|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

| |

|

FORM 8-K

|

| |

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

|

| |

|

Date of Report (Date of earliest event reported): August 19, 2024

|

| |

|

SECURITY FEDERAL CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

South Carolina

|

|

000-16120

|

|

57-0858504

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

| |

|

238 Richland Avenue NW, Aiken, South Carolina

|

|

29801

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

|

Registrant's telephone number (including area code): (803) 641-3000

|

| |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

|

| |

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item 8.01 Other Events

Security Federal Corporation today announced that its Board of Directors has approved an increase in the number of shares authorized for repurchase under the previously approved stock repurchase program.

Under the repurchase program, the Company may repurchase an additional 100,000 of the outstanding shares for a total of 135,276 shares when combined with the remaining 35,276 shares initially approved to repurchase.

Repurchases will be made at management's discretion at prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company's financial performance. Open market purchases will be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934 and other applicable legal requirements.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. There is no guarantee as to the exact number of shares that will be repurchased by the Company.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release of Security Federal Corporation dated August 19, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

SECURITY FEDERAL CORPORATION

|

| |

|

|

| |

|

|

|

Date: August 16, 2024

|

By:

|

/s/ Darrell Rains |

| |

|

Darrell Rains

|

| |

|

Chief Financial Officer

|

NEWS RELEASE

SECURITY FEDERAL CORPORATION ANNOUNCES ADOPTION OF NEW STOCK REPURCHASE PROGRAM

Aiken, South Carolina (August 19, 2024) - Security Federal Corporation (the “Company”) (OTCBB: SFDL), the holding company for Security Federal Bank (the “Bank”), today announced that its Board of Directors has approved an increase in the number of shares authorized for repurchase under the previously approved stock repurchase program.

Under the repurchase program, the Company may repurchase an additional 100,000 of the outstanding shares for a total of 135,276 shares, when combined with the remaining 35,276 shares initially approved to be repurchased.

Repurchases will be made at management's discretion at prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company's financial performance. Open market purchases will be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934 and other applicable legal requirements.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. There is no guarantee as to the exact number of shares that will be repurchased by the Company.

Security Federal has 19 full service branches located in Aiken, Ballentine, Clearwater, Columbia, Graniteville, Langley, Lexington, North Augusta, Ridge Spring, Wagener and West Columbia, South Carolina and Augusta and Evans, Georgia. The Bank’s newest branch, located in downtown Augusta, Georgia, recently opened in April 2023. It is a full-service branch offering depository banking as well as commercial and consumer lending. A full range of financial services, including trust and investments, are provided by the Bank and insurance services are provided by the Bank’s wholly owned subsidiary, Security Federal Insurance, Inc.

For additional information contact Roy Lindburg, President Security Federal Corporation, at (803) 641-3000.

Forward-looking statements:

Certain matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to, among other things, expectations of the business environment in which the Company operates, projections of future performance, perceived opportunities in the market, potential future credit experience, and statements regarding the Company’s mission and vision. These forward-looking statements are based upon current management expectations and may, therefore, involve risks and uncertainties. The Company’s actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety or range of factors including, but not limited to: potential adverse impacts to economic conditions in our local market area or other aspects of the Company’s business, operations or financial markets, including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a potential recession or slowed economic growth caused by increasing oil prices and supply chain disruptions; interest rate fluctuations; economic conditions in the Company’s primary market area; demand for residential, commercial business and commercial real estate, consumer, and other types of loans; success of new products; competitive conditions between banks and non-bank financial service providers; legislative or regulatory changes that adversely affect the Company’s business including changes in regulatory policies and principles, and changes related to the Basel III requirements, the impact of the effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the implementing regulations, including the interpretation of regulatory capital or other rules; the ability to attract and retain deposits; the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions; adverse changes in the securities markets; changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; technology factors affecting operations; pricing of products and services; and other risks detailed in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Accordingly, these factors should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. The Company undertakes no responsibility to update or revise any forward-looking statement.

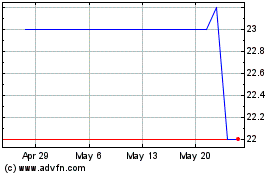

Security Federal (PK) (USOTC:SFDL)

Historical Stock Chart

From Oct 2024 to Nov 2024

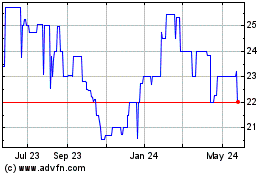

Security Federal (PK) (USOTC:SFDL)

Historical Stock Chart

From Nov 2023 to Nov 2024