UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K/A

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): May 8, 2024

SILVERTON ENERGY, INC.

(Exact name of registrant as

specified in its charter)

| Nevada |

|

000-54920 |

|

92-3197364 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

101 E. Park Blvd., Suite 600

Plano, Texas |

|

75076 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (214) 802-6777

___________________________________

(Former name or former address, if changed since last

report)

Copies to:

D. Grant Seabolt, Jr., Esq.

Seabolt Law Group

8700 Stonebrook Pkwy, Unit 247

Frisco, TX 75035

Phone: (972) 413-9877

Fax: (214) 580-5571

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

SLTN |

OTC Markets |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Amendment No. 1 to the Current Report on Form 8-K amends:

Item 101.1, Section 1 Registrant’s Business and Operations

Added minor name corrections, and corrected ownership of the Company’s

Class “A” Common Stock, to correct some company names and to correct the list of shareholders of the Company’s Class

“A” common Stock.

Item 2.01 Completion of Acquisition or Disposition of Assets;

Item 2.01A

Acquisition Agreement Between Buyer, the Company and Seller, American

Heritage Capital, L.P., dated May 01, 2024, (the “AHC Acquisition Agreement”), a copy of which is EX 2.01A.

EX 2.01A is attached to this 8K/A.

Item 2.01B

Acquisition Agreement between American Heritage Investment Capital,

L.P. and SLTN, as “Buyer” and Kris Agrawal and Kris k. Agrawal, et al, Exxon Oil & Gas, Inc., Vance-1 Properties, LLC,

as “Seller,” signed on May 01, 2024, with an effective date of April 04, 2024), a copy of which is EX 2.01B

EX 2.01B is attached to this 8K/A.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by Silverton

Energy, Inc. (“Silverton” or the “Company”) from time to time with the Securities and Exchange Commission (collectively

the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information

currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. When used in

the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”,

“plan” or the negative of these terms and similar expressions as they relate to the Company’s or Company’s management

identify forward looking statements. Such statements reflect the current view of the Company with respect to future events and are subject

to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk

Factors”) relating to the Company’s industry, the Company’s operations and results of operations and any businesses

that may be acquired by the Company. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions

prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Company’s management believes that the expectations reflected in the forward looking statements are reasonable, the

Company cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including

the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these

statements to actual results. The following discussion should be read in conjunction with the Company’s financial statements and the

related notes filed with this Form 8-K.

In this Form 8-K, references to “we,” “our,” “us,” the “Company,”

or “SLTN” refer to Silverton Energy, Inc., a Nevada corporation.

Item 1.01

Section 1 Registrant’s

Business and Operations

“SLTN” or “the Company”

refers to the Registrant Silverton Energy, Inc., a Nevada corporation

The Company’s Business

Overall Business Objectives

Silverton Energy, Inc., a Nevada corporation,

is a publicly traded company (listed as “SLTN” on the OTC Markets Pink Sheet. The Company was founded in 2010. The Company’s

founding Director and CEO, Samuel C. Smith (“Smith”), acquired the company in 2023. The Overall Business Objectives of the

Company are:

| (i) | Focus on building a large

asset portfolio of oil and gas leases on the Osage Nation sovereign area in Oklahoma, along with selected acquisitions of leases adjacent

to leases owned by others which are outproducing the purchased leases’ daily production (barrels per day). |

| (ii) | The

Company does not desire to be an oil and gas operator (“Operator”). This shelters the Company from any liabilities associated

with production activities as its own Operator for its own oil and gas leases. There are no plans by the Company to set up a to be an

Operator directly for (or through a wholly owned LLC subsidiary for any of the two Acquisition Agreements described below. |

| (iii) | Sales proceeds from the Company’s

sales of shares of its Series “A” Common Stock and Series “C” Preferred Stock are being utilized by the Company

for three general usages: (a) the Company’s operational and overhead expenses (including legal and auditing); (b) continued acquisitions

of qualified leases; and, as needed, (c) selected re-working of its acquired oil and gas existing wells to materially increase the bbl/day

output (which increases the value of its other wells drawing from the same reservoir/formation as the re-worked well). |

Asset Acquisition Agreements

A. The AHIC Assets. On May 01,

2024, the Company entered into an “Acquisition Agreement” between the Company as the Buyer, and American Heritage Investment

Capital, LP. (“AHIC”), (the “AHIC Acquisition Agreement” [see EX 2.01A]. Under the AHIC Acquisition Agreement,

the Company purchased for $52,000,000, a group of American Heritage Investment Capital, L.P’s (‘AHIC”) oil and gas

leases in Oklahoma, listed in Exhibit A.1 to the Agreement (the “AHIC Assets”), which have a with a “current value”

of $81,000,000, via a Contract for Assignment. The AHIC Assets are held in escrow by AHICs attorney, to be formally transferred to the

Company upon $81,000,000 PSA from the Company. The $81,000,000 purchase price is to be paid by an $81,000,000, 20-year, non-interest

bearing Promissory Note (Secured by the AHIC Assets), payable in installments towards a lump sum of $81,000,000, payment on May 01, 2044.

Section 5A of the Promissory Note provides a credit against the $81,000,000 Promissory Note: “For each $15,000,000 introduced to

the company through institutional investors, a payment of $3,000,000 shall be immediately delivered to seller and credited against this

note. Upon default, after May 01, 2044, AHIC can foreclose on the collateralized oil and gas leases or convert the $81,000,000 in collateral

to “preferred stock,” upon a conversion ratio, based on a fair market value of the preferred stock. The $81,000,000, if divided

by 1,072,500 of currently available Class “C” Preferred shares is $0.75/share, which is more than the offering price of Class

“C” Preferred shares at $0.40 per share. After a period of five (5) years from the date of conversion of the Company’s

$81,000,000 into the Company’s Class “C” Preferred shares, the preferred shares shall automatically convert into shares

of common stock of the Borrower company on a one-for-one basis (which is a contractual agreement to convert under the pre-existing five-for-one

conversion rights for the Company’s Class “C” Preferred Stock. The converted preferred stock shall have one-for-one

voting rights per share, the same as the Company’s Series “A” Common Stock.

B. The

Agrawal Assets. On May 01, 2024, the Company entered into an “Acquisition Agreement” between AHIC and SLTN, as the

“Buyer” and Kris Agrawal and Kris K. Agrawal, et al, Exxon Oil & Gas, Inc., Vance-1 Properties, LLC, as the

“Seller” (the Agrawal Acquisition Agreement”), with an effective date of April 04, 2024 [see EX

2.01B]. The Company, together with AHIC purchased all of Seller’s “(Kris Agrawal and Kris K. Agrawal, et. al.

collectively referred to as “Agrawal”), working interests and overriding royalty interests in a list of oil and gas

leases attached as Exh. A1 (the “Agrawal Assets”). At ¶ 2.2(b)(1), the Agrawal Assets shall be held in escrow by

Agrawal’s Escrow Agent and will not be recorded/retitled to Buyers until “one day after receipt of the full purchase

price. As such, this transaction is a contract (a “chose in action”) for lease assignments and is not currently vesting

title to the assets in Buyers.

The agreed purchase price of the Assets is $3,500,000.00,

the payment of which by a “convertible note,” which is to be readily convertible into the Company’s Class “A”

Common Stock, at its “market value” per share “at the moment of execution,” within 13 months of the date of the

agreement. The agreement, itself, is considered to be a “Promissory Note and Mortgage of $3,500,000 upon the purchased leaseholds.

The Buyer must pay $150,000.00 to the Seller within the first six months of the Agreement to improve the purchased leaseholds. The Agreement

can be terminated by Buyer or Seller if they cannot agree upon the obligations under the acquisition. However, all parties to the Agrawal

Acquisition Agreement have expressed a common goal of agreeing upon their obligations under the acquisition.

Value-Added Aspects of

the Acquired Assets

Osage County Oil and Gas properties are attractive

because of the high-quality oil and gas, the extensive reserves, and long production history of Oklahoma Oil Fields. In addition, the

Osage County minerals are owned by the Osage Nation Head Rights which is managed by the US. Department of Interior’s Bureau of

Indian Affairs (BIA). BIA oversight means that all lease contracts are issued and managed by the BIA with the guaranty of clean title,

clean environmental standards, oversite and in good standing for all compliance orders and code.

