BioPharma Credit PLC STATEMENT RE LUMIRADX

July 29 2024 - 1:00AM

RNS Regulatory News

RNS Number : 1739Y

BioPharma Credit PLC

29 July 2024

29 July 2024

BIOPHARMA

CREDIT PLC

(THE

"COMPANY")

STATEMENT

RE LUMIRADX

Pharmakon Advisors, LP, the

investment manager of the Company ("Pharmakon"), notes the

announcement released on 29 July 2024 by Roche Diagnostics Limited

("Roche") regarding the completion of its acquisition of certain

LumiraDx group companies (the "Point of Care Diagnostics

Companies") following the receipt of all required regulatory

clearances (the "Transaction"). The entering into of the sale and

purchase agreement (the "Purchase Agreement") between Roche

and Andrew Johnson, Lisa Rickelton and

Lindsay Hallam of FTI Consulting LLP as the joint administrators

of LumiraDx Group Limited and LumiraDx

International Limited (the

"Administrators") was previously announced by the Company on 29

December 2023.

In connection with the closing of

the Transaction, the amount due to the Administrators is USD$351.1

million, which is comprised of (i) USD$288.4 million pursuant to

the Purchase Agreement and (ii) USD$62.7

million in reimbursement in connection with the administration

funding facility provided by BioPharma Credit Investments V

(Master) LP and BPCR Limited Partnership (the "Senior Secured

Lenders") to support the ongoing ordinary course operations of the

Point of Care Diagnostics Companies in the period to complete the

Transaction (the "Administration Funding Agreement"). The USD$351.1 million amount reflects working capital

adjustments and includes a USD$15.0 million holdback from

the Purchase Price, which is expected to be released in accordance

with the Purchase Agreement within the next 90 days (the "Holdback

Amount").

The Company expects to receive 50%

of the amounts due to the Administrators in connection with the

closing of the Transaction, less certain expenses, most of which

will be returned to the Senior Secured Lenders within the next 10

days and the balance within the next 90 days. Assuming Roche

releases 100% of the Holdback Amount, and estimated total expenses

of USD$10.0 million, the Company is expected to receive

approximately USD$170.6 million, which is USD$3.0 million more than

the June 2024 valuation of USD$167.6 million. When added to the

USD$27.5 million received in the form of interest during the life

of the loan, the Company is expected to recover approximately 96

per cent. of its USD$206 million investment.

Pharmakon notes that the Transaction

did not involve the sale of LumiraDx's approximately 81% interest

in Lumira SAS (Colombia), a Colombian distributor of third party

diagnostic products with USD$13.7 million sales in 2023 and USD$2.9

million in EBITDA in 2023, whose ownership is expected to be

transferred to the Senior Secured Lenders in due course. Any

proceeds received from a potential sale of this interest would be

in addition to the recovery amounts described in the previous

paragraph.

Pharmakon Advisors, LP is continuing

to actively monitor the timing of the expected release of the

proceeds from the Administrators and will provide any updates in

due course.

Enquiries

Buchanan

David Rydell / Mark Court

/ Jamie Hooper / Henry Wilson

+44 (0) 20 7466 5000

biopharmacredit@buchanan.uk.com

Notes to Editors

BioPharma Credit

PLC is London's only specialist debt investor to the

life sciences industry and joined the LSE in March

2017. BioPharma Credit PLC seeks to provide long-term

shareholder returns, principally in the form of sustainable income

distributions from exposure to the life sciences

industry. BioPharma Credit PLC seeks to achieve this

objective primarily through investments in debt assets secured by

royalties or other cash flows derived from the sales of approved

life sciences products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

STRUKOVRSSUBURR

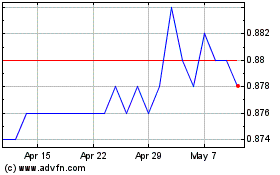

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From Jul 2023 to Jul 2024