false

0000770460

0000770460

2024-07-24

2024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 24, 2024

PEOPLES FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Mississippi

(State or Other Jurisdiction of Incorporation)

|

001-12103

(Commission File Number)

|

64-0709834

(IRS Employer Identification No.)

|

| |

|

|

152 Lameuse Street Biloxi, MS

(Address of Principal Executive Offices)

|

39530

(Zip Code)

|

|

(228) 435-5511

(Registrant’s Telephone Number, Including Area Code)

|

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange on which registered |

| None |

PFBX |

None |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4( c) under the Exchange Act (17 CFR 240.13e-4( c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On July 24, 2024, Peoples Financial Corporation (the “Company”) issued a press release announcing its second quarter results for 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 24, 2024

|

|

PEOPLES FINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Chevis C. Swetman

|

|

|

|

|

Chevis C. Swetman

|

|

|

|

|

Chairman, President and CEO

|

|

Exhibit 99.1: Peoples Financial Corporation Press Release Dated July 24, 2024

FOR IMMEDIATE RELEASE

For more information, contact:

Chevis C. Swetman, President and CEO

228-435-8205

cswetman@thepeoples.com

PEOPLES FINANCIAL CORPORATION REPORTS RESULTS FOR THE SECOND QUARTER OF 2024

BILOXI, MS (July 24, 2024) - Peoples Financial Corporation (the “Company”)(OTCQX Best Market: PFBX), parent of The Peoples Bank (the “Bank”), announced earnings for the second quarter ending June 30, 2024.

Second Quarter Earnings

Net income for the second quarter of 2024 was $2,329,000 compared to net income of $2,910,000 for the second quarter of 2023. The earnings per weighted average common share for the second quarter of 2024 were $0.50 compared to earnings per weighted average common share of $0.62 for the second quarter of 2023. Per share figures are based on weighted average common shares outstanding of 4,661,686 and 4,678,186 for the second quarters of 2024 and 2023, respectively.

The decrease in net income for the second quarter of 2024 was primarily due to a decrease in net interest income of $1,299,000 to $5,903,000 for the second quarter of 2024 as compared with $7,202,000 for the second quarter of 2023. Total interest income increased $45,000 to $8,695,000 for the second quarter of 2024 as compared with $8,650,000 for the second quarter of 2023 due to higher interest income on loans and overnight fed funds caused by an increase in interest rates. Total interest expense increased by $1,344,000 to $2,792,000 for the second quarter of 2024 as compared with $1,448,000 for the second quarter of 2023 because of higher interest rates paid on deposit accounts and borrowings.

The Company started recording income tax expense during 2023 after utilizing its remaining net operating loss carryforward during 2022. The income tax expense decreased $1,040,000 to ($229,000) for the second quarter of 2024 as compared with $811,000 for the second quarter of 2023. This decrease was primarily due to a decrease in pretax income of $1,621,000 as compared to the same period in 2023 and a release of the Company’s tax valuation allowance against deferred tax assets related to federal tax credits expected to be utilized in 2024.

Net income for the first six months of 2024 decreased $789,000 to $4,744,000 compared to net income of $5,533,000 for the first six months of 2023. The earnings per weighted average common share for the first six months of 2024 were $1.02 compared to earnings per weighted average common share of $1.18 for the first six months of 2023. Per share figures are based on weighted average common shares outstanding of 4,661,686 and 4,678,186 for the first six months of 2024 and 2023, respectively. The income tax expense decreased $856,000 to $402,000 for the first six months of 2024 as compared with $1,258,000 for the first six months of 2023. This decrease was due to a decrease in pretax income of $1,645,000 year over year and a release of the Company’s tax valuation allowance against deferred tax assets related to federal tax credits expected to be utilized in 2024.

The federal tax credits to be utilized include rehabilitation tax credits for the recent renovation of the building that houses the asset management and trust department of the Bank as well as the Ellzey building, along with a low-income housing tax credit. The Company plans to use in 2024 these credits of $1,033,090 up to 75% of its taxable income, and any remaining amount of unused credits over that limit will be carried forward for use in future periods.

Return on average assets for the first six months ended June 30, 2024, decreased 0.11% to 1.16% compared to 1.27% for the first six months ended June 30, 2023. The Company’s efficiency ratio increased 5% to 68% for the first six months ended June 30, 2024, compared to 63% for the first six months ended June 30, 2023.

Asset Quality

Although the economy has experienced a rising rate environment, gross loans increased $4,460,000 from $234,280,000 at June 30, 2023 to $238,740,000 at June 30, 2024. Other real estate decreased from $952,000 at June 30, 2023, to $1 as of June 30, 2024.