The Company has now entered into three oil and

gas lease acquisition agreements to provide a substantial increase in the Company’s lease holdings. With this foothold, the Company’s

plan is to build on this success by evaluating and acquiring neighboring oil and gas lease operations. We are confident in our ability

to identify and fund acquisition prospects in Oklahoma to continually build our base of production assets and revenues.

Our plan is to acquire assets in close proximity to our current operations

with an eye on the largest private producers in the area extracting upward of 800 BOPD. To fund the acquisitions, we intend to exploit

three sources of capital; revenue, offered equity, bank debt and in cases of larger acquisitions, a combination of the three. We believe

that by acquiring producing properties, we can deliver strong value to our shareholders.

Silverton Energy, Inc. as a “Complete” Oil and Gas Company

Through Managements extensive industry experience,

certain fundamental elements were recognized as a necessary baseline to function as a “complete” Oil & Gas Company. Those

certain elements are:

| 1.) | Exploration & Production – The company must own the

rights to the hydrocarbons in the ground and have operating permissions to extract those commodities. |

| 2.) | Assets – The company must sufficiently equip the operation

to ensure independent ability to drill, produce and repair without reliance on third party service companies. |

| 3.) | Revenue – As a public company, minimizing Royalty participants

is key to retaining the value exploited through operations, and reflecting that capture in the price p/share |

The following are our guiding principles:

| ✓ | Focus on core production with high reserve value; |

| ✓ | Seek Upside in Acquisitions for cost advantaged production; |

| ✓ | Purchase assets at attractive multiples; |

| ✓ | Control of our budgets and production

timelines; |

| ✓ | Seek to consistently recapitalize the company through the recognition of reserves acquired; and |

| ✓ | Maintain flexibility and creativity in deal structures to maximize shareholder value. |

Risk Factors

The following is a summary of some of the risks

related to an investment in the Company’s securities. Prospective Investors are asked to carefully consider the following factors

relating to risks associated with an investment in the Company’s securities, which should be discussed in greater detail with the

Investors’ personal tax counsel, legal advisor, and/or accountant. The order in which the following risks are presented is not

intended to represent the magnitude of the risks described. Additionally, the enumeration of these risks does not preclude other risks

associated with an investment in the Company’s securities.

Limited Operating History. We acquired

our first oil and gas property in March of 2023. As a result, our company has a limited history. However, we are led by a team of professionals

with decades of experience in the oil and gas industry and a proven track record of evaluating, acquiring, and maximizing values in existing

producing wells and fields.

Reliance Upon Management. Our success

is largely dependent upon the efforts of our executive officers. Although our management has extensive experience in the industry, if

any member of our management ceases to be associated with Silverton, our business could suffer.

Duties and Responsibility of our Directors

and Executive Officers. Our Directors and management are accountable to the shareholders and have a duty to exercise good faith and

to deal fairly with Silverton in handling their affairs. Our corporate organizational documents contain provisions which are intended

to limit the liability of our management for any act or omission within the scope of their authority if it is determined in good faith

that such course of conduct was (a) undertaken in good faith and (b) did not constitute gross negligence or misconduct.

Restriction on Trading. Investors should

be fully aware of the long-term nature of their investment in the Company’s Securities. Although a public trading market does not

yet exist for our common stock, the shares of our Class “A,” “B” and “C” Preferred Stock are NOT

and WILL NOT be registered, but rather, only the shares of Class “C” Preferred Stock are eligible to convert to common shares

when an exemption becomes available. Absent a registration statement, the common shares are eligible for restriction removal and trading

through an exemption under Rule 144 or Rule 4(a)1.5. However, this could take as long as 2 years if the company is unsuccessful in executing

its plan to become a fully reporting company. Each Investor will be required to represent that such Investor is purchasing the Shares

for such Investor’s own account for investment purposes and not with a view to resale or distribute The Shares will not be registered

under the Securities Act or under state securities law but will instead be issued pursuant to specific exemptions, the availability of

which is based in part upon the investment intent of each Investor.

Restrictions on Transfer. The Shares

are not readily transferable, and no transfer of Shares may be made unless the transferor delivers, if requested, an opinion of counsel

to us, satisfactory to our management, that the transfer does not violate federal or state securities laws. To obtain such an opinion

would generally require the Shares be registered under such laws or that an exemption from registration exists. There can be no assurance

that an exemption will be available. If, as a result of some change in circumstances arising from an event not now contemplated, an investor

wishes to transfer his or her Interests, that investor will in all likelihood find no market in the near future.

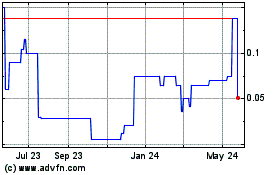

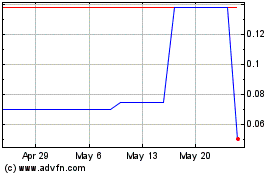

Risks Related to Ownership of Our Common

Stock. Our Common Stock is currently eligible for quotation on the OTC-Pink Market, but few quotations have been made and limited

trading has occurred in our Common Stock. Due to the lack of an active trading market for our securities, investors may have difficulty

selling any shares they purchase, which could result in the loss of their investment. Our Common Stock is eligible for quotation on the

Pink Market operated by OTC Markets Group Inc. The Pink Market is a regulated quotation service that displays real-time quotes, last

sale prices and volume information in over-the-counter securities. The Pink Market is not an issuer listing service, market or exchange.

The requirements for quotation on the Pink Market are considerably lower and less regulated than those of an exchange. Because of this,

it is possible that fewer brokers or dealers will be interested in making a market in our Common Stock because the market for such securities

is more limited, the stocks are more volatile, and the risk to investors is greater, which may impact the liquidity of our Common Stock.

Even if an active market begins to develop in our Common Stock, the quotation of our Common Stock on the Pink Market may result in a

less liquid market available for existing and potential stockholders to trade Common Stock, could depress the trading price of our Common

Stock and could have a long-term adverse impact on our ability to raise capital in the future. If an active market is never developed

for our Common Stock, it will be difficult or impossible for any purchasers to sell any Common Stock they purchase.

Acquisition of Additional Properties.

Although our management has significant experience in identifying and acquiring oil and gas properties and has already identified properties

that would be a good acquisition for us, there can be no assurance we will be successful in our efforts to acquire additional properties

at values that make economic sense. The primary purpose of the Company’s securities offerings is to raise funds to purchase additional

producing oil and gas properties.

Importance of Future Prices and Demand for

Oil and Gas and Delays in Marketing Production. There can be no assurance that a market for any oil or gas produced from our properties

will exist or that the prices obtainable will be adequate to cover the cost of operating such properties. Our revenues are highly dependent

upon future prices of and demand for oil and gas. The energy market makes it particularly difficult to estimate accurately future oil

and gas prices. Various factors beyond our control will continue to affect oil and gas prices. Such factors include, among other things,

the domestic and foreign supply of oil and gas and the price of foreign imports, war or civil unrest, terrorism, the levels of consumer

demand and consumer confidence, recession, decline in economic activity, changes in weather, the price and availability of alternative

fuels, the rate of inflation, the availability of pipeline capacity and changes in existing and proposed state and federal regulations.

Speculative Nature of Oil and Gas Activities.

Oil and gas development involves a high risk of loss. Decisions to acquire properties will be dependent in part on the evaluation of

data compiled by petroleum engineers and geologists and obtained through geophysical testing and geological analysis. The results of

such studies and tests are sometimes inconclusive or subject to varying interpretations. In any oil or gas activity, economic success

depends almost entirely on the accuracy of estimates of oil or gas reserves in the ground, rates of production, demand for oil or gas

and the prices of oil or gas. There can be no assurance that we will recover our investment in any properties we own.

Lack of Diversification. Although our intent behind any securities

offering is to raise funds to acquire interests in other properties, at present our assets are limited. The acquisitions of additional

properties will further mitigate risk through diversification.

