TIDMCNR

RNS Number : 5192I

Condor Gold PLC

05 December 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION (EU) 596/2014 AS IT FORMS PART OF DOMESTIC LAW IN THE

UNITED KINGDOM BY VIRTUE OF THE EU (WITHDRAWAL) ACT 2018

("MAR").

Condor Gold plc

7/8 Innovation Place

Douglas Drive

Godalming

Surrey

GU7 1JX

Tel: +44 (0) 207 493 2784

5 December 2022

Condor Gold Plc

("Condor" or the "Company")

Proposed Open Offer to Raise up to GBP3.9M

Posting of Shareholder Circular and Notice of EGM

Condor Gold Plc (AIM: CNR; TSX: COG) announces that further to

its announcement of 28 November 2022 the Company is today posting

its Open Offer Circular to Shareholders, including a Notice of EGM

(the "Circular") to seek approval for a Sub-division as further

detailed below. The EGM will be held at 7/8 Innovation Place,

Douglas Drive, Godalming, Surrey GU7 1JX on 21 December 2022 at 11

a.m. A copy of the Circular is available on the Company's website,

www.condorgold.com and will be available on the Company's SEDAR

profile at www.sedar.com .

Pursuant to the Open Offer, Qualifying Shareholders will be

given the opportunity to subscribe for:

1 Open Offer Share for every 6 Existing Ordinary Shares

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Circular.

Extracts of the Circular are set out below.

1. INTRODUCTION

The Company is providing all Qualifying Shareholders with the

opportunity to subscribe for an aggregate of up to 26,438,255 Open

Offer Shares, to raise up to approximately GBP3,965,000 (before

expenses), on the basis of one Open Offer Share for every six

Existing Ordinary Shares held on the Open Offer Record Date, at the

Issue Price of GBP0.15. When aggregated with the GBP1,000,000

raised by the issue of the Convertible Loan Notes (as announced on

28 November 2022), this would allow the Company to raise up to

approximately GBP4,965,000. Qualifying Shareholders subscribing for

their full entitlement under the Open Offer may also request

additional Open Offer Shares through the Excess Application

Facility.

The New Shares will be issued pursuant to existing Shareholder

authorities granted at the general meeting of the Company held in

May 2022. Application will be made for the Open Offer Shares to be

admitted to trading on AIM, and the TSX has granted conditional

approval with regard to the listing of the Open Offer Shares on the

TSX. Admission is expected to occur at 8.00 a.m. on 23 December

2022 or such later time and/or date as the Company may agree.

The Open Offer is conditional upon Shareholder approval of the

Sub-Division, which will be sought at the EGM to be held at 11 a.m.

on 21 December 2022, a notice of which is set out at the end of the

Circular . Under the Act, a company is prohibited from issuing new

shares at a price less than the nominal value of its shares. The

Company's Existing Ordinary Shares have a nominal value of GBP0.20.

The middle market share price of each Existing Ordinary Share on

the date prior to the date of this letter was GBP0.1925. In order

to enable the Company to offer New Ordinary Shares at a discount to

Qualifying Shareholders to fund the Company through its sales

process, the Company proposes subdividing each Existing Ordinary

Share into one New Ordinary Share of GBP0.001 and one Deferred

Share of GBP0.199. The Company expects that the Deferred Shares

will never have any real value. The Deferred Shares will have no

rights to vote or to dividends. The rights of the Deferred Shares

to participate on a winding-up of the Company are unlikely to be

realised, as such rights will be subject to the prior payment to

the holders of New Ordinary Shares of the nominal capital paid up

or credited as paid up on the New Ordinary Shares together with the

sum of GBP10,000,000 on each New Ordinary Share.

The Issue Price represents a discount of 22 per cent to the

closing price of the Existing Ordinary Shares on AIM on 2 December

2022.

Further details of the Open Offer and the Sub-Division are set

out in the Circular, which you are encouraged to read carefully. No

part of the Open Offer has been underwritten.

The purpose of the Circular is to provide you with details of

and the background to and reasons for the Open Offer and the

Sub-Division and to explain why the Directors believe that both the

Open Offer and the Sub-Division are in the best interests of the

Company and its Shareholders as a whole.

2. INFORMATION ON CONDOR GOLD PLC

Condor Gold Plc is a UK incorporated gold exploration and

development company, with a focus on Nicaragua. The Company's

shares are admitted to trading on AIM in London and to listing on

the TSX in Toronto.

