TIDMAUGM

28 November 2023

Augmentum Fintech plc

Interim Results for the six months ended 30 September 2023

Augmentum Fintech plc (LSE: AUGM) ("Augmentum" or the "Company"), Europe's

leading publicly listed fintech fund, announces its unaudited interim results

for the six months ended 30 September 2023.

Financial highlights

· NAV per share after performance fee1 increased by 0.8% to 160.2p (31 March

2023: 158.9p).

· IRR of 16.6%2 on invested capital since inception (31 March 2023: 18.5%)

· Available cash at period end of £51.8 million (free cash of £48.0 million)

with no debt (31 March 2023: £38.5 million).

· Repurchased 3,918,878 shares over the period, at an average price of 99.2p per

share.

Portfolio and investment highlights

· The top 10 holdings, which represent 82% of portfolio value, grew revenue at

an average of 74%3 YoY and have an average of 29 months cash runway. 4 of the

top 10 positions are cash generative.

· The sum value of the top three holdings in Tide, Grover, and Zopa, plus

current cash, is above the Company's market capitalisation. These positions

continue to demonstrate their credentials as fintech market leaders, growing

revenues by an average of over 1,200% since the Company's investment and are

either profitable or capitalised until projected profitability.

· Cushon, the workplace pensions and savings provider, completed their majority

shareholding acquisition by NatWest Group in June 2023, which delivered a return

of 2.1x multiple on invested capital with proceeds of £22.8 million and a 62%

IRR.

· Tide, the SME business bank, now services 1 in 10 UK small and mid-sized

businesses, representing 550,000 UK businesses. Since expanding into India in

December 2022, Tide now has more than 150,000 members in the country.

· Zopa Bank, the digital-first consumer bank and lender, announced in September

2023 that it had successfully raised £75 million in Tier 2 capital to fuel its

continuous growth and rapid expansion. This financing follows £75 million of

equity funding raised earlier this year, in which Augmentum participated. Zopa

Bank now serves 1 million customers and expects to hit full-year profitability

for the first time this year.

· Monese, the mobile-only current accounts and banking as a service (BaaS)

provider, announced the launch of XYB, an end-to-end `coreless' banking platform

provider, in May 2023.

· Wematch.live, the capital markets trading platform, surpassed $200 billion in

ongoing notional volume of Total Return Swaps on equities in August 2023.

Wematch.live also reached an average daily matched volume (ADMV) of $11 billion

in EMEA in July 2023.

· A number of acquisitions were made across the portfolio, including by Onfido,

the global leader in automated identity verification, who acquired Airside, the

US-headquartered shareable digital identity technology company and FullCircl,

the company intelligence and risk solution provider for frontline teams, who

acquired RegTech provider W2 Global Data Solutions.

· The Company remains a highly selective investor. Since the start of 2022 it

has consciously slowed deployment as the valuation environment has continued to

re-rate. During the period, the Company made three follow-on investments,

totaling £6.9 million, including £5.3 million into Volt, the account-to-account

payment provider, as part of a $60 million Series B round. The Company also took

up their pro rata shareholder rights to invest a total of £1.6 million in

Grover, the consumer tech subscription platform, and Habito, the digital

mortgage broker and direct lender.

Notes:

1 The Board considers NAV per share after performance fee to be the most

appropriate measure of NAV per share attributable to shareholders.

2 Annualised IRR on invested capital and realisations since inception using

valuations at the last reporting date before performance fee.

3 Revenue growth taken as the LTM to September 2023 vs the LTM to September

2022. Any outliers (>250%) have been capped to 250% to improve comparability.

Neil England, Chairman of Augmentum Fintech plc, commented:

"The Company's NAV per share after performance fee was 160.2p, a gain of 0.8%

over the reporting period. This continues the Company's unbroken NAV per share

increase over every one of the eleven reporting periods since our IPO in 2018,

notwithstanding the recent ongoing challenging market conditions.

"Whilst the Company's shares have continued to trade at a discount to NAV, in

order to convey to the market the Board's confidence in the value of the

portfolio, and to take advantage of the accretion to shareholders offered by the

wide discount, we continued to buy-back shares over the period under review.

These shares are held in treasury and may be reissued when the share price

returns to a premium.

"Our Manager has retained their investment discipline over the last six months

and at the end of the reporting period the Company held net free cash of £48

million. The Augmentum model has been proven through five successful

realisations to date, and the Company's track record coupled with the expected

reduction in interest rates in 2024 may be the trigger for the re-rating that

the Board believes is deserved."

Tim Levene, CEO of Augmentum Fintech Management Limited, commented:

"Despite a strong pipeline of opportunities, our bar for investment has remained

high and we have retained our uncompromising standards for new investments. We

made no additions to our portfolio during the period under review although have

invested £6.9 million in three of our existing portfolio companies. Our three

largest holdings, Tide, Grover and Zopa, are category defining digital leaders

in large and growing markets. They are currently growing at an average of 79%

year on year and are either profitable or funded to profitability."

"We continue to apply a rigorous approach to valuations. This can be seen in our

five exits to-date, where proceeds have been realised above or on-par with

previously reported valuations. In this reporting period Cushon's acquisition by

NatWest Group brought in proceeds of £22.8 million, representing a 2.1 multiple

on invested capital and an uplift of 47% on the previous valuation. Our approach

to valuation, we believe, sets us apart from many other funds."

"Markets are exhibiting the early signs of a shift in sentiment with interest

rates being held steady first in the UK and then in the US. This signals a

cautious yet hopeful economic outlook. This, combined with the continual move

towards the digitisation of financial services and Augmentum's disciplined

approach to both investment and valuation will, we believe, offer exceptional

opportunities for us to deliver a stand-out vintage in 2024 and 2025."

Enquiries

Augmentum Fintech +44 (0)20 3961 5420

Tim Levene (Portfolio Manager) georgie@augmentum.vc

Georgie Hazell Kivell (Marketing and IR)

Quill PR +44 (0)20 7466 5050

Nick Croysdill, Sarah Gibbons-Cook press@augmentum.vc

(Press and Media)

Peel Hunt LLP +44 (0)20 7418 8900

Liz Yong, Luke Simpson, Huw Jeremy

(Investment Banking)

Singer Capital Markets +44 (0)20 7496 3000

Harry Gooden, Robert Peel, James Fischer

(Investment Banking)

Frostrow Capital LLP +44 (0)20 3709 8733

Paul Griggs (Company Secretary)

About Augmentum Fintech

Augmentum invests in fast growing fintech businesses that are disrupting the

financial services sector. Augmentum is the UK's only publicly listed investment

company focusing on the fintech sector in the UK and wider Europe, having

launched on the main market of the London Stock Exchange in 2018, giving

businesses access to patient capital and support, unrestricted by conventional

fund timelines and giving public markets investors access to a largely privately

held investment sector during its main period of growth.

.

--------------------------------------------------------------------------------

--------------------------------------------------------------------

Augmentum Fintech plc

Half Year Report for the six months ended

30 September 2023

.

Chairman's Statement

Introduction

This report covers your Company's progress in the six months to 30 September

2023 and its financial position at that date.

Investment Strategy

Your Company invests in early stage European fintech businesses which have

technologies that are disruptive to the traditional financial services sectors

and/or support the trend to digitalisation and market efficiency. A typical

investment will offer the prospect of high growth and the potential to scale.

Our objective is to provide long-term capital growth to shareholders by offering

them exposure to a diversified portfolio of private fintech companies during

their period of rapid growth and value accretion.

Performance

Your Company's NAV per share after performance fee at 30 September 2023 was

160.2p, a 0.8% gain across the period under review (158.9p as at 31 March 2023).

