TIDMCHRY

RNS Number : 6194R

Chrysalis Investments Limited

30 October 2023

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than to professional investors in Belgium, Denmark, the

Republic of Ireland, Luxembourg, the Netherlands, Norway and

Sweden), Canada, Australia, Japan or the Republic of South

Africa.

30 October 2023

Chrysalis Investments Limited ("Chrysalis" or the "Company")

Quarterly NAV Announcement and Trading Update

Net Asset Value

The Company announces that as at 30 September 2023 the unaudited

net asset value ("NAV") per ordinary share was 134.65 pence.

The NAV calculation is based on the Company's issued share

capital as at 30 September 2023 of 595,150,414 ordinary shares of

no par value.

September's NAV represents a 2.21 pence per share (1.6%)

decrease since 30 June 2023.

Movement in the fair value of the portfolio accounted for

approximately 3.99 pence per share, with foreign exchange

generating a favourable movement of approximately 2.01 pence per

share. Fees and expenses make up the balance.

Investment Adviser Comments

Richard Watts and Nick Williamson (co-portfolio managers)

comment:

"The NAV was broadly flat over the period, largely mirroring the

performance of key equity markets. Notwithstanding this, the IPO

market continued to show signs of life, with ARM listing in the US

towards the back end of the quarter. We also note that Instacart

and Klaviyo listed over the period and while their post-IPO

performances have been mixed, we believe that this represents a

step in the right direction. Private equity markets have also seen

signs of recovery as the interest rate and macro-economic picture

becomes clearer. Deal volumes are increasing from a low point in Q1

2023, and the tech sector remains key for PE.

We consider both public and private exit routes as viable

options. The portfolio contains a number of later-stage assets,

either profitable or funded to profitability, that we believe will

make very attractive targets in due course, with some considered

"IPO ready". With this in mind, Klarna's comments in the period

that the 'requirements have been met' to consider an IPO were

encouraging to us.

Our key assets are continuing to perform well from both an

operational and financial perspective; this gives us confidence in

the potential of the portfolio to drive NAV progression."

Portfolio Activity

Investment activity during the quarter was limited.

In July the Company invested a further GBP6.5 million in Secret

Escapes as part of a wider GBP31.7 million fundraise, supporting

the refinancing of existing debt facilities. This capital will

enable the company to accelerate marketing spend with a view to

driving customer acquisition and ultimately growth. The company is

already profitable, but it is hoped that the additional capital

raised will result in a faster rate of growth and an even more

profitable business in the near to medium term.

Portfolio Update

The portfolio in aggregate continues to make solid progress

against its financial and operating targets; this is particularly

true across the core portfolio which consists of our later-stage

assets:

wefox

wefox continues to grow strongly and has demonstrated a clear

roadmap to profitability. The Investment Adviser believes that

wefox will be profitable towards the end of 2023, a target the

company set itself at the beginning of the period and is well

positioned to post its first full year of profitability in

2024.

In the previous quarter, wefox announced that it had launched

its global affinity business, which will connect insurance

companies with partners that can distribute their insurance

products. In recent weeks, wefox has announced that WINDTRE,

Italy's leading telecommunications business, has signed a 10-year

deal to launch the sale of home and travel insurance products

in-store.

On 1 October, wefox appointed Jonathan Wismer as its new Group

Chief Financial Officer. Jonathan brings more than 25 years of

experience in the insurance industry, having held senior finance

roles at Zurich, AIG and Resolution Life. The appointment

represents the company's continued strengthening of its C-suite as

it steps up its plans for profitable growth and global

expansion.

On 24 October, wefox also appointed Mark Hartigan as Chairman.

Mark was previously Chief Executive at LV and Head of Operations

for Europe, Middle East and Africa at Zurich Insurance Group. He

was Chief Executive Officer for Zurich Global Life in the Asia

Pacific and Middle East region and led its regional business in

Europe.

Starling

Starling continues to benefit from an increase in yields on cash

and debt securities, as a result of increases in the Bank of

England's Base Rate, and this continues to drive interest income

and profitability. Starling generates a post-tax return on equity

of over 40%, making it, the Investment Adviser believes, one of the

most profitable digital banks globally. Engine, the tech platform

that powers Starling, offers the potential to license Starling's

award-winning technology to financial organisations around the

world.

