TIDMBYG

RNS Number : 4112F

Big Yellow Group PLC

10 July 2023

10 July 2023

Big Yellow Group PLC ("Big Yellow" or "the Group")

Q1 Trading Statement

Big Yellow, the UK's brand leader in self storage, provides the

following update on trading for the first quarter ended 30 June

2023 .

Results

Quarter Quarter ended

Financial metrics ended 30 June Change

30 June 2022

2023

Total revenue for the quarter (1) GBP48.1 million GBP45.1 million 6.7%

Like-for-like store revenue for

the quarter (1,2) GBP47.0 million GBP44.6 million 5.4%

Store metrics

Store Maximum Lettable Area ("MLA") 6,416,000 6,152,000 4%

Closing occupancy (sq ft) 5,255,000 5,320,000 (1%)

Occupancy growth in the quarter

(sq ft) (3) 167,000 174,000 (4%)

Closing occupancy 81.9% 86.5% (4.6 ppts)

Big Yellow stores like-for-like

closing occupancy (4) 85.2% 86.7% (1.5 ppts)

Average achieved net rent per sq

ft GBP32.74 GBP29.99 9%

Closing net achieved rent per sq

ft GBP32.88 GBP30.33 8%

(1) The Group changed the way it sold contents protections to

its customers on 1 June 2022 to an Enhanced Liability Service

("ELS"), which is subject to VAT at 20% and not Insurance Premium

Tax ("IPT") at 12%, the latter being included in revenue. We

estimate the impact of this on the total revenue and like-for-like

revenue for the quarter is 0.7%. For the remainder of the year,

revenue from ELS will be on a comparable basis.

(2) Excluding Aberdeen (acquired June 2022), Harrow and Kingston

North (both opened September 2022) and Kings Cross (opened June

2023).

(3) In June 2022, the Group acquired a store in Aberdeen with

39,000 sq ft of occupancy. The total increase in the Group's

occupancy for the quarter to 30 June 2022 was 213,000 sq ft.

(4) As per (2), additionally excluding the Armadillo stores.

Occupancy across all 109 stores increased by 167,000 sq ft (2.6%

of the MLA at 30 June 2023) compared to a gain of 174,000 sq ft in

the same quarter last year (2.8% of the MLA at 30 June 2022).

Like-for-like closing occupancy for the Big Yellow stores has

increased to 85.2% from 83.1% at 31 March 2023. Closing occupancy,

which includes the impact of new store openings, was 81.9%.

The Armadillo stores, representing 10% of the Group's quarterly

revenue, added 42,000 sq ft of occupancy with closing occupancy of

80%, up from 77% at the end of March.

Closing net achieved rent per sq ft for all stores was GBP32.88,

an increase of 8% from the same time last year, with average rate

up 9% on the same quarter last year.

The Group's like-for-like store revenue increased by 5.4%

compared to the same quarter last year, 6.1% on a like-for-like ELS

basis(1) . The total revenue increase compared to the same quarter

last year of 6.7% includes the increasing impact of our recent Big

Yellow store openings.

Property

The Group opened its 103,000 sq ft landmark store in Kings Cross

on 5th June. Early trading has been strong, and we expect this

store to make a valuable contribution to the Group's performance in

the coming years.

The Group has acquired a 0.8 acre property for development on

Belgrave Gate, central Leicester for GBP1.85 million. We will be

seeking planning permission for a 58,000 sq ft self-storage centre

on the site. The site is currently generating an income of

approximately GBP110,000 per annum, across four short-term rolling

tenancies.

This acquisition takes the number of stores in the Group's

pipeline to 11, of which six have planning consent.

We will shortly be commencing construction on our new 63,000 sq

ft Slough Farnham Road store, which as previously announced, will

be replacing our existing similar capacity leasehold store.

Financing

During the period, the Group increased its revolving credit

facility by GBP30 million to GBP270 million, taking total committed

facilities to GBP548 million, with net debt at 30 June of GBP484

million. In addition, the Group has a $225 million unutilised

credit approved shelf facility with Pricoa Private Capital, which

can be drawn in fixed sterling notes with terms of between 7 and 15

years.

Jim Gibson, Chief Executive Officer, commented:

" We have had a solid start to the year with a return to

occupancy growth this quarter, broadly in line with last year. We

are continuing to manage yield, offsetting the adverse impact of

inflation on our cost base, with average rents growing by 9% over

the quarter. In addition, our prospect numbers are back at

pre-Covid levels, and encouragingly we are achieving higher

conversion rates to move-in, which is perhaps indicative of a

higher proportion of needs-driven serious enquiries.

We continue to have confidence in our business model and its

resilience in this higher interest rate environment. Our freehold

portfolio is 75% weighted to London and the South East, with the

balance in large regional conurbations, which provides a

predictable, resilient income stream across a wide customer base.

In addition to growing our earnings from the existing platform, we

will continue to invest in external growth through developing new

stores and selectively acquiring existing centres."

For further information, please contact:

Big Yellow Group PLC

Nicholas Vetch, Executive Chairman

Jim Gibson, Chief Executive

Officer

John Trotman, Chief Financial

Officer 01276 477 811

Teneo

Charlie Armitstead 07703 330 269

Notes to Editors

Big Yellow is the UK's brand leader in self storage. Big Yellow

now operates from a platform of 109 stores, including 24 stores

branded as Armadillo Self Storage. We have a pipeline of 0.9

million sq ft comprising 11 proposed Big Yellow self storage

facilities. The current maximum lettable area of the existing

platform (including Armadillo) is 6.4 million sq ft. When fully

built out the portfolio will provide approximately 7.3 million sq

ft of flexible storage space. 99% of our stores and sites by value

are held freehold and long leasehold, with the remaining 1% short

leasehold.

The Group has pioneered the development of the latest generation

of self storage facilities, which utilise state of the art

technology and are located in high profile, accessible, main road

locations. Our focus on the location and visibility of our stores,

with excellent customer service, a market-leading online platform,

and significant and increasing investment in sustainability, has

created in Big Yellow the most recognised brand name in the UK self

storage industry.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTRRMRTMTAMBLJ

(END) Dow Jones Newswires

July 10, 2023 02:00 ET (06:00 GMT)

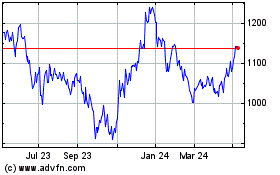

Big Yellow (LSE:BYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

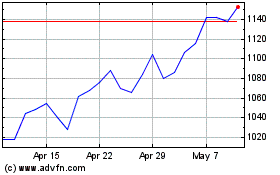

Big Yellow (LSE:BYG)

Historical Stock Chart

From Apr 2023 to Apr 2024