NAV per share has increased in every one of the eleven half year reporting

periods since the Company's IPO in 2018, albeit at a much reduced level during

the past year. This lower increase is largely due to valuations being affected

by lower sales or earnings multiples in the public market comparators that we

use in our valuations, together with some sensible provisions that we have made

against those businesses that have faced challenges.

The operational performance of the vast majority of our portfolio companies has

continued to be strong, with average revenue growth of 74% across the top 10 in

the last 12 months. There have been some standout results, in some cases ahead

of expectations, and the majority have over 2 years of cash runway. Crucially,

our top 5 investments; Tide, Grover, Zopa Bank, Volt and BullionVault, are all

growing strongly.

Shareholders will note that we have not experienced the NAV write-downs that

have been a feature from several other investment companies that focus on

venture and early stage private equity. This is testament to our rigorous and

disciplined approach to investment selection and valuations. As I have reported

previously, as a result of this discipline, we did not write up the value of our

investments to the levels that others did when we were in a bull market for

fintech. It follows that we have not needed to make major corrections now. This

approach is best illustrated by our five realisations, all of which have been at

or above their pre-disposal valuation.

The world is an uncertain place as I write, and there have been capital flows

away from equities into safer havens such as cash and gold. It is expected that

equity markets will remain tough in the coming months. High interest rates and

uncertainty over future rates have continued to be a major negative factor

affecting investment companies that focus on growth. The assumption is that

these companies will need cash to fund that growth and that will be expensive

and/or difficult to get. Unfortunately, the market is not differentiating

between those companies with genuine issues in this regard and those that have

no such needs, as is the case with the bulk of our portfolio. The result is that

the price at which the shares traded continued to significantly under-represent

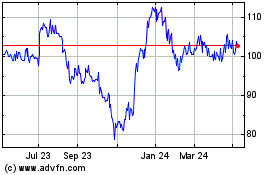

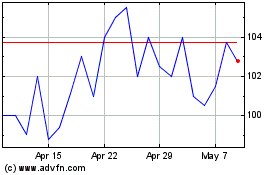

the NAV throughout the period, ending at 94.0p per share, down 3.0p from the

price at 31 March 2023 and representing a discount to the NAV per share after

performance fee of 41.3%. When stripping out our cash from the balance sheet,

the implied discount on our investment portfolio is around 51%. As at 30

September 2023, the valuation of our top three positions in Tide, Grover, and

Zopa Bank, plus cash, was above our market capitalisation, attributing no value

to our £125 million of other investments.

Portfolio and Transactions

Our portfolio stands at 24 companies, diversified across the main fintech

verticals, European markets, and at the various stages that we told our IPO

investors that we would build to. Our Top 10 investments represent 82.3% of the

portfolio value.

In the period, the Company received proceeds of £22.8 million from the

completion of NatWest Group's acquisition of Cushon, significantly ahead of its

prior valuation and representing a 2.1x multiple on invested capital.

The Company made follow-on investments to support Volt (£5.3 million) and Grover

(£1.4 million). No new investments were established during the period, despite

the team reviewing many opportunities, illustrating the discipline of our

investment model. At the period end, the Company had net free cash of £48

million.

The Portfolio Manager's report, beginning on page 8, includes a detailed review

of the portfolio, individual company performance and investment transactions in

the period.

Valuations

Your Board considers its governance role in the valuations process to be of

utmost importance. Together with our advisers we consider and challenge all of

the investment valuations used for the full and half year financial statements.

We have carefully reviewed both the status and the forecasts of all of the

portfolio companies. The valuations have been arrived at using appropriate and

consistent methodologies, and we sense check and debate our conclusions on the

assets themselves and their market context. Also, we benefit from some of our

investments occupying a senior position in the capital structures of these

companies, providing some protection against downside risk.

Portfolio Management

We are active investors with a team that works closely with the companies we

invest in, typically taking either a board or an observer seat and working with

management to guide strategy consistent with long-term value creation. We have

built a balanced portfolio across different fintech sectors and maturity stages

and are committed to a responsible and sustainable investment approach,

believing that the integration of environmental, social and governance factors

helps to mitigate risk.

Discount Control

As reported above, the Company's shares continued to trade at a discount to NAV

during the period under review and up to the date of this report. Buybacks are

one of several mechanisms your board actively consider to reduce this discount.

To convey to the market our confidence in the value of the portfolio and take

advantage of the accretion to shareholders offered by the wide discount we

continued to buy back shares in the period under review. All shares purchased by

the Company are being held in treasury and will potentially be reissued when the

share price

returns to a premium.

3,918,878 shares were bought back into treasury during the six months to 30

September 2023, at an average price of 99.2p per share, representing an average

discount to the 31 March 2023 NAV after performance fee of 37.9% and accreting

1.4p per share. A further 366,308 shares have been bought back since September,

at an average price of 86.3p per share, representing an average discount to the

updated NAV after performance fee as at 30 September 2023 of 46.2%.

The use of our cash reserves is a matter of regular Board review. We aim to

balance the benefits of highly accretive buybacks when discounts are high

against ensuring that we hold appropriate reserves to fund follow on investments

and capture the best of the new investment opportunities that we continue to

see.

Outlook

Inflation and interest rates remain elevated and early stage growth portfolios

continue to be out of favour. However, the need to digitalise and transform last

century's infrastructure remains, as nearly all financial services sectors

continue to be dominated by traditional businesses whose operations cannot

ignore the rapid development of less costly, and in many cases more secure,

business models.

Augmentum has proved its model through the successful realisations to date and

we are confident in the promise that our current investments offer.

Several commentators have highlighted the potential value in the Augmentum

portfolio, but as yet, this has not produced the re-rating that your Board

believe is deserved. A reduction in interest rates could be the trigger for

this. UK inflation appears to have peaked and this may produce a base rate

reduction as early as Q2 2024.

The current share price does not reflect the tangible value creation we have

seen across our top 10 investments and their potential for further growth. This

leads your Board to continue to expect that the patient shareholder will be well

rewarded.

Neil England

Chairman

27 November 2023

.

Investment Objective and Policy

Investment objective

The Company's investment objective is to generate capital growth over the long

term through investment in a focused portfolio of fast growing and/or high

potential private financial services technology ("fintech") businesses based

predominantly in the UK and wider Europe.

Investment policy

In order to achieve its investment objective, the Company invests in early or

later stage investments in unquoted fintech businesses. The Company intends to

realise value through exiting these investments over time.

The Company seeks exposure to early stage businesses which are high growth, with

scalable opportunities, and have disruptive technologies in the banking,

insurance and wealth and asset management sectors as well as those that provide

services to underpin the financial sector and other cross-industry propositions.

Investments are expected to be mainly in the form of equity and equity-related

instruments issued by portfolio companies, although investments may be made by

way of convertible debt instruments. The Company intends to invest in unquoted

companies and will ensure that the Company has suitable investor protection

rights where appropriate. The Company may also invest in partnerships, limited

liability partnerships and other legal forms of entity. The Company will not

invest in publicly traded companies. However, portfolio companies may seek

initial public offerings from time to time, in which case the Company may

continue to hold such investments without restriction.

The Company may acquire investments directly or by way of holdings in special

purpose vehicles or intermediate holding entities (such as the Partnership*).

The Management Team has historically taken a board or board observer position on

investee companies and, where in the best interests of the Company, will do so

in relation to future investee companies.

The Company's portfolio is expected to be diversified across a number of

geographical areas predominantly within the UK and wider Europe, and the Company

will at all times invest and manage the portfolio in a manner consistent with

spreading investment risk.

The Management Team will actively manage the portfolio to maximise returns,

including helping to scale the team, refining and driving key performance

indicators, stimulating growth, and positively influencing future financing and

exits.