Environmental Hazards and Regulatory Liabilities. There are numerous natural hazards involved in the operation of oil

and gas wells, including unexpected or unusual formations, pressures, surface damage, bodily injuries, damage to and loss of equipment,

reservoir damage, loss of reserves, and temporary/permanent shut-in costs of wells. Uninsured or under insured liabilities would reduce

the funds available to us and may result in the loss of properties. We believe we can avoid the significant financial, environmental and

hazards risks associated with operating oil and gas wells by not being an Operator. Even as a non-operator, and potentially responsible

party for our properties, it is possible that insurance coverage may be insufficient. In that event, assets could be utilized to pay personal

injury and property damage claims and the costs of replacing destroyed equipment rather than for additional development activities.

Increases in Development Costs. The oil and gas industry historically has experienced periods of cost

increases from time to time which can occur within short periods of time. These price fluctuations are real and will affect the overall

final budget of any well in which we own an interest. Increases in the cost of exploration and development could affect our ability to

profit within the budget originally established. Increased development activity could lead to shortages of certain equipment and materials

needed for properties in which we own an interest which could make timely development of our properties more difficult.

Unpredictable Producing Life of Oil and Gas

Wells. We cannot predict the life and production of any properties in which we have an interest. The actual life of individual wells

could differ from the currently predicted economic life expectancy now anticipated. However, our existing properties and properties we

anticipate acquiring are in areas that are anticipated to produce from a formation or formations for multiple years. Nevertheless, sufficient

natural gas or oil may not be produced from our properties to provide us with a profit on our investment in such properties.

Joint Activities with Others. The company

intends to acquire properties. However, the company may participate in a joint venture with another operator, acquiring

less than 100% of the working interest. Full development of the properties in which we own an interest may be jeopardized in the event

of the inability of other working interest owners to pay their respective shares of development costs. These potential non-payments may

limit us from recognizing the full value of our interest in our properties.

Competition Against Larger Companies.

The oil and gas industry is highly competitive. We will be competing against other companies with significantly more resources than we

have in the pursuit of good oil and gas properties.

Future Offerings. Our present intent

is to use either equity or a combination of equity and bank debt to acquire additional properties. If we are unsuccessful in raising

additional equity or borrowing funds, our ability to acquire additional properties will be limited.

Bank Debt. Consideration has been made,

and meetings set up to explore the possibility of utilizing bank debt as part of an acquisition. Introducing leverage to the company

could have a negative impact on cashflow and even ability to borrow for future acquisitions in the future.

Executive Officers and Managing Directors

Samuel C. Smith – Chief Executive Officer

Mr. Smith is a United States Marine Corps Veteran

who graduated from Texas A&M University in Commerce with degrees in both Economics and Political Science. Subsequently, he attended

the University of Tulsa College of Law.

His career started in 2001 as a registered representative

for an NASD Member Firm soliciting high net worth investors for participation in Limited Partnership Projects. Shortly following his

role in sales, Mr. Smith moved into analysis and ultimately investment banking with activities focused on the “Buy-Side”

of Mergers & Acquisitions, Leveraged Buyouts, and other types of combinations.

In 2009, with almost a decade of corporate finance

experience, Sam embarked on a career as a Venture Capitalist, raising private and public equity, managing buying and selling groups,

and identifying niche opportunities in a variety of industries.

Mr. Smith has owned and operated numerous businesses

with an emphasis on corporate finance, growth and innovation. He has extensive experience in origination, structuring and oversight for

seed capital funding and structured finance. He guided or overseen numerous private and public companies from the startup phase through

the growth stage including and in particular exploration and production companies in the oil and gas space. At one point, Mr. Smith actively

managed three operatorships, extensive acreage and upwards of 400 producing wells.

Mr. Smith has accepted the role of CEO and brings

the early stage, corporate finance, public company, and energy production experience required to move the company to its full potential.

Dr Eduardo Balli – Chief Financial

Officer

With over 30 years of experience, Dr Eduardo

Balli has worked for both public and private companies within the Accounting and Auditing fields, as well as in the startup and buildout

of several Midwest companies.

Dr. Ed has been a Senior Faculty Member for

two major Midwest and East Coast Universities. He has been an instructor for Auditing, General Accounting, Taxation, Information Systems

Audit, and Cost Accounting. Dr. Ed works with students pursuing both Bachelor and Graduate degrees. He has been on several University

committees such as Curriculum Development, Student Retention, and spent a year as President of the Faculty Advisory Committee providing

improvement suggestions and areas of concern to upper Universities Leadership.

With a B.S, in Economics and Accounting, he graduated from

Northern Illinois University, NIU. Dr Ed earned an M.B.A. in Finance from the University of Wisconsin-Madison, ultimately attained Doctor

of Business Administration (D.B.A.) in Accounting from Argosy University.

John Long – Chief Operating Officer

Mr. Long is a hands-on operator in the mid-south oilfield.

He was born to a multi-generational oil patch family and began checking wells with his father at the age of 10. He later progressed to

helping on the pulling rig and the drilling rig at the age of 14. Thus began Mr. Long’s nearly 50 years working in “The Patch.”

By the age of 20, John bought

his first pulling rig and began a decade of work as an independent contractor servicing several large oil companies before acquiring his

own producing leases at the age of 29. After his production and service company was firmly established, John steadily added equipment,

leases and labor to his company before acquiring his drilling rig at the age of 36.

Mr Long drilled more than 40 wells for his own production

while maintaining his continued contract drilling, well service, dozer and roustabout work for other large and small oil companies in

the region.

At 41, John sold his business to enjoy the fruits

of his endeavor only to discover his desire to remain in the patch was in his blood. In truly short order, John built a new bonded oil

company generating greater than $1,000,000 in annual revenue through efficient operations and strategic acquisitions.

Mr. Long has accepted the role of Chief Operating Officer

and brings his decades of successful oilfield operations experience to assist in evaluating potential acquisitions as well as managing

field operations.

The Company’s Securities

Class “A” Common Stock: The Company

has 500,000,000 authorized shares of Class “A” Common Stock. To date, 95,100,000 shares of the Class “A” Common

Stock has been issued:

Ownership of our executive officers and directors and any

other security holder who owns more than 10% of our common stock are:

| Samuel C. Smith – Board Chair and CEO: |

|

|

32,003,266 |

|

| John Long – Board Member and COO: |

|

|

30,000,000 |

|

| Edward Balli – Board Member and CFO: |

|

|

500,000 |

|

| Ownership by Other Shareholders: |

|

|

2,596 |

|

| Total Class “A” Common Shares Issued: |

|

|

95,100,000 |

|

Preferred Stock.

The Company currently has three classes of preferred stock

authorized:

| · | Class “A” Preferred Stock: This class consists of a single

share created in the custodianship process as a control mechanism, the current holder of which is the Company’s CEO and Board Chair,

Samuel C. Smith. The Class “A” Preferred Stock has 60% voting rights, and the single issued share can be converted into 300,000,000

shares of common stock. At this time, there is no intention by Mr. Smith to utilize his voting rights under his single share of the Class

“A” Preferred Stock. |

| · | Class B Preferred Stock: This is the control block of stock held by

Samuel C. Smith and John P Long Jr. Each share of Class B Preferred Stock entitles the holder thereof to cast 500 votes on all matters

requiring vote. |

| · | Class C Preferred Stock: The Company’s Class

C Preferred Stock, consisting of 5,000,000 authorized shares, was created for purposes of the Company’s Reg D, Section 506(c), exempt

private offering, which was disclosed to the Securities and Exchange Commission in its September 15, 2023 Reg D filing, which is adopted

in this 8K filing by reference, and can be located under the SEC’s Edgar filing system at the following hyperlink: |

https://www.sec.gov/Archives/edgar/data/1508786/000168316823006305/xslFormDX01/primary_doc.xml

The Reg

D Offering is offered solely to qualified investors a maximum offering of 5,000,000 Class “C” Preferred Stock shares

priced at $0.40 per share for a Maximum Offering Purchase Amount of $2,000,000.

This share class is a Preferred Equity Class that

converts at a rate of five (5) Class “A” Common Stock shares for each single (1) Class “C” Preferred Stock

share. As of the date of this filing, of the 5,000,000 authorized shares, 927,500 shares have been issued, with a current Company

Treasury balance of 4,072,500 shares of Series “C” Preferred Stock.

