RNS Number : 3617V

Avon Rubber PLC

28 May 2008

Avon Rubber p.l.c.

Strictly embargoed until 07:00 28 May 2008

Unaudited interim results for the six months ended 31 March 2008

31 March 2008 31 March 2007

(restated)

£Millions

£Millions

CONTINUING OPERATIONS

REVENUE 23.4 31.2

OPERATING (LOSS)/PROFIT (1.9) 0.5

(LOSS)/PROFIT FOR THE PERIOD (5.9) 0.1

(LOSS)/EARNINGS PER SHARE:

Basic (20.7)p (0.5)p

Continuing operations (6.1)p 3.6p

* US$112 million US Government multi-year respirator contract confirmed

* Continued demand from UK MoD for current generation respirators

* Demand for the new C50, FM53 and ST53 respirators and EH15 emergency hood is growing in markets around the world

* Dairy business performed well

* Aerosol gasket business sold

* European mixing facility to close

Commenting on the results, Peter Slabbert, Chief Executive said: "The award of the $112 million, multi-year contract by the US

Government should underpin the Group's return to profitability in the short-term and secure a long-term and growing revenue stream for our

Protection business. Our immediate priority is on increasing our profits through manufacturing efficiencies and cost reductions and

converting significant opportunities for sales of our market leading range of respiratory protection products around the world.

The first half year has seen an improved performance from our already successful Dairy business and we expect this to be maintained. We

further expect to secure long-term contracts for our Engineered Fabrications business which will provide benefits in 2009.

The Board is confident that the foundations are in place for a period of sustainable and profitable growth."

For further enquiries, please contact:

Avon Rubber p.l.c.

Peter Slabbert, Chief Executive 020 7067 0700

(until 1.00pm)

From 29 May: 01225 896 831

Fiona Stewart, Corporate Communications Executive 01225 896 871

Weber Shandwick Financial

Richard Hews 020 7067 0700

Rachel Martin

Hannah Marwood

An analyst meeting will be held at 09:45 for 10:00 am this morning at the offices of

Weber Shandwick Financial, Fox Court, 14 Gray's Inn Road, London, WC1X 8WS

NOTES TO EDITORS: Avon Rubber p.l.c. is an international polymer engineering group adding value through material, manufacturing and

industry sector expertise. The Group is currently capitalised at approximately £34 million. Avon supplies a range of advanced CBRN

respiratory protection solutions through Avon Protection Systems Inc. to the world's military and police forces, as well as first responders

and emergency services. Avon Rubber p.l.c. owns Avon-ISI, which designs, develops and manufactures a range of SCBA equipment for fire,

rescue and law enforcement, as well as military applications. Avon Rubber p.l.c. also owns Avon Engineered Fabrications manufacturing

products including hovercraft skirting and flexible storage tanks and a world leading dairy business manufacturing dairy liners and tubing.

Interim statement

INTRODUCTION

The delayed award by the US Government of the $112 million production contract for the M50 respirator announced on 19 May was welcome

news for the Group. In the period to 31 March 2008, our Dairy business performed well, but in our Protection & Defence business, the delay

in the M50 full rate production order and production difficulties in producing filters at the new Cadillac facility, contributed to a

disappointing overall operating loss of £1.9m (2007: £0.5m profit). We have completed the lengthy strategic refocusing of our business to

two sectors, Protection & Defence and Dairy with the sale of our aerosol gasket business announced in February and the decision to close our

European mixing plant which was announced in January.

RESULTS

Revenue from continuing operations fell in the half year to £23.4m (2007: £31.2m) despite increased revenues from the Dairy business.

We incurred an operating loss of £1.9m (2007: £0.5m profit) on these revenues. Net interest was unchanged at £0.4m and the non cash

finance credit on our net retirement benefit surplus reduced to £0.6m (2007: £1.3m) due to changed actuarial assumptions. This resulted in

a loss before tax of £1.8m (2007: £1.3m profit) and after a tax credit of £0.1m (2007: £nil) the Group incurred a loss for the period

from continuing operations of £1.7m (2007: £1.3m profit).

A loss of £4.2m (2007: £1.2m) was incurred on discontinued operations, including £0.6m attributable to the loss on disposal of the

aerosol gasket business and £2.6m to the closure of the mixing plant. The Group loss for the period was £5.9m (2007: £0.1m profit). The

basic loss per share was 20.7p (2007: 0.5p) and the loss per share from continuing operations was 6.1p (2007: 3.6p earnings per share).