“The Bank’s leadership remains committed to maintaining high-quality assets. We are closely monitoring economic conditions and staying vigilant for any potential changes in interest rates. As hurricane season commences, the Company has proactively prioritized hurricane preparedness. Across all 18 bank facilities, we have ensured that resources are available allowing branches to operate even in the event of power outages. The Company has a comprehensive and thorough business continuity and disaster recovery strategy. The plan has been annually updated since 1999 (Y2K),” said Chevis C. Swetman, chairman and chief executive officer of the Company and the Bank.

Shareholders’ Equity

Total shareholders’ equity increased to $74,200,000 at June 30, 2024 increasing by $9,674,000 from $64,526,000 at June 30, 2023 and by $4,917,000 from $69,283,000 at December 31, 2023. The improvement in shareholders’ equity was mainly due to positive earnings and a decrease of $4,613,000 and $1,012,000 in unrealized losses on securities since June 30, 2023 and December 31, 2023, respectively. Also, the Company has paid dividends of $2,750,000 to shareholders of record since June 30, 2023. The Company reported $43,482,000, $39,881,000 and $38,869,000 in unrealized losses on the available for sale securities portfolio as of June 30, 2023, December 31, 2023 and June 30, 2024, respectively. These unrealized losses are presented in accumulated other comprehensive income for the respective periods. The cause of the unrealized losses has primarily resulted from higher interest rates that have impacted the current market value of available for sale securities. The unrealized losses are not related to any credit deterioration within the portfolio. The Company has maintained strong liquidity and continues to do so; therefore, the Company does not foresee a sale of any affected securities that would cause the realization of these losses by the Company as part of net income in the near future.

The Bank’s leverage ratio has not been impacted by these unrealized losses on available for sale securities due to an opt-out election previously made by the Bank in accordance with current regulatory capital requirements and therefore remained strong at 11.84% as of June 30, 2024.

Liquidity

The Company maintains a well-capitalized balance sheet which includes strong capital and liquidity. The Bank provides a full range of banking, financial and trust services in our local markets. The majority of the Bank’s deposits are fully FDIC insured. The Company evaluates on an ongoing and continuous basis its financial health by preparing for various moderate to severe economic scenarios.

As interest rates have increased and the cost of attracting new deposits and replacing deposit attrition has increased, the Bank experienced a decrease in deposit balances during the six months ended June 30, 2024. This decrease was mostly caused by the loss of several large public fund deposits in 2024 following competitive bid processes held in 2023 whereby the public fund deposit accounts were awarded to other local banks. During the first half of 2024, the Company did not encounter any further losses in its large public fund deposit accounts. As of June 30, 2024, total deposits have decreased $13,576,000 to $674,914,000 from $688,490,000 as of December 31, 2023.

About the Company

Founded in 1896, with $847 million in total assets as of June 30, 2024, The Peoples Bank operates 18 bank facilities along the Mississippi Gulf Coast in Hancock, Harrison, Jackson and Stone counties. In addition to offering a comprehensive range of retail and commercial banking services, the Bank also operates a trust and investment services department that has provided customers with financial, estate and retirement planning services since 1936.

The Company just experienced its third best year of earnings ever and was recently recognized as part of the 2024 OTCQX Best 50, a ranking of the top-performing OTCQX companies in the prior calendar year.

Peoples Financial Corporation’s common stock is listed on the OTCQX Best Market under the symbol PFBX. Additional information is available on the Internet at the Company’s website, www.thepeoples.com, and at the website of the Securities and Exchange Commission (“SEC”), www.sec.gov.

This news release reflects industry conditions, Company performance and financial results and contains “forward-looking statements,’ which may include forecasts of our financial results and condition, expectations for our operations and businesses, and our assumptions for those forecasts and expectations. Do not place undue reliance on forward-looking statements. These forward-looking statements are subject to a number of risk factors and uncertainties which could cause the Company’s actual results and experience to differ materially from the anticipated results and expectation expressed in such forward-looking statements.

Factors that could cause our actual results to differ materially from our forward-looking statements are described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Regulation and Supervision” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and in other documents subsequently filed by the Company with the Securities and Exchange Commission, available at the SEC’s website and the Company’s website, each of which are referenced above. To the extent that statements in this news release relate to future plans, objectives, financial results or performance by the Company, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are generally identified by use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology.

Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. All information is as of the date of this news release. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

|

PEOPLES FINANCIAL CORPORATION

|

|

(In thousands, except per share figures) (Unaudited)

|

|

EARNINGS SUMMARY

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net interest income

|

|

$ |

5,903 |

|

|

$ |

7,202 |

|

|

$ |

12,596 |

|

|

$ |

14,252 |

|

|

Provision for credit losses

|

|

|

- |

|

|

|

(312 |

) |

|

|

- |

|

|

|

(297 |

) |

|

Non-interest income

|

|

|

1,761 |

|

|

|

1,803 |

|

|

|

3,504 |

|

|

|

3,510 |

|

|

Non-interest expense

|

|

|

5,564 |

|

|

|

5,596 |

|

|

|

10,954 |

|

|

|

11,268 |

|

|

Income tax (benefit) expense

|

|

|

(229 |

) |

|

|

811 |

|

|

|

402 |

|

|

|

1,258 |

|

|

Net income

|

|

|

2,329 |

|

|

|

2,910 |

|

|

|

4,744 |

|

|

|

5,533 |

|

|

Earnings per share

|

|

$ |

0.50 |

|

|

$ |

0.62 |

|

|

$ |

1.02 |

|

|

$ |

1.18 |

|

|

TRANSACTIONS IN THE ALLOWANCE FOR CREDIT LOSSES ON LOANS

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Allowance for credit losses on loans, beginning of period

|

|

$ |

3,087 |

|

|

$ |

3,273 |

|

|

$ |

3,224 |

|

|

$ |

3,338 |

|

|

Recoveries

|

|

|

105 |

|

|

|

492 |

|

|

|

163 |

|

|

|

563 |

|

|

Charge-offs

|

|

|

(42 |

) |

|

|

(231 |

) |

|

|

(177 |

) |

|

|

(387 |

) |

|

Provision for (reduction of ) loan losses

|

|

|

- |

|

|

|

(310 |

) |

|

|

(60 |

) |

|

|

(280 |

) |

|

Impact of adopting ASC 326

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(10 |

) |

|

Allowance for credit losses on loans, end of period

|

|

$ |

3,150 |

|

|

$ |

3,224 |

|

|

$ |

3,150 |

|

|

$ |

3,224 |

|

|

PERFORMANCE RATIOS

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

2024

|

|

|

2023

|

|

|

Return on average assets

|

|

|

1.16 |

% |

|

|

1.27 |

% |

|

Return on average equity

|

|

|

13.30 |

% |

|

|

18.64 |

% |

|

Net interest margin

|

|

|

3.07 |

% |

|

|

3.29 |

% |

|

Efficiency ratio

|

|

|

68 |

% |

|

|

63 |

% |

|

BALANCE SHEET SUMMARY

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

2024

|

|

|

2023

|

|

|

Total assets

|

|

$ |

846,747 |

|

|

$ |

895,676 |

|

|

Securities

|

|

|

541,582 |

|

|

|

552,240 |

|

|

Loans, net

|

|

|

235,590 |

|

|

|

231,056 |

|

|

Other real estate (ORE)

|

|

|

- |

|

|

|

952 |

|

|

Total deposits

|

|

|

674,914 |

|

|

|

810,498 |

|

|

Shareholders' equity

|

|

|

74,200 |

|

|

|

64,526 |

|

|

Book value per share

|

|

|

15.92 |

|

|

|

13.79 |

|

|

Weighted average shares

|

|

|

4,661,686 |

|

|

|

4,678,186 |

|

|

PERIOD END DATA

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

2024

|

|

|

2023

|

|

|

Allowance for credit losses on loans as a percentage of loans

|

|

|

1.32 |

% |

|

|

1.38 |

% |

|

Loans past due 90 days and still accruing

|

|

$ |

- |

|

|

$ |

- |

|

|

Nonaccrual loans

|

|

$ |

455 |

|

|

$ |

87 |

|

|

Leverage ratio

|

|

|

11.84 |

% |

|

|

10.69 |

% |

v3.24.2

Document And Entity Information

|

Jul. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PEOPLES FINANCIAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 24, 2024

|

| Entity, Incorporation, State or Country Code |

MS

|

| Entity, File Number |

001-12103

|

| Entity, Tax Identification Number |

64-0709834

|

| Entity, Address, Address Line One |

152 Lameuse Street

|

| Entity, Address, City or Town |

Biloxi

|

| Entity, Address, State or Province |

MS

|

| Entity, Address, Postal Zip Code |

39530

|

| City Area Code |

228

|

| Local Phone Number |

435-5511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000770460

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

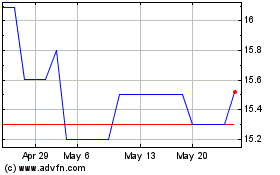

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Nov 2023 to Nov 2024