BlackRock Commodities Income Investment Trust Plc - Portfolio Update

July 20 2018 - 5:50AM

PR Newswire (US)

| BLACKROCK

COMMODITIES INCOME INVESTMENT TRUST plc

(LEI:54930040ALEAVPMMDC31) |

|

| All information is at

30 June 2018 and unaudited. |

|

|

|

|

| Performance at month

end with net income reinvested |

|

|

|

|

|

One |

Three |

Six |

One |

Three |

Five |

|

|

Month |

Months |

Months |

Year |

Years |

Years |

|

| Net asset value |

0.3% |

17.6% |

9.0% |

28.8% |

39.6% |

15.3% |

|

| Share price |

4.6% |

17.9% |

12.8% |

29.1% |

29.6% |

11.7% |

|

|

|

|

|

|

|

|

|

| Sources: Datastream,

BlackRock |

|

|

|

|

| At month end |

|

|

|

|

|

| Net asset value –

capital only: |

87.14p |

|

| Net asset value cum

income*: |

87.55p |

|

| Share price: |

83.90p |

|

| Discount to NAV (cum

income): |

4.2% |

|

| Net yield: |

4.8% |

|

| Gearing - cum

income: |

6.1% |

|

| Total assets^: |

£107.4m |

|

| Ordinary shares in

issue: |

116,816,916 |

|

| Gearing range (as a % of

net assets): |

0-20% |

|

| Ongoing charges**: |

1.4% |

|

|

|

|

* Includes

net revenue of 0.41p.

^ Includes current year revenue.

** Calculated as a percentage of average net assets and using

expenses, excluding any interest costs and excluding taxation for

the year ended 30 November 2017. |

|

|

|

|

| Sector

Analysis |

% Total

Assets |

|

Country

Analysis |

%

Total

Assets |

|

|

|

|

|

| Diversified Mining |

29.7 |

|

Global |

63.6 |

| Integrated Oil |

27.5 |

|

Canada |

14.3 |

| Exploration &

Production |

15.6 |

|

USA |

11.0 |

| Gold |

9.2 |

|

Australia |

4.1 |

| Copper |

8.2 |

|

Latin America |

3.5 |

| Industrial Minerals |

3.8 |

|

Africa |

3.4 |

|

Diamonds |

2.1 |

|

Europe |

1.1 |

| Silver |

1.6 |

|

Net current

liabilities |

(1.0) |

| Steel |

1.3 |

|

|

----- |

| Distribution |

1.1 |

|

|

100.0 |

| Oil Services |

0.9 |

|

|

===== |

| Net current

liabilities |

(1.0) |

|

|

|

|

----- |

|

|

|

|

100.0 |

|

|

|

|

===== |

|

|

|

|

|

|

|

|

| Ten Largest

Investments |

|

|

|

|

|

|

|

|

|

| Company |

|

|

|

|

|

Region

of Risk |

% Total

Assets |

|

|

|

|

|

| Rio Tinto |

Global |

8.7 |

|

| BHP |

Global |

8.3 |

|

| Royal Dutch Shell

‘B’ |

Global |

6.8 |

|

| First Quantum

Minerals* |

Global |

6.2 |

|

| Glencore |

Global |

5.7 |

|

| Chevron |

Global |

5.0 |

|

| BP |

Global |

4.4 |

|

| Exxon Mobil |

Global |

3.7 |

|

| Marathon Oil |

Global |

3.2 |

|

| ConocoPhillips |

USA |

3.1 |

|

|

|

|

|

|

| * The holding in First

Quantum Minerals includes both an equity holding and a holding in

several bonds. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commenting on the

markets, Olivia Markham and Tom Holl, representing the Investment

Manager noted: |

|

|

|

The

Company’s NAV increased by 0.3% during the month of June (in GBP

terms with dividend reinvested).

Markets experienced significant volatility during the month as the

increasing possibility of a trade war between the US and China put

pressure on cyclically sensitive areas of the market. Ongoing

rhetoric from both the Trump and China administrations on the topic

of tariffs has heightened concerns of slower than anticipated

global growth, and led to a risk-off market environment.

June was a difficult month for the mining sector, which moved into

negative territory overall for 2018. The month saw more noise

around potential trade wars as President Donald Trump approved

tariffs worth $50 billion on China, leading Beijing to counter with

$50 billion of tariffs of its own. Concerns heightened around the

potential for this to derail the global economic growth story and

mined commodities suffered as a result. However, whilst the market

focused on the risks surrounding rising protectionism, global

economic data remained healthy, with global manufacturing PMI

increasing to 53.0. The US dollar strengthened over the

month, providing another headwind for commodity prices and precious

metals in particular. Gold, silver and platinum prices were down by

4.1%, 2.2% and 6.2% respectively. The base metals were also weak,

with zinc, copper and nickel down by 6.2%, 3.2% and 2.2%

respectively. The bulk commodities were relatively stable, however,

with the iron ore (62% fe) price up by 2.3% over the month to

$67/tonne.

In the energy sector, the primary news during the month was the

meeting of “OPEC Plus”; where the group announced plans to

re-target 100% compliance with the 1.8 million barrels per day

(b/d) cuts agreed in late 2016. Due to unintended production

declines in Venezuela, Angola and Mexico, the group’s compliance

was 147% in May 2018 and, as a result, we could see up to 1.0

million b/d of supply added back to the market during the second

half of 2018. On the basis that global demand remains robust, this

additional supply looks to be required to balance the market and

our base case is for oil prices to stay around current levels for

the remainder of 2018. With this in mind, we see potential upside

risk as supply outages are likely to increase; US sanctions on Iran

will come into force in November, whilst Venezuela production is

expected to continue falling, and finally, the risk of disruptions

in Libya has increased with growing political tensions.

All data points in US dollar terms unless otherwise specified.

Commodity price moves sourced from Thomson Reuters Datastream. |

|

|

|

| 20 July 2018 |

|

|

|

| ENDS |

|

|

|

| Latest information is

available by typing www.blackrock.co.uk/brci on the internet,

"BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3

(ICV terminal). Neither the contents of the Manager’s website

nor the contents of any website accessible from hyperlinks on the

Manager’s website (or any other website) is incorporated into, or

forms part of, this announcement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copyright y 20 PR Newswire

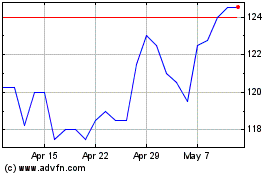

Blackrock Energy And Res... (LSE:BERI)

Historical Stock Chart

From Apr 2024 to May 2024

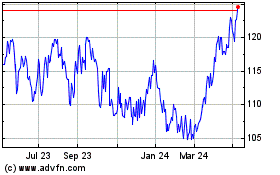

Blackrock Energy And Res... (LSE:BERI)

Historical Stock Chart

From May 2023 to May 2024