The Company's principal asset is La India Project, Nicaragua,

which comprises of a large, highly prospective land package of 588

sq km comprising of 12 contiguous and adjacent concessions. The

Company has filed a feasibility study technical report dated 25

October 2022 and entitled "Condor Gold Technical Report on the La

India Gold Project, Nicaragua, 2022" (the "2022 FS") which is

available on the Company's SEDAR profile at www.sedar.com and was

prepared in accordance with the requirements of NI 43-101. The 2022

FS indicated that La India Project hosts a high grade Mineral

Resource Estimate ("MRE") of 9,672 kt at 3.5g/t gold for 1,088,000

oz gold in the indicated mineral resource category and 8,642 kt at

4.3 g/t gold for 1,190,000 oz gold in the inferred mineral resource

category. The open pit MRE is 8,693 kt at 3.2 g/t gold for 893,000

oz gold in the indicated mineral resource category and 3,026 kt at

3.0 g/t gold for 291,000 oz gold in the inferred mineral resource

category. Total underground MRE is 979 kt at 6.2 g/t gold for

194,000 oz gold in the indicated mineral resource category and

5,615 kt at 5.0 g/t gold for 898,000 oz gold in the inferred

mineral resource category.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

("EP") for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold Project ("La India Project").

The EP is considered the master permit for mining operations in

Nicaragua. The Company has purchased a new semi autogenous Mill

("SAG Mill"), which has mainly arrived in Nicaragua. Site clearance

and preparation is at an advanced stage.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category. The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Other assets include approximately 1,000 hectares of land

purchased for the mine site infrastructure for circa US$4,200,000

and a new SAG Mill package purchased for US$6,500,000.

On 25 October 2021 Condor announced the filing of a Preliminary

Economic Assessment Technical Report ("PEA") for its La India

Project, Nicaragua on SEDAR https://www.sedar.com . The highlight

of the technical study is a post-tax, post upfront capital

expenditure NPV of US$418 million, with an IRR of 54 per cent and

12 month pay-back period, assuming a US$1,700 per oz gold price,

with average annual production of 150,000 oz gold per annum for the

initial nine years of gold production. The open pit mine schedules

have been optimised from designed pits, bringing higher grade gold

forward resulting in average annual production of 157,000 oz gold

in the first two years from open pit material and underground

mining funded out of cashflow. The Mineral Resource estimate and

associated Preliminary Economic Assessment contained in the PEA are

considered a historical estimate within the meaning of NI 43-101. A

qualified person has not done sufficient work to classify such

historical estimate as current, the Company is not treating the

historical Mineral Resource estimate and associated studies as

current, and the reader is cautioned not to rely upon this data as

such. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. The Company believes that the

historical Mineral Resource estimate and PEA are relevant to the

continuing development of the La India Project.

The 2022 FS was completed on La India vein set open pit only,

which has a MRE of 8,487 kt at 3.0g/t gold in for 827,000 oz gold

in the indicated mineral resource category and 893 Kt at 2.4 g/t

gold for 69,000 oz gold in the inferred mineral resource

category.

The Company's strategy has been to develop the fully permitted

La India Project in two stages using the new SAG Mill that has

already been purchased. The delivery of a Feasibility Study on La

India open pit with an average of 81,524 oz gold per annum for the

initial six years for a relatively low total upfront capital cost

of US$106,000,000 is a landmark and further de-risks the Project.

At US$1,600 oz gold, the La India open pit Mineral Reserve produces

total revenues of US$888,000,000, the total operating costs of

mining, process and G&A are US$480,000,000, leading to an

operating profit of US$408,000,000 or a 46 per cent operating

margin. After government and other royalties, but before sustaining

capital, the operating profit is US$355,000,000, which in Condor's

opinion is ample to repay any project debt on the relatively low

upfront capex. At US$2,000 oz gold after paying royalties, but

before sustaining capital the operating profit is US$563,000,000.

In reality, two permitted high grade feeder pits will be added

during the early years of production

thus increasing production ounces of gold. Early production is

targeted at 100,000 oz gold p.a..

The plan has been to materially expand production with a stage

two expansion by converting existing Mineral Resources into Mineral

Reserves and an associated integrated mine plan. On 25 October

2021, the Company announced the results of a Preliminary Economic

Assessment and filed on SEDAR a technical report entitled "Condor

Gold Technical Report on the La Indian Gold Project, Nicaragua,

2021" detailing average annual production of 150,000 oz of gold

over the initial 9 years of production from open pit and

underground Mineral Resources and provides an indication of a

production target. Outside the main La India open pit Mineral

Reserve, there are additional open pit Mineral Resources on four

deposits (America, Mestiza, Central breccia and Cacao) which

represent an aggregate 206 Kt at 9.9 g/t gold for 66,000 oz in the

indicated Mineral Resource category and 2.1Mt at 3.3 g/t gold for

223,000 oz gold in the inferred Mineral Resource category. In

addition, there is an aggregate underground Mineral Resource (La

India, America, Mestiza, Central Breccia San Lucas,

Cristalito-Tatescame, and Cacao) of 979Kt a 6.2 g/t for 194,000 oz

gold in the indicated Mineral Resource category and 5.6Mt at 5.0

g/t gold for 898,000 oz gold in the inferred Mineral Resource

category.