Starling announced that from 1 October, it will share the

benefit of increased interest rates with its customers, by paying

3.25% AER interest on accounts balances of up to GBP5,000. Starling

also offers a One Year Fixed Saver paying 5.53% interest on

deposits between GBP2,000 and GBP1,000,000 that are held for a

year. These represent extremely competitive rates of interest

versus high-street banks.

The Investment Adviser views these moves as consistent with

Starling's brand values, as well as likely providing an incremental

boost to deposit growth. Sharing the benefits of technology and

scale with customers is a key enabler of growth, as has been seen

in other portfolio companies.

Brandtech

Brandtech has made two acquisitions in the year: Jellyfish and

Pencil AI. Although the acquisition of Pencil AI is smaller than

Jellyfish, the Investment Adviser is excited about its potential.

Pencil AI was founded in 2018 and is currently the leading AI

creative and distribution SaaS platform. The company utilises Open

AI's GPT family of large language models (LLMs) to generate content

that is 10x lower in cost to produce but with a 2x uplift in

performance.

During the quarter, Brandtech launched Pencil Pro, an

enterprise-level generative AI product, specifically created to

meet the needs of global brands. This proposition could be

significantly disruptive, and it is encouraging that Unilever and

Bayer have decided to be launch partners.

Smart Pension

Following the announcement of its $95 million Series E funding

round in the previous quarter, led by Aquiline Capital Partners,

Smart has continued to execute its M&A strategy.

During the quarter, Smart acquired Evolve Pensions, a leading

provider of workplace pension services through its master trust,

the Crystal Trust. Evolve has over 128,000 members and GBP750

million in assets. The acquisition of Evolve Pensions represents

one of the largest master trust acquisitions of the year and makes

the Smart Pension Master Trust (SPMT) the country's third biggest

master trust operator. SPMT now has 1.1m members and GBP4bn under

management while the group has a total of over GBP11bn under

management.

Klarna

Klarna released its first half results during the quarter which

demonstrate sustained revenue growth and a return to profitability

through the second quarter of the year.

Gross Merchandise Volume (GMV) increased by +14% year-on-year

(to SEK239 billion) while revenues grew by +17% year-on-year (to

SEK5.5 billion). The Investment Adviser is encouraged by revenues

continuing to grow ahead of GMV as it demonstrates Klarna's ability

to monetise its existing customer base. Fundamental to the improved

operating performance was the increase in gross profit for the

period, which rose 83% year-on-year to SEK2.7 billion, driven by a

49% reduction in credit losses as a percentage of GMV.

In the second quarter, Klarna generated an adjusted operating

profit of SEK10 million which represents a material improvement in

profitability year-on-year and the first full quarter of

profitability since the Company's investment. To give a sense of

how much progress Klarna has made, in the second quarter of 2022,

Klarna's adjusted operating loss was in excess of USD280 million,

which implies the company has moved from an annualised operating

loss of over USD1 billion, into an annualised profit in the space

of 12 months.

Deep Instinct

Deep Instinct continues to innovate and in recent weeks has

launched 'Deep Instinct Prevention for Storage' (DPS). This new

product applies a prevention-first approach to storage protection,

wherever data is stored - Network Attached Storage (NAS), hybrid,

or public cloud environments - and seamlessly integrates into

existing environments to deliver unparalleled efficacy and accuracy

along with enterprise-grade scalability.

This is an exciting development in the industry given that the

amount of data being stored in public and hybrid cloud environments

continues to grow exponentially and a single infected file can put

an enterprise at risk. As part of the Deep Instinct Prevention

Platform, DPS fills gaps in data protection by applying a unique

deep learning framework dedicated to cybersecurity. Whenever a file

is added or changed in a storage environment, it is scanned

immediately, and malicious files are either quarantined or deleted

to prevent execution.

Featurespace

Featurespace is a world leader in enterprise grade technology

preventing fraud and financial crime. This is evidenced by a number

of recent awards and product releases.

