Notification That Quarterly Report Will Be Submitted Late (nt 10-q)

May 16 2016 - 4:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

SEC File Number

333-193058

CUSIP NUMBER

74255T 202

NOTIFICATION OF LATE FILING

|

(Check One)

:

|

☐ Form 10-K

|

☐ Form 20-F

|

☐ Form 11-K

|

☑

Form 10-Q

|

☐ Form 10-D

|

☐ Form N-SAR

|

☐ Form N-CSR

|

For Period Ended:

March 31, 2016

☐ Transition Report on Form 10-K

☐ Transition Report on Form 20-F

☐ Transition Report on Form 11-K

☐ Transition Report on Form 10-Q

☐ Transition Report on Form N-SAR

For the Transition Period Ended: ________________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART I -- REGISTRANT INFORMATION

PRINCIPAL SOLAR, INC.

Full Name of Registrant

Former Name if Applicable

2560 KING ARTHUR BLVD, SUITE 124 PMB 65

Address of Principal Executive Office

(Street and Number)

LEWISVILLE, TX 75056

City, State and Zip Code

PART II -- RULE

S

12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

|

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

[X]

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof

, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof

, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III-- NARRATIVE

State below in reasonable detail why the Form 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR or the transition report portion thereof

, could not be filed within the prescribed time period. (Attach extra sheets if needed.)

The Registrant was unable to file its quarterly report on Form 10-Q within the prescribed time period due to transitional issues stemming from the recent resignation of the Company's Chief Financial Officer.

PART IV -- OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

|

Michael Gorton

|

|

(855)

|

|

774-7799

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

[X] Yes [_] No

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

[X] Yes [_] No

If so: attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

PRINCIPAL SOLAR, INC.

(Name of Registrant as Specified in Charter)

Has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

Date

May 16, 2016

By

/s/

Michael Gorton

Michael Gorton

Chief Executive and

Principal Financial Officer

PRINCIPAL SOLAR, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Three Months Ended March 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(408,748

|

)

|

|

$

|

(1,217,240

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

-

|

|

|

|

75,494

|

|

|

Stock-based employee compensation expense

|

|

|

8,334

|

|

|

|

341,071

|

|

|

Stock-based advisor compensation expense

|

|

|

-

|

|

|

|

75,000

|

|

|

Loss on derivative liability on warrants

|

|

|

-

|

|

|

|

19,215

|

|

|

Amortization of debt discounts

|

|

|

-

|

|

|

|

206,480

|

|

|

Change in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

1,949

|

|

|

|

(17,645

|

)

|

|

Prepaid assets

|

|

|

13,962

|

|

|

|

12,875

|

|

|

Accounts payable

|

|

|

537,384

|

|

|

|

50,551

|

|

|

Compensation payable

|

|

|

33,546

|

|

|

|

116,500

|

|

|

Interest payable

|

|

|

130,712

|

|

|

|

32,842

|

|

|

Accrued expenses and other liabilities

|

|

|

107,062

|

|

|

|

39,567

|

|

|

Net cash provided by (used in) operating activities

|

|

|

424,201

|

|

|

|

(265,290

|

)

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Construction in progress

|

|

|

(3,224,336

|

)

|

|

|

(2,202,092

|

)

|

|

Net cash used in investing activities

|

|

|

(3,224,336

|

)

|

|

|

(2,202,092

|

)

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from Arowana note

|

|

|

2,278,072

|

|

|

|

-

|

|

|

Proceeds from sale of common stock

|

|

|

-

|

|

|

|

1,679,001

|

|

|

Proceeds from convertible debenture payable (Alpha)

|

|

|

-

|

|

|

|

1,250,000

|

|

|

Payment of acquisition note payable

|

|

|

-

|

|

|

|

(62,455

|

)

|

|

Proceeds from convertible note, non-related party

|

|

|

-

|

|

|

|

50,000

|

|

|

Proceeds from short-term note, related party

|

|

|

300,000

|

|

|

|

-

|

|

|

Payments on note payable for insurance premiums

|

|

|

(12,396

|

)

|

|

|

(16,268

|

)

|

|

Change in restricted cash

|

|

|

-

|

|

|

|

28,451

|

|

|

Net cash used in financing activities

|

|

|

2,565,676

|

|

|

|

2,928,729

|

|

|

|

|

|

|

|

|

|

|

|

|

(Decrease) increase in cash and equivalents

|

|

|

(234,459

|

)

|

|

|

461,347

|

|

|

Cash and equivalents, beginning of period

|

|

|

498,330

|

|

|

|

104,328

|

|

|

Cash and equivalents, end of period

|

|

$

|

263,871

|

|

|

$

|

565,675

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

465

|

|

|

$

|

94,152

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Cash Transactions:

|

|

|

|

|

|

|

|

|

|

Discount on covertible debenture recorded as a derivative liability

|

|

$

|

-

|

|

|

$

|

1,250,000

|

|

|

Construction in progress in accounts payable

|

|

|

473,407

|

|

|

|

349,950

|

|

|

Deposit applied to construction in progress

|

|

|

-

|

|

|

|

250,000

|

|

The accompanying notes are an integral part of these consolidated financial statements.

COMPARISON OF OPERATING RESULTS

(all amounts rounded to the

nearest thousand)

Three Months Ended March 31 2016 and 2015

Power generation revenue was $5 thousand in 2016 compared to $184 thousand in 2015, a decrease of $179 thousand; and total costs of revenues was $5 thousand compared to $128 thousand in 2015, a decrease of $123 thousand. Both decreases are due primarily to the sale of our Powerhouse One subsidiary effective July 1, 2015.

The decrease in general and administrative expenses of approximately $642 thousand was comprised of:

|

|

●

|

a net decrease of $370 thousand in equity compensation as 2015 included a general grant of options to management and Board members and advisors resulting in a non-cash expense of $335 thousand; further reduced by the $35 thousand of amortization that ended in 2015

|

|

|

●

|

a net decrease in consulting fees of $164 thousand resulting from the reimbursement of fees incurred for individuals working on the additional projects on behalf of the secured lender

|

|

|

●

|

a net decrease of $73 thousand in legal, investor relations, and filings fees incurred in 2015 in anticipation of a public offering later withdrawn

|

Results of operations were also impacted significantly from the following:

|

|

●

|

a net decrease in interest expense of $202 thousand resulting primarily from the repayment in August 2015 of related party notes saving $37 thousand; repayment of the acquisition note payable to Bridge Bank in August 2015 saving $85 thousand; a decrease of interest expense of $201 thousand reflecting the amortization of the discount on debt (primarily convertible debentures); an increase resulting from a new promissory note with Arowana incurring $86 thousand; and a fee of $45 thousand resulting from a new related party note

|

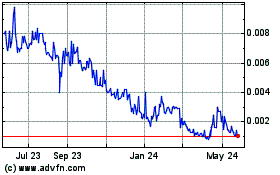

Principal Solar (PK) (USOTC:PSWW)

Historical Stock Chart

From Nov 2024 to Dec 2024

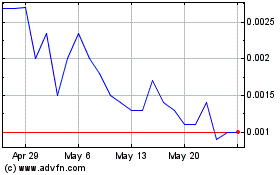

Principal Solar (PK) (USOTC:PSWW)

Historical Stock Chart

From Dec 2023 to Dec 2024