TIDMCNR

RNS Number : 7155G

Condor Gold PLC

21 July 2023

Condor Gold plc

7/8 Innovation Place

Douglas Drive

Godalming

Surrey

GU7 1JX

Tel: +44 (0) 207 493 2784

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION (EU) 596/2014 AS IT FORMS PART OF DOMESTIC LAW IN THE

UNITED KINGDOM BY VIRTUE OF THE EU (WITHDRAWAL) ACT 2018

("MAR").

21 July 2023

Condor Gold Plc

("Condor" or the "Company")

Condor Gold Provides an Update on the Sale of Assets

On 22 November 2022, Condor Gold (AIM: CNR; TSX: COG) announced

that following a robust and economically attractive Bankable

Feasibility Study, also known as a Feasibility Study, on the La

India open pit, it appointed H&P Advisory Limited (Hannam and

Partners) to seek a buyer for the assets of the Company. The last

update on the sale of the Company's assets was via an RNS on 13

March 2023. The current status is that the Company has received

five non-binding offers and three site visits have been completed.

There are currently eight companies under under Non-Disclosure

Agreements (NDA). Additional enquires have been received in the

past 2 weeks.

Mark Child, Chief Executive of Condor Gold, commented:

"There remains substantial interest from gold producers to

acquire the Company's assets. Wholly owned, fully permitted,

construction ready gold mines with potential production of 150,000

oz gold per annum, in major Gold Districts, with the land and a new

SAG Mill package purchased and a construction period of only 18

months are rare. There are currently eight companies under NDAs,

five non binding offers received and three site visits completed.

Companies under NDAs have access to a virtual data room, which

includes all drill data, technical studies to Feasibility Study

level, details of permits to construct and operate a mine and

financial models. While the sales process is taking longer than

anticipated, new enquires continue to be received, the Board is

confident that a binding agreement will be reached. Investors will

be updated in due course."

Cautionary Statement: Investors should note that, whilst the

Board is encouraged by the process to date, there can be no

guarantee that the Company will complete the sale of its

assets.

- Ends -

For further information please visit www.condorgold.com or

contact:

Condor Gold plc Mark Child, CEO

+44 (0) 20 7493 2784

Beaumont Cornish Limited Roland Cornish and James Biddle

+44 (0) 20 7628 3396

SP Angel Corporate Finance Ewan Leggat

LLP +44 (0) 20 3470 0470

H&P Advisory Limited Andrew Chubb, Matt Hasson, Jay Ashfield

+44 207 907 8500

Adelaide Capital (Investor Deborah Honig

Relations) +1-647-203-8793

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed

on the TSX in January 2018. The Company is a gold exploration and

development company with a focus on Nicaragua.

The Company's principal asset is La India Project, Nicaragua,

which comprises of a large, highly prospective land package of 588

sq km comprising of 12 contiguous and adjacent concessions. The

Company has filed a feasibility study technical report dated 25

October 2022 and entitled "Condor Gold Technical Report on the La

India Gold Project, Nicaragua, 2022" (the " 2022 FS ") which is

available on the Company's SEDAR profile at www.sedar.com and was

prepared in accordance with the requirements of NI 43-101. The 2022

FS indicated that La India Project hosts a high grade Mineral

Resource Estimate ("MRE") of 9,672 kt at 3.5g/t gold for 1,088,000

oz gold in the indicated mineral resource category and 8,642 kt at

4.3 g/t gold for 1,190,000 oz gold in the inferred mineral resource

category. The open pit MRE is 8,693 kt at 3.2 g/t gold for 893,000

oz gold in the indicated mineral resource category and 3,026 kt at

3.0 g/t gold for 291,000 oz gold in the inferred mineral resource

category. Total underground MRE is 979 kt at 6.2 g/t gold for

94,000 oz gold in the indicated mineral resource category and 5,615

kt at 5.0 g/t gold for 98,000 oz gold in the inferred mineral

resource category.

The 2022 FS replaces the previously reported Preliminary

Economic Assessment (" PEA ") as presented in the Technical Report

filed on SEDAR in October 2021 as the current technical report for

the La India project.