Net debt increased from £10.4m at the 2007 year end to £13.5m at 31 March 2008. Inventories in particular increased during the period

as we manufactured product and bought raw materials in anticipation of increased revenues in the second half of the year. Operating

activities absorbed £2.3m (2007: £4.2m) resulting from the loss incurred and working capital which increased by £0.9 million in the

continuing operations. The net proceeds from the sale of the aerosol gasket business of £1.6m and further asset sales generated net cash

from investing activities of £0.7m (2007: cash outflow of £3.4m) after capital expenditure of £1.3m (2007: £3.4m). This reduced level of

capital expenditure follows the high spend in the past few years on both the development of new products and the Cadillac facility.

PROTECTION & DEFENCE

The delay in the award of the M50 long-term production contract initially anticipated in the early part of this calendar year had a

significant negative impact on the new Cadillac facility. The growth of this business, however, is now underpinned by this order for 100,000

respirators per year, which we expect will be supplemented by a further contract option allowing for potential additional volumes of 200,000

per annum for a period of up to 10 years. We expect these mask systems orders to be supplemented by significant filter and spares orders.

Difficulties with producing filters supplied with M50 respirators on the low rate initial production order contributed to cost overruns

in the new Cadillac facility which delayed delivery of complete systems to the customer. Good progress has been made on resolving these

production problems and the balance of this order will now be shipped in the early part of the second half of the year. While we are

currently production capable, we have to invest heavily - at short term cost - in order to ensure consistency and quality of output which

will benefit us over the 10 to 15 year production life of this new product range.

The performance of the Avon Engineered Fabrications business in Mississippi was affected by delays to new long-term contracts due to

factors outside our control. These orders are still expected although the timing is uncertain.

At Avon-ISI, which supplies self contained breathing apparatus (SCBA), the new US National Fire Protection Association approved Z Seven

SCBA has been well received by the market. Following the delayed approval in October and a period of sample production and evaluation, we

have experienced a significant level of enquiries and orders towards the end of the financial half year. Our UK Protection business

benefited from continuing demand from the UK MoD and performed satisfactorily. Their focus includes selling our full range of respiratory

protection products to markets around the world and the level of enquiry and opportunity indicates high potential demand for our new C50,

FM53 and ST53 respirators and EH15 emergency hood.

Total revenues for the division were £12.2m (2007: £19.3m) incurring an operating loss of £3.4m (2007: £0.8m). In preparation for

future volume growth our current cost base is significantly underutilised and the contribution from incremental revenues will therefore

directly impact future operating profits.

DAIRY

The healthy profit and cashflows from our Dairy business continue to underpin the Group's performance. Revenues increased by 12.1% to

£10.8m (2007: £9.7m) with improvement in both the US and European businesses. Higher milk prices and growth in sales of our own branded

products, particularly into new markets such as China, were both positive factors. Despite higher input costs driven in particular by the

oil price, we saw some benefit from lower overhead costs in our UK production facility resulting in a higher operating profit of £1.8m

(2007: £1.3m).

DIVIDENDS

In view of the below expectation first half year results together with the Group's short-term working capital funding requirement as we

build up to full production volumes on the US Government contract, the Board feels it is prudent not to pay an interim dividend for this

year. It is our intention to resume dividend payments as soon as the trading results and liquidity position allow us to do so.

BOARD AND MANAGEMENT CHANGES

Terry Stead stood down as Chief Executive on 21 April 2008 and has been succeeded by Peter Slabbert, previously Group Finance Director

and acting head of rest of world sales for the Protection business. A new Finance Director will be appointed in due course and we are also

taking steps to strengthen the sales and marketing function. This, together with the appointment of David Evans as a Non-Executive Director,

means that the Group's restructuring is largely complete and we now have an excellent team experienced in the high value added Protection &

Defence and Dairy businesses who are closely focused on delivering the benefits from the substantial opportunities in these markets.

OUTLOOK

The award of the $112 million, multi-year contract by the US Government should underpin the Group's return to profitability in the

short-term and secure a long-term and growing revenue stream for our Protection business. Our immediate priority is on increasing our

profits through manufacturing efficiencies and cost reductions and converting significant opportunities for sales of our market leading

range of respiratory protection products around the world.

The first half year has seen an improved performance from our already successful Dairy business and we expect this to be maintained. We

further expect to secure long-term contracts for our Engineered Fabrications business which will provide benefits in 2009.

The Board is confident that the foundations are in place for a period of sustainable and profitable growth.