Investment restrictions

The Company will invest and manage its assets with the object of spreading risk

through the following investment restrictions:

·the value of no single investment (including related investments in group

entities or related parties) will represent more than 15% of NAV, save that one

investment in the portfolio may represent up to 20% of NAV;

·the aggregate value of seed stage investments will represent no more than 1% of

NAV; and

·at least 80% of NAV will be invested in businesses which are headquartered in

or have their main centre of business in the UK or wider Europe.

In addition, the Company will itself not invest more than 15% of its gross

assets in other investment companies or investment trusts which are listed on

the Official List of the FCA.

Each of the restrictions above will be calculated at the time of investment and

disregard the effect of the receipt of rights, bonuses, benefits in the nature

of capital or by reason of any other action affecting every holder of that

investment. The Company will not be required to dispose of any investment or to

rebalance the portfolio as a result of a change in the respective valuations of

its assets.

Hedging and derivatives

Save for investments made using equity-related instruments as described above,

the Company will not employ derivatives of any kind for investment purposes.

Derivatives may be used for currency hedging purposes.

Borrowing policy

The Company may, from time to time, use borrowings to manage its working capital

requirements but shall not borrow for investment purposes. Borrowings will not

exceed 10 per cent. of the Company's Net Asset Value, calculated at the time of

borrowing.

Cash management

The Company may hold cash on deposit and may invest in cash equivalent

investments, which may include short-term investments in money market type funds

and tradeable debt securities.

There is no restriction on the amount of cash or cash equivalent investments

that the Company may hold or where it is held. The Board has agreed prudent cash

management guidelines with the AIFM and the Portfolio Manager to ensure an

appropriate risk/return profile is maintained. Cash and cash equivalents are

held with approved counterparties.

It is expected that the Company will hold between 5% and 15% of its Gross Assets

in cash or cash equivalent investments, for the purpose of making follow-on

investments in accordance with the Company's investment policy and to manage the

working capital requirements of the Company.

Changes to the investment policy

No material change will be made to the investment policy without the approval of

Shareholders by ordinary resolution. Non-material changes to the investment

policy may be approved by the Board. In the event of a breach of the investment

policy set out above or the investment and gearing restrictions set out therein,

the Management Team shall inform the AIFM and the Board upon becoming aware of

the same and if the AIFM and/or the Board considers the breach to be material,

notification will be made to a Regulatory Information Service.

*Please refer to the Glossary on page 43.

.

Portfolio

as at 30 September 2023

Fair Net Impact Investment Fair % of

value of investments/ of FX return value of

portfolio

holding (realisations) rate £'000 holding

at £'000 changes at

31 March £'000 30

2023 September

£'000 2023

£'000

Tide 35,692 - - 5,767 41,459 15.2%

Grover 43,150 1,368 (579) (2,655) 41,284 15.1%

Zopa Bank^ 30,093 - - 3,810 33,903 12.4%

Volt 14,216 5,300 - 4,223 23,739 8.7%

BullionVault^ 11,565 - - 404 11,969 4.3%

Monese 11,683 - - (1,588) 10,095 3.7%

AnyFin 9,304 - (369) 770 9,705 3.6%

Onfido 10,242 - (51) (486) 9,705 3.6%

Intellis 8,412 - 113 352 8,877 3.2%

Iwoca 7,882 - - 3 7,885 2.9%

Top 10 182,239 6,668 (886) 10,600 198,621 72.7%

Investments

Other 49,266 211 131 (6,893) 42,715 15.6%

Investments*

Cushon 22,790 (22,790) - - - 0.0%

Total 254,295 (15,911) (755) 3,707 241,336 88.3%

Investments

Cash & cash 40,015 51,772 18.9%

equivalents

Net other (186) (1,979) (0.7)%

current

liabilities

Net Assets 294,124 291,129 106.5%

Performance (16,819) (17,756) (6.5)%

Fee

accrual

Net Assets 277,305 273,373 100.0%

after

performance

fee

^Held via Augmentum I LP

*There are fourteen other investments (31 March 2023: fifteen) held in the

portfolio. See page 14 for further details.

.

Portfolio Manager's Review

Overview

As I write, markets are exhibiting the early signs of a shift in sentiment. The

Bank of England's decision to hold rates steady since September, followed by the

Federal Reserve's similar stance in early November, signals a cautious yet

hopeful economic outlook. While the months ahead present likely challenges with

persistently high rates, the encouraging performance of growth stocks in

response to these developments suggests a return to more positive equity market

performance. Patience is required, as confidence and capital gradually

reinvigorate the markets. However, reaching the apex of this rate tightening

cycle marks a significant turning point, steering us towards a more optimistic

future.

Despite these positive shifts, the UK equity market continues to grapple with

deep-rooted demand issues, even amidst numerous strategic efforts to enhance its

competitiveness. The overwhelming preference for passive investment strategies,

coupled with the US market's dominance, remains a formidable challenge for

trading volumes. This trend has led to reduced liquidity in domestic European

exchanges, with our pension funds and wealth managers disproportionately

investing in US markets.

My responsibility extends beyond reporting our progress; it's about charting our

future course. Investing in Augmentum today means accessing a portfolio and a

pan-European investment platform that has evolved significantly since the

Company's IPO. The portfolio's robustness positions us favourably for the

promising investment landscape in European fintech.

Each new advance in technology, such as those seen this year with AI, adds

momentum to the structural trends driving digitalisation across the economy.

Momentum meets opportunity in financial services, penetration of fintech market

share remains well below 2% and global fintech revenue is forecast to reach

US$1.5 trillion in 2030 (BCG, 2023). The companies that make up our portfolio

and current pipeline are at the forefront of this huge opportunity and Augmentum

remains a unique way for investors to share in it too.

Combined with clear strategy and a disciplined approach, market conditions are

such that returns from 2024-25 private investment vintages have the potential to

be exceptional.

Portfolio Overview

The Company's portfolio stands at 24 fintech companies, with diversification

across fintech verticals, European markets, and maturity stages, as we told

investors we would build during the Company's IPO. Since listing, we have

delivered £84 million in realisations, across five exits and from dividends,

despite the macroeconomic backdrop. The portfolio's top 10 companies employ over

4,000 people and generate close to £1 billion in annual revenues, with year-on

-year growth continuing at an average of 74%. Four of this group are profitable

and the remaining six have an average cash runway to their next funding round of

29 months.

The three largest holdings, Tide, Grover and Zopa Bank are category defining

digital leaders in large and growing markets. They are growing revenue at an

average of 79% year-on-year and are profitable or expected to reach

profitability without further funding. Each has built an exceptional team and

technology platform. True to our model, we have supported these companies from

their early stages with capital and strategic support. Revenue growth since our

initial investment has been over 2,000% on average. We will continue to work to

optimise the exits of the Company's positions in the years ahead.

The resilience of our portfolio is notable against the macro backdrop of the

last 18 months. Whilst in the broader venture and tech landscape, stress is

starting to show through in rates of company failure as cash runways come to an

end. Meanwhile, the companies in the portfolio continue to attract investment,

raising over £200 million in equity funding in the last 12 months. With insight

on performance and strategic direction, we have continued to build the positions

in the portfolio's top performers through follow-on investments.

Following a period of depressed investment activity in the sector over the

course of 2022 and early 2023, we have seen the beginning of a meaningful return

in activity and importantly quality in the last quarter. This has been

accompanied by the start of a reset in valuations to longer-term accepted stage

-appropriate levels. Bolstered by our fifth portfolio exit of Cushon to NatWest

Group, the Company's balance sheet position is strong with £48 million of free

cash and no debt. We believe that the period ahead will be an opportune time to

invest.

Investment Activity

Our deployment into new companies slowed while markets were correcting in 2022

and the first half of 2023. We have continued to assess opportunities, but

prospects and deal dynamics, in particular valuations, have not met our bar for

investment. We remain committed to a long-term, sector-focussed approach that is

built not just on quality companies, but quality investments. Reduced deployment

has been the right course in a market absent of the right investment at the

right price.