Item 1.01 Entry into Material Definitive Agreements.

Since the Company entered into three material definitive

agreements, which also constituted completion of the acquisition of assets, the entry into Material Definitive Agreements is reported

in conjunction with Item 2.01 Completion of Acquisition of Assets.

Item 2.01 Completion of Acquisition or Disposition of

Assets.

The Company, on May 01, 2024, entered into and completed two Material

Definitive Agreements, which resulted in the Company’s Acquisition of Assets:

| |

2.01A. |

Acquisition Agreement Between the Company and American Heritage Investment Capital, L.P. (“AHIC”), dated May 01, 2024, with the Company as Buyer and AHIC, as Seller (the “AHIC Acquisition Agreement”); |

| |

2.01B. |

Acquisition Agreement between American Heritage Investment Capital, L.P. and SLTN, as “Buyer” and Kris Agrawal and Kris k. Agrawal, et al, Exxon Oil & Gas, Inc., Vance-1 Properties, LLC, as “Seller,” signed on May 01, 2024, with an effective date of April 04, 2024). |

Item 2.01A

Acquisition Agreement Between Buyer, the Company and Seller, American

Heritage Investment Capital, L.P., dated May 01, 2024, (the “AHIC Acquisition Agreement”), a copy of which is EX 2.01A.

Assets Acquired. Under the AHIC Acquisition

Agreement, the Company purchasing for $52,000,000, a group of American Heritage Investment Capital, L.P’s (‘AHIC”) oil

and gas leases in Oklahoma (the “AHIC Assets,” listing in Exhibit A.1 to the Agreement), with a “current value”

of $81,000,000, via a Contract for Assignment. The Acquired Assets are held in escrow by AHICs attorney, to be formally transferred to

the Company upon AHIC receiving the agreed upon $81,000,000 from the Company.

Payment for Assets Acquired - $81,000,000 Promissory

Note. The $81,000,000 purchase price is to be paid by an $81M, 20-year, non- interest bearing Promissory Note (Secured by the leases),

payable in a lump sum $81,000,000 payment on May 01, 2044. Section 5A of the Promissory Note provides a credit against the $81,000,000

Promissory Note:

5 (a) For each $15,000,000 introduced to the company through

institutional investors, a payment of $3,000,000 shall be immediately delivered to seller and credited against this note.

Default and Conversion to Shares of Class “C”

Preferred Stock. Upon default, after May 01, 2044, AHIC can: (i) foreclose on the collateralized oil and gas leases, or (ii) convert

the $81,000,000 in collateral to “preferred stock,” upon a conversion ratio, based on a fair market value of the preferred

stock. The $81,000,000, if divided by 927,500 of currently available Class “C” Preferred shares is $0.87/share (the current

more than the offering price of Class “C” Preferred shares is $0.40 per share.

Conversion of Converted Series

“C” Preferred Stock shares into Series “A” Common Stock shares After a period of five (5) years from the date

of conversion of the Company’s $81,000,000 into the Company’s Class “C” Preferred shares, the preferred shares

shall automatically convert into shares of common stock of the Borrower company on a one-for-one basis (which is a contractual agreement

not to convert under the pre-existing five-for-one conversion rights for the Company’s Class “C” Preferred Stock). The

converted preferred stock shall have one-for-one voting rights per share, the same as the Company’

Voting Rights:

The preferred stock shall have one-for-one voting rights per share, the same as the Company’s Series “A” Common

Stock.

Effect of AHIC Conversion of its Class “C”

Preferred Shares to Class “A” Common Shares. The Company has 500,000,000 authorized Class “A” Common Stock,

of which 88,600,000 shares have been issued or committed. Even if all 5,000,000 shares of Class “C” Preferred Stock were sold

and converted on a 5/1 basis to Class “A” Common Stock, which would result in 20,000,000 shares of Class “A” Common

Stock. The remaining 391,140,000 remaining shares of Class “A” Common Stock would be sufficient to absorb a conversion by

AHIC.

* There are currently available of 1,072,500 shares of Series “C”

Preferred Stock in the Company’s corporate treasury, which is assumed, and should be specified as Series “C” Preferred,

it is $0.206 per share of Series “C” Preferred Stock, if all $52,000,000 of the debt is converted. The current Reg. D offering

is $0.40 per share. The fair market value of the Class “C” Preferred Stock, 20 years from the date of the agreement, is not

currently known.

Item 2.01B

Acquisition Agreement between American Heritage Investment Capital,

L.P. and SLTN, as “Buyer” and Kris Agrawal and Kris k. Agrawal, et al, Exxon Oil & Gas, Inc., Vance-1 Properties, LLC,

as “Seller,” signed on May 01, 2024, with an effective date of April 04, 2024), a copy of which is EX 2.01B

The Company, together with American Heritage Investment Capital, L.P.,

on May 01, 2024, entered into an Acquisition Agreement, the Company and American Heritage Investment Capital, L.P. “(“AHIC”)

purchased all of Seller’s “(Kris Agrawal and Kris K. Agrawal, et. al. collectively referred to as “Agrawal”),

working interests and overriding royalty interests in a list of oil and gas leases attached as Appendix “A2” (the “Assets”)

“(the “Agrawal Acquisition Agreement”). At ¶ 2.2(b)(1), the Assets shall be held in escrow by Seller’s Escrow

Agent and will not be recorded/retitled to Buyers “one day after receipt of the full purchase price. As such, this transaction is

a contract (a “chose in action”) for lease assignments and is not currently vesting title to the assets in Buyers.

The agreed purchase price of the Assets is $3,500,000.00, the payment

of which by a “convertible note,” which is to be readily convertible into the Company’s Class “A” Common

Stock, at its “market value” per share “at the moment of execution,” within 13 months of the date of the agreement.

The agreement, itself, is considered to be a “Promissory Note and Mortgage of $3,500,000 upon the purchased leaseholds. The Buyer

must pay $150,000.00 to the Seller within the first six months of the Agreement to improve the purchased leaseholds. The Agreement can

be terminated by Buyer or Seller if they cannot agree upon the obligations under the acquisition. However, all parties to the Agrawal

Acquisition Agreement have expressed a common goal of agreeing upon their obligations under the acquisition.

Item 8.01 Other Events

Item 8.01A – Retaining of an independent Certified Public Accounting Firm to review and prepare

an U.S. GAPP level audit of the Company’s Fiscal Year 2023-2024 Third Quarter Financial Statements, which were previously prepared

according to U.S. Generally Accepted Accounting Principles (GAAP), by the Company’s CFO, Dr. Edward Balli.

The Company has retained the CPA firm of:

FM Financial Services, LLC

2910 Grants Lake Blvd.,

Unit 1402

Sugarland, TX 77479

929-571-1666

Faiza Mehmood, CPA

The auditing firm is in the process of being a PCAOB certified

public company auditing firm, by the Public Company Accounting oversight Board. When the Company’s has its financial

statements certified by a PCAOB level certified CPA firm, it will enable the Company to produce financial statements which will be

considered more reliable by its current shareholders and potential shareholders of securities offered for sale by the Company.