Statement of Directors' responsibilities

The Interim Report and Accounts is the responsibility of, and has been approved by, the Directors. The Directors are responsible for

preparing the Interim Report and Accounts in accordance with the Disclosure and Transparency Rules of the United Kingdom's Financial

Services Authority. The Disclosure and Transparency Rules ('DTR') require that the accounting policies and presentation applied to the

half-yearly figures must be consistent with those applied in the latest published annual accounts, except where the accounting policies and

presentation are to be changed in the subsequent annual accounts, in which case the new accounting policies and presentation should be

followed, and the changes and the reasons for the changes should be disclosed in the Interim Report and Accounts, unless the United Kingdom

Financial Services Authority agrees otherwise.

The Directors confirm that this condensed set of financial statements has been prepared in accordance with the International Accounting

Standard 34, 'Interim Financial Reporting' as adopted by the European Union, and that the interim management report herein includes a fair

review of the information required by DTR4.2.7 and DTR 4.2.8.

Miles Ingrey-Counter

Company Secretary

Independent review report to Avon Rubber p.l.c.

Introduction

We have been engaged by the company to review the condensed set of financial statements in the half-yearly financial report for the six

months ended 31 March 2008, which comprises the consolidated income statement, consolidated balance sheet, consolidated statement of

recognised income and expense, consolidated cash flow statement and related notes. We have read the other information contained in the

half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the information

in the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved by, the directors. The directors are responsible for

preparing the half-yearly financial report in accordance with the Disclosure and Transparency Rules of the United Kingdom's Financial

Services Authority.

As disclosed in note 1, the annual financial statements of the group are prepared in accordance with IFRSs as adopted by the European

Union. The condensed set of financial statements included in this half-yearly financial report has been prepared in accordance with

International Accounting Standard 34, "Interim Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the half-yearly financial

report based on our review. This report, including the conclusion, has been prepared for and only for the company for the purpose of the

Disclosure and Transparency Rules of the Financial Services Authority and for no other purpose. We do not, in producing this report, accept

or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save

where expressly agreed by our prior consent in writing.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the Entity' issued by the Auditing Practices Board for use in the United

Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the

half-yearly financial report for the six months ended 31 March 2008 is not prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European Union and the Disclosure and Transparency Rules of the United Kingdom's

Financial Services Authority.

PricewaterhouseCoopers LLP

Chartered Accountants

Bristol 28 May 2008

Consolidated Income Statement

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(unaudited) (unaudited (unaudited and

Note and restated)

restated) £'000

£'000 £'000

Continuing operations

Revenue 3 23,385 31,191 60,287

Cost of sales (19,808) (24,652) (46,994)

Gross profit 3,577 6,539 13,293

Operating expenses (5,526) (6,081) (11,457)

Operating (loss)/profit from 3,4 (1,949) 458 1,836

continuing operations

Finance income 5 3 - 114

Finance costs 5 (451) (417) (915)

Other finance income 5 566 1,251 2,489

(Loss)/profit before tax (1,831) 1,292 3,524

Taxation 6 109 17 (717)

(Loss)/profit for the period (1,722) 1,309 2,807

from continuing operations

Discontinued operations

Loss for the period from 7 (4,166) (1,171) (1,712)

discontinued operations

(Loss)/profit for the period (5,888) 138 1,095

Profit attributable to 5 273 1

minority interest

(Loss)/profit attributable to (5,893) (135) 1,094

equity shareholders

(5,888) 138 1,095

(Loss)/earnings per share 9

expressed in pence per share

Basic (20.7) (0.5) 3.9

Diluted (20.7) (0.5) 3.8

(Loss)/earnings per share from

continuing operations

Basic (6.1) 3.6 10.1

Diluted (6.1) 3.5 9.8

Consolidated Statement of Recognised Income and Expense

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(unaudited) (unaudited) (unaudited)

£'000 £'000 £'000

(Loss)/profit for the financial period (5,888) 138 1,095

Actuarial gain recognised in 9,323 5,527 26,187

retirement benefit schemes

Movement on deferred tax relating to (2,611) - (4,606)

retirement benefit schemes

Net exchange differences offset in 583 (1,610) (2,441)

reserves

Net gains not recognised in income 7,295 3,917 19,140

statement

Total recognised income for the period 1,407 4,055 20,235

Attributable to:

Equity shareholders 1,402 3,782 20,234

Minority interest 5 273 1

Total recognised income for the period 1,407 4,055 20,235

Consolidated Balance Sheet

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(unaudited) (unaudited) (unaudited)