During the period we invested £5.3 million into existing portfolio company Volt

as part of the company's US$60 million Series B round. Volt is addressing a huge

opportunity in real-time payments that sits at the intersection of trends in

ecommerce, payment behaviours, and increasing focus on payment costs and

security. Since Augmentum's first investment in December 2020, Volt has

consistently delivered double-digit month-on-month revenue growth as a leading

provider of real-time payment connectivity to global merchants and payment

service providers. The series B round was led by US investor IVP who will

support the company's expansion into North American markets, building on their

existing presence in the UK, Europe, Brazil and Australia.

We also took up our pro rata shareholder rights to invest a total of £1.6

million in small additional rounds at Grover and Habito.

Post-period end, we invested £4.2 million in an oversubscribed primary and

secondary transaction at Tide, which is now our largest holding. As the leading

digital banking platform for small businesses in the UK, Tide has now achieved

10% share of the UK market with more than 550,000 members. Tide is profitable in

the UK and moving into a new phase of maturity, delivering strong revenue

diversification through product cross-sell across a large and stable base of

business customers. To further diversify from a predominantly UK revenue focus,

Tide has launched in India, and in less than 12 months has attracted more than

150,000 new members.

The portfolio's second largest holding, Grover, continues to define a new

category at the intersection of fintech and ecommerce, fundamentally changing

how retail and business customers consume technology products. Part payment

-method, part-financing, Grover's technology subscriptions offer the flexibility

and choice that underpin the secular trend towards an access-rather than

ownership-economy. During the period annual recurring revenue reached ?266

million (September 2022: ?202 million), with 320,000 active customers across 5

core markets. In the last 18 months Grover adjusted marketing spend to move

towards profitability in 2024. Following the recent ?23 million transaction that

Augmentum participated in, Grover is funded to reach this milestone. The

revaluation of our holding by £3.2 million reflects currency impact and the

terms of the transaction. The company continues to track its profitability

-focused year-on-year revenue growth target of 30% with EBIT and net income

margin performing ahead of expectations due to a close focus on costs.

Zopa Bank's performance demonstrates the powerful combination of exceptional

technology, a world class team, and a strong balance sheet. The company is

profitable, and performing ahead of budget year-to-date and further strengthened

its balance sheet raising £75 million in Tier 2 regulatory capital. The upward

movement in the valuation of the Company's holding by £3.8 million follows year

-on-year revenue growth of 92% and returns the full position above cost of

investment for the first time since the write down event that coincided with

their securing a banking licence in 2019. The transformation of the business

since, and a 17 year lending track record, have seen Zopa Bank continue along an

ambitious growth trajectory.

BullionVault has enjoyed a strong year of trading and is on track to deliver

record profits. Performance follows from investor demand for gold and other

precious metals as an inflationary hedge, and net interest income earned on fiat

balances held by users on exchange. BullionVault is a mature position in the

portfolio and serves a hedging function within the Augmentum portfolio during

times of heightened market uncertainty. The moderate uplift of the Company's

position by £0.4 million reflects this performance, but also the degree of

cyclicality we believe is exhibited in these elevated levels of earnings.

Investor interest in the banking-as-a-service market remains high and Monese's

business-to-business coreless banking platform `XYB' has proven competitive

amongst a strong peer set. The opportunity is clear; having tried and failed to

launch internally-built digital propositions, incumbent financial services firms

are seeking partnership with fintech players. Monese's client list, including

HSBC and Investec, is reflective of the high quality of the technology platform,

originally built and proven out through the consumer business. As Monese's

revenue mix is increasingly built on long-term licensing revenues from XYB, the

valuation comparables of the company will adjust. Our downward adjustment to the

fair value of our holding by £1.6 million reflects the basket of public market

comparators we have used.

Founded in Sweden, Anyfin supports financial wellbeing for consumers. The core

product of credit refinancing is combined with saving accounts, budgeting tools

and subscription management services driving high retention across their prime

-credit user base. Year-on-year revenue growth has remained strong, although

higher costs of capital have impacted at the gross margin level. The experienced

management team has demonstrated strong capability while navigating a more

challenging macro environment.

Onfido provides identity verification services to enterprise clients in

financial services. These clients have proven to be a resilient base, although

rates of customer onboarding have reduced since peaks seen in 2021, with some

verticals hit harder than others. Onfido has a leading position in the US and

Europe through diversification across the financial services sector, and entry

into new areas including healthcare. The downward adjustment to the fair value

of our holding by £0.5 million is reflective of the contraction in valuation

multiples amongst Onfido's listed peers. The business is a highly strategic

asset which will have strong exit opportunities as the macroeconomic environment

improves.

The £0.4 million uplift of the Company's holding in Intellis follows a period of

profitability for the business, despite falling market volatility. Intellis

remains a unique proposition in the market and in the portfolio, deploying

advanced proprietary AI trading strategies in foreign exchange markets with

highly automated execution and a very lean cost base. Operating under a fully

licensed fund structure, the road is set to enable the business to scale, both

in current focus markets, and potentially in other adjacent asset classes.

iwoca's return to performance, and to the Company's top 10, exemplifies the

resilience and capability of the teams that make up our portfolio. In 2020,

Covid funding support schemes dislocated iwoca's market overnight. As these

schemes have ended, and high-street lenders have once again retreated from small

business funding, iwoca's trading performance has progressed from strength-to

-strength. Revenue run rate is now above £140 million with year-on-year growth

at 141%. Achieving profitability in January 2023 and building this consistently

month on month, iwoca is another example of the profit potential of lending

businesses that harness digital technologies to drive significant operating

leverage at scale.

We retain a cautious approach to the digital asset sector, although crypto-asset

pricing has seen recovery following positive regulatory news on ETF products

approvals in the US. Our combined holdings in this area equate to 4.7% of the

portfolio, which we believe to be an appropriate level of exposure to a market

opportunity that has the potential to deliver upside value if demand continues

to return.

Outside the top 10 there were two notable fair value movements, with both Gemini

and Previse adjusted downwards during the period in light of trading performance

at both companies. In the US, Gemini continue to act as an agent in the recovery

of customer assets lent through a third-party program known as `Earn'. This case

has attracted legal action towards the third-party operator of the program and

Gemini, and we continue to monitor the situation as it evolves.

Exits

In June, our fifth portfolio exit completed with the sale of Cushon to NatWest

Group. Augmentum received £22.8 million, delivering an IRR of 62% and a multiple

on capital invested of 2.1 times, representing a 47% uplift on the previously

reported fair value of Augmentum's position.

We have delivered five exits to date, all at or above the previously reported

holding value. Combined with dividends from elsewhere in the portfolio these

have delivered £84 million of cash.

Performance

As at 30 September 2023, we are reporting a NAV per share after performance fee

of 160.2p (31 March 2023: 158.9p). Since IPO the Company has generated a Gross

IRR (before expenses) on Capital Deployed* of 16.6%.

Each position is valued objectively using the most appropriate methodology. 92%

of the portfolio is valued using public market comparables. Wider governance is

a key element of the process with each valuation signed off by the Board and

Valuations Committee. Over time we have demonstrated consistency and prudence in

our approach, protecting the valuations from some of the outsized market swings

that were seen in 2021 and 2022.

As mentioned in previous reports, downside protections, such as liquidation

preference and anti-dilution provisions, are integral to the way we structure

our typical venture investments.. These structures are atypical of ordinary

share structures typically seen in the public or private markets as they protect

the value of Augmentum's position in the event of a reduction in the equity

value of a company.

Outlook

Many commentators expect rates to remain elevated for a sustained period. Our

base position is that 2024 is likely to be a year of economic challenge, but we

expect that confidence is likely to rebound in 2025.

