TIDMBBB

RNS Number : 2741J

Bigblu Broadband PLC

12 December 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Bigblu Broadband plc

('BBB', the 'Group' or the 'Company')

Trading Update

Double digit like for like growth, and consideration of

potential ASX listing for SkyMesh

Bigblu Broadband plc (AIM: BBB.L), a leading provider of

alternative super-fast and ultra-fast broadband services, is

pleased to provide a trading update for the 12-month period ended

30 November 2022 (the "Period"). During the Period, BBB delivered

positive progress with double-digit like for like revenue growth

achieved with particularly strong growth in the Australasian

region. The Norwegian business was impacted by a cyber-attack to

its satellite provider and by delays in the 5G product launch,

which impacted on performance in the period. Quickline, which the

Group still have a retained interest in, has undergone significant

scaling with the support of Northleaf and has strategically

enhanced its platform for growth from an FWA business to a

distinguished hybrid GFWA and FTTP player with ambitious growth

plans. Whilst the Company operates in several different

geographies, the directors remain confident in the future growth

prospects of the business and the Board will continue its focus on

ensuring it can maximise the inherent value within the Company and

deliver further shareholder returns.

Financial Highlights

-- Total revenue increased 15.1% to GBP31.2m (FY21: GBP27.1m)

with like for like revenue growth(1) on a constant currency basis

of 13.3% (FY21: 15.3%).

-- Adjusted EBITDA(2) in the Period was GBP5.0m (FY21: GBP4.6m)

after investment in New Zealand and new product launches in

Norway.

-- Adjusted Free cash inflow(4) of GBP1.5m (FY21: inflow

GBP2.1m) after investment in stock In Norway of c. GBP1m following

chip shortages earlier in the year.

-- Net cash(5) at 30 November 2022 was GBP4.2m (FY21: GBP5.2m)

following the purchase of the customers and assets of Clear

Networks (Pty) Ltd ("Clear") for up to GBP1.6m.

Operational Highlights

-- The acquisition of c.2.2k satellite and fixed wireless

customers together with certain business assets of Clear Networks

(Pty) Ltd ("Clear") ISP, serving primarily customers in the greater

Melbourne area in Australia was completed post regulatory approval

in early 2022.

-- The distribution agreement the Norwegian business entered

into with Telenor is providing next generation ultrafast broadband

via Fixed Wireless Access using 5G technology ("5G FWA"),

delivering speeds up to 500 Mbps with unlimited data packages.

Although at the start of the year this was running six months

behind schedule, due to equipment shortages, it has now reached

c.1k customers with month-on-month growth and significantly lower

annualised churn rates, reflecting greater customer satisfaction

with the products.

-- On 21 December 2021 the Company signed a Distribution Partner

Agreement with OneWeb, to distribute low Earth Orbit ("LEO")

satellite based broadband services .

-- Total customers at the period end were 59.4k (FY21: 58.8k).

-- We are pleased with the progress made in the New Zealand

("NZ") market with our Asia Pacific broadband satellite partner,

Kacific Broadband Satellites Group and are delighted to report that

NZ has fully opened its borders after the long pandemic closure,

which will allow us to drive activity. We have also recruited a

local experienced sales executive, in country, and progress is

accelerating.

-- Post period end, we announced that BBB had conditionally

acquired the Satellite operations of Harbour ISP PTY LTD, a

subsidiary of Uniti Group LTD in Australia (the "Acquisition"), for

a total consideration of up to AUD$5.2m (GBP2.9m), to be satisfied

from existing cash resources. This acquisition, combined with the

Clear acquisition, will result in SkyMesh having an enlarged

national presence of 45% of the NBN Co satellite market across

Australia especially in the rural and suburban market segments.

1 Like for like (LFL) revenue treats acquired businesses as if

they were owned for the same period across both the current and

prior year and adjusts for constant currency and business disposed

of in the period are excluded from the calculation.

2 Adjusted EBITDA is stated before interest, taxation,

depreciation, amortization, share based payments and exceptional

items. It also excludes property lease costs which, under IFRS 16,

are replaced by depreciation and interest charges.