Additionally, it will enable the Company to start on the path to being listed on a National Public Exchange, such as NASDAQ.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following is a complete list of exhibits filed as part of this Report. Exhibit

numbers correspond to the numbers in the exhibit table of Item 601 of Regulation S-K.

| |

|

|

| Exhibit No. |

|

Description |

| 2.01A. |

|

Acquisition Agreement Between the Company and American Heritage

Investment Capital, L.P. (“AHIC”) |

| 2.01B. |

|

Acquisition Agreement between American Heritage Investment Capital,

L.P. and SLTN, as “Buyer” and Kris Agrawal and Kris k. Agrawal, et al, Exxon Oil& Gas, Inc., Vance-1 Properties,

LLC, as “Seller,” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 9, 2024 |

Silverton Energy, Inc. |

| |

|

| |

By: |

/s/ Samuel C. Smith |

| |

|

Samuel C. Smith, CEO |

Exhibit 2.01A

A C Q UIS ITIO N AGRE EMENT BETW EEN : S IL VE RTO N ENE RGY In c, a N e v ad a C orpor a ti o n a 101 E Park Blvd Ste 600, Plano , TX 75074 (" SL TN " r eferred to as " Buy e r ".) AND: AME RIC AN HERITAG E IN V E ST MEN T CAPI T AL , LP a T e x as Co rporation 1001 Texas Ave #14 00 , Houston , T X 77 002 (referred to as " AHI C " the "Se ll er ".) and: ( Bu ye r a nd Seller incl u ding their below defined representatives are con secutiv el y referred as t h e " Parti es" ) Attachm e n t s: App e ndix " A1" : Definitions and Interpreta t ion s Append ix " A2 " : List of A s sets Appendix "A3" : Li s t and particul ars of Overridin g Royalti es Appendix "A3" : Selle rs Statements Page l of 14

Page 2 of 14 WHEREAS: A. (a) Buyer is a public company, reporting to a fully regulated sto ck exchange in the OTCMARKETS, INC USA, with more than three hundred shareholders. The company has its common s har es li ste d on the OTC Markets , Inc (the "SLTN") under the symbol SLTN. Bu yer is in good standing with all Regulatory Authorities as well as current with all its corporate filings and has i ts registered offices. Buyer 's objectives are to be focused on investments and E& P within the Oil & Gas i ndu stry and, SLTN i s desirous to acquire certain percentages of the NRI of se l ected assets of NET in stages including o pera ting experience to expand its management team withi n that industry sector. (b) Seller is represented by its General Partners , Mr . Jeffrey Fannmg ("JF"}, and Mr . Rafael Pinedo ("RP"), whereby JF a nd RP will also be th e agen ts for Buyer to nego t iat i ons to facilitate the execution of the proposed transaction with Seller ; and (c) Buyer d esi r es to acquire all the working interest and overriding royalty interests in the listed Assets of the Leasehold (Appendix " A") . B. (a) Se ller owns and operates an oil a nd gas Leasehold described in Append i x " A I", which are all l ocated in Oklahoma and Arkansas (hereinafter the " Assets ") covering we lls and leases located in Beaver , Creek, C ana dian, Garvin , Garfie ld , Harper, Kingfisher, Major , Okmul gee, Muskogee (C ul to n , Milligan , fuller, an d Woodward Co u nties, including its in Oklahoma located Assets listed in Appendix "A 1 ". C. Seller believes the curren t value of these assets is E i ghty - one Million dollars ($81,000,00 0 ), based upon the Resou r ce Evaluat i on Report prepared according to National Instrum e nt 51 - 101 by MKM ENGINEERING (QP), In dependent Qualified Reserves Evaluator License F - 009377 , dated April 2 9 , 2022. This report reflected a Net P resent Value of Future Net Reve n ues (10% di scount rate) of $52,500,000 at the time of the report. Based upon the increase in the market value of the underlying pr ice of a barre l of oil and billion cubic feet of gas s in ce t hi s report , Se ll er believes that the value of the asset s has increased to $81, 00 0,000. However, Seller can offe r no assurances as to the increase in the value of the assets; Seller has agreed hereb y to se ll , assign , and convey to the Company and the Company has agreed hereby to purchase and accept the Subject Interest in the L eases subject to the terms and conditions of this Agreement a n d all it s working and overriding royalty interests i n the Assets listed in Appen di x "A2". D. The Parties have reached a consent as to the terms and conditions of the purchase and sale and wish to articulate this agreement. NOW THEREFORE t he Parti es agree that, to proceed effectively, the terms and conditions set forth within thi s agreement including its Appendices will be the basic terms and therefore the Parties agree to the following : 1. Definitions and Interpretation 2. (a) For the purposes of this Agreement and the convenience to the r eader hereof , the Definitions and Interpretations are attached as Appendix " Al . 0 " to this Agreemen t whereby all capitalized word and short for ms within this Agreement are referred to as defined herein ; (b) th i s Agreement may include additional defin ed tem 1 s set forth within "ex clama tio n marks " ; (c) unless the context otherw ise clearly indicates , words u se d in the sing ular include the plural , the word "Person" includ es natural and artificial persons as define in Appendix " A " 1 . 0 ", t h e plural includes the singular, and any gender includes the masculine, feminine, and n euter . 1. Basic Structure the Acquisition of Seller's Assets and Int e gration of Operating Entity 2. The Parties agree to use their best commercial efforts to formulate a payment structure for the acqu isiti on of Assets including the integration of operating entity including an operating team into Bu yer 's organization: (a) the Partie s will minimize or eliminate any adverse approval tax conse quence s and be as cost effect i ve , but also to provide the possibility of a cost - efficient unwinding of the Transaction for the

Page 3 of 14 Parties in case the desired funding or any other of the agreed upon conditions cannot be accomplished; and (b) the Transa ction becomes effective subsequent to the approval of the company including the approval of the Board of Directors ("BoD ") and the completio n of a NI 51 - 101 Repo rt performed by a Qua l ified Person ("QP"), wh i c h is compliant w ith the ''Nl 51 - 10 I "Stan dards of Disclosure for Oil and Gas Activities " under the SEC rules. 2. Th e Parties r ecog nize and confirm further tha t: (a) Buyer will continue its due diligence and will have examined the title and cond i tions of all equipment which Seller will sell , assign, and deliver t o Buyer all of Seller's right, title, and interest, in the working interests in the listed Assets i s going to be executed; but (b) the acquisition and assignme nt of leases shall be those listed in Appendix " Al ", The Parties agree that Seller will assign all its right , title, and interest of every kind in the Leasehold regardless of whether it i s covered by the leas es described in said assignmen t ; but ( ii) (i) the said assignment shall stay in the control of t h e Seller's Escrow Agent , as i n demnified within Appendix "A1 ") and shall only be recorded one day after the receipt of the full purchase price and No recordation provision will survive this agreement, the Acquisition include that Seller will assign and deliver, and Buye r will acquire all the working and overriding royalty interest of all Assets owned by Selle r ; whereby (i) Seller shall not merge the Overriding Royalty Interests into the working interest until purchase price h as been paid in full; and Parties agree that the overriding royalty interest in the Silver Red Fork Sand unit i s amounts to three hundred thousand US dollars (US$300,000) as w ill be confirmed by QP; (c) unless disclosed the Assets to be acquired by Buyer, will be free from any outstanding l iens, charges, claims or Encumbrances and the Partie s wi ll execute all documents as the Parties, or their solicitors may require in order to effect Transaction under this Agreement. The Parties also confirm that they have no further engagements and liabilities outs tand ing othe r than those that have been di sclose d herewith o r within their attached financial statements. 1. A gr eed ba sic Te rms for the Transaction 2. Buyer desires to acquire the Assets of Seller's Leasehold for the Acqui sition - P rice referred to the va l ue of the Leasehold must be confirmed by an ''NI 51 - 10I Report' ' or verified by a PQ as referred to in this Agreement as basis for the accounting validation by Bu yers's auditors. 3. The execution of the agreement will contai n the custom ar y representations, warranties and covenants given by the Parties which wil1 also include in more detail the initial operating objectives 4. upon the execution of this agreement , with the consent of the board of directors. 5. The term "Leasehold" as used he rein, shall mean: • all oil, gas, and mineral lea ses, any unitization orders, all forced poolin g orders and all othe r licen ses, permits and orders which cover , authorize or relate to the exploration for and production of oil, gas, and other minerals from the lands described above . all wells located on the above described lands, personal prope1ty , fixture s, compressors, gatheri n g systems, pipelines, inventory located thereon , equipment, a n d improvements located on the Leases or the Land, or u s ed or obtained in connection with the ownership, exploration, dev e l opme nt , or operation of the leases

