TIDMCORO

RNS Number : 4399N

Coro Energy PLC

25 September 2023

25 September 2023

Coro Energy Plc

("Coro" or the "Company" and together with its subsidiaries the

"Group")

Half Year Report

Coro Energy PLC, the South East Asian energy company with a

natural gas and clean energy portfolio, announces its unaudited

interim results for the six-month period ended 30 June 2023.

Highlights

Results

-- Reduced loss after tax from continuing operations of $2.5m

(restated H1 2022: $3.8m) mainly due to the contribution of gross

profit from Vietnam operations and a reduction in net finance

expense. Total loss further reduced to $2.3m (restated H1 2022:

$3.0m) if gain for the period from discontinued Italy operations of

$0.2m is included.

-- Coro has a strong funding position from a combination of its

cash position of approximately US$0.7m (as at 30 June 2023), and

more recently supported by the post balance sheet events of the

sale of shares in ion Ventures Holding Ltd and a further advance of

Italy sale proceeds.

Operational

Gas

Italy

-- Coro signed a Sale and Purchase Agreement ("SPA") for the

disposal of its Italian natural gas assets (the "Italian

Portfolio") to Zodiac Energy plc ("Zodiac" or the "buyer") by way

of the sale of the entire issued share capital of Coro Europe

Limited for a total consideration of up to EUR 7.5M, including

contingent payments of up to an aggregate of EUR 1.5M through a 10%

net profit interest ("NPI") in the Italian Portfolio over the three

years from the date of completion of any disposal of the Italian

Portfolio. An initial cash payment of EUR 1.5M was received.

Following the interim period an Addendum to the Sale and Purchase

Agreement ("SPA") of the Italian Portfolio whereby Zodiac agreed to

make a further cash advance of EUR 0.7M. Coro has agreed to reduce

the sum due at completion by the further cash advance and an

additional EUR 0.14m. The total potential consideration for the

transaction is now therefore EUR 7.4M from the previous EUR

7.5M.

Indonesia

-- The operator of the Duyung PSC continues to make steady

progress commercially derisking the Mako gas field and preparing

for Final Investment Decision ("FID"). During the period t he

Operator Conrad advised of negotiation of key terms of the Mako gas

sales agreement between a Singaporean buyer and the Indonesian

regulator (SKKMigas).

-- In addition Conrad engaged a global investment bank to lead a

farm-down process for the divestment of a portion of its interest

in the Duyung Production Sharing Contract. Coro, which holds a

15.0% interest in the Duyung PSC, may participate pro rata in the

farm-down process as various drag and tag-along clauses exist in

the Joint Operating Agreement. Coro may also entertain a full exit,

depending on the terms offered.

Renewables

Vietnam

-- The 3MW solar rooftop project has been operational since

October 2022 and generated revenue of US$116,000 during the first

six months of 2023.

-- Coro announced the acquisition of a 2.39MW rooftop solar

portfolio from the shareholders of KIMY Trading and Service JSC

("KIMY"). The total acquisition price is US$1.3 million (US$543/MW)

with Coro assuming US$600,000 of existing specialist renewables

debt with a Vietnamese bank and the remainder of the consideration

in cash and shares.

-- Following the interim period Coro reported advanced talks

with Capton Energy regarding possible co-investment solutions for

Coro's 50MW pipeline of Vietnamese rooftop solar projects. Capton

Energy, based in Dubai, is a joint venture between Siemens

Financial Services and Desert Technologies.

Philippines

-- Coro has two development stage renewables projects in the

Oslob onshore area of Cebu in the Philippines, a 100MW solar

project and a 100MW wind project. The Company is currently focused

on securing land access alongside regulatory permits and approvals,

securing offtake arrangements, and data gathering at the proposed

sites.

-- Coro originally had a right to 80% of the dividends from the

Philippines projects and this was restructured to achieve 88% of

dividends.

-- The application for the Philippines Department of Energy's

Wind Energy Service Contract ("WESC") in respect of the wind

project was approved and a WESC was formally awarded.

Corporate

-- Coro announced on 24 August 2023 the sale of its 18.76%

shareholding in ion Ventures Holdings Ltd ("ion") to SLT1 LLC a

privately owned entity based in the USA for a cash consideration of

GBP1.25 million ($1.59 million), of which GBP1 million was paid

immediately, and the remaining GBP250,000 will be paid by the 31

March 2024.

-- Naheed Memon and Tom Richardson were appointed as independent

non-executive directors of the Company.