Note £'000 £'000 £'000

Assets

Non-current assets

Goodwill 5,705 5,294 5,511

Intangible assets 11,317 12,086 11,794

Property, plant and equipment 18,700 21,247 20,041

Deferred tax assets 334 1,053 334

Retirement benefit assets 26,300 - 16,380

62,356 39,680 54,060

Current assets

Inventories 14,346 12,929 11,526

Trade and other receivables 10,518 16,889 12,773

Cash and cash equivalents 710 1,876 957

25,574 31,694 25,256

Assets classified as held for - - 2,173

sale

25,574 31,694 27,429

Liabilities

Current liabilities

Financial liabilities

- Borrowings 14,245 11,906 11,393

- Derivative financial - 15 -

instruments

Trade and other payables 15,364 19,011 13,906

Deferred tax liabilities 265 - 265

Current tax liabilities 350 621 744

30,224 31,553 26,308

Liabilities directly associated

with assets classified as held - - 1,707

for sale

30,224 31,553 28,015

Net current (liabilities)/assets (4,650) 141 (586)

Non-current liabilities

Deferred tax liabilities 8,862 2,260 6,251

Retirement benefit obligations 656 7,712 1,730

Provision for liabilities and 10 4,600 2,880 2,037

charges

14,118 12,852 10,018

Net assets 43,588 26,969 43,456

Shareholders' equity

Ordinary shares 11 29,141 28,340 29,125

Share premium 34,708 34,212 34,707

Capital redemption reserve 500 500 500

Translation reserve (2,061) (1,814) (2,644)

Profit and loss account (19,262) (35,059) (18,789)

Equity shareholders' funds 12 43,026 26,179 42,899

Minority interests (equity 562 790 557

interests)

Total equity 43,588 26,969 43,456

Consolidated Cash Flow Statement

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(unaudited) (unaudited) (unaudited)

Note £'000 £'000 £'000

Cash flows from operating

activities

Cash used in operations 13 (1,735) (3,762) (1,894)

Finance income received 3 - 114

Finance costs paid (483) (258) (896)

Tax paid (93) (178) (438)

Net cash used in operating (2,308) (4,198) (3,114)

activities

Cash flows from investing

activities

Proceeds from sale of 7 1,571 - -

operations

Proceeds from sale of 413 3 14

property, plant and equipment

Purchase of property, plant (908) (2,032) (2,874)

and equipment

Purchase of intangible assets (367) (1,408) (2,445)

Net cash generated from/(used 709 (3,437) (5,305)

in) investing activities

Cash flows from financing

activities

Net proceeds from issue of 17 86 1,441

ordinary share capital

Net movements in loans 5,037 3,921 (2,488)

Dividends paid to shareholders (1,367) (1,326) (2,353)

Net cash generated from/(used 3,687 2,681 (3,400)

in) financing activities

Net increase/(decrease) in 2,088 (4,954) (11,819)

cash and cash equivalents

Cash and cash equivalents at (5,037) 6,893 6,893

beginning of the period

Effects of exchange rate (20) (63) (111)

changes

Cash and cash equivalents at 14 (2,969) 1,876 (5,037)

end of the period

Notes to the Interim Financial Statements

1. Basis of preparation

This condensed consolidated half-yearly financial information for the half-year ended 31 March 2008 has been prepared in accordance with

the Disclosures and Transparency rules of the Financial Services Authority and with IAS 34, 'Interim financial reporting' as adopted by the

European Union. The half-yearly condensed consolidated financial report should be read in conjunction with the annual financial statements

for the year ended 30 September 2008, which have been prepared in accordance with IFRS as adopted by the European Union.

These financial statements were approved by the Board of Directors on 27 May 2008.

2. Accounting policies

The accounting policies adopted are consistent with those of the annual financial statements for the year ended 30 September 2007, as

described in those financial statements.

Recent accounting developments

The following standards, amendments and interpretations have been issued by the International Accounting Standards Board or by the IFRIC

but have not yet been adopted. Subject to endorsement by the European Union, these will be adopted in future periods. IFRS 8 has been

endorsed, and the other standards, amendments and interpretations are being considered for endorsement.

* IFRS 8 'Operating segments'

* IAS 23 'Borrowing costs' (revised)

* IFRIC 12 'Service concession arrangements'

* IFRIC 13 'Customer loyalty programmes'

* IAS 27 'Consolidated and separate financial statements' (revised)

* IFRS 3 'Business combinations' (revised)

3. Segmental analysis

Due to the differing natures of the products and their markets, Avon Rubber p.l.c.'s primary reporting segment is by business sector.