Acquisitions have traditionally been the primary exit strategy for fintechs, a

trend we see persisting into 2024 and beyond. This trajectory is bolstered by

growing bank balance sheets in the current fiscal landscape and an increasing

synergy between fintechs and incumbent firms. The urgency for digital

transformation - to manage operational pressures and stay competitive against

fintech challengers - remains paramount. In the banking sector, global leaders

like JPMorgan Chase, which faced scrutiny for its projected US$15.3 billion

technology spend across acquisitions and partnerships in 2023, are now reaping

rewards for their strategic investments through outperformance. This has not

gone unnoticed by their smaller counterparts or shareholders.

Our focus aligns with the growing trend towards business-to-business

investments, but we also see untapped potential in business-to-consumer fintech

ventures. Harnessing cutting-edge technologies like AI, these ventures are

poised to offer consumer products far surpassing those of incumbent firms.

For venture capital funds that have weathered the challenges of the past two

years, a new cycle of opportunity is unfolding. In Europe, the recalibration of

early-stage valuations coincides with a maturing technology infrastructure,

evolving start-up ecosystems, and new regulatory frameworks. These elements,

coupled with substantial room for digital disruption in financial services, lay

the groundwork for the next generation of impactful businesses.

The announcement of The Mansion House Compact in July 2023 marked a potential

paradigm shift for UK pension fund capital, with ten of the UK's largest funds

committing to allocate up to 5% of assets to private markets by 2030. This

signals a welcome change in allocator mindset; with progression beyond the

singular focus on cost-minimisation that has seen UK pensions underperform

against international benchmarks. Talk, however, is cheap and the industry needs

to move swiftly and decisively to ensure the Compact delivers on its significant

potential to address the UK's pension performance gap, and to support the wider

investment environment.

European venture capital has demonstrated that private market strategies can

offer both value and outstanding returns. We believe that by building

diversified private market strategies, capitalising on the UK's venture capital

expertise in various sectors and stages, pension fund managers can access some

of the highest quality private market opportunities.

During our Capital Markets Day in July, we underscored the importance of sector

specialisation. This focus enhances deal sourcing and execution and elevates the

support we provide to portfolio companies. Our thesis-led approach, grounded in

a deep understanding of technological advancements and regulatory shifts, guides

our identification of emerging fintech opportunities.

Looking ahead, our team is cultivating a pipeline centred on expanding retail

access to private markets, regulatory and compliance technologies, financial

operations including treasury management, and financial market infrastructure

for the carbon and energy sectors.

We maintain an uncompromising standard for new investments. Our meticulous

approach has been instrumental in building our resilient, diverse, and rapidly

growing portfolio, which continues to scale even in uncertain economic times. We

believe that the coming years will offer exceptional opportunities for top-tier

venture investors to deliver a standout vintage.

Tim Levene

CEO

Augmentum Fintech Management Limited

27 November 2023

.

Investments

Tide

Tide's (www.tide.co) mission is to help small and mid-sized businesses ("SMEs")

save time and money in the running of their businesses. Customers can be set up

with an account number and sort code in less than 10 minutes, and the company is

building a comprehensive suite of digital banking services for businesses,

including automated accounting, instant access to credit, card control and

quick, mobile invoicing. In November 2022, Tide acquired Funding Options, a

leading UK marketplace for SMEs seeking business finance giving Tide's customers

access to a wider range of credit options and creating one of the UK's biggest

digital marketplaces for SME credit. In December 2022, Tide launched in India

with two business banking solutions - the Tide Business Account and its RuPay

-powered Tide Expense Card. Tide now has 10% market share of small business

accounts in the UK, with more than 500,000 customers, and more than 150,000

members in India.

Augmentum led Tide's £44.1 million first round of Series B funding in September

2019, alongside Japanese investment firm The SBI Group. In July 2021 Tide

completed an £80 million Series C funding round led by Apax Digital, in which

Augmentum invested an additional £2.2 million and into which the £2.5 million

loan note converted. In October 2023 Augmentum invested a further £4.2 million

through a combination of primary and secondary transactions.

Source: Tide

30 Sept 31 March

2023 2023

£'000 £'000

Cost 13,200 13,200

Value 41,459 35,692

Valuation Methodology^ Rev. Multiple Rev. Multiple

% ownership (fully diluted) 5.1% 5.1%

As per last filed audited accounts of the investee company for the year to 31

December 2021 (2022 accounts are expected to be filed shortly):

2021 2020

£'000 £'000

Turnover 33,541 14,442

Pre tax loss (32,719) (25,825)

Net assets 66,297 17,761

^see note 7 on pages 30 and 31.

Grover

Berlin-based Grover (www.grover.com) is the leading consumer-tech subscription

platform, bringing the access economy to the consumer electronics market by

offering a simple, monthly subscription model for technology products. Private

and business customers have access to over 8,000 products including smartphones,

laptops, virtual reality technology, wearables and smart home appliances. The

Grover service allows users to keep, switch, buy, or return products depending

on their individual needs. Rentals are available in Germany, Austria, the

Netherlands, Spain and the US. Grover is at the forefront of the circular

economy, with products being returned, refurbished and recirculated until the

end of their usable life. Grover has circulated over 1.2 million devices. With

total funding of around ?1.4 billion to date and over 400 employees, Grover is

one of the fastest-growing scale-ups in Europe.

In September 2019 Augmentum led a ?11 million funding round with a ?6 million

convertible loan note ("CLN") investment. This coincided with Grover signing a

?30 million debt facility with Varengold Bank, one of Germany's major fintech

banking partners. In March 2021 Grover completed a ?60 million Series B equity

and debt funding round, with Augmentum participating and converting its CLN, and

Grover's Series C funding round in April 2022 raised US$330 million in equity

and debt funding. In September 2023, Augmentum invested £1.4 million as part of

a ?23 million transaction that will support the company to profitability.

Source: Grover

30 Sept 31 March

2023 2023

£'000 £'000

Cost 9,295 7,927

Value 41,284 43,150

Valuation Methodology^ Rev. Multiple Rev. Multiple

% ownership (fully diluted) 6.3% 6.3%

As an unquoted German company, Grover is not required to publicly file audited

accounts.

Zopa

Having been founded in 2005 as the world's first peer-to peer ("P2P") lending

company, Zopa (www.zopa.com) launched Zopa Bank following a funding round in

2020. It was granted a full UK banking licence, allowing it to offer a wider

product range to its customers. After 17 years of delivering positive returns

for investors, Zopa closed the P2P lending side of its business in 2021 to fully

focus on Zopa Bank.

Current products include fixed term and smart savings, wedding and home

improvement loans, debt consolidation loans, a credit card and motor finance.

Zopa Bank is regulated by both the PRA and the FCA.

Zopa Bank is a multiple awards winner. It was awarded Banking Brand of the Year

in the 2022 MoneyNet Awards and won three Savings Champion Awards: Best New

Savings Provider, Best Fixed Rate Bond Provider and Best Short Term Fixed Rate

Bond Provider. These follow a string of previous awards, including being named

the British Bank Awards' Best Personal Loan Provider for the fifth year in a row

in 2021.

Augmentum participated in a £20 million funding round led by Silverstripe in

March 2021, in October 2021 participated with a further £10 million investment

in a £220 million round led by SoftBank, and in February 2023 invested a further

£4 million as part of a £75 million equity funding round alongside other

existing investors. In September 2023 Zopa Bank raised £75 million in Tier 2

Capital to support further scaling.

