Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 07 2024 - 5:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 1-15200

Equinor ASA

(Translation of registrant's name into English)

FORUSBEEN 50, N-4035, STAVANGER

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On February 7, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated February 7, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Equinor ASA |

| | | (Registrant) |

| | | |

| | | |

| Date: February 7, 2024 | | /s/ TORGRIM REITAN |

| | | Torgrim Reitan |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Equinor ASA: Buy-back of shares to share programmes for employees

Equinor ASA (OSE: EQNR, NYSE: EQNR) has on 7 February 2024 engaged a third party to conduct repurchases of the company’s shares to be used in the share-based incentive plans for employees and management for the period from 15 February 2024 until 15 January 2025.

Acquisition of shares under the buy-back programme from 15 February 2024 to 15 May 2024 is based upon the authorization from the annual general meeting on 10 May 2023, registered in the Norwegian register for business enterprises. According to the authorization, the maximum number of shares to be purchased in the market is 11,000,000, the minimum price that can be paid per share is NOK 50, and the maximum price is NOK 1,000. Share buy-back after 15 May 2024 is subject to a new authorization from the annual general meeting in 2024.

The buy-back programme is time-scheduled, and the share purchases shall take place on specific dates in the period from 15 February 2024 until 15 January 2025 with a determined purchase amount on each date, as set out in the buy-back programme.

The total purchase amount under the share buy-back programme is NOK 1,156,000,000. The maximum number of shares to be acquired is 16,800,000 shares, of which up to 7,400 000 shares can be acquired in the period from 15 February 2024 to 15 May 2024, and up to 9,400,000 shares can be acquired in the period from 16 May 2024 to 15 January 2025.

The shares shall be used to meet obligations towards employees who participate in the company’s share-based incentive plans.

Shares will be purchased on the Oslo Stock Exchange. The share buy-back programme is conducted in accordance with applicable safe harbour conditions, and as further set out i.a. in the Norwegian Securities Trading Act of 2007, EU Commission Regulation (EC) No 2016/1052 and the Oslo Stock Exchange's Guidelines for buy-back programmes and price stabilisation February 2021.

Further information from:

Investor relations

Bård Glad Pedersen, senior vice president Investor Relations,

+47 918 01 791

Media

Sissel Rinde, vice president Media Relations,

+ 47 412 60 584

This is information that Equinor is obliged to make public pursuant to the EU Market Abuse Regulation and subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act.

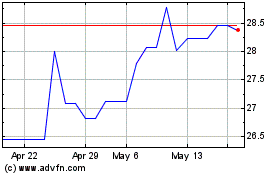

Equinor ASA (PK) (USOTC:STOHF)

Historical Stock Chart

From Apr 2024 to May 2024

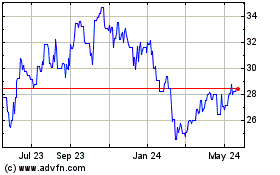

Equinor ASA (PK) (USOTC:STOHF)

Historical Stock Chart

From May 2023 to May 2024