The secondary reporting format comprises the geographical segments by origin.

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(unaudited) (unaudited and restated) (unaudited and restated)

£'000 £'000

£'000

Revenue by business sector

Protection and Defence 12,243 19,327 37,838

Dairy 10,842 9,670 19,071

Other Engineered Products 300 2,194 3,378

23,385 31,191 60,287

Operating profit by business

sector

Protection and Defence (3,406) (794) (1,037)

Dairy 1,799 1,281 2,975

Other Engineered Products (342) (29) (102)

(1,949) 458 1,836

Revenue by origin

Europe 5,890 8,659 16,923

North America 17,495 22,532 43,364

23,385 31,191 60,287

4. Operating profit

The following items of unusual nature have been credited to operating profit.

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited) (Unaudited)

£'000 £'000 £'000

Settlement of legal claims 376 - -

Cancellation of USA post retirement 505 - -

medical scheme

A scheme which provided post retirement medical benefits to certain former employees of previously disposed businesses has now been

terminated.

5. Interest and similar charges

Half year to Half Year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited) (Unaudited)

£'000 £'000 £'000

Bank loans and overdrafts (451) (416) (914)

Other interest charges - (1) (1)

Total interest payable (451) (417) (915)

Interest receivable 3 - 114

(448) (417) (801)

Other finance income represents the excess of the expected return on pension plan assets over the interest cost relating to retirement

benefit obligations.

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited) (Unaudited)

£'000 £'000 £'000

Interest cost: UK Scheme (6,799) (6,432) (12,863)

Expected return on plan assets: UK 7,446 7,752 15,479

Scheme

Other finance cost: USA Scheme (81) (69) (127)

566 1,251 2,489

6. Taxation

The split of the tax (credit)/charge between UK and overseas is as follows:

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited) (Unaudited)

£'000 £'000 £'000

United Kingdom 167 - 88

Overseas (276) (17) 629

(109) (17) 717

7. Results from discontinued operations

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited and (Unaudited and restated)

restated) £'000

£'000

£'000

Revenue 5,754 6,558 13,434

Operating loss from (3,612) (1,171) (1,712)

discontinued operations

Operating loss is analysed as:

Before exceptional items (1,021) (1,171) (1,712)

Exceptional operating items (2,591) - -

Loss on disposal (554) - -

Loss for the period from (4,166) (1,171) (1,712)

discontinued operations

Discontinued operations consist of the UK mixing operation, which the company has announced is being closed during the financial year

and the UK aerosol gasket operation which was sold on 4 March 2008 to Crosslinks Limited.

2007 numbers have been restated to include the revenues and losses of these businesses.

Assets and liabilities directly attributable to the UK mixing operation, shown on the September 2007 balance sheet as held for sale have

now been reclassified as the operation will now be closed.

The loss on disposal resulting from the sale of the aerosol gasket operation has been calculated as follows:

£'000 £'000

Proceeds from sale 2,091

Costs associated with sale (179)

1,912

Assets and liabilities disposed of:

Property, plant and equipment (1,074)

Intangible assets (251)

Inventory (476)

Trade and other receivables (1,027)

Trade and other payables 362

(2,466)

Loss on disposal (554)

£1,750,000 was received on completion of the sale on 4 March 2008, £341,000 deferred consideration is included in trade and other

receivables in the interim balance sheet.

8. Dividends

The Directors are proposing that no interim dividend will be paid in respect of the half year ending 31 March 2008.

9. Loss per share

Basic loss per share is based on a loss attributable to ordinary shareholders of £5,893,000 (2007: £135,000) and 28,472,000 (2007:

27,637,000) ordinary shares being the weighted average of the shares in issue during the period on which dividends are paid.

Loss per share from continuing operations is based on a loss attributable to ordinary shareholders of £1,727,000 (2007: 1,036,000

profit).

Loss per share from discontinued operations amounts to 14.6p (2007: 4.1p) and is based on a loss of £4,166,000 (2007: £1,171,000).

The company has dilutive potential ordinary shares in respect of the Sharesave Option Scheme and the Performance Share Plan. The diluted

loss per share is not materially different to the basic loss per share.