For further information please contact:

Coro Energy plc Via Vigo Consulting Ltd

James Parsons, Executive Chairman

Ewen Ainsworth, Chief Financial Officer

Cavendish Securities plc (Nominated Tel: 44 (0)20 7220 0500

Adviser)

Adrian Hadden

Ben Jeynes

Vigo Consulting (IR/PR Advisor) Tel: 44 (0)20 7390 0230

Patrick d'Ancona

Finlay Thomson

WH Ireland (Broker) Tel: 44 (0)20 7220 1670 / 44

Harry Ansell (0)113 946 618

Katy Mitchell

Gneiss Energy Limited (Financial Advisor) Tel: 44 (0)20 3983 9263

Jon Fitzpatrick

Doug Rycroft

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation 596/2014 which is

part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

STATEMENT FROM THE CHAIRPERSON

Coro's strategy remains to monetise the Duyung PSC through the

operator's farm-out process, repay or restructure our corporate

debt, complete the sale of our Italian assets, and then

strategically invest to grow our South East Asian renewables

business. The Company is also seeking to secure new opportunities

in South East Asia, which will assist the regional transition away

from its over-reliance on coal while meeting its significant and

growing energy demand.

Consistent with this strategy, Coro continues to make

operational progress across all aspects of the business. Recently,

this has included securing a Gas Sales Agreement Heads at the

Company's flagship Indonesian gas asset, securing a Wind Energy

Services Contract and ordering a Met Mast in the Philippines

renewables business, commencing detailed negotiations following

receipt of an indicative offer to fund our Vietnamese rooftop solar

business and providing additional near term funding with both the

sale of our Italian gas assets and our interest in IoN Ventures

Limited. The IoN Ventures investment was sold at a 2.5 times

premium to the original investment, some two years prior.

We see the Company's renewables portfolio, spanning Utility

Scale wind and solar in the Philippines and Commercial and

Industrial (C&I) rooftop solar in Vietnam, as both the future

of our business and an important part of the energy mix in South

East Asia. The opportunities to accelerate growth in both countries

are significant and we believe the window to position Coro as one

of the first movers in this space remains open.

It is in this context that we are delighted to present our

interim report to shareholders.

Gas

Italy

As announced on 27 March 2023 Coro signed a Sale and Purchase

Agreement ("SPA") for the disposal of its Italian natural gas

assets to Zodiac Energy plc by way of the sale of the entire issued

share capital of Coro Europe Limited for a total consideration of

up to EUR 7.5M, including contingent payments of up to an aggregate

of EUR 1.5M through a 10% net profit interest ("NPI") in the

Italian Portfolio over the three years from the date of completion

of any disposal of the Italian Portfolio. To date, Coro has

received a cash advance on the total consideration of EUR 2.5M

subject to confirmation of the normal regulatory approvals for the

transaction.

Indonesia

The Mako gas field is one of the largest gas discoveries (437

Bcf gross, full field) 2C (contingent recoverable resources) in the

West Natuna Basin and, the Directors believe, the largest confirmed

undeveloped resource in the area.

The Operator of the Duyung PSC is West Natuna Exploration Ltd

("WNEL"), a 100%-owned subsidiary of Conrad Asia Energy Ltd, and

has continued to technically mature the development of the Mako gas

field alongside negotiations of a GSA, both in preparation for

FID.

Coro announced on 12 September 2023 that the operator of the

Duyung PSC had signed a non-binding Term Sheet with Sembcorp Gas

Pte. Ltd. for a long-term gas sales agreement for the Mako gas

field. Critically, the Term Sheet has been endorsed by the

Indonesian petroleum upstream regulator, SKK Migas. The Operator

has indicated finalisation of a GSA and FID before the end of Q4

2023.

During 2023 the Operator has engaged a global investment bank to

lead a farm-down process for the divestment of a portion of its

interest in the Duyung Production Sharing Contract. Coro, which

holds a 15.0% interest in the Duyung PSC, may participate pro rata

in the farm-down process as various drag and tag along clauses

exist in the Joint Operating Agreement. Coro may also entertain a

full exit, depending on the terms offered.

Renewables

Vietnam

On 11 April 2022, Coro announced the entry into a 25-year PPA

for its first rooftop solar project in Vietnam.

The PPA was entered into by Coro Renewables Vietnam (85% owned

by Coro and 15% owned by Coro's local partner Vinh Phuc Energy JSC)

and Phong Phu, a listed Vietnamese high volume manufacturer of

textiles, who will purchase up to 3MW of electricity annually.

The 3MW solar rooftop project has been operational since October

2022 and generated revenue of US$116,000 during the first six

months of 2023.

