TIDMCLI

RNS Number : 1654R

CLS Holdings PLC

15 November 2012

CLS Holdings plc

("CLS", the "Company" or the "Group")

Interim Management Statement for the period 1 July 2012 to 14

November 2012

The Group announces its Interim Management Statement for the

period 1 July 2012 to 14 November 2012.

HIGHLIGHTS

-- Successful issue of GBP65 million retail bond

-- Weighted average cost of debt remains low at 3.79% (30 June 2012: 3.74%)

-- Planning application for 143,000 sq m scheme at Vauxhall Square, London progressing well

-- Occupational demand resilient; vacancy level reduced to 3.3% (30 June 2012: 3.5%)

-- New leases, lease renewals and extensions completed on 9,738 sq m

-- Over GBP170 million of liquid resources

-- Over GBP90 million of undrawn credit facilities

OVERVIEW - Since 1 July, the Group has continued to make

positive progress on a number of fronts. Its core investment

activities continue to perform well, the development opportunities

are moving forward and we have increased and diversified our

financing through the successful issue of a publicly quoted retail

bond.

The occupational markets remain resilient, with the Group's

vacancy level of 3.3% by rental income at its lowest level for ten

years. Demand from existing and potential occupiers is steady, with

some encouraging highlights. 66% of the Group's income benefits

from indexation and 40% is paid by government occupiers. We have

made two acquisitions in London since the half year totalling

GBP5.2 million, with further acquisitions being actively

pursued.

Demolition is well under way at our student and hotel scheme,

Spring Mews in Vauxhall, SE11, and the planning application for the

mixed use proposal Vauxhall Square, SW8 is expected to go to

planning committee with a recommendation for approval before the

year end.

The financial markets have been somewhat less volatile since the

summer. Whilst this is welcome, there remains uncertainty and risks

in the Eurozone which could lead to renewed volatility. Meanwhile

the value of the Group's corporate bond investments has benefited

significantly from the fall in yields as investors have

increasingly searched for income.

LONDON - Whilst the UK economy still has many issues to

overcome, the capital's safe haven status has been enhanced with

the successful Olympics, and overseas investors continue to be

significant buyers, particularly in prime West End and City

locations. The purchase of the iconic Battersea Power Station by a

Malaysian consortium is testament to a willingness to consider

other areas where there is a strong rationale. The banks, however,

have continued to increase pressure on distressed borrowers who are

currently finding refinancing very challenging to achieve. This is

providing attractive opportunities for the Group, and since 1 July

we have completed two acquisitions. First, we bought a 1,963 sq m

property in Wallington, Surrey for GBP2.1 million, where we have

let the remaining vacant space and increased the rent to

GBP320,885. Secondly, we have completed on the purchase of a 1,844

sq m office property, Gateway House in Kennington, SE11 for GBP3.1

million, fully let and generating a rent of GBP282,000 from two

occupiers. Both of these purchases were at capital values per sq m

well below replacement cost, and we are considering other similar

potential acquisitions.

We continue to be successful in leasing space and the vacancy

rate has been further reduced to just 2.5%. New lettings were

achieved on 3,050 sq m, including 1,450 sq m over three floors at

Great West House, Brentford on a 10 year lease with a break at year

7, and lease renewals and extensions were completed on 3,958 sq m.

Tenants vacated from 3,956 sq m, of which 2,323 sq m was taken out

of lettable stock and demolished to create part of the Spring Mews

site.

The Spring Mews development is progressing according to plan and

in line with the guidance given at the time of the half year

results. Demolition is due for completion before the end of the

year and piling work is due to start early in the New Year. We are

in discussions with a number of operators to manage the hotel.

Discussions have progressed well with stakeholders on the

143,000 sq m Vauxhall Square mixed use development proposal, which

is expected to go to the Local Authority's planning committee

before the year end with a recommendation for approval. The scheme

is at the heart of the Vauxhall Nine Elms regeneration zone where

an encouraging pace of activity continues. The recent acquisition

of the Battersea Power Station by a Malaysian consortium, the start

of initial ground works for the new United States embassy and

significant pre-selling of residential apartments on a number of

projects are positive elements of progress.

The planning application on Clifford's Inn, Fetter Lane, EC4 is

also expected to go to planning committee before the year end with

a recommendation for approval for 3,433 sq m of new Grade A offices

and eight residential apartments. If planning is granted we expect

to start on site in April 2013 with a 15 month construction

programme.

FRANCE - Economic data from France shows proof of weak growth

and the economy also faces substantial budget cuts to reduce the

country's deficit. However, there are some positive indicators,

with consumer spending growing in September and we have seen an

increase in leasing enquiries from existing and potential

customers.

