be made without charge to the

Holder hereof for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificates.

The Company shall pay all Transfer Agent fees required for same-day processing of any Notice of Conversion and all fees to the Depository

Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery of

the Conversion Shares.

(vi)

Reservation of Shares Issuable Upon Conversion. The Company covenants that in accordance with and pursuant to Section 4.8 of the

Purchase Agreement it will at all times reserve and keep available out of authorized and unissued shares of Common Stock for the sole

purpose of issuance upon conversion of this Note and payment of interest on this Note, each as herein provided, free from preemptive

rights or any other actual contingent purchase rights of Persons other than the Holder (and the other holders of the Notes), such aggregate

number of shares of the Common Stock as required by Section 4.8 of the Purchase Agreement and as shall be issuable upon the conversion

of the then outstanding principal amount of this Debenture and payment of interest hereunder. The Company covenants that all shares of

Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and nonassessable and, if a

registration statement covering the resale of the Conversion Shares is then effective under the Securities Act, shall be registered for

public resale in accordance with such registration statement.

(vii)

Compensation for Buy-In on Failure to Timely Deliver Conversion Shares Upon Conversion. In addition to any other rights available

to the Holder, if the Company fails for any reason (other than the failure of Holder’s attorney to timely deliver any opinion required

in connection with such conversion) to deliver to the Holder such Conversion Shares by the Share Delivery Date pursuant to Section 4(c)(ii),

and if after such Share Delivery Date the Holder is required by its brokerage firm to purchase (in an open market transaction or otherwise),

or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of

the Conversion Shares which the Holder was entitled to receive upon the conversion relating to such Share Delivery Date (a “Buy-In”),

then the Company shall have the remedies provided for in accordance with Section 4.1 of the Purchase Agreement. Nothing herein or therein

shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation,

a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver Conversion Shares

upon conversion of this Note as required pursuant to the terms hereof.

(d)

Holder’s Conversion Limitations. The Company shall not effect any conversion of this Note, and a Holder shall not have the

right to convert any portion of this Note, to the extent that after giving effect to the conversion set forth on the applicable Notice

of Conversion, the Holder (together with the Holder’s Affiliates, and any Persons acting as a group together with the Holder or

any of the Holder’s Affiliates) would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For

purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and its Affiliates shall include

the number of shares of Common Stock issuable upon conversion of this Note with respect to which such determination is being made, but

shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted principal amount

of this Note beneficially owned by the Holder or any of its Affiliates and (ii) exercise or conversion of the unexercised or unconverted

portion of any other securities of the Company subject to a limitation on conversion or exercise analogous to the limitation contained

herein (including, without limitation, any other Notes or the Warrants) beneficially owned by the Holder or any of its Affiliates. Except

as set forth in the preceding sentence, for purposes of this Section 4(d), beneficial ownership shall be calculated in accordance with

Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. To the extent that the limitation contained in

this Section 4(d) applies, the determination of whether this Note is convertible (in relation to other securities owned by the Holder

together with any Affiliates) and of which principal amount of this Note is convertible shall be in the sole discretion of the Holder,

and the submission of a Notice of Conversion shall be deemed to be the Holder’s determination of whether this Note may be converted

(in relation to other securities owned by the Holder together with any Affiliates) and which principal amount of this Note is convertible,

in each case subject to the Beneficial Ownership Limitation. To ensure compliance with this restriction, the Holder will be deemed to

represent to the Company each time it delivers a Notice of Conversion that such Notice of Conversion has not violated the restrictions

set forth in this Section 4(d) and the Company shall have no obligation to verify or confirm the accuracy of such determination. In addition,

a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act

and the rules and regulations promulgated thereunder. For purposes of this Section 4(d), in determining the number of outstanding shares

of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as stated in the most recent of the following:

(i) the Company’s most recent periodic or annual report filed with the SEC, as the case may be, (ii) a more recent public announcement

by the Company, or (iii) a more recent written notice by the Company or the Company’s Transfer Agent setting forth the number of

shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall within two Trading Days confirm orally

and in writing to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of

Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Note,

by the Holder or its Affiliates since the date as of which such number of outstanding shares of Common Stock was reported. The “Beneficial

Ownership Limitation” shall be 4.99% of the number of shares of the Common Stock outstanding immediately after giving effect to

the issuance of shares of Common Stock issuable upon conversion of this Note held by the Holder. The Holder, upon notice to the Company,

may increase or decrease the Beneficial Ownership Limitation provisions of this Section 4(d), provided that the Beneficial Ownership

