Standard Life Invs Property Inc Tst Edison reviews Standard Life Inv. Prprty Inc. Trst

June 12 2018 - 11:13AM

RNS Non-Regulatory

TIDMSLI

Standard Life Invs Property Inc Tst

12 June 2018

London, UK, 12 June 2018

Edison issues review on Standard Life Inv. Property Income

Trust

Standard Life Investments Property Income Trust (SLI) is managed

by Jason Baggaley. He aims to deliver an attractive level of income

with the potential for income and capital growth from a diversified

portfolio of UK commercial property. The manager notes that the

industry is in a period of change, such as in the office sector,

where tenants are demanding a higher level of service from their

landlords. Baggaley says that SLI is embracing and benefiting from

the changing environment, continuing to forge strong relationships

with its tenants. He is cautiously optimistic about future returns

from UK property and is building on his positive long-term

performance track record. SLI's NAV total return has outperformed

its IPD Monthly Index Funds (quarterly version) benchmark over the

last one, three, five and 10 years. The trust offers an attractive

5.0% dividend yield.

SLI's current 6.8% premium to NAV is modestly lower than its

average premiums over the last one, three and five years (range of

5.8% to 7.7%). The board issues shares aiming to limit the premium;

so far in FY18, the share count has increased by 2.4%, raising

gross proceeds of GBP8.9m.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisoninvestmentresearch.com

About Edison: Edison is an investment research and advisory

company, with offices in North America, Europe, the Middle East and

AsiaPac. The heart of Edison is our world-renowned equity research

platform and deep multi-sector expertise. At Edison Investment

Research, our research is widely read by international investors,

advisers and stakeholders. Edison Advisors leverages our core

research platform to provide differentiated services including

investor relations and strategic consulting.

Edison is authorised and regulated by the Financial Conduct

Authority.

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information please contact Edison:

Mel Jenner, +44 (0)20 3077 5720

Gavin Wood, +44 (0)20 3681 2503

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn https://www.linkedin.com/company/edison-investment-research

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAFTMFTMBBBBBP

(END) Dow Jones Newswires

June 12, 2018 12:13 ET (16:13 GMT)

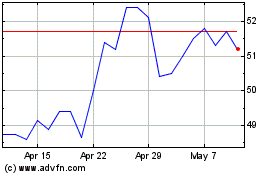

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2024 to May 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From May 2023 to May 2024