Since the end of June, we have let or renewed 2,046 sq m of

offices and taken back 2,396 sq m, resulting in a vacancy rate in

France of 3.8%. Rents appear stable with some positive movement in

Lyon.

GERMANY - The German economy shows more strength than any other

major Eurozone country. The need of certain owners to sell for

structural reasons could lead to potentially attractive

acquisitions for CLS over the forthcoming 12 months. Of the 2.2

million sq m of new construction in the top six cities over the

next two years, only 37% is unlet at this stage, and the average

vacancy level in these cities is stable at approximately 9.4%.

We have noticed a rise in enquiries, particularly in Munich, and

we have let 686 sq m of offices during the period, with no leases

having expired. The vacancy rate of the German portfolio has fallen

to 4.8% by rental value, following these lettings and the

completion on time and on budget of the fourth phase of our pre-let

development at Landshut to the north of Munich, which added 5,389

sq m of occupied space.

SWEDEN - A healthy level of consumer purchasing power in Sweden

has to a degree offset the impact of lower exports to the Eurozone.

GDP growth is expected to be 0.9% in 2012 and 1.8% in 2013, with

inflation below the 2% target at 0.9%.

The planning application in Stockholm for the 150,000 sq m mixed

use scheme owned by the Group's 29.9% associate, Catena, is

proceeding towards final approval by the end of this year for 800

apartments and 70,000 sq m of commercial space. The share price of

Catena at 14 November of SEK 62.5 means the current market value of

the Group's interest exceeds book value by GBP6.8 million, which

would add 15.6 pence per share of CLS's net asset value.

Occupancy of the Group's only directly held property,

Vänerparken, to the north of Gothenburg, has remained unchanged

with a vacancy of 1.8% by rental value.

FINANCE - Core profit has continued to be resilient, with stable

net rental income, high debt collection rates, tightly controlled

costs, and a continuing low cost of debt of 3.79% (30 June 2012:

3.74%). At 31 October 2012, the Group had cash and liquid resources

of over GBP170 million and undrawn facilities in excess of GBP90

million.

In September, we issued an unsecured GBP65 million retail bond

on the London Stock Exchange's Order Book for Retail Bonds with a

coupon of 5.5% per annum, and a maturity date of 31 December 2019.

This successful issue was 30% oversubscribed and gave the Group

considerable additional resources to fund its growth plans as well

as diversifying our sources of funding. The Group has 56 loans from

18 lenders, and two unsecured corporate bonds; none of the loan

covenants is in breach and none of the debt has been

securitised.

After a period of relative stability in the first quarter of

2012, the financial markets in Europe again became more volatile

during the summer. The euro, in which half of our business is

conducted, is at broadly the same level against our reporting

currency of sterling as at 30 June.

The corporate bond portfolio has performed strongly since the

half year and is generating an attractive running yield of 8.9%

against current values, and we continue to monitor actively the

underlying strength and performance of all the issuers. There are

currently 44 different bonds in the portfolio, giving broad

diversification. Since 1 July 2012, the bond portfolio has risen in

value by some 7.5% like-for-like and the total return for the bond

investments year to date has been 22.3%

In the latest tender offer, all of the shares available were

cancelled by the Company on 26 September, resulting in a

distribution of GBP4.6 million to shareholders and leaving 43.3

million shares in circulation.

Executive Chairman of CLS, Sten Mortstedt, commented:

"The Group's core investment portfolio is continuing to deliver

strong income returns against the Group's very low cost of debt and

benefits from significant rental indexation. We are adding value

through the planning and development process, particularly in the

Vauxhall regeneration zone in London. In addition the balance sheet

is strong, we benefit from excellent relationships with our banks

and we have substantial liquid resources to fund the increasing

number of attractive opportunities which we continue to

identify.

"This puts us in a solid position to deliver good returns,

whilst being able to respond to events and opportunities as they

arise."

-ends-

For further information, please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Sten Mortstedt, Executive Chairman

Henry Klotz, Executive Vice Chairman

Richard Tice, Chief Executive Officer

Liberum Capital Limited +44 (0)20 3100 2222

Tom Fyson

Charles Stanley Securities

Mark Taylor +44 (0)20 7149 6000

Hugh Rich

Kinmont Limited +44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants (Financial PR) +44 (0)20 7903 0669

Alex Simmons

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSLLFSDLDLSLIF

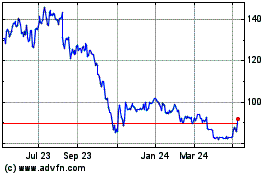

Cls (LSE:CLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

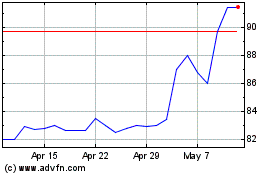

Cls (LSE:CLI)

Historical Stock Chart

From Feb 2024 to Feb 2025