TIDMASAI

RNS Number : 4887D

ASA International Group PLC

21 June 2023

ASA International Group plc May 2023 trading and business

update

Amsterdam, The Netherlands, 21 June 2023 - ASA International,

('ASA International', the 'Company' or the 'Group'), one of the

world's largest international microfinance institutions, today

provides the following update on its business operations as of 31

May 2023.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated by the

Market Abuse Regulation (EU) No.596/2014, as it forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018 ("MAR").

Upon the publication of this announcement, this inside information

is now considered to be in the public domain.

Business review YTD 2023 and revised Outlook

Whilst inflation and related FX movement are affecting the

Group, we do see that our operating environment for clients has

improved and is expected to continue to do so.

However, our profitability growth expectations are not

materialising as expected and as such, we do not expect profits to

grow in 2023 compared to levels seen in 2022 due to the following

factors:

- Impact on operations in Nigeria following recent elections and

demonetization taking longer than expected, alongside a steep rise

in fuel costs;

- Devaluation of operating currencies against USD year-to-date

has been higher than expected in Pakistan, Ghana, Kenya and

Nigeria; and

- Slower recovery of overdue and written off loans in India than expected.

May 2023 Business update highlights

-- The Group's Gross OLP increased to USD 346 million (3% higher

than in March 2023 and 16% lower than in May 2022), primarily due

to increased disbursements in Ghana and Nigeria.

-- All operating subsidiaries except India and Nigeria, achieved

collection efficiency of more than 90% with 11 countries achieving

more than 95%.

-- The lower collection efficiency in Nigeria was largely due to

continuing impact of cash shortages following the Central Bank

voiding old banknotes as legal tender, as well as the challenging

operating environment during the elections.

-- India collections remained stable at 86% in May 2023 compared

to March 2023. Collection efficiency, including regular and overdue

collections as well as advance payments, as a percentage of the

regular, realisable collections, including advance payments,

decreased from 109% in March 2023 to 101% in May 2023.

-- PAR>30 for the Group, including off-book loans and

excluding loans overdue more than 365 days, decreased to 4.2% in

May 2023 from 4.5% in March 2023, primarily due to write-offs of

overdue loans in India.

-- The PAR>30 for the Group's operating subsidiaries,

excluding India and Myanmar, increased to 2.8% in May 2023 from

2.6% in March 2023.

-- Excluding all loans which have been overdue for more than 180

days and, as a result, have been fully provided for, PAR>30

improved to 2.5% in May 2023 from 2.6% in March 2023.

-- Disbursements as a percentage of collections exceeded 100% in

10 countries. The lower percentage in India was due to cash

retention in order to service debt obligations, while Sri Lanka was

on account of carefully managing disbursement by reviewing clients'

repayment capability due to economic challenges in the country.

Collection efficiency until 31 May 2023 (1)

Countries Dec/22 Jan/23 Feb/23 Mar/23 Apr/23 May/23

---------- ---------- ---------- --------- ---------

Pakistan 99% 99% 99% 99% 99% 100%

India (total) 87% 83% 84% 86% 88% 86%

Sri Lanka 93% 93% 94% 95% 95% 96%

The Philippines 99% 99% 99% 99% 99% 99%

Myanmar 97% 97% 98% 100% 99% 100%

Ghana 100% 100% 100% 100% 100% 100%

Nigeria 94% 94% 84% 78% 77% 84%

Sierra Leone 93% 93% 94% 95% 96% 96%

Tanzania 100% 100% 100% 100% 99% 99%

Kenya 100% 100% 100% 100% 100% 100%

Uganda 99% 99% 99% 100% 100% 99%

Rwanda 97% 97% 96% 96% 96% 96%

Zambia 97% 97% 97% 98% 98% 98%

----------------------- ---------- ---------- ---------- --------- --------- ---------

(1) Collection efficiency refers to actual collections from clients

divided by realisable collections for the period. It is calculated

as follows: the sum of actual regular collections, actual overdue collections

and actual advance payments divided by the sum of realisable regular

collections, actual overdue collections

and actual advance payments. Under this definition collection efficiency

cannot exceed 100%.

-- Collection efficiency remained broadly stable in most of our

operating countries compared to March 2023.

-- Adjusted collection efficiency in India, including regular

and overdue collections as well as advance payments, as a

percentage of the regular, realisable collections, including

advance payments decreased from 109% in March 2023 to 101% in May

2023. The substantial difference of this adjusted collection

efficiency metric is related to the Group's policy that any loan

instalment paid is first credited against the oldest outstanding

amount overdue. This has an adverse impact on India's monthly

collection efficiency, which is further aggravated by the

relatively long duration of the loans disbursed in India. This

adjusted collection efficiency metric illustrates that most clients

in India continue to make payments on their loans due.

-- Although market conditions in both Myanmar and Sri Lanka

remained challenging, collection efficiency marginally improved in

both markets.

