UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

|

þ

|

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the quarterly period ended

September 30, 2010

or

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from ________ to __________

Commission

File No. 000-30841

UNITED

ENERGY CORP.

(Exact

name of registrant as specified in its charter)

|

Nevada

(State

or other jurisdiction of

incorporation

or organization)

|

22

-

3342379

(I.R.S.

Employer Identification No.)

|

600

Meadowlands Parkway #20, Secaucus, N.J. 07094

(Address

of principal executive offices)

(Registrant's

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding

12 months (or for such shorter period that the Registrant was required to file

such reports), and (2) has been subject to such filing requirements for the past

90 days.

þ

Yes

¨

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes

¨

No

þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

¨

|

Accelerated

filer

¨

|

|

|

|

|

Non-accelerated

filer

¨

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in rule

12b-2 of the Exchange Act. Yes

¨

No

þ

As of

November 17, 2010, 31,504,449 shares of common stock, par value $.01 per share,

were outstanding.

INDEX

|

PART

I. FINANCIAL INFORMATION

|

|

|

|

|

|

Item

1.

|

Financial

Statements

|

3

|

|

|

|

|

|

|

Consolidated

balance sheets September 30, 2010 (Unaudited) and March 31,

2010

|

3-4

|

|

|

|

|

|

|

Consolidated

statements of operations for the three months and six months ended

September 30, 2010 (Unaudited) and 2009 (Unaudited)

|

5

|

|

|

|

|

|

|

Consolidated

statement of stockholders' equity for the six months ended September 30,

2010 (Unaudited)

|

6

|

|

|

|

|

|

|

Consolidated

statements of cash flows for the six months ended September 30, 2010

(Unaudited) and 2009 (Unaudited)

|

7-8

|

|

|

|

|

|

|

Notes

to consolidated financial statements

|

9-13

|

|

|

|

|

|

Item

2.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

13-16

|

|

|

|

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

16

|

|

|

|

|

|

Item

4.

|

Controls

and Procedures

|

17

|

|

|

|

|

|

PART

II. OTHER INFORMATION

|

|

|

|

|

|

Item

1.

|

Legal

Proceedings

|

18

|

|

|

|

|

|

Item

1A.

|

Risk

Factors

|

18

|

|

|

|

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds

|

18

|

|

|

|

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

18

|

|

|

|

|

|

Item

4.

|

(Removed

and Reserved)

|

18

|

|

|

|

|

|

Item

5.

|

Other

Information

|

18

|

|

|

|

|

|

Item

6.

|

Exhibits

|

18

|

|

|

|

|

|

Signatures

|

|

19

|

Item

1.

Financial

Statements

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

|

|

|

September 30,

|

|

|

March 31,

|

|

|

|

|

2010

|

|

|

2010

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT

ASSETS:

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

150,447

|

|

|

$

|

311,506

|

|

|

Accounts

receivable, net of allowance for doubtful accounts of $72,719 and $77,211,

respectively

|

|

|

303,816

|

|

|

|

190,915

|

|

|

Inventory

|

|

|

77,772

|

|

|

|

80,870

|

|

|

Prepaid

expenses and other current assets

|

|

|

21,429

|

|

|

|

62,827

|

|

|

Loan

receivable, net of reserve of $25,000

|

|

|

25,000

|

|

|

|

25,000

|

|

|

Total

current assets

|

|

|

578,464

|

|

|

|

671,118

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY

AND EQUIPMENT, net of accumulated depreciation and amortization of

$467,103 and $492,121 respectively

|

|

|

68,520

|

|

|

|

79,050

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER

ASSETS:

|

|

|

|

|

|

|

|

|

|

Goodwill

|

|

|

15,499

|

|

|

|

15,499

|

|

|

Patents,

net of accumulated amortization of $299,653 and $280,306,

respectively

|

|

|

300,064

|

|

|

|

317,318

|

|

|

Loans

receivable

|

|

|

38,864

|

|

|

|

35,793

|

|

|

Deposits

|

|

|

14,185

|

|

|

|

1,385

|

|

|

Total

assets

|

|

$

|

1,015,596

|

|

|

$

|

1,120,163

|

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

|

|

|

September 30,

|

|

|

March 31,

|

|

|

|

|

2010

|

|

|

2010

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT

LIABILITIES:

|

|

|

|

|

|

|

|

Accounts

payable

|

|

$

|

323,578

|

|

|

$

|

234,948

|

|

|

Accrued

expenses

|

|

|

266,545

|

|

|

|

362,925

|

|

|

Convertible

term note

|

|

|

30,000

|

|

|

|

30,000

|

|

|

Due

to related parties

|

|

|

464,781

|

|

|

|

453,781

|

|

|

Total

current liabilities

|

|

|

1,084,904

|

|

|

|

1,081,654

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS'

EQUITY (DEFICIT):

|

|

|

|

|

|

|

|

|

|

Preferred

Stock: 100,000 shares authorized; Series A Convertible Preferred Stock:

