Bank of Ireland Group PLC Capital Reorganisation Approved (3132M)

July 27 2017 - 7:01AM

UK Regulatory

TIDMBIRG

RNS Number : 3132M

Bank of Ireland Group PLC

27 July 2017

Bank of Ireland Group plc ("BOIG plc" or the "Company")

Capital Reorganisation Approved

27 July 2017

BOIG plc is pleased to confirm that it has today received the

approval of the High Court for a reorganisation of the Company's

capital through the reduction of (i) EUR5,394,142,155.20 standing

to the credit of the Company's undenominated capital account and

(ii) EUR105,857,844.80 of the EUR562,139,426 standing to the credit

of the Company's share premium account, and the transfer of total

amount of EUR5,500,000,000 to the distributable reserves account of

the Company. These distributable reserves will be available to form

part of any distributions to shareholders, or for any other

corporate purposes the directors of the Company may consider

appropriate, in the future. The capital reorganisation will not

have any impact on the operating performance of the Bank of Ireland

Group (the "Group") or the Group's capital ratios.

The capital reorganisation will become effective when the High

Court order and minute are registered with the Companies

Registration Office.

Ends

For further information please contact:

Bank of Ireland

Helen Nolan Group Secretary +353 (0)766 23 4710

Alan Hartley Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell Head of Group Communications +353 (0)766 23 4770

Forward Looking Statement

This announcement contains certain forward-looking statements

with respect to certain of the Group's plans and its current goals

and expectations relating to its future financial condition and

performance, the markets in which it operates, and its future

capital requirements. These forward-looking statements often can be

identified by the fact that they do not relate only to historical

or current facts. Generally, but not always, words such as 'may,'

'could,' 'should,' 'will,' 'expect,' 'intend,' 'estimate,'

'anticipate,' 'assume,' 'believe, ' 'plan,' 'seek,' 'continue,'

'target,' 'goal', 'would,' or their negative variations or similar

expressions identify forward-looking statements, but their absence

does not mean that a statement is not forward looking. Examples of

forward-looking statements include among others, statements

regarding the Group's near term and longer term future capital

requirements and ratios, level of ownership by the Irish

Government, loan to deposit ratios, expected impairment charges,

the level of the Group's assets, the Group's financial position,

future income, business strategy, projected costs, margins, future

payment of dividends, the implementation of changes in respect of

certain of the Group's pension schemes, estimates of capital

expenditures, discussions with Irish, United Kingdom, European and

other regulators and plans and objectives for future

operations.

Nothing in this announcement should be considered to be a

forecast of future profitability, dividends or financial position

and none of the information in this document is or is intended to

be a profit forecast, profit estimate or dividend forecast. Any

forward-looking statement speaks only as at the date it is made.

The Group does not undertake to release publicly any revision to

these forward-looking statements to reflect events, circumstances

or unanticipated events occurring after the date hereof.

This information is provided by RNS

The company news service from the London Stock Exchange

END

CARRRMBTMBTTBMR

(END) Dow Jones Newswires

July 27, 2017 08:01 ET (12:01 GMT)

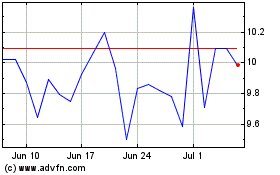

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2024 to May 2024

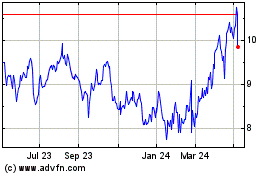

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From May 2023 to May 2024