10. Provisions for liabilities and charges

Reorganisation provision Automotive disposal £'000 Total

£'000 £'000

Opening balance 1 October 2006 1,526 1,900 3,426

Payments in the period (546) - (546)

At 31 March 2007 980 1,900 2,880

Opening balance 1 October 2007 737 1,300 2,037

Charged to income statement 2,591 - 2,591

(Payments)/receipts in the (480) 452 (28)

period

At 31 March 2008 2,848 1,752 4,600

11. Share capital

Number of shares Ordinary shares Share premium £'000

(thousands) £'000 Total

£'000

Opening balance 1 October 2006 28,275 28,275 34,191 62,466

Proceeds from shares issued 64 64 21 85

pursuant to option schemes

At 31 March 2007 28,339 28,339 34,212 62,551

Opening balance 1 October 2007 29,125 29,125 34,707 63,832

Proceeds from shares issued 16 16 1 17

pursuant to option schemes

At 31 March 2008 29,141 29,141 34,708 63,849

12. Changes in equity

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited) (Unaudited)

£'000 £'000 £'000

At the beginning of the period 42,899 23,514 23,514

Loss for the period attributable to (5,893) (135) 1,094

equity shareholders

Dividends paid (1,367) (1,326) (2,353)

Actuarial gain recognised in 9,323 5,527 26,187

retirement benefit schemes

Movement on deferred tax relating to (2,611) - (4,606)

retirement benefit liabilities

Net exchange differences offset in 583 (1,610) (2,441)

reserves

New share capital subscribed 17 85 1,366

Movement in respect of employee 75 124 138

share schemes

At the end of the period 43,026 26,179 42,899

13. Cash generated from operations

Half year to Half year to Year to

31 Mar 08 31 Mar 07 30 Sep 07

(Unaudited) (Unaudited and (Unaudited and restated)

restated) £'000

£'000

£'000

Continuing operations

(Loss)/profit for the (1,722) 1,309 2,807

financial period

Adjustments for:

Tax (109) (17) 717

Depreciation 1,077 1,018 1,994

Impairment of fixed assets - - 250

Amortisation and impairment of 829 444 1,054

intangibles

Net interest expense 448 417 801

Other finance income (566) (1,251) (2,489)

Loss on disposal of property, 31 4 -

plant and equipment

Movements in working capital (918) (3,808) (5,663)

and provisions

Other movements (1,030) 16 (245)

Cash used in continuing (1,960) (1,868) (774)

operations

Discontinued operations

Loss for the financial period (4,166) (1,171) (1,712)

Adjustments for:

Depreciation 169 91 189

Loss on sale of discontinued 554 - -

operations

Movements in working capital 3,668 (814) 403

provisions

Cash generated from/(used in) 225 (1,894) (1,120)

discontinued operations

Cash used in operations (1,735) (3,762) (1,894)

14. Analysis of net debt

As at Exchange movements As at

30 Sep 07 Cash flow £'000 £'000 31 Mar 08

£'000 £'000

Cash at bank and in hand 791 (91) 10 710

Overdrafts (5,994) 2,347 (32) (3,679)

Current asset investments 166 (168) 2 -

classified as cash equivalents

Cash and cash equivalents (5,037) 2,088 (20) (2,969)

Debt due within 1 year (5,399) (5,037) (130) (10,566)

(10,436) (2,949) (150) (13,535)

Borrowing facilities

Total

facili Utilised Undrawn

ty

£'000 £'000 £'000

United Kingdom 16,450 14,177 2,273

North America 2,138 68 2,070

Utilised in respect of guarantees 377 377 -

18,965 14,622 4,343

All of the above facilities are subject to annual review, periodic covenant testing and have commitment periods which end within the

next twelve months. Since the period end the level of the bank facility in the United Kingdom has been increased to £17,500,000.

15. Seasonality

Seasonal fluctuations have no material impact on the company's revenues.

16. Copies of this announcement are available for download at www.avon-rubber.com. Further enquiries should be directed to the

company's registered office at Hampton Park West, Semington Road, Melksham, Wiltshire, SN12 6NB, England. Email: enquiries@avon-rubber.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ARMRTMMITBMP

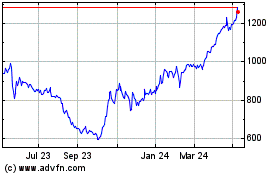

Avon Technologies (LSE:AVON)

Historical Stock Chart

From Jan 2025 to Feb 2025

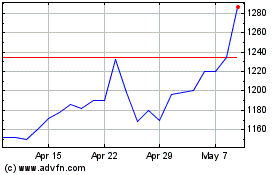

Avon Technologies (LSE:AVON)

Historical Stock Chart

From Feb 2024 to Feb 2025