Issue of Debt

September 29 2010 - 12:00PM

UK Regulatory

TIDMCOD

RNS Number : 5565T

Compagnie de Saint-Gobain

29 September 2010

September 29, 2010

SUCCESSFUL BOND EXCHANGE AND BOND BUYBACK

Compagnie de Saint-Gobain has successfully placed EUR750 million worth of 4.00%

bonds due 2018.The issue proceeds will be used to refinance EUR634 million in

outstanding bonds maturing in 2013 and 2014 (with coupons ranging from 6.00% to

8.25%). In addition, to optimize use of cash reserves, Saint-Gobain will buy

back EUR323 million worth of 4.25% bonds due 2011.

These transactions will enable Saint-Gobain to extend and smooth its bond debt

maturity profile, by reducing the 2013 and 2014 maturities by EUR320 million and

EUR314 million respectively and substituting a new EUR750 million maturity in

2018. They will also reduce the average cost of the Group's debt.

The transactions are being carried out as follows:

- Compagnie de Saint-Gobain today placed EUR750 million worth of 4.00% bonds due

October 2018. The new issue attracted considerable investor interest, with the

order book reaching more than EUR2 billion in the space of one hour, allowing the

transaction to be finalized very quickly on attractive terms.

- BNP Paribas today concluded the buyback offer launched on September 22, 2010

for Saint-Gobain 4.25% bonds due May 2011 (EUR1,100 million nominal amount), 6.00%

bonds due May 2013 (EUR750 million nominal amount), 7.25% bonds due September 2013

(EUR750 million nominal amount) and 8.25% bonds due July 2014 (EUR1,000 million

nominal amount). Investors responded favorably by tendering an average of nearly

27% of the issues to the offer.

- Compagnie de Saint-Gobain will deliver to BNP Paribas the latest bond issue

plus a cash sum in settlement of the bonds bought back by the bank.

The success of this transaction is a further demonstration of bond investors'

confidence in the credit quality of Saint-Gobain, whose long-term debt issues

are rated BBB by Standard & Poor's and Baa2 by Moody's.

BNP Paribas (global coordinator and lead structuring advisor), JP Morgan

(structuring advisor), Citi, HSBC, The Royal Bank of Scotland and Société

Générale CIB acted as lead managers for this transaction.

About Saint-Gobain

Saint-Gobain, a worldwide leader in the habit and construction markets, designs,

manufactures and distributes building materials, providing innovative solutions

in expanding emerging markets and in the buoyant energy efficiency and

environmental protection segments. With EUR37.8 billion of sales in 2009,

Saint-Gobain is present in 64 countries and employs over 190,000 people.

+------------------------+---------------------------+

| | |

| Press relations | Analyst/Investor |

| | relations |

| | |

+------------------------+---------------------------+

| | |

| | Florence TRIOU-TEIXERA |

| Sophie CHEVALLON | +33 1 47 62 45 19 |

| +33 1 47 62 30 48 | Etienne HUMBERT |

| | +33 1 47 62 30 49 |

| | Vivien DARDEL |

| | +33 1 47 62 44 29 |

| | |

+------------------------+---------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODKKCDPABKDCCB

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

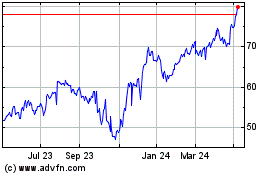

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024