$8,000 stated value, 3 shares issued and outstanding as of September 30,

2010 and March 31, 2010

|

|

|

24,000

|

|

|

|

24,000

|

|

|

Common

stock: $0.01 par value 100,000,000 shares authorized; 31,504,449 shares

issued and outstanding as of September 30, 2010 and March 31,

2010

|

|

|

315,045

|

|

|

|

315,045

|

|

|

Additional

paid-in capital

|

|

|

23,286,248

|

|

|

|

23,245,536

|

|

|

Accumulated

deficit

|

|

|

(23,694,601

|

)

|

|

|

(23,546,072

|

)

|

|

Total

stockholders' equity (deficit)

|

|

|

(69,308

|

)

|

|

|

38,509

|

|

|

Total

liabilities and stockholders' equity (deficit)

|

|

$

|

1,015,596

|

|

|

$

|

1,120,163

|

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS

|

|

|

For the Three Months

|

|

|

For the Six Months

|

|

|

|

|

Ended September 30,

|

|

|

Ended September 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES,

net

|

|

$

|

439,321

|

|

|

$

|

613,202

|

|

|

$

|

882,826

|

|

|

$

|

1,007,206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST

OF GOODS SOLD

|

|

|

164,914

|

|

|

|

231,845

|

|

|

|

337,379

|

|

|

|

385,559

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

profit

|

|

|

274,407

|

|

|

|

381,357

|

|

|

|

545,447

|

|

|

|

621,647

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling,

general and administrative

|

|

|

309,363

|

|

|

|

790,606

|

|

|

|

578,075

|

|

|

|

1,141,638

|

|

|

Research

and development

|

|

|

35,813

|

|

|

|

64,143

|

|

|

|

70,969

|

|

|

|

115,639

|

|

|

Gain

on sale of asset

|

|

|

(8,000

|

)

|

|

|

-

|

|

|

|

(8,000

|

)

|

|

|

-

|

|

|

Depreciation

and amortization

|

|

|

11,596

|

|

|

|

12,435

|

|

|

|

23,164

|

|

|

|

24,512

|

|

|

Total

operating expenses

|

|

|

348,772

|

|

|

|

867,184

|

|

|

|

664,208

|

|

|

|

1,281,789

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

from operations

|

|

|

(74,365

|

)

|

|

|

(485,827

|

)

|

|

|

(118,761

|

)

|

|

|

(660,142

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER

INCOME (EXPENSE), net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

income

|

|

|

1

|

|

|

|

7

|

|

|

|

7

|

|

|

|

14

|

|

|

Interest

expense

|

|

|

(14,062

|

)

|

|

|

(11,878

|

)

|

|

|

(29,055

|

)

|

|

|

(19,423

|

)

|

|

Total

other income (expense), net

|

|

|

(14,061

|

)

|

|

|

(11,871

|

)

|

|

|

(29,048

|

)

|

|

|

(19,409

|

)

|

|

Net

loss

|

|

|

(88,426

|

)

|

|

|

(497,698

|

)

|

|

|

(147,809

|

)

|

|

|

(679,551

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREFERRED

DIVIDENDS

|

|

|

(360

|

)

|

|

|

(360

|

)

|

|

|

(720

|

)

|

|

|

(720

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss applicable to common shareholders

|

|

$

|

(88,786

|

)

|

|

$

|

(498,058

|

)

|

|

$

|

(148,529

|

)

|

|

$

|

(680,271

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

AND DILUTED LOSS PER SHARE:

|

|

$

|

(0.00

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

AND DILUTED WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING:

|

|

|

31,504,449

|

|

|

|

31,328,587

|

|

|

|

31,504,449

|

|

|

|

31,255,192

|

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS' EQUITY

FOR

THE SIX MONTHS ENDED SEPTEMBER 30, 2010 (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Preferred

|

|

|

Paid-In

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Stock

|

|

|

Capital

|

|

|

Deficit

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE,

April 1, 2010

|

|

|

31,504,449

|

|

|

$

|

315,045

|

|

|

$

|

24,000

|

|

|

$

|

23,245,536

|

|

|

$

|

(23,546,072

|

)

|

|

$

|

38,509

|

|

|

Compensation

expense associated with options

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

712

|

|

|

|

-

|

|

|

|

712

|

|

|

Compensation

expense associated with warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

40,000

|

|

|

|

-

|

|

|

|

40,000

|

|

|

Dividends

accrued on preferred shares

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(720

|

)

|

|

|

(720

|

)

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(147,809

|

)

|

|

|

(147,809

|

)

|

|

BALANCE,

September 30, 2010

|

|

|

31,504,449

|

|

|

$

|

315,045

|

|

|

$

|

24,000

|

|

|

$

|

23,286,248

|

|

|

$

|

(23,694,601

|

)

|

|

$

|

(69,308

|

)