3 Adjusted Operating cash flow relates to the amount of cash

generated from the Group's operating activities and is calculated

as follows: Profit/(Loss) before Tax adjusted for Depreciation,

Amortisation, Share Based Payments and adjusting for changes in

Working Capital and non-cash items.

4 Adjusted Free cash flow being cash (used)/generated by the

Group after investment in capital expenditure, servicing of debt

and payment of taxes. Both excludes exceptional items.

5 Cash / Net debt excludes lease-related liabilities of GBP1.2m

of under IFRS 16 (FY21 GBP1.1m).

Andrew Walwyn, Chief Executive Officer of Bigblu Broadband plc,

commented:

"We started the year with a couple of initial setbacks,

including a cyber-attack to one of our satellite providers

affecting c.3k customers in Norway, as well as a delayed 5G launch

due to chip shortages. Despite this we are satisfied with the

continued progress shown by the Group in the Period. Extensive

effort has been made across the business units to switch customers

into more attractive packages at the expense of net adds, with c.9k

migrations in the period and net adds of 0.6k, of which net adds of

c.2.2k were associated with the Clear acquisition in Australia. We

ended the period with 59.4k customers. The recently announced Uniti

transaction, on completion, will result in a customer base of c.58k

(out of a total Company base of c66k post completion of the Uniti

acquisition) in Australasia and we remain focused on our strategy

in Australia of organic growth combined with targeting suitable

bolt-on acquisition opportunities. In addition, we remain focused

on creating and realising shareholder value for BBB Shareholders

and in this regards we are exploring all options for the

Australasian business including a potential ASX listing.

The necessary investment made to improve our offerings in

Norway, resulted in c1k new FWA 5G customers at the period end.

Work is still required to improve the performance of the Norwegian

business including product offerings, costs and systems.

Despite the global economic environment, the Group continues to

demonstrate strong year on year revenue growth underpinned with a

high percentage (c.90%) of recurring revenue. We remain confident

in our ability to deliver further attractive returns for

shareholders from our operations in Australasia and to realise a

return from the Norwegian business together with the remaining

equity stake in Quickline. As we enter the new financial year,

there are opportunities for each business unit to deliver

shareholder value as we continue to support customers unserved and

underserved in the digital divide, whilst at the same time

improving our product range thereby reducing churn. Whilst

operationally we remain focused, working with our network partners,

on increasing gross adds and reducing churn as well as ensuring our

customers are on the most suitable packages and receive the best

customer support, we will continue to consider all options in

respect of maximising shareholder value."

For further information:

Bigblu Broadband Group PLC www.bbb-plc.com

Andrew Walwyn, Chief Executive Officer Tel: +44 (0)20 7220

Frank Waters, Chief Financial Officer 0500

finnCap (Nomad and Broker) Tel: +44 (0)20 7220 0500

Marc Milmo / Simon Hicks / Charlie Beeson

(Corporate Finance)

Tim Redfern / Harriet Ward (ECM)

About Bigblu Broadband plc

Bigblu Broadband plc (AIM: BBB.L), is a leading provider of

alternative superfast and ultrafast broadband solutions throughout

Australasia and the Nordics. BBB delivers a portfolio of superfast

and ultrafast wireless broadband products for consumers and

businesses typically unserved or underserved by fibre.

High levels of recurring revenue, increasing economies of scale

and Government stimulation of the alternative broadband market in

many countries provide a solid foundation for significant organic

growth as demand for alternative ultrafast broadband services

increases around the world.

BBB's range of solutions includes satellite, next generation

fixed wireless and 4G/5G FWA delivering between 30 Mbps and 500Mbps

for consumers, and up to 1 Gbps for businesses. BBB provides

customers with a full range of services including hardware supply,

installation, pre-and post-sale support, billings and collections,

whilst offering appropriate tariffs depending on each end user's

requirements.

Importantly, as its core technologies evolve, and more

affordable capacity is made available, BBB continues to offer

ever-increasing speeds and higher data throughputs to satisfy

market demands for broadband and broadband services. BBB's

alternative broadband offerings present a customer experience that

is similar to that offered by wired broadband and the connection

can be shared in the normal way with PCs, tablets and smart phones

via a normal wired or wireless router.

