Bluefield Solar Income Fund Limited Unaudited NAV as at 30 September 2023 (6178T)

November 16 2023 - 1:00AM

UK Regulatory

TIDMBSIF

RNS Number : 6178T

Bluefield Solar Income Fund Limited

16 November 2023

16 November 2023

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

UNAUDITED NET ASSET VALUE AS OF 30 SEPTEMBER 2023

Bluefield Solar (LON: BSIF), the London listed UK income fund

focused primarily on acquiring and managing solar energy assets,

announces the Company's net asset value ('NAV') as at 30 September

2023. Unless otherwise noted herein, the information provided in

this announcement is unaudited.

The Company's NAV as at 30 September 2023 was GBP834 million, or

136.4 pence per Ordinary Share, compared to the audited NAV of

139.7 pence per Ordinary Share ('pps') as at 30 June 2023. This

equates to a movement of -3.3 pps and a NAV return for the quarter

of -2.4%.

The 30 September 2023 NAV is stated after deducting the

FY2022/23 fourth Interim dividend of 2.30 pps announced on 28

September 2023 and paid on 6 November 2023. Excluding the deduction

of the fourth interim dividend would result in a NAV total return

for the quarter of -0.7%.

The principal factors behind the movement in the NAV from 30

June 2023 are: additional value recognised in our development and

construction projects following planning consent being achieved on

a co-located 70MW solar and 40MW storage project; continued

investment into solar PV construction sites Yelvertoft and

Mauxhall; and the ongoing programme of repowering selected wind

turbines in Northern Ireland. The ROC inflation assumption for

April 2024 has also been updated from 7.0% to 9.8%, with all other

inflation assumptions remaining as per 30 June 2023.

Offsetting these positive movements is a decrease from

operational updates, which includes a slight underperformance in

generation during the quarter, due to lower than expected

irradiation, and advanced quarterly payments connected to

corporation tax and the Electricity Generator Levy.

Whilst power curves from the Company's three independent

forecasters reported lower price forecasts for the near term, there

were slight increases in the curves further out, compared to those

used in the 30 June 2023 valuation. As a result of over 81% of the

Company's revenues being fixed until June 2024 there has been no

overall impact from these updates on the valuation.

All other core valuation assumptions have remained consistent

with the NAV issued in the Company's financial statements for the

period ended 30 June 2023.

The breakdown of contributing factors is summarised in the table

below:

Pence

per Ordinary

Share

Audited NAV as at 30 June 2023 139.7

================================== ==============

Development and construction 1.1

ROC Inflation 1.9

Power prices 0.0

Operational Updates -4.0

FY23 fourth interim dividend -2.3

================================== ==============

Unaudited NAV as at 30 September

2023 136.4

================================== ==============

Development update

In the period since 30 June 2023, the Company has achieved

planning permission for 70MW of solar PV and 40MW of battery

storage, and Bluefield Solar achieved allocations of Contracts for

Difference ('CfD') on all four projects submitted to CfD Allocation

Round 5.

Dividend target

The Board has set a target dividend for the 2023/24 financial

year of not less than 8.80 pence per Ordinary Share. This is

expected to be covered by earnings and to be post debt

amortisation.

- Ends -

For further information:

Bluefield Partners LLP (Company Investment Tel: +44 (0) 20 7078

Adviser) 0020

James Armstrong / Neil Wood / Giovanni www.bluefieldllp.com

Terranova

Deutsche Numis (Company Broker) Tel: +44 (0) 20 7260

Tod Davis / David Benda / Matt Goss 1000

www.dbnumis.com

Ocorian Tel: +44 (0) 1481

(Company Secretary & Administrator) 742 742

Chezi Hanford www.ocorian.com

Media enquiries:

Buchanan (PR Adviser) Tel: +44 (0) 20 7466

Henry Harrison-Topham / Henry Wilson 5000

www.buchanan.uk.com

BSIF@buchanan.uk.com

For further information:

About Bluefield Solar

Bluefield Solar is a London listed income fund focused primarily

on acquiring and managing solar energy assets. Not less than 75% of

the Company's gross assets will be invested into UK solar assets.

The Company can also invest up to 25% of its gross assets into

other technologies, such as wind and storage. Bluefield Solar owns

and operates a UK portfolio of 812MW, comprising 754MW of solar and

58MW of onshore wind.

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners

Bluefield Partners LLP was established in 2009 and is an

investment adviser to companies and funds investing in renewable

energy infrastructure. It has a proven record in the selection,

acquisition and supervision of large-scale energy assets in the UK

and Europe. The team has been involved in over GBP6.5 billion

renewable funds and/or transactions in both the UK and Europe,

including over GBP1 billion in the UK since December 2011.

Bluefield Partners LLP has led the acquisitions of, and

currently advises on, over 100 UK based solar PV assets that are

agriculturally, commercially or industrially situated. Based in its

London office, it is supported by a dedicated and experienced team

of investment, legal and portfolio executives. Bluefield Partners

LLP was appointed Investment Adviser to Bluefield Solar in June

2013.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDZMMMLKLGFZM

(END) Dow Jones Newswires

November 16, 2023 02:00 ET (07:00 GMT)

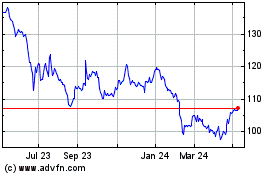

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

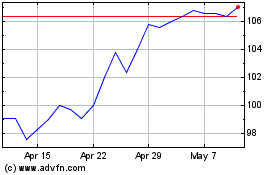

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Apr 2023 to Apr 2024