Source: Zopa Bank

30 Sept 31 March

2023 2023

£'000 £'000

Cost 33,670 33,670

Value 33,903 30,093

Valuation Methodology Rev. Multiple Rev. Multiple

% ownership (fully diluted) 3.4% 3.4%

As per last filed audited accounts of the investee company for the year to 31

December 2022:

2022 2021

£'000 £'000

Operating income 153,737 53,788

Pre tax loss (23,783) (48,312)

Net assets 299,674 264,307

Volt

Volt (www.volt.io) is a provider of account-to-account payments connectivity for

international merchants and payment service providers (PSPs). An application of

Open Banking, account-to-account payments - where funds are moved directly from

one bank account to another rather than via payment rails - delivering benefits

to both consumers and merchants. This helps merchants shorten their cash cycle,

increase conversion and lower their costs. Volt offers coverage in 25 markets

and counting, including UK, Europe, Brazil and Australia. In June 2023 Volt

announced their partnership with Worldpay, the world's number one global non

-bank merchant acquirer by volume processed, with more than 1 million merchant

customers across 146 markets. Starting with Australia, Worldpay merchants will

gain access to Volt's open payment infrastructure. In the same month Volt also

announced integration with Shopify, the leading global commerce company. Volt

will power a `pay-by-bank' option at checkout for merchants who use the Shopify

platform.

Augmentum invested £0.5 million in Volt in December 2020, £4 million in Volts

June 2021 US$23.5 million Series A funding round and £5.3 million in its US$60

million Series B funding round in June 2023.

Source: Volt

30 Sept 31 March

2023 2023

£'000 £'000

Cost 9,800 4,500

Value 23,739 14,216

Valuation Methodology CPORT CPORT

% ownership (fully diluted) 8.3% 8.3%

Volt is not required to publicly file audited accounts.

BullionVault

BullionVault (www.bullionvault.co.uk) is a physical gold and silver market for

private investors online. It enables people across 175 countries to buy and sell

professional-grade bullion at the very best prices online, with US$3.7 billion

of assets under administration, over US$100 million worth of gold and silver

traded monthly, and over 100,000 clients.

Each user's property is stored at an unbeaten low cost in secure, specialist

vaults in London, New York, Toronto, Singapore and Zurich. BullionVault's unique

daily audit then proves the full allocation of client property every day.

The company generates solid monthly profits from trading, commission and

interest. It is cash generative, dividend paying, and well-placed for any cracks

in the wider financial markets.

Source: BullionVault

30 Sept 31 March

2023 2023

£'000 £'000

Cost 8,424 8,424

Value 11,969 11,565

Valuation Methodology EBITDA Multiple EBITDA Multiple

% ownership (fully diluted) 10.8% 11.1%

Dividends paid - 564

As per last filed audited accounts of the investee company for the year to 31

October 2022:

2022 2021

£'000 £'000

Gross profit 13,071 12,086

Pre tax profit 8,364 7,741

Net assets 41,294 39,148

Monese

Monese (www.monese.com) offers consumers the ability to open a UK or European

current account with a fully digital process. Launched in 2015 Monese has more

than 2 million registered users. 70% of incoming funds are from salary payments,

with customers using Monese as their primary account. In May 2023, building on

strong platform infrastructure, Monese launched XYB, a banking-as-a-service

("BaaS") platform. XYB enables financial institutions to build digital products

using Monese's technology. Monese counts HSBC and Investec amongst its XYB

client base. The BaaS market shows strong growth as established banks and

fintech companies continue to bring innovative digital products to market.

Augmentum is invested alongside Kinnevik, PayPal, International Airlines Group,

Investec and HSBC Ventures.

Source: Monese

30 Sept 31 March

2023 2023

£'000 £'000

Cost 11,467 11,467

Value 10,095 11,683

Valuation Methodology Rev. Multiple CPORT

% ownership (fully diluted) 5.9% 6.0%

As per last filed audited accounts of the investee company for the year to 31

December 2021 (2022 accounts are expected to be filed shortly):

2021 2020

£'000 £'000

Turnover 17,573 16,285

Pre tax loss (17,529) (28,461)

Net liabilities (2,972) (15,410)

AnyFin

Anyfin (www.anyfin.com) was founded in 2017 by former executives of Klarna,

Spotify and iZettle, and leverages technology to allow creditworthy consumers

the opportunity to improve their financial wellbeing by consolidating and

refinancing existing credit agreements with improved interest rates, as well as

offering smart budgeting tools. Anyfin is currently available in Sweden,

Finland, Norway and Germany, with plans to expand across Europe as well as

strengthen its product suite in existing markets.

Augmentum invested £7.2 million in Anyfin in September 2021 as part of a US$52

million funding round and a further £2.7 million as part of a US$30 million

funding round in November 2022.

Source: AnyFin

30 Sept 31 March

2023 2023

£'000 £'000

Cost 9,924 9,924

Value 9,705 9,305

Valuation Methodology Rev. Multiple Rev. Multiple

% ownership (fully diluted) 3.2% 3.2%

As an unquoted Swedish company, Anyfin is not required to publicly file audited

accounts.

Onfido

Onfido (www.onfido.com) is building the new identity standard for the internet.

Its AI-based technology assesses whether a user's government-issued ID is

genuine or fraudulent, and then compares it against their facial biometrics.

Using computer vision and a number of other AI technologies, Onfido can verify

against 4,500 different types of identity documents across 195 countries, using

techniques like "facial liveness" to see patterns invisible to the human eye.

Onfido was founded in 2012. It has offices in London, San Francisco, New York,

Lisbon, Paris, Amsterdam, New Delhi and Singapore and helps over 900 companies,

including industry leaders such as Revolut, bung and Bitstamp. These customers

are choosing Onfido over others because of its ability to scale, speed in on

-boarding new customers (15 seconds for flash verification), preventing fraud,

and its advanced biometric technology. In May 2023 Onfido announced the

acquisition of Airside Mobile Inc, the leader in private, digital identity

sharing technology whose customers include the world's largest airlines.

Augmentum invested £4 million in 2018 as part of a US$50 million funding round

and an additional £3.7 million in a convertible loan note in December 2019 as

part of a £4.7 million round. The latter converted into equity when Onfido

raised an additional £64.7 million in April 2020.

Source: Onfido

30 Sept 31 March

2023 2023

£'000 £'000

Cost 7,750 7,750

Value 9,705 10,242

Valuation Methodology Rev. Multiple Rev. Multiple

% ownership (fully diluted) 2.1% 2.1%

As per last filed audited accounts of the investee company for the year to 31

January 2023:

2023 2022

£'000 £'000

Turnover 102,099 94,513

Pre tax loss (70,190) (45,159)

Net (liabilities)/assets (9,372) 40,165

Intellis

Intellis, based in Switzerland, is an algorithmic powered quantitative hedge

fund operating in the FX space. Intellis' proprietary approach takes a

conviction based assessment towards trading in the FX markets, a position which

is uncorrelated to traditional news driven trading firms. They operate across a

range of trading venues with a regulated Investment Trust fund structure that

enables seamless onboarding of new Liquidity Partners.

Following an initial investment of ?1 million In 2019, Augmentum exercised its

option to invest a further ?1 million in March 2020 and a further ?1 million in

March 2021.

Source: Intellis

30 Sept 31 March

2023 2023

£'000 £'000

Cost 2,696 2,696

Value 8,877 8,412

Valuation Methodology P/E Multiple P/E Multiple

% ownership (fully diluted) 23.8% 23.8%

As an unquoted Swiss company, Intellis is not required to publicly file audited

accounts.