3. BACKGROUND TO AND REASONS FOR THE OPEN OFFER AND SUB-DIVISION

On 22 November 2022, the Company announced that the Board has

concluded that now is the right time to sell the assets of the

Company to a gold producer with mine building expertise, thus

ensuring a new mine at La India, a significant investment in the

local area and a regeneration of the local communities. The Company

has appointed Hannam and Partners to run the sales process.

On 28 November 2022, the Company announced that it had

successfully raised GBP1,000,000 (before expenses) through an issue

of Convertible Loan Notes, with warrants attached, to Galloway

Limited, an 18.7 per cent shareholder, which is wholly owned by

Burnbrae Group Limited which is, in turn, wholly owned by Jim

Mellon, the Company's chairman. The GBP1,000,000 financing provided

the Company with working capital and enables it to cover its short

term funding requirements.

On 28 November 2022 the Company also announced that it intended

to launch an open offer providing pre-emptive rights to Qualifying

Shareholders to subscribe for one New Ordinary Share for every six

Existing Ordinary Shares held at the Open Offer Record Date,

subject to shareholder approval of the Sub-Division. Galloway

Limited will not participate in the Open Offer, but the Convertible

Loan Notes will automatically convert into New Ordinary Shares at

the Issue Price if the Open Offer raises GBP1,000,000 before

expenses for the Company.

The equity markets have been difficult of late and the impact of

US sanctions as announced by the Company on 27 October 2022 delayed

a financing by the Company. The Board concluded that the fairest

and best way to finance the Company's operations is via existing

shareholders. It also considers it important that Shareholders have

an opportunity (where it is practicable for them to do so) to

subscribe for Open Offer Shares on the same terms as Galloway

Limited subscribed for the Convertible Loan Notes, but excluding

any entitlement to warrants. Therefore, the Company is making the

Open Offer to Qualifying Shareholders.

The Company expects that the proceeds of the Open Offer will

fund the Company through the sales process announced on 22 November

2022 and enable it to meet its short term liabilities, which

include working capital requirements at the Company's operations in

Nicaragua, and the payment of the balance of US$300,000 due for the

SAG Mill purchased by the Company from First Majestic Silver in

March 2021.

4. USE OF PROCEEDS OF THE OPEN OFFER

The net proceeds of the Open Offer will be used to fund the

Company through the sales process announced on 22 November 2022,

including to:

-- finance the working capital requirements at the Company's

operations in Nicaragua, including keeping concessions and permits

in good standing and re-registering title to land;

-- pay the balance of US$300,000 for the SAG Mill purchased by

the Company from First Majestic Silver;

-- cover head office expenses; and

-- cover interim expenses linked to the sales process.

5. DETAILS OF THE OPEN OFFER

The Company is making an Open Offer pursuant to which it may

raise a further amount of up to approximately GBP3,965,000 (before

expenses). The Issue Price per Open Offer Share is GBP0.15, which

is the same price as the price at which the Convertible Loan Notes

were issued to Galloway Limited, an 18.7 per cent shareholder which

is wholly owned by Burnbrae Group Limited which is, in turn, wholly

owned by Jim Mellon, Condor's Chairman, on 25 November 2022.

Subject to the fulfilment of the conditions set out below and in

Part IV of the Circular, Qualifying Shareholders may subscribe for

Open Offer Shares in proportion to their holding of Existing

Ordinary Shares held on the Open Offer Record Date. Shareholders

subscribing for their full entitlement under the Open Offer may

also request additional Open Offer Shares as an Excess Entitlement,

up to the total number of Open Offer Shares available to Qualifying

Shareholders under the Open Offer. The Open Offer is not

underwritten.

The Open Offer is conditional on, amongst other things, the

following conditions being satisfied:

-- the approval by shareholders of the Resolution at the EGM; and

-- admission of the Open Offer Shares becoming effective by 8.00

a.m. on or around 23 December 2022.

If these and the other conditions to the Open Offer are not

satisfied or waived (where capable of waiver), the Open Offer will

lapse and will not proceed and any applications made by Qualifying

Shareholders will be rejected. In these circumstances, application

monies received by the Receiving Agent in respect of Open Offer

Shares will be returned (at the applicant's sole risk), without

payment of interest, as soon as reasonably practicable thereafter.

Lapsing of the Open Offer cannot occur after dealings in the Open

Offer Shares have begun.

The Open Offer Shares to be issued pursuant to the Open Offer

will, when issued, rank pari passu in all respects with the New

Ordinary Shares, including the right to receive dividends and other

distributions declared following Admission.

Basic Entitlement

On, and subject to the terms and conditions of the Open Offer,

the Company invites Qualifying Shareholders to apply for their

Basic Entitlement of Open Offer Shares at the Issue Price. Each

Qualifying Shareholder's Basic Entitlement has been calculated on

the following basis:

One Open Offer Share for every six Existing Ordinary Shares held

at the Open Offer Record Date

Basic Entitlements will be rounded down to the nearest whole

number of Ordinary Shares.