As highlighted earlier in the year, Featurespace has developed a

bespoke fraud transaction monitoring framework for NatWest that led

to a +135% improvement in Natwest's financial scam detection rate

and a 75% reduction in false positives. During the quarter, NatWest

and Featurespace won 'Best Innovation by a Financial Institution'

at the Datos Insights 2023 Fraud and AML Impact Awards for that

specific initiative.

More recently, the company has launched TallierLTM, the world's

first Large Transaction Model (LTM). TallierLTM, a foundation AI

technology for the payment and financial services industry, is a

large-scale, self-supervised, pre-trained model designed to power

the next generation of AI applications. The model has shown

improvements of up to 71% in fraud value detection when compared to

industry standard models.

Cash Update

As of 30 September, the Company had net cash of approximately

GBP23 million, subsequent to the follow-on investment in Secret

Escapes, and a position in Wise of GBP10 million, to give a total

liquidity position of approximately GBP33 million.

The majority of follow-on investments have now been completed

and most of the portfolio is now either profitable or funded

through to profitability. While there may be additional funding

requirements across the portfolio in the short to medium term, the

Investment Adviser considers the Company has sufficient available

liquidity to address these.

Portfolio composition

As of 30 September 2023, the portfolio composition was as

follows:

30-Sep

Carrying Value

Portfolio Company (GBP millions) % of portfolio

---------------- -----------------

wefox 188.6 23.5%

---------------- -----------------

Starling 141.7 17.6%

---------------- -----------------

Brandtech 103.9 12.9%

---------------- -----------------

Smart Pension 79.7 9.9%

---------------- -----------------

Klarna 56.9 7.1%

---------------- -----------------

Deep Instinct 51.5 6.4%

---------------- -----------------

Featurespace 49.6 6.2%

---------------- -----------------

Tactus 29.0 3.6%

---------------- -----------------

InfoSum 27.2 3.4%

---------------- -----------------

Secret Escapes 25.0 3.1%

---------------- -----------------

Graphcore 16.5 2.1%

---------------- -----------------

Wise 10.3 1.3%

---------------- -----------------

Sorted 0.3 0.0%

---------------- -----------------

Gross cash 22.6 2.8%

---------------- -----------------

Source: Jupiter Investment Management Limited. Due to rounding,

the figures may not add up to 100%. The above percentages are based

on an aggregate portfolio value (including cash) of approximately

GBP803 million for 30 September 2023.

Outlook

The Investment Adviser remains optimistic about the prospects

for the Company. As noted in the last NAV update, IPO and private

markets have shown some signs of life, which is an indication that

investor risk appetite is recovering to some degree.

The Investment Adviser remains focused on helping the portfolio

companies get to a position where they can "exit" and considers a

number of assets "IPO ready". It is intended that any future

realisations flow through the proposed Capital Allocation Policy

that was outlined to shareholders on 13 October 2023. The

Investment Adviser believes this policy would be an essential

mechanism to help unwind the current share price discount to

NAV.

Factsheet

An updated Company factsheet will shortly be available on the

Company's website: https://www.chrysalisinvestments.co.uk

-ENDS-

For further information, please

contact:

Media +44 (0) 7976 098 139

Montfort Communications: chrysalis@montfort.london

Charlotte McMullen / Toto Reissland

/

Lesley Kezhu Wang

Jupiter Asset Management:

James Simpson +44 (0) 20 3817 1696

Liberum:

Chris Clarke / Darren Vickers

/ Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown / Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Chris Bougourd +44 (0) 20 3530 3109

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at https://www.chrysalisinvestments.co.uk

The information contained in this announcement regarding the

Company's investments has been provided by the relevant underlying

portfolio company and has not been independently verified by the

Company. The information contained herein is unaudited.

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFEIFDUEDSEFS

(END) Dow Jones Newswires

October 30, 2023 03:00 ET (07:00 GMT)

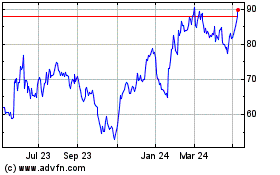

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Jan 2025 to Feb 2025

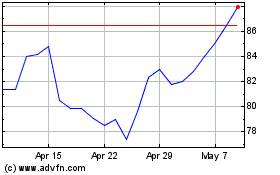

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Feb 2024 to Feb 2025