Page 4 of 14 • on the Land, or th e production, sa le , processing, treating, stor i ng, gathering, transportat i on or disposal of h ydrocarbons, water or any other s ub stances p r oduced th erefrom or attributable thereto; • all contracts, agreements, l eases, lic enses, easements, right s - of - way, ri gh t s under o rd e r s of re gulatory authorities ha ving jurisdiction w i th re spect to, a n d other properties and rights of every nature whatso ever in or incident to the owners hip, exploration, development , u se or occupancy of t he Leases or the Land or any interest t her e in , or th e pro d uc ti on, sa le, proce ss in g, treatin g, sto rin g, gathe rin g, tran s portation or d i sposa l of h y drocarbons , wate r or any othe r substance prod u ced therefrom or attributable thereto ; and all other right s a nd intere sts of every nature whatsoever owned by Sell e r r el ating to the Leases o r the listed Assets, Land or the ownership or operation t h ereof, including, but not limited t o, s urface l eases and und e veloped l ease hold l oca t e d within the Listed Assets, prov ided , however, that there i s excepted speci fically from the t erm Leas eh old: • • surface ownership of the real pro p erty cove r ed by the Assets , all mineral int erests and ro ya lty inter est, overriding royalty interest owned b y third patties, and ot h er similat · rights and in tere sts in and under the Leasehold and t he Land, and all hydrocarbon pr od uction fro m or attributable to the Leasehold or the Lan d with resp ect to all p er i ods prior to the Effe ct ive Time of this agreement. 1. Acquisition or Purchase Price and Payment Terms for Acquisition 2. Buyer agrees to pay for a ll of Seller' s in terest in th e Leas e h o ld includin g Royaltie s and ov er riding Royalties, the principal s um of eighty - one million US Dollars , (US$81,0 0 0,000.00), which s hall be paid as follows: WHER EAS, t he Company and Purchaser are executing a nd deliverin g this Agreement in reliance upon the exemptio n from secu r ities regi stration afforded by the rules and r egulat ion s promulgated by the U nited States Secu ri ties an d Exchange Commission (The "SE C ") under the Sec uritie s Act of 1933 , and amended (the '' 1 933 Act ") ; WHEREAS, t be Purchase Price for th e Purchased Assets s h all be paid b y the Company t o t he sell e r : 1. the iss uance of a Co nvertibl e Promissory Note payable to (AHIC) in the principal amount of E ighty - one million d olla r s ($81 ,00 0 , 000) in the form of Exhi bit B , attac hed hereto and incorporated herein. The note is convertible into shares of the Company's co mm on stock. Notes maturing within (twe n ty years) 20 years of the acquisition , upon execution of this Agreement. (c) Un til full pay ment h as been re ceive d by Seller : (i) B uyer shall not encumbe r the leases , wells equ ipment and th e U nit Pr oduc t ion, with mortgages, liens , saJe contracts, dr illing co ntract s, UCC - l liens (see Appendix "Al"), Operator's Lien, Un it Op e rator 's lien s, production payment s ; (ii) Bu yer sha ll at all times maintain th e p r operty su bj ect to its contracted free and clear to be handed over to the Seller in the present o r better condition as received on date of this contr act until fu ll pa yment has been received. (d) Once Buy e r is in charge of the operation, Buyer - S eller shall operate the wells and the l eases ; and (e) This contract shall be treated as a Promissor y Note and Mortgage upon the Leasehold with right to sell and rep oss es s without a judicial s al e which shall be updated and reduced t o the remaining

Page 5 of 14 balance after each payment to the p r incipal s u m of the Acquisit i on - Price. (f) Selle r shall still be deemed to be tbe owner of the leases and the production of the Leasehold until payment has been received i n full by the Buyer. Seller may enter the premises at mutuall y agreed times, but will take back contro l of premises , wells, equipme n t, product ion and exclude the Buyer from the premises only, if an uncured default is es t ablished. 5. The Effective Date of the Ac quisition . The Parties agree that the Effe ctive Date of the Acquisit i on w ill b e the April 4, 2024. 6. No Warrantv of Equ ipm ent or Amount of Production. Buyer acknowledges that the e q ui p ment located o n or in the we ll s located on th e Listed Asset s and an y equipment used for the production of the Assets, wells, are being tr ansferred "as is" and "where is" without warranty of merchantability or condition and that Bu yer has satisfied itself regarding the condition of the equipment and the wells ability to produce a specified amount of oi l or othe r products therefrom and no warranty or repr ese n tatio n regarding the amoun t of production that will be availa ble from operating the wells is being made by Seller. 7. Representations and Warranties of Se ller. 1. As a mate ri a l i nduce m ent to Buyer enter ing int o and perfor ming it s obligations under t hi s Agree ment , Seller h ereby represents and warrants to Buyer as of the date hereof, and by proceeding with theClosing will be deemed to represent and warrant to Bu yer as of the C l osing - Date , t h e following: (a) B in ding Effect . That the u nd ers i gned has duly executed and delivered this AGR EE MENT as Seller and he is author i zed to execute it on behalf of all parties named ab ove as Seller, and a ll in str ument s required h ereu nder to be executed and delivered by Seller . (b) Status of Properties: No Liens . Since the acquisition by Seller of the Leasehold, Seller ha s not made any assignment, conveyance , or other dispo sitio n of any suc h prop ert ie s or any intere st therei n . Seller's interests i n the Leasehold are not subject to or b u rdened by a mortgage , security inte r est or other lien cre ated or arising by , thr ough o r under Seller. Any benefits accrued to Seller by any instrument file d , are to be conveyed to Buyer. No l abor or material liens may be filed against the pro perty or the intere st of S ell er for services provided within the l ast 1 80 day s has not been paid for by Seller, or Seller sha ll beobligated to pay all costs i ncurred by it to develo p and mainta i n the Leasehold oil and gas production. (c) Status of Leas eh old : All leases are in full force and effect (an d before the end of February 2022). Seller wou l d have made shut in royalty payments or are being held by production from the lis t ed Assets. All royalty and Overriding R oyalty Interest payments have been made current through Oil Purchasers via l ast purchase of o i l in January 2022 . Th ere are no lawsuits or disputes filed i11 any Distr ic t Court of La w w ith min era l owners ove r the validity of the o il and gas le ases . T h e ac re age under non - operated wells are for Buyer to propose n ew dri ll ing s ite s. All expenses to suc h non operated wells have not been paid and Bu yer is under n o obligation to purchase them without reducing the purchasing price. Seller will give notice to Operators of non - operating we ll s to shut dow n the ope r at i ons to not in cur add i tiona l lia bilit ies. Selle r h as ce11a in o bl i gations to Ok l ahoma Corporation Commission. 1. Broker and Other Fees. Seller has in cu1Ted no li ab ility, contingent or otherw ise, for broker or si milar fees in respect of t hi s tra n sac tion for which B uyer s hall have any r esponsibil i ty whatsoever. 2. Compliance with Agreements and Laws. To Seller ' s knowledge, no default exists under any of the tenns and provisi on , express or implied , of the Leases or of any material agreement , contract or co mm itment to which Se ller i s a party or to which any of the Le asehol d i s subject, and Se ll er has not received any notice of any claim of s uch default from mineral owners. Seller is unaware if any wells included in the Lea seho ld have been drilled , completed , and operated in substantial compliance with all applicable rules and regulations of the Oklahoma Corporation Commi ssio n . T h ere are no unabated environmental vio l ations.