Limitation in no event exceeds 9.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance

of shares of Common Stock upon conversion of this Note held by the Holder and the Beneficial Ownership Limitation provisions of this

Section 4(d) shall continue to apply. Any such increase or decrease will not be effective until the 61st day after such notice is delivered

to the Company. The Beneficial Ownership Limitation provisions of this paragraph shall be construed and implemented in a manner otherwise

than in strict conformity with the terms of this Section 4(d) to correct this paragraph (or any portion hereof) which may be defective

or inconsistent with the intended Beneficial Ownership Limitation contained herein or to make changes or supplements necessary or desirable

to properly give effect to such limitation. The limitations contained in this Section 4(d) shall apply to a successor holder of this

Note.

Section

5. Negative Covenants. As long as any portion of this Note remains outstanding, unless the holders of at least 50% in

principal amount of the then outstanding Notes shall have otherwise given prior written consent, the Company shall not, and shall

not permit any of the Subsidiaries to, directly or indirectly:

(a)

other than Permitted Indebtedness, enter into, create, incur, assume, guarantee or suffer to exist any indebtedness for borrowed money

of any kind, including, but not limited to, a guarantee, on or with respect to any of its property or assets now owned or hereafter acquired

or any interest therein or any income or profits therefrom, unless the net proceeds of such Indebtedness are immediately used to pay

amounts due hereunder;

(b)

other than Permitted Liens, enter into, create, incur, assume or suffer to exist any Liens of any kind, on or with respect to any of

its property or assets now owned or hereafter acquired or any interest therein or any income or profits therefrom;

(c)

amend its charter documents, including, without limitation, its articles of incorporation and bylaws, in any manner that materially and

adversely affects any rights of the Holder, increases in authorized shares and stock splits shall not be deemed to materially and adversely

affects any rights of the Holder;

(d)

purchase or otherwise acquire more than a de minimis number of shares of its Common Stock or Common Stock Equivalents;

(e)

repay, or offer to repay, any Indebtedness other than the Note as provided in Section 2(b) or Permitted Indebtedness, as such terms Indebtedness

and Permitted Indebtedness are in effect as of the Original Issue Date, provided that such payments other than on the Notes shall not

be permitted if, at such time, or after giving effect to such payment, any Event of Default exists or occurs or the Company is not be

able to satisfy obligations owing to the Noteholders;

(f)

pay cash dividends or distributions on any equity securities of the Company;

(g)

enter into any transaction with any Affiliate of the Company which would be required to be disclosed in any public filing with the SEC

assuming that the Company is subject to the Securities Act or the Exchange Act, unless such transaction is made on an arm’s-length

basis;

(h)

issue any equity securities of the Company other than pursuant to or as permitted by the provisions of the Purchase Agreement, this Note

or an Exempt Issuance; or

(i)

enter into any agreement with respect to any of the foregoing.

Section

6. Events of Default.

(a)

“Event of Default” means, wherever used herein, any of the following events (whatever the reason for such event and

whether such event shall be voluntary or involuntary or effected by operation of law or pursuant to any judgment, decree or order of

any court, or any order, rule or regulation of any administrative or governmental body):

(i)

any default in the payment of (A) principal and interest payment under this Note or any other Indebtedness, or (B) late fees, liquidated

damages and other amounts owing to the Holder of this Note, as and when the same shall become due and payable (whether on a Conversion

Date, or the Maturity Date, or by acceleration or otherwise), which default, solely in the case of a default under clause (B) above,

is not cured within five (5) Trading Days;

(ii)

the Company shall fail to observe or perform any other covenant or agreement contained in this Note (other than a breach by the Company

of its obligations to deliver Conversion Shares, which breach is addressed in clause (xvi) below) or any Transaction Document which failure

is not cured, if possible to cure, within the earlier to occur of ten (10) Trading Days after notice of such failure is sent by the Holder

or by any other Holder to the Company and (B) the Company has become aware of such failure;

(iii)

any representation or warranty made in this Note, any other Transaction Document, any written statement pursuant hereto or thereto or

any other report, financial statement or certificate made or delivered to the Holder or any other Holder shall be untrue or incorrect

in any material respect as of the date when made or deemed made, which failure is not cured, if possible to cure, within the earlier

to occur of ten (10) Trading Days after (A) notice of such failure is sent by the Holder or (B) by any other Holder to the Company;

(iv)

the Company or any Subsidiary shall be subject to a Bankruptcy Event;