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR

THE SIX MONTHS ENDED SEPTEMBER 30, 2010 AND 2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net

loss from continuing operations

|

|

$

|

(147,809

|

)

|

|

$

|

(679,551

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments

to reconcile net loss to net cash used in operating

activities

|

|

|

|

|

|

|

|

|

|

Depreciation

and amortization

|

|

|

29,877

|

|

|

|

34,694

|

|

|

Allowance

for doubtful accounts

|

|

|

(4,492

|

)

|

|

|

18,680

|

|

|

|

|

|

(8,000

|

)

|

|

|

-

|

|

|

Compensation

expense associated with warants

|

|

|

40,000

|

|

|

|

524,385

|

|

|

Compensation

expense associated with options

|

|

|

712

|

|

|

|

712

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes

in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

(108,409

|

)

|

|

|

(221,185

|

)

|

|

Inventory

|

|

|

3,098

|

|

|

|

30,092

|

|

|

Prepaid

expenses and other current assets

|

|

|

41,399

|

|

|

|

47,648

|

|

|

Deposits

|

|

|

(12,800

|

)

|

|

|

-

|

|

|

Accounts

payable and accrued expenses

|

|

|

(7,751

|

)

|

|

|

1,679

|

|

|

Net

cash used in operating activities

|

|

|

(174,175

|

)

|

|

|

(242,846

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Employee

loans

|

|

|

(3,071

|

)

|

|

|

(1,023

|

)

|

|

Proceeds

from sale of asset

|

|

|

8,000

|

|

|

|

-

|

|

|

Payments

for acquisition of property and equipment

|

|

|

-

|

|

|

|

(985

|

)

|

|

Payments

for patents

|

|

|

(2,093

|

)

|

|

|

(3,699

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

provided by (used in) investing activities

|

|

|

2,836

|

|

|

|

(5,707

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Proceeds

from related party payable

|

|

|

11,000

|

|

|

|

303,781

|

|

|

Preferred

stock dividend

|

|

|

(720

|

)

|

|

|

(720

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash provided by financing activities

|

|

|

10,280

|

|

|

|

303,061

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

(decrease) increase in cash and cash equivalents

|

|

|

(161,059

|

)

|

|

|

54,508

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

AND CASH EQUIVALENTS, beginning of period

|

|

|

311,506

|

|

|

|

56,372

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

AND CASH EQUIVALENTS, end of period

|

|

$

|

150,447

|

|

|

$

|

110,880

|

|

UNITED

ENERGY CORP. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR

THE SIX MONTHS ENDED SEPTEMBER 30, 2010 AND 2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL

DISCLOSURES OF CASH FLOW INFORMATION:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

paid during the period

|

|

|

|

|

|

|

|

Interest

|

|

$

|

899

|

|

|

$

|

886

|

|

|

Income

taxes

|

|

$

|

1,700

|

|

|

$

|

1,040

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL

DISCLOSURES OF NON-CASH INVESTING AND FINANCING

ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Conversion

of note payable into common stock

|

|

$

|

-

|

|

|

$

|

35,000

|

|

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

UNITED

ENERGY CORP.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER

30, 2010 (Unaudited)

|

1.

|

BASIS

OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

|

Basis

of presentation

Interim

Financial Statements

The

accompanying unaudited consolidated financial statements of United Energy Corp.

(“we”, “United Energy” or the “Company”) have been prepared in accordance with

generally accepted accounting principles for interim financial information and

with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly,

they do not include all of the information and footnotes required by generally

accepted accounting principles for complete financial statements. In the opinion

of management, the unaudited interim financial statements furnished herein

include all adjustments necessary for a fair presentation of the Company's

financial position at September 30, 2010 (unaudited) and the results of its

operations for the three and six months ended September 30, 2010 and 2009

(unaudited) and cash flows for the three and six months ended September 30, 2010

and 2009 (unaudited). All such adjustments are of a normal and recurring nature.

Interim financial statements are prepared on a basis consistent with the

Company's annual financial statements. Results of operations for the three and

six months ended September 30, 2010 and 2009 are not necessarily indicative of

the operating results that may be expected for the year ending March 31,

2011.

The

consolidated balance sheet as of March 31, 2010 has been derived from the

audited financial statements at that date but does not include all of the

information and notes required by accounting principles generally accepted in

the United States for complete financial statements.

For further information, refer to the

consolidated financial statements and notes thereto included in the Company's

Annual Report on Form 10-K for the fiscal year ended March 31,

2010.

Going

Concern

– The accompanying

consolidated financial statements have been prepared in conformity with

accounting principles generally accepted in the United States of America which

contemplate continuation of the Company as a going concern. However, the Company

has year-end losses from operations and has an accumulated deficit of

$23,694,601 as of September 30, 2010.

During the six months ended September

30, 2010 the Company experienced a net loss from operations of $147,809 and a

negative cash flow from operations of $158,175. These matters raise substantial

doubt about the Company’s ability to continue as a going concern. Our

consolidated financial statements do not include any adjustment that might

result from the outcome of this uncertainty

.

Our

continued existence is dependent upon several factors, including raising

additional funds through loans, additional sales of its equity securities,

increased sales volumes and the ability to achieve profitability from the sales

of our product lines. In order to increase our cash flow, we are continuing our

efforts to stimulate sales and cut back expenses not directly supporting our

sales and marketing efforts.