Iwoca

Founded in 2011, iwoca (www.iwoca.co.uk) uses award-winning technology to

disrupt small business lending across Europe. They offer short-term `flexi

-loans' of up to £500,000 to SMEs across the UK and Germany. iwoca leverages

online integrations with high-street banks, payment processors and sector

-specific providers to look at thousands of data points for each business. These

feed into a risk engine that enables the company to make a fair assessment of

any business - from a retailer to a restaurant, a factory to a farm - and

approve a credit facility within hours. In addition to its flexi-loans Iwoca

launched iwocaPay in June 2020, an innovative business-to-business (B2B) `buy

now pay later' product to provide flexible payment terms to buyers while giving

peace of mind to sellers. It also launched a revenue-based loan with eBay in

2022 where repayments are a percentage of a business's monthly sales. The

Company has lent over £2.5 billion in the UK and Germany since its launch across

more than 120,000 business loans.

Augmentum originally invested £7.5 million in Iwoca in 2018 and has since added

£0.35 million. Iwoca has raised over £850 million in debt commitments from

partners including Barclays, Pollen Street Capital and Värde.

Source: Iwoca

30 Sept 31 March

2023 2023

£'000 £'000

Cost 7,852 7,852

Value 7,885 7,882

Valuation Methodology Rev. Multiple* Rev. Multiple

% ownership (fully diluted) 2.4% 2.4%

As per last filed audited accounts of the investee company for the year to 31

December 2022:

2022 2021

£'000 £'000

Turnover 78,260 68,468

Pre tax loss (10,980) (4,119)

Net assets 32,956 40,579

.

Farewill

In the next 10 years, £1 trillion of inheritance will pass between generations

in the UK. Farewill (www.farewill.com) is a digital, all-in-one financial and

legal services platform for dealing with death and after-death services,

including wills, probate and cremation. In 2022 Farewill won National Will

Writing Firm of the Year for the fourth year in a row and in 2021 was Probate

Provider of the Year for the second consecutive year at the British Wills and

Probate Awards. Farewill also won Best Funeral Information Provider and Low-cost

Funeral Provider of the Year at the Good Funeral Awards 2021. The organisation

has also been voted the UK's best-rated death experts on Trustpilot, scoring an

average customer approval rating of 4.9/5 from over 14,000 reviews. It is now

the largest will writer in the UK.

Since its launch in 2015 Farewill's customers have pledged over £800 million to

charities through their wills.

Augmentum led Farewill's £7.5 million Series A fundraise in January 2019, with a

£4 million investment, participated in its £20 million Series B, led by Highland

Europe in July 2020, with £2.6 million, and in its further £4.8 million

fundraise in March 2023, with £0.8 million.

Gemini

Gemini (www.gemini.com) enables individuals and institutions to safely and

securely buy, sell and store cryptocurrencies. Gemini was founded in 2014 by

Cameron and Tyler Winklevoss and has been built with a security and regulation

first approach. Gemini operates as a New York trust company regulated by the New

York State Department of Financial Services (NYSDFS) and was the first

cryptocurrency exchange and custodian to secure SOC 1 Type 2 and SOC 2 Type 2

certification. Gemini entered the UK market in 2020 with an FCA Electronic Money

Institution licence and is one of only ten companies to have achieved FCA

Cryptoasset Firm Registration.

Gemini announced acquisitions of portfolio management services company BITRIA

and trading platform Omniex in January 2022. During 2023 Gemini has been

expanding into the UAE and Asia.

Augmentum participated in Gemini's first ever funding round in November 2021

with an investment of £10.2 million.

Tesseract

Tesseract (www.tesseractinvestment.com) is a forerunner in the dynamic digital

asset sector, providing digital lending solutions to market makers and other

institutional market participants via regulated custody and exchange platforms.

Tesseract was founded in 2017, is regulated by the Finnish Financial Supervisory

Authority ("FIN-FSA"), and was one of the first companies in the EU to obtain a

5AMLD (Fifth Anti-Money Laundering Directive) virtual asset service provider

("VASP") licence. It is the only VASP with an express authorisation from the FIN

-FSA to deploy client assets into decentralized finance or "DeFi".

Tesseract provides an enabling crypto infrastructure to connect digital asset

lenders with digital asset borrowers. This brings enhanced capital efficiency

with commensurate cost reduction to trading, in a space that is currently

significantly under-leveraged relative to traditional capital markets.

Augmentum led Tesseract's Series A funding round in June 2021 with an investment

of £7.3 million.

Kipp

platform that transforms the traditional payment model to increase credit card

transaction approvals, revenue, and customer satisfaction. Its core solution

relies heavily on data enrichment and risk management to help merchants and

banks split the cost of risk to incentivize issuing banks to approve more

transactions.

Augmentum invested £4 million in May 2022.

baobab

Berlin based Baobab (www.baobab.io) is a pioneer in the provision of European

cyber insurance for SMEs. With capacity provision from Zurich, Baobab uses a

novel approach to underwriting, pricing and risk mitigation, and works with

leading SME cyber security providers to prevent breaches for its insured

customers.

Augmentum invested £2.6 million in January 2023.

ParaFi Capital

ParaFi Capital (www.parafi.com) is an investor in decentralised finance

protocols that address tangible use cases of the technology and demonstrate

signs of product-market fit. ParaFi investment has drawn on their domain

expertise developed in both traditional finance and crypto to identify and

invest in leading protocols such as Compound (lending and interest accrual),

Aave (asset borrowing), Uniswap (automated liquidity provision), Synthetix

(synthetic asset trading) and MakerDAO (stablecoins). ParaFi also supports its

protocols as a liquidity provider and governance participant.

Augmentum invested £2.8 million in ParaFi in January 2021. Co-investors include

Bain Capital Ventures and Galaxy Digital.

WeMatch

Wematch (www.wematch.live) is a capital markets trading platform that helps

financial institutions transition liquidity to an orderly electronic service,

improving productivity and de-risking the process of voice broking. Their

solution helps traders find liquidity, negotiate, trade, optimise and manage the

lifecycle of their portfolios of assets and trade structures. Wematch is focused

on structured products such as securities financing, OTC equity derivatives and

OTC cleared interest rates derivatives.

Created in 2017, Wematch is headquartered in Tel Aviv and has offices in London

and Paris. In March 2023 it announced a collaboration with MTS Markets, owned by

Euronext, creating MTS Swaps by Wematch.live, which aims to bridge the gap

between legacy voice trading and pure electronic trading in the interdealer IRS

market. In August 2023 Wematch passed a milestone of US$200 billion in ongoing

notional value of trades on their platform and also reached an average daily

matched volume (ADMV) of US$11 billion in Europe, the Middle East, and Africa.

Augmentum invested £3.7 million in September 2021.

Wayhome

Wayhome (www.wayhome.co.uk) offers a unique part-own part-rent model of home

ownership, requiring as little as 5% deposit with customers paying a market rent

on the portion of the home that Wayhome owns, with the ability to increase the

equity in the property as their financial circumstances allow. It launched to

the public in September 2021, following closure of the initial phase of a £500

million pension fund investment and has crossed the milestone of completing the

purchase of its first 100 homes.

Wayhome opens up owner-occupied residential property as an asset class for

pension funds, who will earn inflation-linked rent on the portion not owned by

the occupier.

Augmentum invested £2.5 million in 2019, £1 million in 2021 and a further £0.9

million in the Company's financial year to 31 March 2023.

Habito

Habito (www.habito.com) is transforming the United Kingdom's £1.3 trillion

mortgage market by taking the stress, arduous paperwork, hidden costs and

confusing process out of financing a home.

Since launching in April 2016, Habito had brokered £7 billion of mortgages by

July 2021. Habito launched its own buy-to-let mortgages in July 2019 and in

March 2021 launched a 40-year fixed-rate mortgage `Habito One', the UK's longest

-ever fixed rate mortgage.

In August 2019, Augmentum led Habito's £35 million Series C funding round with a

£5 million investment and added £1.3 million in the Company's financial year

ended 31 March 2023.

