Augmentum Fintech Plc Portfolio Fundraising Update: Tide, Zopa Bank, iwoca

November 02 2023 - 2:00AM

UK Regulatory

TIDMAUGM

2 November 2023

Augmentum Fintech plc

Portfolio Fundraising Update: Tide, Zopa Bank, iwoca

Augmentum Fintech plc (LSE: AUGM) ("Augmentum" or the "Company"), Europe's

leading publicly listed fintech fund, notes successful fundraising developments

at three of its portfolio companies: Tide, Zopa Bank and iwoca.

Tide

The Company has invested a further £4.2 million in Tide, (www.tide.co, 14.1% of

portfolio1), the business banking platform, through a combination of primary and

secondary transactions.

Augmentum first invested in Tide in August 2018 and with this latest investment

the Company aims to capitalise on the bank's accelerating growth trajectory.

Tide announced on 20 September that it has reached 10% market share of all UK

small businesses, with more than 550,000 customers ("members")2. Tide acquired

the UK's leading business credit marketplace Funding Options in November 2022,

with regulatory approval from the FCA in February 2023. The acquisition fast

-tracked the company's credit offering by providing existing and new members

access to over 120 lenders.

The past year also saw Tide realise the first steps in its international

ambitions, as it officially launched in India in December 2022, expanding

throughout 2023. Tide now has more than 150,000 members in India.

Zopa Bank

Zopa Bank (www.zopa.com, 11.9% of portfolio1), the digital-first bank, announced

on 8 September that it has raised £75 million in Tier 2 capital to further drive

its growth and expansion plans.

The financing follows £75 million of equity funding raised in Q1 this year, in

which Augmentum participated, which the bank used to support its M&A strategy

and to acquire Point-of-Sale platform DivideBuy amongst other activities. Zopa

Bank now serves 1 million customers and aims to reach 5 million by 2027. Zopa

Bank expects to hit full-year profitability for the first time this financial

year.

iwoca

iwoca (www.iwoca.co.uk, 3.1% of portfolio1), the SME lender, announced on 17

October that it has secured a new debt facility with initial commitments of £200

million from Barclays Bank plc and Värde Partners. As the UK's high street

lenders retrench and reduce access to capital for SMEs, this funding line allows

iwoca to meet the growing SME demand for working capital. This comes as iwoca

hits net profitability for the fourth consecutive quarter.

In January this year, iwoca secured an increase and extension to its existing

funding line, with long-standing partner Pollen Street Capital - from £125

million to £170 million. With the new £200 million funding line from Barclays

and Värde this now takes the total debt commitments to over £850 million.

Tim Levene, Augmentum Fintech CEO, said: "Amidst challenging macroeconomic

conditions and geopolitical uncertainty, these three key portfolio companies,

which together comprise nearly 30% of our total portfolio value, have not only

shown remarkable resilience but have also continued their upward growth

trajectory, as evidenced by their successful and substantial funding rounds.

From the time of our initial investment, these businesses have undergone a

transformative journey, growing from employing fewer than 400 individuals and

generating under £100 million in revenue, to now collectively boasting a

workforce of over 2,500 dedicated professionals and being on track to generate

upwards of £500 million in annual revenue. These companies have not just

survived; they have thrived, setting new industry standards and driving positive

change. We look forward to sharing a fuller update to our shareholders in our

interim results later this month."

Notes

1 Portfolio percentage values as at 31 March 2023.

2 Tide press release dated 20 September 2023.

Enquiries

Augmentum Fintech +44 (0)20 3961 5420

Tim Levene (Portfolio Manager) georgie@augmentum.vc

Georgie Hazell Kivell (Marketing and IR)

Quill PR +44 (0)20 7466 5050

Nick Croysdill, Sarah Gibbons-Cook press@augmentum.vc

(Press and Media)

Peel Hunt LLP +44 (0)20 7418 8900

Liz Yong, Luke Simpson, Huw Jeremy

(Investment Banking)

Singer Capital Markets +44 (0)20 7496 3000

Harry Gooden, Robert Peel, Alaina Wong

(Investment Banking)

Frostrow Capital LLP +44 (0)20 3709 8733

Paul Griggs (Company Secretary)

About Augmentum Fintech

Augmentum invests in fast growing fintech businesses that are disrupting the

financial services sector. Augmentum is the UK's only publicly listed investment

company focusing on the fintech sector in the UK and wider Europe, having

launched on the main market of the London Stock Exchange in 2018, giving

businesses access to patient capital and support, unrestricted by conventional

fund timelines and giving public markets investors access to a largely privately

held investment sector during its main period of growth.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 02, 2023 03:00 ET (07:00 GMT)

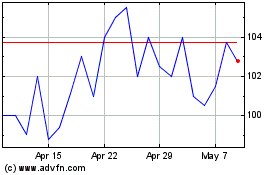

Augmentum Fintech (LSE:AUGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

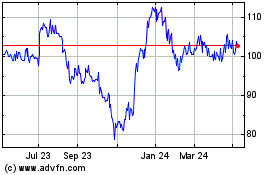

Augmentum Fintech (LSE:AUGM)

Historical Stock Chart

From Apr 2023 to Apr 2024