There can

be no assurance that we will be successful in stimulating sales or reducing

expenses to levels sufficient to generate cash flow sufficient to fund our

anticipated liquidity requirements. There also can be no assurance that

available financing will be available, or if available, that such financing will

be on terms acceptable to us.

Basic

earnings per share is computed by dividing net income available to common

shareholders by the weighted average number of common shares outstanding during

the period. Diluted earnings per share reflects the potential dilution that

could occur if stock options and other commitments to issue common stock were

exercised or equity awards vest resulting in the issuance of common stock that

could increase the number of shares outstanding and lower the earnings per share

of the Company’s common stock. This calculation is not done for periods in a

loss position as this would be antidilutive. As of September 30, 2010, there

were stock options and warrants that would have been included in the computation

of diluted earnings per share that could potentially dilute basic earnings per

share in the future, however, the Company is in a loss position and the result

of the computation would be antidilutive.

|

3

|

RECENTLY

ISSUED ACCOUNTING STANDARDS

|

Accounting

Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles

In August 2010, the FASB issued

Accounting Standard Updates No. 2010-21 (ASU No. 2010-21) “Accounting for

Technical Amendments to Various SEC Rules and Schedules” and No. 2010-22 (ASU

No. 2010-22) “Accounting for Various Topics – Technical Corrections to SEC

Paragraphs”. ASU No 2010-21 amends various SEC paragraphs pursuant to the

issuance of Release no. 33-9026: Technical Amendments to Rules, Forms, Schedules

and Codification of Financial Reporting Policies. ASU No. 2010-22 amends various

SEC paragraphs based on external comments received and the issuance of SAB 112,

which amends or rescinds portions of certain SAB topics. Both ASU No. 2010-21

and ASU No. 2010-22 are effective upon issuance. The amendments in ASU No.

2010-21 and No. 2010-22 will not have a material impact on the Company’s

financial statements.

A variety

of proposed or otherwise potential accounting standards are currently under

study by standard-setting organizations and various regulatory agencies. Because

of the tentative and preliminary nature of these proposed standards, management

has not determined whether implementation of such proposed standards would be

material to the Company’s consolidated financial statements.

On

November 6, 2009, the Company issued a convertible term note in the amount of

$30,000, which accrues interest at 7% per year. Principal and interest is

payable on demand. The holder of this term note has the option to convert all or

a portion of the note (including principal and interest) into shares of common

stock at any time at a conversion price of $0.21 per share. The conversion price

is subject to adjustment for stock splits, stock dividends and similar

events.

The preparation of consolidated

financial statements in accordance with accounting principals generally accepted

in the United States of America requires the Company to make estimates and

judgments that affect the reported amounts of assets, liabilities, revenues and

expenses, and related disclosure of contingent assets and

liabilities.

On an on-going basis, the Company

evaluates its estimates, including those related to option and warrant values,

bad debts, inventories, intangible assets, contingencies and litigation. The

Company bases its estimates on historical experience and on various other

assumptions that are believed to be reasonable under the circumstances, the

results of which form the basis for making judgments about the carrying values

of assets and liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates under different assumptions or

conditions.

Inventory consists of the

following:

|

|

|

September 30,

|

|

|

March 31,

|

|

|

|

|

2010

|

|

|

2010

|

|

|

Blended

chemicals

|

|

$

|

20,677

|

|

|

$

|

29,734

|

|

|

Raw

materials

|

|

|

57,095

|

|

|

|

51,136

|

|

|

Total

inventory

|

|

$

|

77,772

|

|

|

$

|

80,870

|

|

|

7.

|

FAIR

VALUE MEASUREMENT

|

Fair value of certain of the Company’s

financial instruments including cash and cash equivalents, inventory, account

payable, accrued expenses, notes payables, and other accrued liabilities

approximate cost because of their short maturities. The Company measures and

reports fair value in accordance with ASC 820, “Fair Value Measurements and

Disclosure” defines fair value, establishes a framework for measuring fair value

in accordance with generally accepted accounting principles and expands

disclosures about fair value investments.

Fair

value, as defined in ASC 820, is the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between market

participants at the measurement date. The fair value of an asset should reflect

its highest and best use by market participants, principal (or most

advantageous) markets, and an in-use or an in-exchange valuation premise. The

fair value of a liability should reflect the risk of nonperformance, which

includes, among other things, the Company’s credit risk.

Valuation

techniques are generally classified into three categories: the market approach;

the income approach; and the cost approach. The selection and application of one

or more of the techniques may require significant judgment and are primarily

dependent upon the characteristics of the asset or liability, and the quality

and availability of inputs. Valuation techniques used to measure fair value

under ASC 820 must maximize the use of observable inputs and minimize the use of

unobservable inputs. ASC 820 also provides fair value hierarchy for inputs and

resulting measurement as follows:

Level

1

Quoted

prices (unadjusted) in active markets that are accessible at the measurement

date for identical assets or liabilities;

Level

2

Quoted

prices for similar assets or liabilities in active markets; quoted prices for

identical or similar assets or liabilities in markets that are not active;

inputs other than quoted prices that are observable for the asset or liability;

and inputs that are derived principally from or corroborated by observable

market data for substantially the full term of the assets or liabilities;

and

Level

3

Unobservable

inputs for the asset or liability that are supported by little or no market

activity and that are significant to the fair values.