Excess Entitlement

Qualifying Shareholders are also invited to apply for additional

Open Offer Shares (up to the total number of Open Offer Shares

available to Qualifying Shareholders under the Open Offer) as an

Excess Entitlement. Any Open Offer Shares not issued to a

Qualifying Shareholder pursuant to their Basic Entitlement will be

apportioned between those Qualifying Shareholders who have applied

for an Excess Entitlement at the sole and absolute discretion of

the Board, provided that no Qualifying Shareholder shall be

required to subscribe for more Open Offer Shares than he or she has

specified on the Application Form or through CREST.

The Open Offer Shares will, when issued and fully paid, rank

pari passu in all respects with the New Ordinary Shares in issue at

that time, including the right to receive all dividends and other

distributions declared, made or paid after the date of Admission of

the Open Offer Shares. The Open Offer is not underwritten.

If and to the extent that the Open Offer is not fully taken up

by Qualifying Shareholders, the Company may place any Open Offer

Shares that have not been subscribed for with non-Qualifying

Shareholders or institutional investors at the Issue Price.

Qualifying Shareholders should note that the Open Offer is not a

"rights issue". Invitations to apply under the Open Offer are not

transferable unless to satisfy bona fide market claims. Qualifying

non-CREST Shareholders should be aware that the Application Form is

not a negotiable document and cannot be traded. Qualifying

Shareholders should also be aware that in the Open Offer, unlike in

a rights issue, any Open Offer Shares not applied for will not be

sold in the market nor will they be placed for the benefit of

Qualifying Shareholders who do not apply for Open Offer Shares

under the Open Offer.

Overseas Shareholders

The Open Offer Shares have not been and are not intended to be

registered or qualified for sale in any jurisdiction other than the

United Kingdom. Accordingly, unless otherwise determined by the

Company and effected by the Company in a lawful manner, the

Application Form will not be sent to Shareholders with registered

addresses in, or who are resident or located in the United States

or any other Restricted Jurisdiction since to do so would require

compliance with the relevant securities laws of that jurisdiction.

The Company reserves the right to treat as invalid any application

or purported application for Open Offer Shares which appears to the

Company or its agents or professional advisers to have been

executed, effected or despatched in a manner which may involve a

breach of the laws or regulations of any jurisdiction or if the

Company or its agents or professional advisers believe that the

same may violate applicable legal or regulatory requirements or if

it provides an address for delivery of share certificates or

warrant certificates for Open Offer Shares outside the UK, or in

the case of a credit of Open Offer Shares in CREST, to a CREST

member whose registered address would not be in the UK.

Notwithstanding the foregoing and any other provision of the

Circular or the Application Form, the Company reserves the right to

permit any Shareholder to apply for Open Offer Shares if the

Company, in its sole and absolute discretion, is satisfied that the

transaction in question is exempt from, or not subject to, the

legislation or regulations giving rise to the restrictions in

question.

PART VI of the Circular together with the accompanying

Application Form, in the case of Qualifying non-CREST Shareholders,

contains the terms and conditions of the Open Offer. If a

Qualifying Shareholder does not wish to apply for Open Offer

Shares, THEY should not complete or return the Application Form or

send a USE message through CREST.

The Open Offer is not being made in Canada

The Open Offer is not being made in Canada or to Canadian

Shareholders and is not available for acceptance by any shareholder

in Canada.

Qualifying non-CREST Shareholders

If you are a Qualifying non-CREST Shareholder you will receive

an Application Form, which accompanies the Circular and which gives

details of your Basic Entitlement (as shown by the number of the

Open Offer Shares allocated to you). If you wish to apply for Open

Offer Shares under the Open Offer you should complete the

accompanying Application Form in accordance with the procedure for

application set out in paragraph 4 of Part IV of the Circular and

on the Application Form itself. The completed Application Form,

accompanied by full payment, should be returned by post to

Computershare Investor Services PLC, Corporate Actions Projects,

Bristol, BS99 6AH so as to arrive as soon as possible and in any

event no later than 11 a.m. on 20 December 2022.

Qualifying CREST Shareholders

Application will be made for the Open Offer Entitlements of

Qualifying CREST Shareholders to be credited to stock accounts in

CREST. It is expected that the Open Offer Entitlements will be

credited to stock accounts in CREST on 6 December 2022.

Applications through the CREST system may only be made by the

Qualifying CREST Shareholder originally entitled or by a person

entitled by virtue of a bona fide market claim. If you are a

Qualifying CREST Shareholder, no Application Form is enclosed but

you will receive credits to your appropriate stock account in CREST

in respect of the Basic Entitlements to which you are entitled. You

should refer to the procedure for application set out in paragraph

4 of Part IV of the Circular. The relevant CREST instruction must

have settled by no later than 11 a.m. on 20 December 2022.

