BT Profit Rises but Grapples with Deficit -- Update

October 27 2016 - 7:30AM

Dow Jones News

(Adds detail, analyst comments and updated stock price.)

By Simon Zekaria

LONDON--BT Group PLC's (BT) profit rose Thursday as sales surged

on the integration of its newly-formed consumer mobile business but

the U.K. telecommunications and media operator is also grappling

with a ballooning pension deficit.

BT's net profit in its second quarter ended Sept. 30 rose to 566

million pounds ($690 million) from GBP525 million in the same

period a year earlier, slightly below a market consensus forecast

of GBP567 million. The firm's closely-watched earnings before

interest, taxes, depreciation and amortization on an adjusted basis

increased 31% on the same period a year before.

Revenue in the second quarter on an adjusted basis jumped 38% to

GBP6.05 billion, higher than a consensus market forecast of GBP5.92

billion. Excluding exceptional items, foreign exchange movements

and acquisitions or disposals, as well as transit costs, and

adjusted for the acquisition of EE, revenue rose 1.1%.

BT's consumer business, which is powering the group's

performance, posted reported revenue up 11%. BT has 4.5 million

broadband customers, propelled by the take-up of higher speed

fiber-optic subscriptions and 1.7 million TV customers.

"Our consumer-facing lines of business have performed well,"

said Chief Executive Gavin Patterson.

Still, the company recorded a net pension deficit of GBP9.5

billion, up from GBP6.2 billion at June 30, citing "falling

corporate bond yields and higher expected inflation."

BT also took a GBP145 million non-cash charge after uncovering

"inappropriate management behavior" at its Italian unit.

At 1150 GMT, BT shares were down 2.14% at 379.3 pence, having

pared some losses.

Hargreaves Lansdown analyst George Salmon said that while the

consumer financials impressed, the increase in the pension deficit

was the "elephant in the room."

"With a deficit that size, extra contributions will surely be

needed to plug the shortfall after the next review in June," said

Mr. Salmon, adding that BT also needed to service the extra debt

taken on to fund the EE acquisition.

"The group's strong position in the TV, mobile, broadband and

landline markets gives it the tools to cope, but the extra demands

on the group's cash flow from here mean that the stakes are

high."

Mr Patterson said there were "multiple calls" on the cash

generated by the business and noted it was "challenging" to invest

in its network when the pension deficit was rising. Still, he said

the business has become stronger in recent years and could balance

its different needs.

UBS analyst Polo Tang added that concerns over separating BT's

infrastructure division Openreach and increasing industry

competition were also weighing on shares.

Mr. Patterson said BT didn't expect Britain's vote to leave the

EU to have a "significant" impact on its outlook, but that

uncertainty in its wake could jeopardize investment in the U.K.'s

telecom and media industries.

He said unfettered trading access across Europe was BT's chief

priority.

The group recommended an interim dividend of 4.85 pence, up

10%.

BT said it remained on track to deliver on its full-year

outlook. It expects adjusted Ebitda of around GBP7.9 billion.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

October 27, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

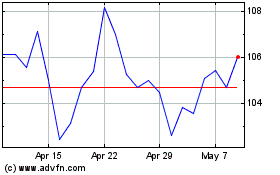

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2024 to May 2024

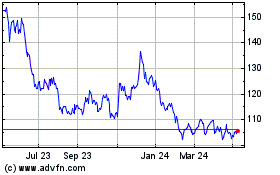

Bt (LSE:BT.A)

Historical Stock Chart

From May 2023 to May 2024