(v)

the Company or any Subsidiary shall: (A) apply for or consent to the appointment of a receiver, trustee, custodian or liquidator of it

or any of its properties; (B) admit in writing its inability to pay its debts as they mature; (C) make a general assignment for the benefit

of creditors; (D) be adjudicated as bankrupt or insolvent or be the subject of an order for relief under Title 11 of the United States

Code or any bankruptcy, reorganization, insolvency, readjustment of debt, dissolution or liquidation law or statute of any other jurisdiction

or foreign country; or (E) file a voluntary petition in bankruptcy, or a petition or an answer seeking reorganization or an arrangement

with creditors or to take advantage or any bankruptcy, reorganization, insolvency, readjustment of debt, dissolution or liquidation law

or statute, or an answer admitting the material allegations of a petition filed against it in any proceeding under any such law, or (F)

take or permit to be taken any action in furtherance of or for the purpose of effecting any of the foregoing including a composition

with creditors or similar action;

(vi)

if any order, judgment or decree shall be entered, without the application, approval or consent of the Company or any Subsidiary, by

any court of competent jurisdiction, approving a petition seeking liquidation or reorganization of the Company or any Subsidiary, or

appointing a receiver, trustee, custodian or liquidator of the Company or any Subsidiary, or of all or any substantial part of its assets,

and such order, judgment or decree shall continue unstayed and in effect for any period of 10 days;

(vii)

the SEC suspends the Common Stock from trading;

(viii)

the Company’s Common Stock is not listed or quoted for trading on a Trading Market which failure is not cured, if possible to cure,

within the earlier to occur of ten (10)Trading Days after notice of such failure is sent by the Holder or by any other Holder to the

Company;

(ix)

the transfer of shares of Common Stock through the Depository Trust Company System is no longer available or is subject to a “chill”

by the Depository Trust Company or any successor;

(x)

the Company shall fail for any reason, except if caused by the action or inaction of the Holder, to deliver Conversion Shares or the

Warrant Shares to the Holder by the earlier of (i) the second Trading Day after a Conversion Date pursuant to Section 4(c) or receipt

of an exercise notice or (ii) the Standard Settlement Date, or the Company shall provide at any time notice to the Holder, including

by way of public announcement, of the Company’s intention to not honor requests for conversions of this Note or exercise of Warrants

in accordance with the terms hereof and thereof; or

(xi)

the Company fails to comply in any material respect with the reporting requirements of the Exchange Act (including but not limited to

becoming delinquent in the filing of any report required to be filed under the Exchange Act including any extension permitted by Rule

12b-25 under the Exchange Act) or ceases to be subject to the reporting requirements of the Exchange Act. For avoidance of doubt, a failure

to file an Exchange Act report within such time shall be deemed to be a failure to comply in a material respect.

(b)

Remedies Upon Event of Default. If any Event of Default occurs, the outstanding principal amount of this Note, plus liquidated

damages and other amounts owing in respect thereof through the date of acceleration, shall become, at the Holder’s election, immediately

due and payable in cash at the Mandatory Default Amount. Upon the payment in full of the Mandatory Default Amount, the Holder shall promptly

surrender this Note to or as directed by the Company. In connection with such acceleration described herein, the Holder need not provide,

and the Company hereby waives, any presentment, demand, protest or other notice of any kind, and the Holder may immediately and without

expiration of any grace period enforce any and all of its rights and remedies hereunder and all other remedies available to it under

applicable law. Such acceleration may be rescinded and annulled by Holder at any time prior to payment hereunder and the Holder shall

have all rights as a holder of the Note until such time, if any, as the Holder receives full payment pursuant to this Section 6(b). No

such rescission or annulment shall affect any subsequent Event of Default or impair any right consequent thereon.

(c)

Interest Rate Upon Event of Default. Commencing on the occurrence of any Event of Default and until such Event of Default is cured,

this Note shall accrue interest at an interest rate equal to the Default Interest Rate.

(d)

Intentionally Omitted.

(e)

Notice of an Event of Default. Upon learning of an Event of Default with respect to this Note, the Company shall within two Trading

Days deliver written notice thereof via facsimile or electronic mail and overnight courier (with next day delivery specified) to the

Holder.