Page 6 of 14 4. Contracts Relating to the Interes t s . Seller has n ot entered on any contracts affecting Seller's interest in the Lease h old for which B uyer will have any responsib i lity or liability after the Closing except as set forth in Appendix ''B" attached hereto. 5. Clai m s o r Lit i gat i on . There is n o suit, act i o n o r other procee d i n g pe n d i ng agai n st Se ll er before any court or govemmentaJ agency relati n g to the Lease h old , nor to the knowledge of the Seller. If there will be any claim, d i spute , suit, action, or other proceedi n g threatened again s t Seller or pend i ng or threatened against any of the Leasehold which might result in the impairment or loss of Seller's title to the same or the va lu e thereof, t hen such lease h o l d shall b e excluded from this sale. 8 . 0 R e pre s entation s and Warranties of Bu ye r . As a material inducement to Seller entering into and performing its obligations under the terms of this agreement . Buyer hereby represents and warrants to Seller as of the date hereof , and by proceeding wi t h t h e Clos i ng will be dee m ed to r epresent a n d warra n t to Seller as of t h e C l osing - D at e . (a) The authorized capital stock of the Compan y consists of " Unlimited " shares of common stock, par value $ . 001 per share (the "Company Common Stock") , of which 94 , 600 , 000 shares are issued and outsta n ding as of thedate of this Agreement, 1 s h are of Se r ies A P r eferre d S t ock, 1 , 0 0 0 , 00 0 shares of Ser i es B P r e ferred Stock and approx i mate l y 825 , 000 shares of S e ries C Preferred Stock at par va l ue $ . 00 per share are a l so issued and outstanding , as oft b e date of this Agreement . (b) All of the issued and outstanding shares of Company Common Stock have been duly authorized and validly i ssued and are fu ll y p a id , nonassessa b le an d free of p reempt i ve r i g h ts . The Company Com m on Stoc k to be i ssue d to the Seller pui - suant to t his Agreement will , w h en issued as specified herein, be validly i ssue d and outstandi n g , fully paid and non - assessable , and not issued in violat i o n of t he p r eem p tive rights of any other person . ( c) To the Company's knowledge, there are no voting trusts, stockholder agreements or other voting arrangements that hav e b een ente r ed in t o among t he s t ockholders o f the Co m pa n y, or charges, lie n s or enc u mbrances on i ssu ed shares of th e Company Common Sto c k . 1. Financial Statements. As a company whose common stock trades on the Over - T he - Counter Bu ll etin Board, the Company is required to file certa i n financial reports with the Securities and Exchange Commission (the "SEC"). The Se ll er a nd its directors have had a c ha n c e to review said reports as they are pu blic d ocuments (said p u bli c l y ava i lable r eports and schedules thereto are referred to herei n as the "Compa n y F inancial Statements"). Except as otherwise set forth in Section 2.4 of the D isclosure Schedule , each of the Company Financial Stateme n ts filed since D ecembe r 31 , 2021 is complete and correct in all material respects , has been prepared in accordance with GAAP consistently applied throughout the periods presented, and p r esents fairly the fi n a n cial posit i o n , re sults of ope ra tions , cash :flo ws and stock h olde r s ' equity of t h e Co mp any as at the dates and for the perio d s indicated (su b ject , in the case of unaudited statements, to n ormal , recurring aud i t adjustments which will n o t be mater i al i n amount or significance) and does not include or omit to state any fact which renders the Company Financial Statements misleading. There has been no change in Company accounting policies since March 16, 2022, except as described i n the notes to the Company F i nancia l Stateme n ts. 2. Absence of Certain Changes. Excep t as otherwise set forth in Section of the Disclosure Schedule or in its periodic r eports fi l ed w i th the SEC pursuant to the Securities Exchange Act of 1934 , since Marc h I6 , 2022 , the Company has not: (a ) suffered any mater i al a d ve r se change i n its bus i ness, o p erations, assets, or fi n a n cia l cond i tio n , except as reflected on the Company Financial Statements;

Page 7 of 14 (b) suffered any material damage or destruction to or loss of the as se ts of the Company, whether or not cov e red by insurance, which property or assets are matedal to the operations or business of the Company taken as a whole ; (c) se ttled, forg iven , compromised , cance l ed, rele ase d, waived or pennitted to lap se any material ri gh ts or clai m s oth er than in th e o rdina ry course of bu siness; (d) entered into or terminated any material agreement, commitment o r tran saction, or agreed to or made any changes in mat e rial leases or agr eeme nt s, ot h er than ren ewals or exte nsi o ns th ereof and leases, agre eme nts, transactions and commitment s ente r ed into or terminated in the o rdi nary course of bu si ness ; (e) w ritten up , written down o r written off the book valu e of a n y material am o unt of ass ets , othe r than in the o rdinary co urse of busine ss ; or declared , paid or s et aside for payment any dividend o r distribution with respec t to the capital s tock of the Company . 9. Th e future Board of Directors As required , the company will need to nominate two direct ors with spe ific knowledge in th e Oil & Gas indu stry to its board. The present boar d members, officers a nd the new board members will provide full di sc l osure and cooperate in every aspect with the affairs of Buyer and Seller , to facilitate an efficie n t team cooperation. 10. Closing Closing Place and T i me . The agreement can be exe cu ted in multipl e l ocation and su bmitt ed via ele c troni c mail or facsimile but the closing shall take place within one (1) Bu s iness Da ys after the confinned ex ecution by both parties. C l osing s hall take place at the offices of Seller, at 4 I33 N. Linc oln Blvd . , Oklahoma City, OK 73105, o r s uch earlie r date or time and place as may be agreed to by Parties. 1. At the Clo si ng : (a) Seller s hall d elive r executed Assignment, Conveyance and B ill of Sale cov ering the Leaseho ld to Buyer to be placed with Seller as defined in Appendix " Al "; (b) Seller sha ll deliver all files, da ta, and r eco rd s pertain i ng t o the Leasehold to be return ed upon demand to Seller in case o f a default by Buyer until said default is cured. (c) Seller s hall d e liver a pr ope rl y exe cut ed Form - 1073 (see Appendix "A I ") for t h e transfer of o perati o n s to Bu yer. 11.0 l 1.1 Preliminary Acts and Conveya nc es . Pri or to effecting the sale and purchase the Buyer has satisfied him se l f on title to the Leasehold and the parties agree to work togeth e r diligentl y and in good faith to acco mpli sh a s ex pediti ously as reasonabl y pra ct icable any qu es ti o ns that ma y arise regarding title to the Leasehold pr operty or theoperations . 2. F o r this agree men t, the purchase price includes 90 % of mineral leasehold and 10 % e quipm e ntlea seho ld du e to depr ec iation . 3. However , n o equipment shall be removed , hypothecated, and sold : (a) by Seller pri o r to transfe r of ope rati o n s to Bu yer ; and (b) by Buyer until full pur c hase price of Leaseho l d has be e n paid ,

Page 8 of 14 (c) any reduction and alienation in equipment or Lease h old value under 11.2, (a) and (b) shall be considered as a criminal felony. 1. Po st - C losing Matters. 2. (a) Sa le s Taxes. lt is under stoo d that sales taxes, if any - ma y be imp osed on account of the transact io n contemplated hereby. Selle r will be respon s ible for a ll s uch taxes , will remit same to the proper governmental authorities within the time allowed for by law for payment t hereof and will h o ld B uyer harm les s with respect thereto, including any penal tie s or i n tere st assessed for l ate payment. (b) Receipts and Disbursements . If, after the Closing, Bu yer r eceives any funds relating t o operatio ns on o r pro ducti on from the Leasehold prior to the Effective Time, or Seller receives any fu nd s re latin g to operations o n or production fr om the L easeho ld after the Effective T i me , thenthe party receiving such funds shall account the r efor and pa y the same to the other party promptl y after re ce ipt th e re of. Oil produced and in the tanks prior to closi ng shall b e mea sured by both part i es prior to closing and if Selle r wishes it pick ed - u p b y purchaser shall cause it to be done prior to clos in g. Otherwise, Buye r will pay the n et amount to Se ller when paymen t t herefo re i s received b y Buyer following closing. 1. Allocation of Liability . (a) Se ller sha ll remain liable and r esponsib le for a ll cost s and expen ses attributable to th e owners hip or operation of the Leasehold in c luding all environmen t a l vio lation s w h ic h occur prior t o the transfer of operat i ons to Buyer ; and (b) Buyer shall be liabl e a nd responsible for all costs and ex penses attributable to the ownership or ope rati on of the Lea se hold including all environmenta l violations which occu r , during the time the transfe r of opera tion s t o Bu yer has been executed by Seller. 2. Access to Information, Co nfidentiality and Disclosure . 3. The Parties agree that , immediately u pon the execution of this agreement: (a) Buye r and its respective or autho r ized advisors will have fu ll acc ess during n onnal business hours to review, or Seller will deliv er to Buyer, copie s ofall documen ts pertaining to the operations of Seller ; (b) Seller and it s r espective adv i sors will have fuH access dur ing normal b usiness hours to r eview, or Buyer will de l iver to Seller, copies of all documents pertaini n g to the operations t o t h e buye r which are reque sted by Seller r equired by the Regulatory Authorities. 4. Confidentiality . (a) Each party shall without limi t in time, keep and procure to be kept secre t and co nfidential all Confident ia l lnfo1mat i on belonging to the other party disclosed or obtained as a re sult of the d i s cussi ons and negotiatio n s leading to the execu ti on of, or t h e performance of this agreement and s hall n eit h er u se n o r disc l ose any s uch Confidential Information except for t h e purposes of the proper performance of this agreement or with th e prior written cons ent of the othe r party. Where disclosure is made to any employee , consultant, adviser , or ag e n t, i t sh all be made subject to obligations eq uivalen t to thos e se t out in th i s agreement; and (b) Each par ty sha ll use i ts b est endeavors to procure that any s uch employee, consultant, adviser, or agent complies with each of those obligations. Each party shall be respo n sib l e to the other party in respe c t of a n y disclo s ur e or us e of a ny of the o ther party's Confidential Information b y a person to w h o m disclosure is made. (c) Buyer shall not contact the mineral owne r s o r Se ll e r shall not contact the Regulatory auth or ities or buyers 's s hareholder s u nless i t is required as part of their due dili ge nce and without the i n te nt to cause any haim to the ot her party.