Fair

value measurements are required to be disclosed by the Level within the fair

value hierarchy in which the fair value measurements in their entirety fall.

Fair value measurements using significant unobservable inputs (in Level 3

measurements) are subject to expanded disclosure requirements including a

reconciliation of the beginning and ending balances, separately presenting

changes during the period attributable to the following: (i) total gains or

losses for the period (realized and unrealized), segregating those gains or

losses included in earnings, and a description of where those gains or losses

included in earning are reported in the statement of income.

As of

September 30, 2010, the Company does not possess any long-term monetary or

nonmonetary financial instruments whose fair value is measured on a recurring

basis. The Company possesses financial instruments of a short-term nature, such

as cash, prepaid expenses, accounts receivable, loans receivable, accounts

payable, accrued expenses and convertible notes, whose fair value can be

approximated due to their short term maturity.

|

8.

|

EMPLOYEE

BENEFITS PLAN

|

Stock

Option Plans

In August

2001, the Company’s stockholders approved the 2001 Equity Incentive Plan (the

“2001 Plan”), which provides for the grant of stock options to purchase up to

2,000,000 shares of common stock to any employee, non-employee director, or

consultant at the Board’s discretion. Under the 2001 Plan, these options may be

exercised for a period up to ten years from the date of grant. Options issued to

employees are exercisable upon vesting, which can range between the dates of the

grant to up to 5 years

.

An

amendment and restatement of the 2001 Equity Incentive Plan increasing the

number of shares for a total of 4,000,000 was approved by the Board of Directors

on May 29, 2002 and was approved by the shareholders at the annual

meeting.

Under the 2001 Plan, options are

granted to non-employee directors upon election at the annual meeting of

stockholders at a purchase price equal to the fair market value on the date of

grant. In addition, the non-employee director stock options shall be exercisable

in full twelve months after the date of grant unless determined otherwise by the

board.

Fair

Value of Stock Options

For disclosure purposes under FASB

guidance now codified as ASC Topic 505, the fair value of each option grant is

estimated on the date of grant using the Black-Scholes option valuation model

with the following weighted-average assumptions:

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

Expected

life (in

years)

|

|

|

10

|

|

|

|

10

|

|

|

Risk-free

interest rate

|

|

|

4.54

|

%

|

|

|

4.54

|

%

|

|

Volatility

|

|

|

191.2

|

|

|

|

169.4

|

|

|

Dividend

yield

|

|

|

0

|

%

|

|

|

0

|

%

|

Utilizing

these assumptions, the weighted average fair value of options granted with an

exercise price equal to their fair market value at the date of the grant is

$1.05 for the six months ended September 30, 2010.

Summary

Stock Option Activity

The following table summarizes stock

option information with respect to all stock options for the quarter ended

September 30, 2010:

|

|

|

|

|

|

Weighted

Average

Exercise

Price

|

|

|

Weighted

Average

Remaining

Contractual

Life (Years)

|

|

|

|

|

|

Options

outstanding April 1, 2010

|

|

|

3,287,500

|

|

|

$

|

1.05

|

|

|

|

4.67

|

|

|

|

|

|

Granted

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expired

|

|

|

(40,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Options

outstanding September 30, 2010

|

|

|

3,247,500

|

|

|

$

|

1.06

|

|

|

|

4.22

|

|

|

|

|

|

Vested

and expected to vest–end of quarter

|

|

|

3,247,500

|

|

|

$

|

1.06

|

|

|

|

4.22

|

|

|

$

|

—

|

|

|

Exercisable–end

of quarter

|

|

|

3,172,500

|

|

|

$

|

1.06

|

|

|

|

4.16

|

|

|

$

|

—

|

|

Pursuant

to the terms of an employment agreement with Ronald Wilen, Chief Executive

Officer, President, Secretary and Director of the Company dated April 17, 2007,

for each of the next five (5) years of the term of the agreement (commencing

with April 17, 2008), Mr. Wilen will receive an option to purchase fifty

thousand (50,000) shares of common stock of the Company. The exercise price with

respect to any option granted pursuant to the employment agreement shall be the

fair market value of the common stock underlying such option on the date such

option was granted.

Options

outstanding at September 30, 2010 have an exercise price ranging between $0.09

to $2.05.

The aggregate intrinsic

value in the table above represents the total intrinsic value (the difference

between United Energy’s closing stock price on September 30, 2010 and the

exercise price, multiplied by the number of in–the–money options) that would

have been received by the option holders had vested option holders exercised

their options on September 30, 2010. This amount changes based upon changes in

the fair market value of United Energy’s stock. As of September 30, 2010, 2,133

of the total unrecognized compensation costs related to stock options are

expected to be recognized over a period of one year and six months.