Section

8. Security Interest. This Note also creates a first lien on and grants a security interest in all of the Company’s

(including its subsidiaries) Accounts, Goods, Inventory, Equipment, Investment Property, General Intangibles, Instruments, Documents,

and all other assets and personal property of the Company, wherever located, together with all the proceeds now or hereafter arising

in connection therewith (the “Collateral”). This Note shall also constitute a security agreement under the New York Uniform

Commercial Code or other law applicable to the creation of liens on personal property. Capitalized terms used in this Section 8 shall

have the meanings that are given to them under the New York Uniform Commercial Code. The Company acknowledges and agrees that the Holder

shall have the right to file a UCC-1 financing statement and any renewals and continuations thereof or other documents as the Holder

may reasonably require with respect to this security interest. If a default occurs under this Note, the Holder shall have all rights

and remedies of a secured party under the New York Uniform Commercial Code. The Company shall take all such action in order to cause

the Holder to have a first lien and priority security interest in accordance with this Section 8 while this Note is outstanding.

Section

9. Miscellaneous.

(a)

No Rights as Stockholder Until Conversion. This Note does not entitle the Holder to any voting rights, dividends or other rights

as a stockholder of the Company prior to the conversion hereof.

(b)

Notices. All notices, offers, acceptance and any other acts under this Agreement (except payment) shall be in writing, and shall

be sufficiently given if delivered to the addressees in person, email, followed by FedEx or similar receipted next day delivery, as follows:

| |

If

to the Company: |

MGT

Capital Investments, Inc. |

| |

|

150

Fayetteville Street, Suite 1110 |

| |

|

Raleigh,

NC 27601 |

| |

|

Attention

Robert Ladd, CEO |

| |

|

Email:

rladd@mgtci.com |

| |

If

to the Purchaser: |

To

the address listed on the Purchase Signature Page to the Securities Purchase Agreement. |

or

to such other address as any of them, by notice to the other may designate from time to time. Time shall be counted to, or from, as the

case may be, the date of delivery.

(c)

Absolute Obligation. Except as expressly provided herein, no provision of this Note shall alter or impair the obligation of the

Company, which is absolute and unconditional, to pay the principal of, liquidated damages and accrued interest and late fees, as applicable,

on this Note at the time, place, and rate, and in the coin or currency, herein prescribed. This Note is a direct debt obligation of the

Company.

(d)

Lost or Mutilated Note. If this Note shall be mutilated, lost, stolen or destroyed, the Company shall execute and deliver, in

exchange and substitution for and upon cancellation of a mutilated Note, or in lieu of or in substitution for a lost, stolen or destroyed

Note, a new Note for the principal amount of this Note so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of

such loss, theft or destruction of this Note, and of the ownership hereof, reasonably satisfactory to the Company.

(e)

Exclusive Jurisdiction; Governing Law; Prevailing Party Attorneys’ Fees. All questions concerning the construction, validity,

enforcement and interpretation of this Note and venue shall be governed by and construed and enforced in accordance with Section 5.8

of the Purchase Agreement. If any party shall commence an Action or Proceeding to enforce or otherwise relating to this Note, then, in

addition to the other obligations of the Company elsewhere in this Note, the prevailing party in such action or proceeding shall be reimbursed

by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation

and prosecution of such Action or Proceeding.

(f)

Waiver. Any waiver by the Company or the Holder of a breach of any provision of this Note shall not operate as or be construed

to be a waiver of any other breach of such provision or of any breach of any other provision of this Note. The failure of the Company

or the Holder to insist upon strict adherence to any term of this Note on one or more occasions shall not be considered a waiver or deprive

that party of the right thereafter to insist upon strict adherence to that term or any other term of this Note on any other occasion.

Any waiver by the Company or the Holder must be in writing.

(g)

Severability. If any provision of this Note is invalid, illegal or unenforceable, the balance of this Note shall remain in effect,

and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and

circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the applicable law governing

usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under

applicable law. The Company covenants (to the extent that it may lawfully do so) that it shall not at any time insist upon, plead, or

in any manner whatsoever claim or take the benefit or advantage of, any stay, extension or usury law or other law which would prohibit

or forgive the Company from paying all or any portion of the principal of or interest on this Note as contemplated herein, wherever enacted,

now or at any time hereafter in force, or which may affect the covenants or the performance of this Note, and the Company (to the extent

it may lawfully do so) hereby expressly waives all benefits or advantage of any such law, and covenants that it will not, by resort to

any such law, hinder, delay or impede the execution of any power herein granted to the Holder, but will suffer and permit the execution

of every such as though no such law has been enacted.

