Japan Could Divest Stake in iPhone Display Maker

September 20 2016 - 11:10PM

Dow Jones News

TOKYO—Japan's industry minister said the government would

consider divesting its stake in an unprofitable maker of smartphone

displays unless the company can demonstrate it is more than just a

commodity supplier to Apple Inc.

The comment by Hiroshige Seko, a confidant of Prime Minister

Shinzo Abe, comes as Japan Display Inc. is in talks about getting

further support from its top shareholder, government-backed fund

Innovation Network Corp. of Japan. Japan Display, a top supplier of

displays for Apple's iPhones, recorded losses in the past two

business years because of tougher competition, a stronger yen and

slowing iPhone sales.

Japan has long been seen as reluctant to allow major domestic

companies to collapse or be taken over by foreign companies,

fearing layoffs and the leakage of technology overseas.

Such thinking is outdated, said Mr. Seko, minister for economy,

trade and industry, in a recent interview. "Unlike Japanese leaders

in the past, I don't take the simplistic view that we've got to

make sure we have such-and-such in Japan or else it's dangerous,"

he said.

"Instead of clinging to commoditized businesses, I believe Japan

should focus on cutting-edge technologies where other countries

haven't caught up," he said. "That's when we can make solid money,

and then when these become commoditized, it's fine to yield them to

other countries."

The government-backed INCJ created Japan Display in 2012 by

combining display operations from Sony Corp., Hitachi Ltd. and

Toshiba Corp. The company had an initial public offering in 2014

but quickly ran into trouble, and its stock has been trading at

around a fifth of its IPO price of ¥ 900 (about $9). INCJ remains

Japan Display's top shareholder with a 35.6% stake.

Mr. Seko listed two possible approaches to Japan Display—keeping

it under Japanese ownership at all costs, or concluding that the

business is commoditizing and doesn't have to be kept in domestic

hands.

"Right now, where it's effectively an Apple contractor and their

performance automatically gets worse when Apple's performance gets

worse—that kind of situation just doesn't work," he said.

However, no decision has been reached on Japan Display's future,

he said, and he is open to any arguments about the company's

importance in advancing the nation's technology edge.

A Japan Display spokesman said the company has been trying to

diversify its business so isn't tied so strongly to volatile

smartphone sales. It is developing new technologies that will help

the growth of the Japanese economy, he said.

The spokesman said Japan Display was in discussions with INCJ

about how to pay for future investments. A spokesman at INCJ, which

operates independently under METI oversight, said it would continue

to support Japan Display as a major shareholder. Both spokesmen

said nothing specific has been decided.

Earlier this year, INCJ made a bid to take over Sharp Corp., the

other major Japanese maker of smartphone displays. INCJ envisioned

combining Sharp's display business with Japan Display, but it was

outbid for Sharp by Taiwan's Foxconn Technology Group.

The two Japanese makers have fallen behind South Korean rivals

in technology for organic light-emitting diode, or OLED, screens,

which are expected to be used increasingly in smartphones and other

devices.

Write to Mitsuru Obe at mitsuru.obe@wsj.com

(END) Dow Jones Newswires

September 20, 2016 23:55 ET (03:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

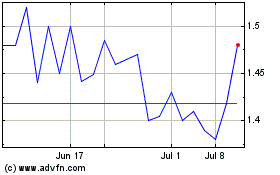

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

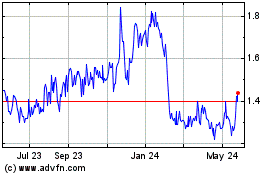

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Nov 2023 to Nov 2024