Page 9 of 14 3. Disclosure. (a) Except as and to the extent required by law or policies of any Governmental Authorities , withoutthe prior written consent of the other party, neither Seller nor Buyer w i ll, and each will direct its representatives not to make, directly or indirectly , any public comment, statement, or remarks with respect to the transaction, o r otherwise d i sclose or to pennit the disclos u re of the existence of d iscussio n s r egard i ng a possible Acquisitio n between the Parties or any of the terms. (b) if a party is required by law to make any such disclosure, it must first provide to the other Parties the content of the proposed d i sclosure, the reasons that such disclosure is required by law, and the time and place that the disclosure will be made. 1. Termin a tion . It is understood and agreed that this AGREEME T may be te1minated by either Party if: (a) the Parties cannot meet the agreed upon obligatio n s of the Acquisition; and (b) t h e Parties agree to promptly return all doc u mentations, upon req u est, w hi ch have be en delive r e d t o each other as part of the anticipated Acquisition. (c) Buyer s hall reserve the right to terminate this agreement, in all parts, in the event the completed R esource Eva l uation Report does not reflect , at minimum, the value of the cont r acted purchase p ri ce. (d) Buyer shall reserve the right to tenninate th i s agreement, in all parts, in the event Buyer should identify a discrepancy in the chain of titlefor sufficient delivery of the asse t s to the Buyer. (e) Buyer shall reserve the right to terminate this agreement in the event i n st i t u tiona l s p onsors are unw ill ing to ap propriately c a p i talize the company wi t h at minimum , 10% of the R esource Eva l uation Repott Value . 1. Misc e ll a n eo u s . 2. Notices. All comm u nications r eq uired or permitted to be g i ve n u nder th i s A greement s h a ll be in wr i ting and delivered, ma i led , or transmitted by e - mail to the Parties at the addresses set out below. Not i ces shall be deemed given when received except t hose notices given by e - mail transmi ssion on weekends, holiday s or after 5:00 p.m. Ce n tral Time, shall be deemed received on the next bus i ness day. If delive r ed by commercial delivery service or mailed by registered or certified mail, th e delivery receipt shall be evidence of the date of recei p t. Either party m ay , by w r itten notice so deli v ered to t h e other, cha n ge the address to which del iv ery shall thereafter b e made. Venue of this agreement shall be in Ok l ahoma County. (a) Not i ces to Seller : AME RIC AN HE RI TAGE INVE S TMENT C APIT AL, L P a Te x a s C orpor a ti o n at 4133 N. Lincoln Blvd , Oklahoma City, OK 73105. Notices to Buy e r : S ILVERTON ENE RG Y In c, a N e v ada C orporation at 101 E P ark Blvd Ste 600 , Plano, TX 7507. 2. Binding Ef f e ct and Co un te rparts. This Agreement shall be binding upon and shall inureto the benefit of the parties h e r eto and their respective successors and assigns and may be executed in any nu m ber of counte rp arts wh i c h take n together s h a ll constitute o ne and the same instrument and each of which shall be cons i dered an original for all purposes. 3. E xp e n ses . Each party hereto will bear and pay its own expenses of negotiating and consummatingthe transactions contemplated hereby. 4. S uper se ding E ffect and S urvival . This Ag r eement supersedes any prior agreement or understanding between the parties with respect to the subject matter hereof a n d the representations, warranties and covenants of the parties set out he r ein shall s urvive the Closing. 5. Waiver . The rights and remedies of the Parties to the Agreement are cumulative and not alternative.

Page 10 of 14 Neither the failure nor any delay by any party in exercising any right, power or privilege under this Agreement or the documents referred to herein will operate as a waiver of s uch right, power or privilege, and no si ngle or partia l exercise of any such right, power o r privilege will preclude any othe r or further exerc i se of such right, power or privilege or the exercise of any other right, power or privilege. To the maximum extent pennitted by applicable law; (a) no waiver of any claim or right under this Agreement will be valid unless evidenced by a writing signed by the waiving party; (b) no waiver given by a party will be app l icab l e excep t in the specific instance for which it is given; and (c) no notice to or demand on a party will be deemed to be a waiver of any obligation of such party or of the right of the pa 1 ty giving such notice or demand to take fu 1 ther action without notice or demand as provided in this Agreement or the documents r eferred to herein . 6. Liti g ation. In the event it is necessary to file suit or hire an attorney to enforce the provisions oft his agreement each party shall incur its own costs of litigation. 7. Offe r to E mp loy . Bu yer sha ll not hire Se ller 's employees and vice versa, prior to the transfer of operations from Seller to Bu yer unless it is mutually agreed upon. It is understood that irreparable harm cou ld occur to the Parties and the Parties shal l be entitled to immediate injunction against each other without posting a bond for violation, se lling , encumbering the equipment, lease s, wells, production, and the Leasehold. 8. T i me l y Rova l tv pa y m ents . The patty in c harge of th e o peration shall always assure that all R oy alties are paid and kept current. 9. C urren cy. All references to "US $" in this agreement shall refer to currency of USA . 10. Severa bili ty . Jf one or more of the provisions in this AGREEME T are deemed void by law, then the remaining provisions will con tinue in full force and effect. 11. Successors and Ass i g n s. This AGRE EMEN T will be binding upon, executors, administrators and other legal representatives and its assigns. 12. Fo rbe ara n ce Not a Waiver . Extension of the time for or modification of perfonnance shall not operate to release the liability of Parties. A party shall not be required to comme nce proceedings against any default party. Any forbearance in exercising any right or remedy including, without limitati o n, sha ll not be a waiver of or preclude the exercise of any right or remedy.

IN WITNESS WHEREOF, the Parties hereto have agreed to accept the reference date as the execution date of this Agreement. For Buyer: SILVERTON ENERGY Inc For Seller ; AMERICAN HERITAGE INVESTMENT CAPITAL, LP ACKNOWLEDGE ME TS STATE OF Ot..OtS ) )SS COUNTY OF 't> Q.S. ) 'S4 c 1 .. . . - . , .. - , .. C - , . The foregoing instrument was acknowledged before me this _ _ day of VY' o...d , 2024, by s .t - ' - " . Manager and Authorized Repr esentative of Silverton Energy, Inc ., on behalfoft he Silverton Energy I nc . IN WITNESS WHEREOF, I have hereunto set my hand and affixed my notarial seal the day and year first above written . Page 11 of 14 ( SE A L _ ) - -- -- - - - -- Notary Public My Commission Expires 2 i . Commission No. 5' - '1.0 L YOANY SERV I N Notary ID #134203912 My Commission Expires February 15, 202 7 STATE OF Texas ) )SS COUNTY OF Tarrant ) The foregoing instrument was acknowledged before me this day of May 2024, by Rafael Pinedo Manager and Authorized Representative of AMERICAN HERITAGE INVESTMENT CAPITAL, LP of the company . IN WITNESS WHEREOF, I have hereunto set my hand and affixed my notarial seal the day and year first above written. (SEAL) -- - ..!l :S:: =11 • = Notary Public, State of Texas otary Public Shannon Johnson Shannon Johnson ID NUMBER 134729043 COM M I SSION E X P I RE S Jan u ary 24 , 2 028 My Commission Expires 0112412028 . Commission o . 13 4729043 . Electronically signed and notar i zed online using the Proof platform.