MOL 4Q Net Loss HUF437.7 Billion Vs HUF69.3 Billion Net Loss Year Ago

February 23 2016 - 7:13PM

Dow Jones News

By Margit Feher

BUDAPEST--Central European integrated oil and gas company MOL

Nyrt., Hungary's largest firm by revenue, booked a net loss in the

fourth quarter on a steep impairment charge, a result of plunging

global oil prices.

Still, full-year earnings before interest, tax, depreciation and

amortization, an indicator of profitability in the oil industry

that investors watch the closest, was $2.48 billion. That beat the

company's upwardly revised $2.2 billion target for 2015, thanks to

the robust refining performance.

"Our ultimate goal for 2016 is to generate around $2 billion

Ebitda and sufficient cash flows to be able to continue to cover

both internal investment needs and dividends to our shareholders,"

Chairman and Chief Executive Zsolt Hernadi said in MOL's earnings

released Wednesday. The 2016 Ebitda target would also allow for

small-size mergers and acquisitions, the company added.

MOL projects global oil prices will range between $35 and $50 a

barrel this year versus $52.4 in 2015.

It targets to "comfortably" pay dividends even at an oil price

of $35 a barrel, the company said.

To "reflect the new oil price reality," MOL has scaled back its

capital expenditure plan for 2016 significantly, to $1.3 billion

from up to $1.5 billion earlier, and plans to cut operating

expenses by up to $100 million this year, it added.

In the fourth quarter, the company generated a net loss of 437.7

billion forints ($1.58 billion), several times deeper than a net

loss of HUF69.3 billion a year earlier. It translated to a loss of

HUF4,780 a share, up from a loss of HUF786 a share a year

earlier.

Asset impairment charges amounted to HUF504 billion, exceeding

most analysts' expectations. MOL already flagged in November a

HUF131 billion charge on its Akri-Bijeel block in Kurdistan.

Additional write-offs related to lower oil price assumptions

included a HUF218 billion item on its North Sea upstream assets in

the U.K. and a further HUF109 billion related to its Croatian oil

and gas company INA.

The write-offs didn't affect clean Ebitda, which was HUF147.3

billion after a quarterly record high of HUF204.5 billion in the

third quarter, and down 1% from HUF146.5 billion a year earlier. It

was in line with analysts' forecast of HUF147.6 billion. Clean

earnings don't include the revaluation of inventories and one-off

items.

Downstream--or refining and marketing--operations posted a

robust result after historically strongest quarterly results in the

previous three months. Downstream clean Ebitda was HUF105.7

billion, up 43% from HUF74 billion a year earlier.

The clean Ebitda of the upstream--or exploration and

production--segment was HUF44.1 billion, down by a sharp 32% from

HUF65.3 billion a year earlier.

(END) Dow Jones Newswires

February 23, 2016 19:58 ET (00:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

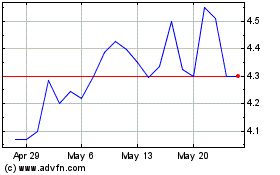

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jan 2025 to Feb 2025

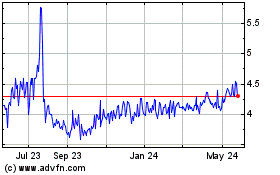

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Feb 2024 to Feb 2025