Key Financials

We ended the year with a customer base of 59.4k (FY21: 58.8k)

despite having had to contend with a cyber-attack to our satellite

provider in the Nordics which impacted churn during the period, as

well as product shortages which delayed the 4G/5G FWA launch with a

combined impact of 1.6k in customers, GBP0.5m in lost revenue and

GBP0.3m in EBITDA. There was a focus on launching new products in

new territories, with Telenor 4G/5G FWA in Norway and Kacific

Satellite in NZ as well as significant marketing campaigns to

migrate c.9k customers in Australia to more suitable products which

the business believe should help to reduce churn in the future.

Total revenue including recurring airtime, equipment,

installation sales, network support and the Clear acquisition was

GBP31.2m, up 15.1% (FY21: GBP27.1m). This increase in revenue

reflected a higher number of customers, ARPU progression and

favorable FX rates in the period. Recurring airtime revenue,

defined as revenue generated from the Company's broadband airtime,

which is typically linked to contracts, was GBP29.6m representing

95% of total revenue (FY21: 95%). Total like-for-like (LFL) revenue

for the Continuing Group in the period was GBP30.7m representing

13.3% growth.

Gross profit margins reduced to 42.5% in FY22 (FY21: 45.0%), due

to planned product mix changes with the increase in 5G FWA

customers being at slightly lower margins than existing recurring

margins for fixed wireless but carrying a higher lifetime value due

to lower churn.

Overheads, before items identified as exceptional in nature,

increased to GBP10.8m (FY21: GBP9.2m) representing 34.6% of revenue

(FY21: 33.9%) mainly due to increased marketing costs of GBP0.4m

associated with new product and market launches as well as

communications to customers post the cyber-attack, Australasian

headcount costs GBP0.3m and amortisation of the Clear acquisition

of GBP0.5m in the period. Operationally we moved offices in each

geography to less expensive more flexible locations which will

impact positively in FY23. Significant effort was directed towards

pivoting customers and the businesses to a wider hybrid product

suite during the period.

Consequently, adjusted EBITDA for the period was GBP5.0m

representing an adjusted EBITDA margin of 16.0% compared to GBP4.6m

in FY21 and an adjusted EBITDA margin of 16.9%.

Australasia

Our Australian business SkyMesh, is the leading Australian

satellite broadband service provider having been named Best

Satellite NBN Provider for the fourth year in succession

(2019-2022). SkyMesh has continued to be the market leader in the

satellite broadband market with total market share pre the recent

Uniti transaction of c.38.5%, a growth of 2.6% year on year.

SkyMesh has consolidated its purchase of Clear Networks and

expanded into NZ during the year and the recently announced

conditional acquisition of the satellite customers of Uniti further

strengthens our position in the market.

Our Australasian business performed strongly during the year,

with customer numbers at 51.5k, an increase of 3.5% on prior year

(FY21: 49.7k), which includes the customers acquired from Clear

(2.2k). As a result of this growth plus ARPU improvements, SkyMesh

revenues increased to GBP26.5m (LFL: GBP21.8m), up 21.6% (LFL:

19.3%) on prior year, with adjusted EBITDA of GBP5.0m, up 25.1% on

prior year (FY21: GBP4.0m), supporting both a positive adjusted

operating cash inflow(3) of GBP5.6m and generating a positive

adjusted underlying free cash flow before group transfers of

GBP4.4m.

Post period end, we announced the conditional acquisition of the

Uniti satellite operations with c6k customers which the Board will

look to transfer to Skymesh post completion.

The emergence of 5G and LEO satellite technologies is expected

to lead to accelerated uptake of non-fibre broadband internet

services in Australasia. Further acquisitions and new product

opportunities are emerging as SkyMesh heads into 2023 with its

product offering likely to expand, leading to continued increases

in customer numbers.

