Interview: Franc Makes Jaeger-LeCoultre Mull Second Price Hike

July 13 2011 - 8:29AM

Dow Jones News

LE SENTIER, Switzerland: Luxury watchmaker Jaeger-LeCoultre, a

brand of Compagnie Financiere Richemont SA(CFR.VX), could increase

prices for the second time this year to offset the continued

strength of the Swiss franc.

The brand, which sells watches from CHF5,000 to CHF400,000, will

review its pricing strategy in the next few weeks, marketing

director Stephane Belmont told Dow Jones Newswires.

"The Swiss franc is an issue for everyone, and we have adapted

our prices," said Belmont. "For our people it is very challenging

with strong changes in the currencies, the franc against the euro,

the RMB or the dollar."

Jaeger-LeCoultre is following what is happening in the market,

and will decide "very soon" whether to increase prices as the

strong franc hits its margins, Belmont said.

The Swiss franc has weighed on Swiss industry in recent months

as the currency has soared in value driven by its safe haven

status. Rival watch maker Swatch Group (UHR.VX) has complained the

currency could knock more than CHF500 million from its sales in

2011.

Jaeger-LeCoultre increased its prices for the first time this

year in April, and Belmont said the rises had not hit sales so far.

The Jaeger-LeCoultre brand is strong enough to withstand price

increases, while the company will be reasonable in the increases it

introduces, he added.

Despite the currency issue, Belmont expects Jaeger-LeCoultre to

achieve record sales in 2011.

He declined to reveal figures, but said they were in line with

the overall watch industry, which has seen exports rise 21.7% in

the first five months of 2011.

"For us, it is a very good time. Overall sales and volumes will

both be higher this year than last year," said Belmont.

Jaeger-LeCoultre has been trying to increase its upmarket

positioning through an emphasis on watch making and by adding

complications to its watches. This is helping it to raise average

selling prices, and could see it compete increasingly with

companies such as privately-held Patek Philippe and Swatch's

Breguet brand, said Belmont.

The company could also expand further in Asia, where it is a

relative newcomer to the market, the Middle East and North America

by increasing the number of boutiques it operates. It has 12 owned

and operated shops, as well as up to 38 franchised sales outlets,

but wants to add around 10 new boutiques a year over the next three

years with a particular focus on the Middle East, and the main

cities in Europe and North America, said Belmont.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

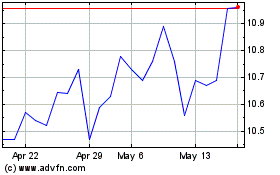

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

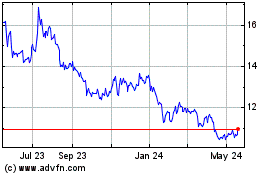

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jul 2023 to Jul 2024