(h)

Remedies, Characterizations, Other Obligations, Breaches and Injunctive Relief. The remedies provided in this Note shall be cumulative

and in addition to all other remedies available under this Note and any of the other Transaction Documents at law or in equity (including

a decree of specific performance and/or other injunctive relief), and nothing herein shall limit the Holder’s right to pursue actual

and consequential damages for any failure by the Company to comply with the terms of this Note. The Company covenants to the Holder that

there shall be no characterization concerning this instrument other than as expressly provided herein. Amounts set forth or provided

for herein with respect to payments, conversion and the like (and the computation thereof) shall be the amounts to be received by the

Holder and shall not, except as expressly provided herein, be subject to any other obligation of the Company (or the performance thereof).

The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the Holder and that the remedy

at law for any such breach would be inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach,

the Holder shall be entitled, in addition to all other available remedies, to an injunction restraining any such breach or any such threatened

breach, without the necessity of showing economic loss and without any bond or other security being required. The Company shall provide

all information and documentation to the Holder that is requested by the Holder to enable the Holder to confirm the Company’s compliance

with the terms and conditions of this Note.

(i)

Next Trading Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Trading Day, such payment

shall be made on the next succeeding Trading Day.

(j)

Headings. The headings contained herein are for convenience only, do not constitute a part of this Note and shall not be deemed

to limit or affect any of the provisions hereof.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the Company has caused this Note to be duly executed by a duly authorized officer as of the date first above indicated.

| |

MGT

Capital Investments, Inc. |

| |

|

|

| |

By:

|

/s/

Robert Ladd |

| |

Name:

|

Robert

Ladd |

| |

Title:

|

Chief

Executive Officer |

Signature

Page to Note

ANNEX

A

NOTICE

OF CONVERSION

The

undersigned hereby elects to convert principal under the Original Issue Discount Secured Convertible Note due December 31, 2024 of MGT

Capital Investments, Inc., a Delaware corporation (the “Company”), into shares of common stock (the “Common Stock”),

of the Company according to the conditions hereof, as of the date written below.

By

the delivery of this Notice of Conversion the undersigned represents and warrants to the Company that its ownership of the Common Stock

does not exceed the amounts specified under Section 4(d) of this Note, as determined in accordance with Section 13(d) of the Exchange

Act.

The

undersigned agrees to comply with the prospectus delivery requirements under the applicable securities laws in connection with any transfer

of the aforesaid shares of Common Stock.

Conversion

calculations:

| |

Date

to Effect Conversion: |

| |

Principal

Amount of Note to be Converted: |

| |

Number

of shares of Common Stock to be issued: |

| |

Signature: |

| |

Name: |

| |

DWAC

Instructions: |

| |

Broker

No: |

|

|

| |

Account

No: |

|

|

Exhibit

10.1

EXCHANGE

AGREEMENT

This

Exchange Agreement (this “Agreement”) is entered into as of December 19, 2023, by and among PROJECT NICKEL LLC,

a Delaware limited liability company (“Lender”), and MGT CAPITAL INVESTMENTS, INC., a Delaware corporation

(“Borrower”). Capitalized terms used in this Agreement without definition shall have the meanings given to them in

the Note (as defined below).

Whereas,

Borrower previously issued to Lender an Original Issue Discount Secured Convertible Promissory Note, dated September 12, 2022 in the

principal amount of $1,500,000.00 (the “Note”);

Whereas,

the parties agree to an exchange of the Note as set forth herein (the “Exchange”); and,

Whereas,

Lender has agreed, subject to the terms, amendments, conditions and understandings expressed in this Agreement, to grant the Exchange.

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1.

Recitals. Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Agreement are true and

accurate and are hereby incorporated into and made a part of this Agreement.

2.

Exchange. The parties hereby agree to an exchange of the Note for a new Note having a principal amount equal to the principal

amount plus all accrued and unpaid interest outstanding on the prior Note as of the date of this Agreement, and with a Maturity Date

for the new Note of December 31, 2024 and a lower conversion price.

3.

Note. A copy of the proposed new Note is attached as Exhibit A

4.

Representations and Warranties. In order to induce Lender to enter this Agreement, Borrower, for itself, and for its affiliates,

successors and assigns, hereby acknowledges, represents, warrants and agrees as follows:

(a)

Borrower has full power and authority to enter into this Agreement and to incur and perform all obligations and covenants contained herein,

all of which have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice

to any governmental authority is required as a condition to the validity of this Agreement or the performance of any of the obligations

of Borrower hereunder.

(b)

There is no fact known to Borrower or which should be known to Borrower which Borrower has not disclosed to Lender on or prior to the

date of this Agreement which would or could materially and adversely affect the understanding of Lender expressed in this Agreement or

any representation, warranty, or recital contained in this Agreement.