The Board's focus will be on organic growth with our network

partners with suitable accretive bolt on acquisitions that could

accelerate the Company's presence into the wider Australasia region

and importantly accelerate the scaling of the Australasian

business. In addition, the Board continues to explore all options

to realise value for BBB shareholders from Skymesh, which could

include an ASX listing of Skymesh.

Norway

Reflecting the decrease in customer numbers associated with the

demounting program on non-profitable sites, as well as the impact

of the satellite cyber-attack on the satellite provider to our

Norwegian business, BB Norge (rebranded Brdy.no), ended FY22 with

customer numbers at 7.9k, down on the previous year (FY21: 9.1k).

Consequently, revenues for BB Norge were GBP4.0m, down 13.0% on the

prior year (FY21: GBP4.6m). After some initial delays, the 4G/5G

FWA revenue stream has grown in FY22 and is now contributing early

growth in new customers and revenue. Adjusted EBITDA for the region

was GBP1.0m, down 47.3% on prior year (FY21: GBP1.9m). Adjusted

operating cash was an outflow of GBP0.1m and adjusted underlying

free cash flow was an outflow of GBP1.0m following capital

expenditure of GBP0.9m and set up costs associated with the 5G FWA

of GBP0.2m.

During the Period the Group invested in refining and enhancing

the Company's service proposition in the Nordic market to support

the next generation ultrafast broadband via wireless 5G FWA,

delivering speeds up to 500 Mbps with unlimited data packages. As

reported previously this is beginning to show early momentum with

growing traction in the market (c.1k customers) and great customer

satisfaction being reported.

The Board continues to evaluate the opportunity to refine and

enhance the Group's service proposition in the Nordic market.

Initiatives include the launch of new satellite offerings across

the region offering speeds of 50Mbps and unlimited capacity. The

Directors consider that the Group's ability to offer a combination

of services including our own Fixed Wireless network, 5G FWA via

Telenor and satellite solutions in the Nordics provides the Group

with potentially scope to expand its presence and reach in this

region and create shareholder value. At the same time the Board are

examining all opportunities to create shareholder value and a

transaction with management is being considered as a potential

option amongst others.

Strategy

Across the regions in which we operate, we have worked hard with

our network partners to be able to offer our customers a selection

of products that best suits their needs. We continue to see the

demand for our products increasing with an element of home working

in the Nordics and Australasia now being the norm, and the

consequential need for faster broadband solutions to the home.

Whilst recognising the pressure on individuals and companies'

disposal income and profits, we firmly believe that the updated

solution set that the Group offers to its customers is becoming

more important and a very necessary utility cost. The opportunity

in the super-fast broadband market remains extremely exciting

across the businesses as it is changing significantly and

accelerating at pace. Where in the past a service of 30Mbps was

seen as an appropriate solution to a typical customer, nowadays

this is upward of 50Mbps and our satellite, fixed wireless and FWA

5G solutions will ensure that all unserved and underserved

customers can receive an appropriate solution.

The Directors consider that, given their respective strengths,

each of the remaining business units in Australasia and the Nordics

has potential opportunities to enhance shareholder value and

therefore the Board will be focused on ensuring that it can fully

capitalise on this opportunity.

Specifically post the recent acquisitions for the SkyMesh

business in Australia, the Board believes that its strategy of

organic growth complemented by further bolt-on acquisitions should

accelerate the Company's presence into the wider Australasia region

as it considers all options to realise value for shareholders

including a potential ASX listing. The Board believes the business

has the potential to achieve 100,000 customers in the region over

the next three years through organic and acquisitive growth.

In Norway, following the launch of new FWA 5G products and the

new Satellite offerings, whilst early days we are witnessing

increased customers and showing early signs of stabilizing,

although the business remains cash consumptive.

The Board will continue to look at all opportunities to maximise

shareholder value from its operations in Australasia Norway and its

retained stake in Quickline.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIRFFLAIIF

(END) Dow Jones Newswires

December 12, 2022 02:00 ET (07:00 GMT)

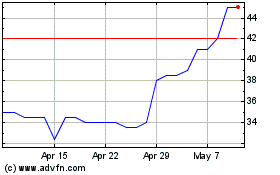

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Feb 2024 to Feb 2025