6. RISK FACTORS

Potential investors are strongly advised to read Part II of the

Circular detailing the risks associated with an investment in the

Company. Set out below are two risks the Board would draw to any

potential investors' attention in particular:

Sales Process

Whilst the Company has launched a process to seek buyers for the

Company's assets as announced on 22 November 2022, there can be no

guarantee that such an offer will be forthcoming or that it will be

on terms that the Directors consider acceptable or could recommend

to Shareholders. If this process were to result in no acceptable

offers for the Company's assets, this could lead to the Company

having to consider its future strategy and, as such, Shareholders

may see a significant reduction in the value of the Company and

their interest therein.

Open Offer not Underwritten

There is no guarantee that Open Offer Shares will be taken up by

Shareholders and no part of the Open Offer has been underwritten.

As such, should the Company not raise any additional funds under

the Open Offer it expects to have sufficient cash resources

available to it until 31 January 2023; at such time it would

require further funding to meet its ongoing liabilities.

Furthermore, the Convertible Loan Notes issued to Galloway Limited

are, unless converted, due for repayment on 25 November 2023 and

therefore the Company would need to raise additional funding to

make the repayment or otherwise be in default of the terms of the

Convertible Loan Notes; such event could see a significant impact

on the value of the Company.

7. DETAILS OF THE SUB-DIVISION

The Sub-Division comprises the sub-division of each Existing

Ordinary Share into one New Ordinary Share and one Deferred

Share.

The rights attaching to the New Ordinary Shares will be

identical in all respects to those of the Existing Ordinary Shares,

including voting, dividend, return of capital and other rights. The

Deferred Shares shall have the rights set out in the

Resolution.

Application will be made 158,629,530 New Ordinary Shares to be

admitted to trading on AIM in place of the Existing Ordinary Shares

with admission expected to become effective at 8 a.m. on 23

December 2022. Subject to Shareholder approval of the Resolution,

it is expected that the Sub-Division will become effective on 22

December 2022. No application for Admission or listing on the TSX

will be made in respect of the Deferred Shares. Following the

Sub-Division, the ISIN Code and the SEDOL Code for the New Ordinary

Shares will be the same as for the Existing Ordinary Shares.

Existing share certi cates will continue to be valid following

the Sub-Division and no new share certi cates will be issued in

respect of the New Ordinary Shares. No share certi cates will be

issued in respect of the Deferred Shares.

Following the Sub-Division, all mandates and other instructions,

including communication preferences given to the Company by

Shareholders and in force at the Sub-Division Record Date shall,

unless and until revoked, be deemed to be valid and effective

mandates or instructions in relation to the New Ordinary

Shares.

Shareholders will not need to take any action in connection with

the Sub-Division. In Canada, Computershare Investor Services Inc.

will deliver the appropriate number of Deferred Shares to CDS

Clearing and Depository Services Inc. ("CDS") upon the

effectiveness of the Sub-Division for distribution to beneficial

owners whose shares are held through CDS. Such beneficial owners

who hold their Existing Ordinary Shares in an account with their

investment dealer or another intermediary will have their accounts

automatically updated to reflect the Sub-Division in accordance

with the applicable brokerage account providers' typical

procedures. The Deferred Shares will not be transferrable; as a

result, holders of Existing Ordinary Shares who sell or otherwise

transfer their New Ordinary Shares following the Sub-Division will

not be able to sell or otherwise transfer their Deferred

Shares.

8. ADMISSION, SETTLEMENT AND CREST

Application will be made to the London Stock Exchange for the

Open Offer Shares to be admitted to trading on AIM and the TSX has

conditionally approved the listing of the Open Offer Shares on the

TSX. It is expected that Admission of the Open Offer Shares will

become effective at 8 a.m. on 23 December 2022 and that dealings in

the Open Offer Shares will commence at that time.

No application for Admission to trading on AIM or for listing on

the TSX will be made in respect of the Deferred Shares arising on

the Sub-Division. Following the Sub-Division, the ISIN Code for the

New Ordinary Shares and the SEDOL Code will remain the same as for

the Existing Ordinary Shares.

The Articles permit the Company to issue shares in

uncertificated form. CREST is a computerised paperless share

transfer and settlement system which allows shares and other

securities to be held in electronic computerised paper form. The

Existing Ordinary Shares are already admitted to CREST and

therefore the Open Offer Shares will also be eligible for

settlement in CREST.

It is expected that the Open Offer Shares due to uncertificated

holders will be delivered in CREST on 23 December 2022.

9. OVERSEAS SHAREHOLDERS

The offer of Open Offer Shares and the distribution of the

Circular and the Application Form to persons who have registered

addresses in, or who are resident or ordinarily resident in, or

citizens of, or which are corporations, partnerships or other

entities created or organised under the laws of countries other

than the UK or to persons who are nominees of or custodians,

trustees or guardians for citizens, residents in or nationals of,

countries other than the UK may be affected by the laws or

regulatory requirements of the relevant jurisdictions. The Open

Offer is not being made in Canada or to Canadian shareholders and

is not available for acceptance by any shareholder in Canada.