(c)

Except as expressly set forth in this Agreement, Borrower acknowledges and agrees that neither the execution and delivery of this Agreement

nor any of the terms, provisions, covenants, or agreements contained in this Agreement shall in any manner release, impair, lessen, modify,

waive, or otherwise affect the liability and obligations of Borrower under the terms of the Transaction Documents.

(d)

Borrower has no defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes

of action of any kind or nature whatsoever against Lender, directly or indirectly, arising out of, based upon, or in any manner connected

with, the transactions contemplated hereby, whether known or unknown, which occurred, existed, was taken, permitted, or begun prior to

the execution of this Agreement and occurred, existed, was taken, permitted or begun in accordance with, pursuant to, or by virtue of

any of the terms or conditions of the Transaction Documents. To the extent any such defenses, affirmative or otherwise, rights of setoff,

rights of recoupment, claims, counterclaims, actions or causes of action exist or existed, such defenses, rights, claims, counterclaims,

actions and causes of action are hereby waived, discharged and released. Borrower hereby acknowledges and agrees that the execution of

this Agreement by Lender shall not constitute an acknowledgment of or admission by Lender of the existence of any claims or of liability

for any matter or precedent upon which any claim or liability may be asserted.

8.

Certain Acknowledgments. Each of the parties acknowledges and agrees that no property or cash consideration of any kind whatsoever

has been or shall be given by Lender to Borrower in connection with the Exchange. The parties intend that this Agreement will qualify

for tacking of the holding period of the Note pursuant to Rule 144(d) under the Securities Act of 1933, and each party agrees not to

take a position to the contrary.

9.

Exchange. The Holder shall surrender its Note to the Company, and the Company will in turn issue the new Note to the Holder pursuant

to this Agreement. Any reference to the Note after the date of this Agreement is deemed to be a reference to the Note as exchanged by

this Agreement. If there is a conflict between the terms of this Agreement and the Note, the terms of this Agreement shall control. No

forbearance or waiver may be implied by this Agreement. Except as expressly set forth herein, the execution, delivery, and performance

of this Agreement shall not operate as a waiver of, or as an amendment to, any right, power, or remedy of Lender under the Note, as in

effect prior to the date hereof. For the avoidance of doubt, this Agreement shall be subject to the governing law, venue, and exclusive

jurisdiction provisions, as set forth in the Note.

10.

No Reliance. Borrower acknowledges and agrees that neither Lender nor any of its officers, directors, members, managers, equity

holders, representatives or agents has made any representations or warranties to Borrower or any of its agents, representatives, officers,

directors, or employees except as expressly set forth in this Agreement and the Transaction Documents and, in making its decision to

enter into the transactions contemplated by this Agreement, Borrower is not relying on any representation, warranty, covenant or promise

of Lender or its officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Agreement.

11.

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all

of which together shall constitute one instrument. The parties hereto confirm that any electronic copy of another party’s executed

counterpart of this Agreement (or such party’s signature page thereof) will be deemed to be an executed original thereof.

12.

Further Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall

execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in

order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

[Remainder

of page intentionally left blank; Signature page follows]

IN

WITNESS WHEREOF, the undersigned have executed this Agreement as of the date set forth above.

| |

LENDER: |

| |

|

| |

PROJECT

NICKEL, LLC |

| |

|

|

| |

By: |

/s/

Grady Kittrell |

| |

Name: |

Grady

Kittrell |

| |

Title: |

Manager |

| |

|

|

| |

BORROWER: |

| |

|

| |

MGT

Capital Investments, Inc. |

| |

|

|

| |

By: |

/s/

Robert Ladd |

| |

Name: |

Robert

Ladd |

| |

Title: |

President

and Chief Executive Officer |

[Signature

Page to Exchange Agreement]

Exhibit

A

New

Note

[Attached]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

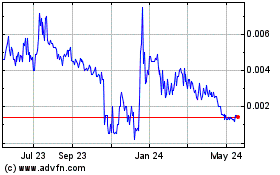

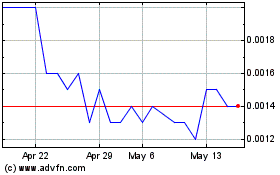

MGT Capital Investments (CE) (USOTC:MGTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

MGT Capital Investments (CE) (USOTC:MGTI)

Historical Stock Chart

From Dec 2023 to Dec 2024