The Company did not have any material

subsequent events to disclose from the balance sheet date to the filing date.

The Company evaluated subsequent events through November 17,

2010.

|

Item

2

|

Management's Discussion and

Analysis of Financial Condition and Results of

Operations

|

CAUTIONARY

STATEMENT RELATING TO FORWARD-LOOKING STATEMENTS

The

matters discussed in this Form 10-Q contain certain forward-looking statements

and involve risks and uncertainties (including changing market conditions,

competitive and regulatory matters, etc.) detailed in the disclosure contained

in this Form 10-Q and the other filings with the Securities and Exchange

Commission made by us from time to time. The discussion of our liquidity,

capital resources and results of operations, including forward-looking

statements pertaining to such matters, does not take into account the effects of

any changes to our operations. Accordingly, actual results could differ

materially from those projected in the forward-looking statements as a result of

a number of factors, including those identified herein and those discussed under

the heading “Risk Factors” in the Company’s 10-K for the fiscal year ended March

31, 2010. This item should be read in conjunction with the financial statements

and other items contained elsewhere in the report. Unless the context otherwise

requires, “we”, “our”, “us”, the “Company” and similar phrases refer to United

Energy Corp.

Overview

We

develop and distribute environmentally friendly specialty chemical products with

applications in several industries and markets. Our current line of products

includes our K-Line of Chemical Products for the oil industry and related

products.

Through

our wholly owned subsidiary, Green Globe Industries, Inc., we provide the U.S.

military with a variety of solvents, paint strippers and cleaners under our

trade name “Qualchem.” Green Globe is a qualified supplier for the U.S. military

and has sales contracts currently in place with no minimum purchase

requirements, which are renewable at the option of the U.S.

Military.

A key

component of our business strategy is to pursue collaborative joint working and

marketing arrangements with established international oil and oil service

companies. We intend to enter into these relationships to more rapidly and

economically introduce our K-Line of Chemical Products to the worldwide

marketplace for refinery, tank and pipeline cleaning services.

We

provide our K-Line of Chemical Products and our Green Globe Products to our

customers and generated revenues of $882,826 for the six-month period ended

September 30, 2010 and $1,007,206 for the six-month period ended September 30,

2009.

RESULTS

OF OPERATIONS

Three

Months Ended September 30, 2010 Compared to the Three Months Ended September 30,

2009

Revenues

. Revenues for the

three months ended September 30, 2010 were $439,321, a $173,881, or 28% decrease

from revenues of $613,202 in the comparable three months of 2009. Revenues from

our K-Line of Chemical Products decreased by $140,832 to $411,048 or 26%

compared to $551,880 in the comparable three months ended September 30, 2009,

and revenues from our Green Globe/Qualchem military sales decreased by $33,049

to $28,273 or 54% compared to $61,322 in the comparable three months ended

September 30, 2009.

Cost of Goods Sold

. Cost of

goods sold decreased $66,931, or 29% to $164,914 or 38% of revenues, for the

three months of September 30, 2010 from $231,845 or 38% of revenues, for the

three months of September 30, 2009. The decrease in cost of goods sold was due

to the lower sales level in the period compared to the comparable period in

2009. Cost of goods sold from our K-Line of Chemical Products decreased by

$54,305 to $151,790 or 26% compared to $206,095 in the comparable three months

ended September 30, 2009, and cost of goods sold by our Green Globe/Qualchem

military sales decreased by $12,626 to $13,124 or 49% compared to $25,750 in the

comparable three months ended September 30, 2009.

Gross Profit

. Gross profit

for the three months ended September 30, 2010, decreased by $106,950, or 28% to

$274,407 or 62% of sales compared with $381,357 or 62% of sales in the prior

period. The decrease in gross profit reflects the lower levels of

sales.

Operating

Costs and Expenses

Selling, General and Administrative

Expenses

. Selling, general and administrative expenses decreased $481,243

to $309,363 or 70% of sales for the three months ended September 30, 2010

compared with $790,606 or 129% of sales for the three months ended September 30,

2009. The decrease in general and administrative expenses is primarily related

to a decrease in financing costs associated with the issuance of warrants and in

insurance expenses, professional fees, salaries, employee benefits and travel

and entertainment.

Research and Development.

Research and development expenses decreased $28,330 to $35,813 or 8% of sales

for the three months ended September 30, 2010 compared with $64,143 or 10% of

sales for the three months ended September 30, 2009. The decrease in research

and development expenses was primarily related to a decrease in lab supplies and

salaries.

Depreciation and

Amortization

. Depreciation and amortization remained relatively constant

for the three months ended September 30, 2010 as compared with September 30,

2009.

Interest Income

. Interest

income remained relatively constant for the six months ended September 30, 2010

as compared with September 30, 2009.

Gain on sale of asset.

During

the period ended September 30, 2010, the company sold a fully depreciated

vehicle for $8,000.

Interest Expense

. The Company

had interest expense of $14,062 for the three months ended September 30, 2010

compared with $11,878 in the corresponding period in 2009. The increase was due

to the indebtedness outstanding on the loans by directors and their

affiliates.