The 2021 PEA considered the expanded Project inclusive of the

exploitation of the Mineral Resources associated to the La India,

Mestiza, America and Central Breccia deposits. The strategic study

covers two scenarios: Scenario A, in which the mining is undertaken

from four open pits, termed La India, America, Mestiza and Central

Breccia Zone ("CBZ"), which targets a plant feed rate of 1.225

million tonnes per annum ("Mtpa"); and Scenario B, where the mining

is extended to include three underground operations at La India,

America and Mestiza, in which the processing rate is increased to

1.4 Mtpa. The 2021 PEA Scenario B presented a post-tax, post

upfront capital expenditure NPV of US$418 million, with an IRR of

54% and 12 month pay-back period, assuming a US$1,700 per oz gold

price, with average annual production of 150,000 oz gold per annum

for the initial 9 years of gold production. The open pit mine

schedules were optimised from designed pits, bringing higher grade

gold forward resulting in average annual production of 157,000 oz

gold in the first 2 years from open pit material and underground

mining funded out of cashflow. The 2021 PEA Scenario A presented a

post-tax, post upfront capital expenditure NPV of US$302 million,

with an IRR of 58% and 12 month pay-back period, assuming a

US$1,700 per oz gold price, with average annual production of

approximately 120,000 oz gold per annum for the initial 6 years of

gold production. The Mineral Resource estimate and associated

Preliminary Economic Assessment contained in the 2021 PEA are

considered a historical estimate within the meaning of NI 43-101, a

qualified person has not done sufficient work to classify such

historical estimate as current, and the Company is not treating the

historical Mineral Resource estimate and associated studies as

current, and the reader is cautioned not to rely upon this data as

such. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. The Company believes that the

historical Mineral Resource estimate and Preliminary Economic

assessment is relevant to the continuing development of the La

India Project.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

("EP") for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold Project ("La India Project").

The EP is considered the master permit for mining operations in

Nicaragua. Condor has purchased a new SAG Mill, which has mainly

arrived in Nicaragua. Site clearance and preparation is at an

advanced stage.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category. The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Following the permitting of the Mestiza and America open pits,

together with the La India open pit Condor has 1.12 M oz gold open

pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

Qualified Persons

The technical and scientific information in this press release

has been reviewed, verified and approved by Andrew Cheatle, P.Geo.,

a director of Condor Gold plc, and Gerald D. Crawford, P.E., the

Chief Technical Officer of Condor Gold plc, each of whom is a

"qualified person" as defined by NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of

historical fact, are 'forward-looking information' with respect to

the Company within the meaning of applicable securities laws,

including statements with respect to: future development and

production plans, projected capital and operating costs, mine life

and production rates, metal or mineral recovery estimates, Mineral

Resource, Mineral Reserve estimates at the La India Project, the

potential to convert Mineral Resources into Mineral Reserves. the

Company's plans to sell the assets of the Company or seek

alternatives to an asset sale and the construction timeline of the

La India project upon receipt of financing. Forward-looking

information is often, but not always, identified by the use of

words such as: "seek", "anticipate", "plan", "continue",

"strategies", "estimate", "expect", "project", "predict",

"potential", "targeting", "intends", "believe", "potential",

"could", "might", "will" and similar expressions. Forward-looking

information is not a guarantee of future performance and is based

upon a number of estimates and assumptions of management at the

date the statements are made including, among others, assumptions

regarding: future commodity prices and royalty regimes;

availability of skilled labour; timing and amount of capital

expenditures; future currency exchange and interest rates; the

impact of increasing competition; general conditions in economic

and financial markets; availability of drilling and related

equipment; effects of regulation by governmental

agencies; the receipt of required permits; royalty rates; future

tax rates; future operating costs; availability of future sources

of funding; ability to obtain financing and assumptions underlying

estimates related to adjusted funds from operations. Many

assumptions are based on factors and events that are not within the

control of the Company and there is no assurance they will prove to

be correct.

Such forward-looking information involves known and unknown

risks, which may cause the actual results to be materially

different from any future results expressed or implied by such

forward-looking information, including, risks related to: mineral

exploration, development and operating risks; estimation of

mineralisation and resources; environmental, health and safety

regulations of the resource industry; competitive conditions;

operational risks; liquidity and financing risks; funding risk;

exploration costs; uninsurable risks; conflicts of interest; risks

of operating in Nicaragua; government policy changes; ownership

risks; permitting and licencing risks; artisanal miners and

community relations; difficulty in enforcement of judgments; market

conditions; stress in the global economy; current global financial

condition; exchange rate and currency risks; commodity prices;

reliance on key personnel; dilution risk; payment of dividends; as

well as those factors discussed under the heading "Risk Factors" in

the Company's annual information form for the fiscal year ended

December 31, 2021 dated March 29, 2022 and available under the

Company's SEDAR profile at www.sedar.com .

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that such information will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. The Company disclaims any intention

or obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise

unless required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFVRDLIIFIV

(END) Dow Jones Newswires

July 21, 2023 02:00 ET (06:00 GMT)

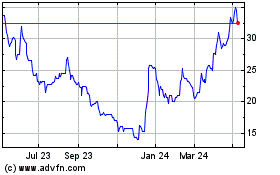

Condor Gold (LSE:CNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

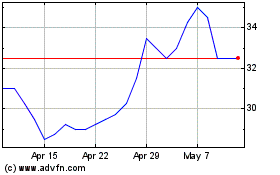

Condor Gold (LSE:CNR)

Historical Stock Chart

From Apr 2023 to Apr 2024