Accordingly, any persons into whose possession the Circular

comes should inform themselves about and observe any applicable

restrictions or requirements. No action has been taken by the

Company that would permit possession or distribution of the

Circular in any jurisdiction where action for that purpose is

required. Any failure to comply with such restrictions or

requirements may constitute a violation of the securities laws of

any such jurisdiction.

10. ACTION TO BE TAKEN BY SHAREHOLDERS

You will find set out at the end of the Circular, a notice

convening an extraordinary general meeting to be held at the

Company's registered office address, 7/8 Innovation Place, Douglas

Drive, Godalming, Surrey GU7 1JX on 21 December 2022 at 11 a.m.

Shareholders may nd enclosed a Form of Proxy for use at the EGM.

The Form of Proxy should be completed and returned in accordance

with the instructions printed on it so as to arrive with the

Company Secretary at GBH Law Limited, 7/8 Innovation Place, Douglas

Drive, Godalming, Surrey GU7 1JX or by email to

condor2022@condorgold.com, or, for Canadian shareholders, to

Computershare Investor Services Inc., Attention: Proxy Department,

100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 Canada,

as soon as possible and in any event, no later than 11 a.m. on 19

December 2022.

In order for the Open Offer to proceed, Shareholders will need

to approve the Resolution. If the Resolution is not passed, the

Open Offer will not proceed with the result that the anticipated

net proceeds of the Open Offer will not become available to fund

the Company through its sales process and the Company could be

materially adversely affected as a result. Accordingly, it is

important that Shareholders vote in favour of the Resolution so the

Open Offer can proceed.

Qualifying non-CREST Shareholders wishing to apply for Open

Offer Shares or the Excess Open Offer Shares must complete the

enclosed Application Form in accordance with the instructions set

out in paragraph 4 of Part IV of the Circular and on the

accompanying Application Form and return it with the appropriate

payment to Computershare Investor Services PLC, Corporate Actions

Projects, Bristol, BS99 6AH, so as to arrive no later than 11 a.m.

on 20 December 2022.

If you do not wish to apply for any Open Offer Shares under the

Open Offer, you should not complete or return the Application Form.

If you are a Qualifying CREST Shareholder, no Application Form will

be sent to you. Qualifying CREST Shareholders will have Open Offer

Entitlements and Excess CREST Open Offer Entitlements credited to

their stock accounts in CREST. You should refer to the procedure

for application set out in paragraph 4 of Part IV of the Circular.

The relevant CREST instructions must have settled in accordance

with the instructions in paragraph 4 of Part IV of the Circular by

no later than 11 a.m. on 20 December 2022.

Qualifying CREST Shareholders who are CREST sponsored members

should refer to their CREST sponsors regarding the action to be

taken in connection with the Circular and the Open Offer.

11. RECOMMATION

The Board considers the Open Offer to be in the best interests

of the Company and its Shareholders as a whole. Accordingly, the

Board unanimously recommends that Shareholders vote in favour of

the Resolution at the EGM, as the Directors intend to do so in

respect of their own bene cial holdings of the Company's Ordinary

Shares, representing approximately 21.5 per cent. of the Company's

Existing Ordinary Shares.

- Ends -

For further information please visit www.condorgold .com or

contact:

Condor Gold plc Mark Child, CEO

+44 (0) 20 7493 2784

Beaumont Cornish Limited Roland Cornish and James Biddle

+44 (0) 20 7628 3396

SP Angel Corporate Finance Ewan Leggat

LLP +44 (0) 20 3470 0470

H&P Advisory Limited Andrew Chubb and Nilesh Patel

+44 207 907 8500

Adelaide Capital (Investor Deborah Honig

Relations) +1-647-203-8793

APPIX - TIMETABLE

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date and time for entitlements 6 p.m. on 1 December

under the Open Offer 2022

Canadian Record Date for Extraordinary 6 p.m. on 1 December

General Meeting 2022

Existing Ordinary Shares marked ' ex' 8.00 a.m. on 5 December

by London Stock Exchange 2022

Announcement of the Open Offer 7 a.m. on 5 December

2022

Posting of Circular, Forms of Proxy and 5 December 2022

Application Forms

Basic Entitlements and Excess Open Offer As soon as possible

Entitlements credited to stock accounts after 8 a.m. on 6 December

in CREST of Qualifying CREST Shareholders 2022

Recommended latest time for requesting 4.30 p.m. on 14 December

withdrawal of Basic Entitlements and 2022

Excess Open Offer Entitlements from CREST

Latest time and date for depositing Open 3p.m. on 15 December

Offer Entitlements and Excess Entitlements 2022

into CREST

Latest time and date for splitting Application 3 p.m. on 16 December

Forms (to satisfy bona fide market claims 2022

only)

Latest time and date for receipt of 11 a.m. on 19 December

Forms of Proxy 2022

Latest time and date for receipt of 11a.m. on 20 December

completed Application Forms and payment 2022

in full under the Open Offer or settlement

of relevant CREST instructions (as appropriate)