Net Loss

. The three months

ended September 30, 2010 resulted in a net loss of $88,426 or $0.00 per share as

compared to a net loss of $497,698 or $0.02 per share for the three months ended

September 30, 2009. The average number of shares of common stock used in

calculating earnings per share increased 175,862 shares to 31,504,444 as a

result of 175,862 shares issued in the connection with the exercise of

warrants.

Six

Months Ended September 30, 2010 Compared to the Six Months Ended September 30,

2009

Revenues

. Revenues for the

six-month period ended September 30, 2010 were $882,826, a $124,380 or 12%

decrease from revenues of $1,007,206 in the comparable six-month period ended

September 30, 2009. Revenues from our K-Line of Chemical Products decreased by

$45,157 to $822,401 or 5% compared to $867,558 in the comparable six months

ended September 30, 2009, and revenues from our Green Globe/Qualchem military

sales decreased by $79,223 to $60,425 or 57% compared to $139,648 in the

comparable six months ended September 30, 2009.

Cost of Goods Sold

. Cost of

goods sold decreased $48,180, or 13% to $337,379 or 38% of revenues, for the

six-month period ended September 30, 2010 from $385,559 or 38% of revenues, for

the six-month period ended September 30, 2009. The decrease in cost of goods

sold was due to the lower sales level in the period compared to the comparable

period in 2009. Cost of goods sold from our K-Line of Chemical Products

decreased by $15,813 to $309,390 or 5% compared to $325,203 in the comparable

six months ended September 30, 2009, and cost of goods sold from our Green

Globe/Qualchem military sales decreased by $32,367 to $27,989 or 54% compared to

$60,356 in the comparable six months ended September 30, 2009.

Gross Profit

. Gross profit

for the six months ended September 30, 2010, decreased by $76,200, or 12% to

$545,447 or 62% of revenues compared with $621,647 or 62% of revenues in the

prior period. The decrease in gross profit reflects the lower levels of sales of

our Specialty Chemicals and Green Globe/Qualchem military sales

Operating

Costs and Expenses

Selling, General and Administrative

Expenses

. Selling, general and administrative expenses decreased $563,563

to $578,075 or 65% of revenues for the six months ended September 30, 2010

compared with $1,141,638 or 113% of revenues for the six months ended September

30, 2009. The decrease in selling, general and administrative expenses was

primarily related to a decrease in financing costs associated with the issuance

of warrants and in insurance expenses, professional fees, salaries, employee

benefits and travel and entertainment.

Research and Development.

Research and development expenses decreased $44,670 to $70,969 or 8% of sales

for the six months ended September 30, 2010 compared with $115,639 or 11% of

sales for the six months ended September 30, 2009. The decrease in research and

development expenses was related to a decrease in lab supplies and

salaries.

Depreciation and

Amortization

. Depreciation and amortization remained relatively constant

for the six months ended September 30, 2010 as compared with September 30,

2009.

Interest Income

. Interest

income remained relatively constant for the six months ended September 30, 2010

as compared with September 30, 2009.

Gain on sale of asset.

During

the period ended September 30, 2010, the company sold a fully depreciated

vehicle for $8,000.

Interest Expense

. The Company

had interest expense of $29,055 for the six months ended September 30, 2010

compared with $19,423 in the corresponding period in 2009. The increase was due

to the indebtedness outstanding on the loans by directors and their

affiliates.

Net Loss

. The six months

ended September 30, 2010 resulted in a net loss of $147,809 or $0.00 per share

as compared to a net loss of $679,551 or $0.02 per share for the six months

ended September 30, 2009. The average number of shares of common stock used in

calculating earnings per share increased 249,257 shares to 31,504,449 as a

result of 298,472 shares issued in connection with the conversion of the

convertible note and 175,862 shares issued in the connection with the exercise

of warrants.

Liquidity

and Capital Resources

As of

September 30, 2010, the Company had $150,447 in cash and cash equivalents, as

compared to $311,506 at March 31, 2010.

The

$161,059 decrease in cash and cash equivalents was due to net cash used in

operations of $174,175, net cash provided by investing activities of $2,836 and

net cash provided by financing

activities

of $10,280. Cash

provided by investing activities consisted of proceeds from sale of

asset of $8,000, offset by patent purchases of $2,093 and employee loans of

$3,071. Cash provided by financing activities consisted of related party loans

of $11,000, offset by preferred stock dividends of $720.

The accompanying consolidated financial

statements have been prepared in conformity with accounting principles generally

accepted in the United States of America which contemplate continuation of the

Company as a going concern. However, the Company has year-end losses from

operations and has an accumulated deficit of $23,694,601 as of September 30,

2010.

During the six

months ended September 30, 2010 the Company experienced a net loss from

operations of $147,809 and a negative cash flow from operations of $158,175.

These matters raise substantial doubt about the Company’s ability to continue as

a going concern. Our consolidated financial statements do not include any

adjustment that might result from the outcome of this

uncertainty

.