Previse

Previse (www.previ.se) allows suppliers to be paid instantly. Previse's

artificial intelligence ("AI") analyses the data from the invoices that sellers

send to their large corporate customers. Predictive analytics identify the few

problematic invoices, enabling the rest to be paid instantly. Previse charges

the suppliers a small fee for the convenience, and shares the profit with the

corporate buyer and the funder. Previse precisely quantifies dilution risk so

that funders can underwrite preapproval payables at scale. In January 2022

Mastercard unveiled that its next-generation virtual card solution for instant

B2B payments would use Previse's machine learning capabilities. The solution

combines Previse's machine learning, with Mastercard's core commercial solutions

and global payment network, to transform how businesses send and receive

payments.

Augmentum invested £250,000 in a convertible loan note in August 2019. This

converted into equity as part of the company's US$11 million funding round in

March 2020, alongside Reefknot Investments and Mastercard, as well as existing

investors Bessemer Venture Partners and Hambro Perks. Previse was awarded a £2.5

million Banking Competition Remedies' Capability and Innovation Fund grant in

August 2020. In May 2022 Previse closed the first phase of its series B

financing round, which was led by Tencent, with US$18 million raised, including

£2 million from Augmentum.

FullCircl

FullCircl (www.fullcircl.com) was formed from the combination of Artesian and

Duedil. Artesian was founded with a goal to change the way B2B sellers

communicate with their customers. They built a powerful sales intelligence

service using the latest in Artificial Intelligence and Natural Language

Processing to automate many of the time consuming, repetitive tasks that cause

the most pain for commercial people.

In August 2023 FullCircl announced the acquisition of W2 Global Data Solutions,

a provider of real-time digital solutions for global regulatory compliance. The

acquisition strengthens FullCircl's compliance suite and accelerates the

company's ambition to become the market leader in smart customer onboarding

solutions for regulated businesses. The combined company now provides coverage

on entities located in 160 countries.

Augmentum originally invested in DueDil, which merged with Artesian in July

2021. Combining DueDil's Business Information Graph (B.I.G.)T and Premium APIs,

and Artesian's powerful web application and advanced rules engine delivers an

easy to deploy solution for banks, insurers and FinTechs to engage, onboard and

grow the right business customers.

Epsor

Epsor (www.epsor.fr) is a Paris based provider of employee and retirement

savings plans delivered through an open ecosystem, giving access to a broad

range of asset management products accessible through its intuitive digital

platform. Epsor serves more than 850 companies in France.

Augmentum invested £2.2 million in Epsor in June 2021.

Sfermion

Sfermion (www.sfermion.io) is an investment fund focused on the non-fungible

token (NFT) ecosystem. Their goal is to accelerate the emergence of the open

metaverse by investing in the founders, companies, and entities creating the

infrastructure and environments forming the foundations of our digital future.

Augmentum committed US$3 million in October 2021, to be drawn down in tranches.

WhiskyInvestDirect

Founded in 2015, WhiskyInvestDirect (www.whiskyinvestdirect.com), was a

subsidiary of BullionVault and is the online market for buying and selling

Scotch whisky as it matures in barrel. This is an asset class that has a long

track record of growth, yet has previously been opaque and inaccessible.

The business seeks to change the way some of the three billion litres of

maturing Scottish whisky is owned, stored and financed, giving self-directed

investors an opportunity to profit from whisky ownership, with the ability to

trade 24/7. At its October 2022 financial year end the company's clients held 12

million LPA (Litres of Pure Alcohol) of spirit. Augmentum's holding derives from

WhiskeyInvestDirect being spun out of BullionVault in 2020.

.

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2023

Six Six months

months ended

ended 30

30 September

September 2022

2023

Notes Revenue Capital Total Revenue Capital Total

return return £'000 return£'000 return £'000

£'000 £'000 £'000

Gains on - 2,952 2,952 - 1,497 1,497

investments

held

at fair

value

Investment 702 - 702 38 - 38

income

AIFM and 2 (292) - (292) (301) - (301)

Performance

Fees

Other (2,453) (16) (2,469) (2,256) (21) (2,277)

expenses

(Loss)/return (2,043) 2,936 893 (2,519) 1,476 (1,043)

before

taxation

Taxation - - - - - -

(Loss)/return (2,043) 2,936 893 (2,519) 1,476 (1,043)

attributable

to

equity

shareholders

of

the parent

company

(Loss)/return 3 (1.2) 1.7 0.5 (1.4) 0.8 (0.6)

per share

(pence)

The total column of this statement represents the Group's Consolidated Income

Statement, prepared in accordance with IFRS as adopted by the UK.

The revenue return and capital return columns are supplementary to this and are

prepared under guidance published by the Association of Investment Companies.

The Group does not have any other comprehensive income and hence the total

return, as disclosed above, is the same as the Group's total comprehensive

income.

All items in the above statement derive from continuing operations.

All returns are attributable to the equity holders of Augmentum Fintech plc, the

parent company. There are no non-controlling interests.

.

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 September 2023

Six months ended 30 September 2023

Group Ordinary Share Special Other Revenue Total

share premium reserve capital reserve £'000

capital account £'000 reserve £'000

£'000 £'000 £'000

Opening 1,810 105,383 85,218 117,740 (16,027) 294,124

shareholders'

funds

Purchase of own - - (3,888) - - (3,888)

shares into

treasury

Return/(loss) for - - - 2,936 (2,043) 893

the period

At 30 September 1,810 105,383 81,330 120,676 (18,070) 291,129

2023

Six months ended 30 September 2022

Group Ordinary Share Special Other Revenue Total

share premium reserve capital reserve £'000

capital account £'000 reserve £'000

£'000 £'000 £'000

Opening 1,810 105,383 91,191 107,989 (11,169) 295,204

shareholders'

funds

Purchase of own - - (2,036) - - (2,036)

shares into

treasury

Return/(loss) for - - - 1,476 (2,519) (1,043)

the period

At 30 September 1,810 105,383 89,155 109,465 (13,688) 292,125

2022

.

Condensed Consolidated and Company Statement of Financial Position

as at 30 September 2023

Note 30 September 31 March

2023 2023

£'000 £'000

Non current assets

Investments held at fair value 7 241,336 254,295

Property, plant & equipment 262 297

Current assets

Right of use asset 513 588

Other receivables 131 555

Cash and cash equivalents 51,772 40,015

Total assets 294,014 295,750

Current liabilities

Other payables (2,307) (948)

Lease liability (578) (678)

Total assets less current liabilities 291,129 294,124

Net assets 291,129 294,124

Capital and reserves

Called up share capital 4 1,810 1,810

Share premium account 4 105,383 105,383

Special reserve 81,330 85,218

Retained earnings:

Capital reserves 120,676 117,740

Revenue reserve (18,070) (16,027)

Total equity 291,129 294,124

NAV per share (pence) 5 170.7 168.5

NAV per share after performance fee (pence) 5 160.2 158.9

.

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2023

Six months Six months

ended ended

30 September 30 September

2023 2022

£'000 £'000

Cash flows from operating

activities

Purchases of investments (5,511) (11,994)

Sales of investments 22,790 44,226

Acquisition of property, (4) (355)

plant and equipment

Interest received 680 29

Operating expenses paid (1,769) (1,846)

Net cash outflow from 16,186 30,060

operating activities

Cash flow from financing

activities

Purchase of own shares into (4,429) (2,036)

Treasury

Net cash (outflow) from (4,429) (2,036)

financing

Increase in cash and cash 11,757 28,024

equivalents

Cash and cash equivalents at 40,015 31,326

the beginning of the period

Cash and cash equivalents at 51,772 59,350

the end of the period

.

Notes to the Financial Statements

For the six months ended 30 September 2023

1.a General information

Augmentum Fintech plc is a company limited by shares, incorporated and domiciled

in the UK. Its registered office is 25 Southampton Buildings, London WC2A 1AL,