-- The lower collection efficiency in Nigeria was largely due to

continuing impact of cash shortages following the Central Bank's

decision to no longer accept old banknotes as legal tender as of 10

February 2023, as well as the challenging operating environment

during the elections. Nigeria's Supreme Court on 3 March 2023,

ordered the Central Bank of Nigeria to extend the use of these old

banknotes until 31 December 2023.

Loan portfolio quality up to and including May 2023 (2, 3,

4)

Gross OLP (in USDm) Non-overdue loans PAR>30 less PAR>180

-------------------------

Mar-23 Apr-23 May-23 Mar-23 Apr-23 May-23 Mar-23 Apr-23 May-23

Pakistan 64 64 66 99.2% 99.3% 99.5% 0.5% 0.4% 0.3%

India (total) 44 43 45 68.3% 69.4% 67.8% 6.4% 5.0% 5.3%

Sri Lanka 5 4 5 89.2% 88.4% 85.2% 3.7% 3.6% 5.1%

Philippines 52 52 51 97.4% 97.4% 97.2% 1.2% 1.2% 1.2%

Myanmar 18 17 18 88.0% 88.1% 89.1% 1.3% 1.1% 0.8%

Ghana 35 36 39 99.3% 99.3% 99.7% 0.1% 0.1% 0.1%

Nigeria 24 25 27 59.5% 64.2% 72.8% 15.7% 19.2% 16.3%

Sierra

Leone 4 4 4 84.6% 84.7% 84.8% 6.5% 5.3% 4.6%

Tanzania 53 54 55 99.1% 99.1% 99.0% 0.4% 0.4% 0.5%

Kenya 18 18 17 99.1% 99.1% 99.1% 0.2% 0.3% 0.3%

Uganda 11 11 12 99.2% 98.9% 98.7% 0.4% 0.4% 0.4%

Rwanda 4 4 4 92.0% 91.4% 91.5% 4.0% 4.2% 4.2%

Zambia 3 3 3 93.0% 93.3% 93.5% 2.6% 2.4% 2.1%

-------

Group 335 338 346 90.9% 91.5% 91.8% 2.6% 2.7% 2.5%

PAR>30 PAR>90 PAR>180

---------------------------- ------------------------- -------------------------

Mar-23 Apr-23 May-23 Mar-23 Apr-23 May-23 Mar-23 Apr-23 May-23

Pakistan 0.6% 0.5% 0.4% 0.4% 0.3% 0.3% 0.1% 0.1% 0.1%

India (total) 15.8% 14.7% 12.7% 14.5% 13.4% 9.9% 9.4% 9.7% 7.4%

Sri Lanka 6.8% 6.8% 8.2% 5.0% 5.0% 5.7% 3.1% 3.2% 3.2%

Philippines 1.7% 1.7% 1.8% 1.1% 1.3% 1.3% 0.6% 0.6% 0.6%

Myanmar 6.7% 4.9% 3.3% 6.5% 4.8% 3.2% 5.4% 3.8% 2.5%

Ghana 0.2% 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1%

Nigeria 16.5% 20.1% 18.6% 4.9% 5.8% 8.4% 0.8% 1.0% 2.3%

Sierra

Leone 11.7% 11.2% 10.9% 9.6% 9.9% 9.7% 5.2% 5.9% 6.3%

Tanzania 0.6% 0.6% 0.6% 0.3% 0.3% 0.4% 0.2% 0.2% 0.2%

Kenya 0.6% 0.6% 0.7% 0.5% 0.5% 0.5% 0.3% 0.3% 0.4%

Uganda 0.6% 0.6% 0.7% 0.4% 0.4% 0.5% 0.2% 0.2% 0.3%

Rwanda 6.3% 6.6% 6.6% 4.1% 4.5% 4.7% 2.2% 2.3% 2.4%

Zambia 5.1% 4.9% 4.4% 4.0% 3.8% 3.5% 2.6% 2.5% 2.3%

Group 4.5% 4.5% 4.2% 3.2% 3.0% 2.8% 1.9% 1.8% 1.6%

(2) Gross OLP includes the off-book BC and DA model.

(3) PAR>x is the percentage of outstanding customer loans with at

least one instalment payment overdue x days, excluding loans more

than 365 days overdue, to Gross OLP including off-book loans. Loans

overdue more than 365 days now comprise 3.0% of the Gross OLP.

(4) The table "PAR>30 less PAR>180" shows the percentage of outstanding

client loans with a PAR greater than 30 days, less those loans which

have been fully provided for.

-- Gross OLP in India increased to USD 45 million (3 % higher

than in March 2023 and 51% lower than in May 2022).

-- PAR>30 for the Group improved from 4.5% in March 2023 to

4.2% in May 2023, primarily due to write-offs of overdue loans in

India .