Extraordinary General Meeting 11 a.m. on 21 December

Record Date for the Sub-Division 6 p.m. on 21 December

2022

Announcement of result of Open Offer 21 December 2022

and EGM Voting Results

Effective Date of the Sub-Division 22 December 2022

Admission and commencement of dealings 8.00 a.m. on 23 December

Open Offer Shares on AIM 2022

CREST accounts expected to be credited 23 December 2022

for the Open Offer Shares to be held

in uncertificated form

Latest date for posting of share certificates 9 January 2022

for the Open Offer Shares in certificated

form

Notes: Each of the times and dates referred to above and where

used elsewhere in this Announcement refer to GMT (unless otherwise

stated) and are subject to change by the Company, in which case

details of the new times and dates will be notified to the London

Stock Exchange and the Company will make an appropriate

announcement through a Regulatory Information Service.

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed

on the TSX in January 2018. The Company is a gold exploration and

development company with a focus on Nicaragua.

The Company's principal asset is La India Project, Nicaragua,

which comprises of a large, highly prospective land package of 588

sq km comprising of 12 contiguous and adjacent concessions. The

Company has filed a feasibility study technical report dated 25

October 2022 and entitled "Condor Gold Technical Report on the La

India Gold Project, Nicaragua, 2022" (the "2022 FS") which is

available on the Company's SEDAR profile at www.sedar.com and was

prepared in accordance with the requirements of NI 43-101. The 2022

FS indicated that La India Project hosts a high grade Mineral

Resource Estimate ("MRE") of 9,672 kt at 3.5g/t gold for 1,088,000

oz gold in the indicated mineral resource category and 8,642 kt at

4.3 g/t gold for 1,190,000 oz gold in the inferred mineral resource

category. The open pit MRE is 8,693 kt at 3.2 g/t gold for 893,000

oz gold in the indicated mineral resource category and 3,026 kt at

3.0 g/t gold for 291,000 oz gold in the inferred mineral resource

category. Total underground MRE is 979 kt at 6.2 g/t gold for

194,000 oz gold in the indicated mineral resource category and

5,615 kt at 5.0 g/t gold for 898,000 oz gold in the inferred

mineral resource category.

The 2022 FS replaces the previously reported Preliminary

Economic Assessment ("PEA") as presented in the Technical Report

filed on SEDAR in October 2021 as the current technical report for

the La India project.

The 2021 PEA considered the expanded Project inclusive of the

exploitation of the Mineral Resources associated to the La India,

Mestiza, America and Central Breccia deposits. The strategic study

covers two scenarios: Scenario A, in which the mining is undertaken

from four open pits, termed La India, America, Mestiza and Central

Breccia Zone ("CBZ"), which targets a plant feed rate of 1.225

million tonnes per annum ("Mtpa"); and Scenario B, where the mining

is extended to include three underground operations at La India,

America and Mestiza, in which the processing rate is increased to

1.4 Mtpa. The 2021 PEA Scenario B presented a post-tax, post

upfront capital expenditure NPV of US$418 million, with an IRR of

54% and 12 month pay-back period, assuming a US$1,700 per oz gold

price, with average annual production of 150,000 oz gold per annum

for the initial 9 years of gold production. The open pit mine

schedules were optimised from designed pits, bringing higher grade

gold forward resulting in average annual production of 157,000 oz

gold in the first 2 years from open pit material and underground

mining funded out of cashflow. The 2021 PEA Scenario A presented a

post-tax, post upfront capital expenditure NPV of US$302 million,

with an IRR of 58% and 12 month pay-back period, assuming a

US$1,700 per oz gold price, with average annual production of

approximately 120,000 oz gold per annum for the initial 6 years of

gold production. The Mineral Resource estimate and associated

Preliminary Economic Assessment contained in the 2021 PEA are

considered a historical estimate within the meaning of NI 43-101, a

qualified person has not done sufficient work to classify such

historical estimate as current, and the Company is not treating the

historical Mineral Resource estimate and associated studies as

current, and the reader is cautioned not to rely upon this data as

such. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. The Company believes that the

historical Mineral Resource estimate and Preliminary Economic

assessment is relevant to the continuing development of the La

India Project.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

("EP") for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold Project ("La India Project").

The EP is considered the master permit for mining operations in

Nicaragua. Condor has purchased a new SAG Mill, which has mainly

arrived in Nicaragua. Site clearance and preparation is at an

advanced stage.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category. The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Following the permitting of the Mestiza and America open pits,

together with the La India open pit Condor has 1.12 M oz gold open

pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

TSX Matters

For the purposes of TSX approvals in connection with the Open

Offer, the Company is relying on the exemption set forth in Section

602.1 of the TSX Company Manual, which provides that the TSX will

not apply its standards to certain transactions involving "eligible

interlisted issuers" such as Condor whose shares are also listed on

a recognized exchange such as AIM.