Our

continued existence is dependent upon several factors, including raising

additional funds through loans, additional sales of its equity securities,

increased sales volumes and the ability to achieve profitability from the sales

of our product lines. In order to increase our cash flow, we are continuing our

efforts to stimulate sales and cut back expenses not directly supporting our

sales and marketing efforts.

There can

be no assurance that we will be successful in stimulating sales or reducing

expenses to levels sufficient to generate cash flow sufficient to fund our

anticipated liquidity requirements. There also can be no assurance that

available financing will be available, or if available, that such financing will

be on terms acceptable to us.

Concentration

of Risk

Sales to our top three customers,

accounted for approximately 82% of revenue, or $725,112, for the six-month

period ending September 30, 2009 and sales to our top four customers, accounted

for approximately 85% of our revenue, or $854,786, for the three-month period

ending September 30, 2009.

Sales to our top customer, for the

six-month period ending September 30, 2010 were $461,112.

Off-Balance

Sheet Arrangements

We do not

currently have any off-balance sheet arrangements that have or are reasonably

likely to have a current or future effect on our financial condition, changes in

financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources that are material to our

stockholders.

|

Item 3.

|

Quantitative and Qualitative

Disclosures About Market

Risks.

|

Not

applicable

|

Item 4.

|

Controls and

Procedures.

|

Evaluation

of the Company's Disclosure Controls and Procedures

We

carried out an evaluation, under the supervision and with the participation of

the Company's management, including our Chief Executive Officer and our

Principal Accounting Officer (Interim Chief Financial Officer), of the

effectiveness of our “disclosure controls and procedures” (as defined in Rules

13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended) as of

September 30, 2010. Based upon that evaluation, the Chief Executive Officer and

the Principal Accounting Officer (Interim Chief Financial Officer) concluded

that our disclosure controls and procedures are effective, in all material

respects, with respect to the recording, processing, summarizing, and reporting,

within the time periods specified in the Securities and Exchange Commission's

rules and forms, of information required to be disclosed by us in the reports

that we file or submit under the Exchange Act. In designing and evaluating our

“disclosure controls and procedures” (as defined in Rules 13a-15(e) or 15d-15(e)

of the Securities Exchange Act of 1934, as amended), management recognized that

any controls and procedures, no matter how well designed and operated, can

provide only reasonable assurances of achieving the desired control objectives,

as ours are designed to do, and management necessarily was required to apply its

judgment in evaluating the cost-benefit relationship of possible controls and

procedures.

Changes

in Control Over Financial Reporting

Management

has not identified any change in our internal control over financial reporting

that occurred during the second quarter ended September 30, 2010 that has

materially affected, or is reasonably likely to materially affect, the Company’s

internal control over financial reporting.

PART

II

OTHER

INFORMATION

|

Item

1.

|

Legal

Proceedings

|

None.

Not applicable.

|

Item 2.

|

Unregistered

Sales of Equity Securities and Use of

Proceeds

|

In August

2010, the Company issued warrants to acquire 1,000,000 shares of Common Stock in

the aggregate to members of its Board of Directors as compensation for their

services. The Company did not receive any proceeds from the issuance of the

warrants. The warrants were issued pursuant to the exemption from registration

provided by Section 4 (2) of the Securities Act of 1933, as

amended.

|

Item

3.

|

Defaults Upon Senior

Securities

|

None

|

Item

4.

|

(

Removed and

Reserved)

|

|

Item

5.

|

Other

Information

|

None

|

|

31.1

|

Chief

Executive Officer’s Certificate, pursuant to Rule 13a-14(a)/ 15d-14(a) of

the Exchange Act.

|

|

|

31.2

|

Chief

Financial Officer’s Certificate, pursuant to Rule 13a-14(a)/ 15d-14(a) of

the Exchange Act

|

|

|

32.1

|

Chief

Executive Officer’s Certificate, pursuant to Section 1350 of Chapter 63 of

Title 18 of the United States Code (18 U.S.C.

1350).

|

|

|

32.2

|

Chief

Financial Officer’s Certificate, pursuant to Section 1350 of Chapter 63 of

Title 18 of the United States Code (18 U.S.C.

1350).

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this Report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

Dated: November

17, 2010

|

|

UNITED

ENERGY CORP.

|

|

|

|

|

|

|

By:

|

/s/ Ronald Wilen

|

|

|

|

Ronal

Wilen,

|

|

|

|

Chief

Executive Officer

|

|

|

|

(as

principal executive officer)

|

|

|

|

|

|

|

By:

|

/s/ James McKeever

|

|

|

|

James

McKeever,

|

|

|

|

Interim

Chief Financial Officer

|

|

|

|

(as

principal financial and accounting

officer)

|

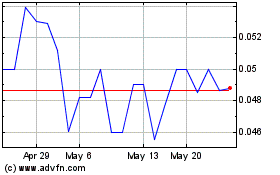

United Energy (PK) (USOTC:UNRG)

Historical Stock Chart

From Oct 2024 to Nov 2024

United Energy (PK) (USOTC:UNRG)

Historical Stock Chart

From Nov 2023 to Nov 2024