-- Credit exposure of the India off-book IDFC portfolio of USD

15.7 million is capped at 5%. The included off-book DA portfolio of

USD 1.1 million has no credit exposure.

Disbursements vs collections of loans until 31 May 2023 (5)

Countries Dec/22 Jan/23 Feb/23 Mar/23 Apr/23 May/23

--------- --------- --------- --------- ---------

Pakistan 86% 101% 101% 107% 108% 115%

India (total) 26% 52% 72% 87% 77% 61%

Sri Lanka 89% 81% 104% 120% 46% 88%

The Philippines 106% 100% 104% 104% 107% 98%

Myanmar 87% 124% 126% 91% 80% 115%

Ghana 131% 89% 99% 104% 117% 110%

Nigeria 82% 50% 34% 58% 110% 126%

Sierra Leone 94% 67% 105% 118% 119% 110%

Tanzania 125% 104% 103% 106% 118% 110%

Kenya 41% 121% 112% 109% 107% 106%

Uganda 93% 89% 107% 101% 100% 103%

Rwanda 104% 78% 85% 93% 100% 115%

Zambia 95% 102% 118% 115% 132% 115%

---------------------- --------- --------- --------- --------- --------- ---------

(5) Disbursements vs collections refers to actual loan disbursements made

to clients divided by total amounts collected from clients in the period.

-- Disbursements as a percentage of collections exceeded 100% in

10 countries. The lower percentage in India was due to cash

retention in order to service debt obligations, while Sri Lanka was

on account of carefully managing disbursement by reviewing clients'

repayment capability due to economic challenges in the country.

Development of Clients and Outstanding Loan Portfolio until 31

May 2023

Gross OLP (in

Clients (in thousands) Delta USDm) Delta

Apr/23-

May/22-May/23 May/22-May/23 May/23

Countries May/22 Apr/23 May/23 May/22-May/23 Apr/23-May/23 May/22 Apr/23 May/23 USD CC(6) USD

Pakistan 561 601 605 8% 1% 80 64 66 -18% 17% 2%

India

(total) 442 211 235 -47% 11% 93 43 45 -51% -48% 5%

Sri Lanka 49 45 45 -8% 2% 4 4 5 23% -1% 17%

The

Philippines 306 328 330 8% 1% 48 52 51 6% 13% -2%

Myanmar 109 97 98 -10% 2% 20 17 18 -10% 2% 2%

Ghana 163 180 181 11% 0% 43 36 39 -9% 31% 8%

Nigeria 233 170 164 -29% -3% 40 25 27 -33% -26% 7%

Sierra Leone 41 35 35 -14% 0% 6 4 4 -34% 14% -9%

Tanzania 199 223 225 13% 1% 42 54 55 33% 35% 2%

Kenya 131 163 170 30% 5% 20 18 17 -16% 0% -7%

Uganda 100 104 108 8% 4% 11 11 12 5% 5% 0.3%

Rwanda 18 20 19 8% -1% 4 4 4 7% 18% 4%

Zambia 18 22 22 28% 2% 2 3 3 32% 49% -6%

Total 2,370 2,197 2,239 -6% 2% 413 338 346 -16% -0.8% 2%

(6) Constant currency ('CC') implies conversion of local

currency results to USD with the exchange rate from the beginning

of the period.

-- The Group's Gross OLP slightly increased to USD 346 million

(3% higher than in March 2023 and 16% lower than in May 2022),

primarily due to increased disbursements in Ghana and Nigeria.

Key events in May and June 2023

In India, a memorandum of understanding was signed by

Microfinance Institutions with Assam Government, whereby

regular/defaulting clients will be provided incentive/relief by The

Government of Assam in categories I to III. The Assam Government

has since honoured its commitment to reimburse clients/Microfinance

entities for Category I and Category II payments. In a recent

communication, the Assam Government has clarified that they would

be settling the overdues of Category III customers with payments

made directly to the associated MFIs by March 2024 not exceeding

the OLP balance of ASA India of approximately USD 4.2 million.

---

The person responsible for the release of this announcement on

behalf of the Company for the purposes of MAR is Tanwir Rahman,

CFO.

Enquiries:

ASA International Group plc

Investor Relations

Mischa Assink ir @asa-international.com

About ASA International Group plc

ASA International Group plc (ASAI: LN) is one of the world's

largest international microfinance institutions, with a strong

commitment to financial inclusion and socioeconomic progress. The

company provides small, socially responsible loans to low-income,

financially underserved entrepreneurs, predominantly women, across

South Asia, South East Asia, West and East Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLSRLILFIV

(END) Dow Jones Newswires

June 21, 2023 10:15 ET (14:15 GMT)

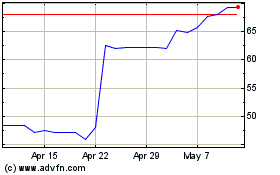

Asa (LSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024