Qualified Persons

The technical and scientific information in this press release

has been reviewed, verified and approved by Andrew Cheatle, P.Geo.,

a director of Condor Gold plc, and Gerald D. Crawford, P.E., the

Chief Technical Officer of Condor Gold plc, each of whom is a

"qualified person" as defined by NI 43-101.

Important Notice(s)

Forward Looking Statements

All statements in this press release, other than statements of

historical fact, are 'forward-looking information' with respect to

the Company within the meaning of applicable securities laws,

including statements with respect to the open offer and the

potential conversion of the Convertible Loan Notes; the subdivision

of the Company's existing ordinary shares and the meeting of

shareholders to approve such subdivision; future development and

production plans, projected capital and operating costs, mine life

and production rates, metal or mineral recovery estimates, Mineral

Resource, Mineral Reserve estimates at the La India Project, the

potential to convert Mineral Resources into Mineral Reserves; and

the Company's strategic plans and ongoing sales process.

Forward-looking information is often, but not always, identified by

the use of words such as: "seek", "anticipate", "plan", "continue",

"strategies", "estimate", "expect", "project", "predict",

"potential", "targeting", "intends", "believe", "potential",

"could", "might", "will" and similar expressions. Forward-looking

information is not a guarantee of future performance and is based

upon a number of estimates and assumptions of management at the

date the statements are made including, among others, assumptions

regarding: future commodity prices and royalty regimes;

availability of skilled labour; timing and amount of capital

expenditures; future currency exchange and interest rates; the

impact of increasing competition; general conditions in economic

and financial markets; availability of drilling and related

equipment; effects of regulation by governmental agencies; the

receipt of required permits; royalty rates; future tax rates;

future operating costs; availability of future sources of funding;

ability to obtain financing and assumptions underlying estimates

related to adjusted funds from operations. Many assumptions are

based on factors and events that are not within the control of the

Company and there is no assurance they will prove to be

correct.

Such forward-looking information involves known and unknown

risks, which may cause the actual results to be materially

different from any future results expressed or implied by such

forward-looking information, including, risks related to: mineral

exploration, development and operating risks; estimation of

mineralisation and resources; environmental, health and safety

regulations of the resource industry; competitive conditions;

operational risks; liquidity and financing risks; funding risk;

exploration costs; uninsurable risks; conflicts of interest; risks

of operating in Nicaragua; government policy changes; ownership

risks; permitting and licencing risks; artisanal miners and

community relations; difficulty in enforcement of judgments; market

conditions; stress in the global economy; current global financial

condition; exchange rate and currency risks; commodity prices;

reliance on key personnel; dilution risk; payment of dividends; as

well as those factors discussed under the heading "Risk Factors" in

the Company's annual information form for the fiscal year ended

December 31, 2021 dated March 29, 2022 and available under the

Company's SEDAR profile at www.sedar.com .

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that such information will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. The Company disclaims any intention

or obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise

unless required by law.

Beaumont Cornish Limited, which is authorised and regulated in

the United Kingdom by the FCA, is acting as Nominated Adviser

exclusively for the Company and no one else in connection with the

contents of this Announcement and will not regard any other person

(whether or not a recipient of this Announcement) as its client in

relation to the contents of this Announcement nor will it be

responsible to anyone other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the contents of this Announcement. Apart from the

responsibilities and liabilities, if any, which may be imposed on

Beaumont Cornish by the Financial Services and Markets Act 2000, as

amended or the regulatory regime established thereunder, Beaumont

Cornish accepts no responsibility whatsoever, and makes no

representation or warranty, express or implied, as to the contents

of this Announcement including its accuracy, completeness or

verification or for any other statement made or purported to be

made by it, or on behalf of it, the Company or any other person, in

connection with the Company and the contents of this Announcement,

whether as to the past or the future. Beaumont Cornish accordingly

disclaims all and any liability whatsoever, whether arising in

tort, contract or otherwise (save as referred to above), which it

might otherwise have in respect of the contents of this

Announcement or any such statement. The responsibilities of

Beaumont Cornish as the Company's Nominated Adviser under the AIM

Rules for Companies and the AIM Rules for Nominated Advisers are

owed solely to the London Stock Exchange and are not owed to the

Company or to any director or shareholder of the Company or any

other person, in respect of its decision to acquire shares in the

capital of the Company in reliance on any part of this

Announcement, or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURDZLFBLLLEFBB

(END) Dow Jones Newswires

December 05, 2022 02:00 ET (07:00 GMT)

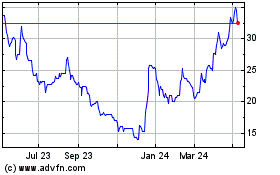

Condor Gold (LSE:CNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

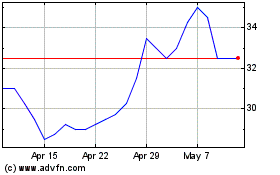

Condor Gold (LSE:CNR)

Historical Stock Chart

From Nov 2023 to Nov 2024