On 15 June 2023, Coro announced the acquisition of a 2.39MW

rooftop solar portfolio from the shareholders of KIMY Trading and

Service JSC ("KIMY"). The total acquisition price is US$1.3 million

(US$543/MW) with Coro assuming US$600,000 of existing specialist

renewables debt with a Vietnamese bank and the remainder of the

consideration in cash and shares.

Coro continues to evaluate further solar projects in

Vietnam.

Philippines

Coro has two development stage renewables projects in the Oslob

onshore area of Cebu in the Philippines, a 100MW solar project and

a 100MW wind project. The Company is currently focused on securing

land access alongside regulatory permits and approvals, securing

offtake arrangements, and data gathering at the proposed sites.

Coro originally had a right to 80% of the dividends from the

Philippines projects and this was restructured to achieve 88% of

dividends.

The application for the Philippines Department of Energy's Wind

Energy Service Contract ("WESC") in respect of the wind project was

approved and a WESC was formally awarded.

Coro continues to evaluate further wind and solar projects in

the Philippines.

Corporate

Coro has a strong funding position from a combination of its

cash position of approximately US$0.7m (as at 30 June 2023), and

more recently supported by the post balance sheet events of the

sale of shares in ion Ventures Holding Ltd (receipt of GBP1m in

cash) and a further advance of Italy sale proceeds (receipt of EUR

0.7M in cash).

Naheed Memon was appointed as an independent non-executive

director of the Company.

Post Reporting Period

Indonesia

As already mentioned Coro announced on 12 September 2023 that

the operator of the Duyung PSC had signed a non-binding Term Sheet

with Sembcorp Gas Pte. Ltd. for a long-term gas sales agreement for

the Mako gas field. Critically, the Term Sheet has been endorsed by

the Indonesian petroleum upstream regulator, SKK Migas. The

Operator has indicated finalisation of a GSA and FID before the end

of Q4 2023.

Italy

An Addendum to the Sale and Purchase Agreement ("SPA") of the

Italian Portfolio whereby Zodiac agreed to make a further cash

advance of EUR 0.7M which was subsequently received was announced

on 10 August 2023. The total cash advance received to date is now

EUR 2.5M. Coro has agreed to reduce the sum due at completion by

the further cash advance and an additional EUR 0.14m. The total

potential consideration for the transaction is now therefore EUR

7.4M from the previous EUR 7.5M.

Vietnam

Advanced talks with Capton Energy regarding possible

co-investment solutions for Coro's 50MW pipeline of Vietnamese

rooftop solar projects. Capton Energy, based in Dubai, is a joint

venture between Siemens Financial Services and Desert

Technologies.

Corporate

As announced on 24 August 2023 Coro agreed to sell its 18.76%

shareholding in ion Ventures Holdings Ltd ("ion") to SLT1 LLC a

privately owned entity based in the USA for a cash consideration of

GBP1.25 million ($1.59 million), of which GBP1 million was paid

immediately, and the remaining GBP250,000 will be paid by the 31

March 2024.

Tom Richardson was appointed as an independent non-executive

director of the Company.

James Parsons

Executive Chair

FINANCIAL REVIEW

Results from continuing operations

The Group made a loss after tax from continuing operations of

$2.5m (restated H1 2022: $3.8m). The overall reduction in loss

after tax compared to the first half of 2022 was primarily due to

the decrease in net finance expense of $1.2m, which comprised

mainly of an increase in unrealised foreign exchanges gains related

to the translation of the Eurobond debt and the gross profit

contribution from Vietnam operations.

In aggregate, general and administrative expenses of $1.6m

(restated H1 2022: $1.6m) was unchanged from the comparative

period. As shown in more detail in note 4, an increase of $109k in

business development expenses and an increase in Duyung related

general and administrative expenses of $57k was offset by cost

savings of $291k in other areas, notably investor and public

relations costs (reduction of 93k) and corporate costs (reduction

of $75k) as management focussed on cost control. The increase in

share based payments of $121k is a non-cash expense.

Results from discontinued operations

A sale and purchase agreement with respect to the disposal of

the Italian gas portfolio was executed on 27 March 2023, and an

initial cash payment of EUR1.5m was received during the reporting

period. The sale remains dependent only on customary regulatory

consents.

The accounting profit after tax from discontinued operations for

the period was $0.2m, lower than $0.8m (restated) reported in the

comparative period. This was primarily due to a reduction in gross

profit due to a combination of lower gas prices achieved in

comparison with the same comparative period and higher associated

production costs. However focus remained on cost control.

Going concern

The interim financial statements have been prepared under the

going concern assumption, which presumes that the Group will be

able to meet its obligations as they fall due for the foreseeable

future.

The Group ended the period with cash of $0.65m. During the

reporting period the Group increased its available cash resources

through an advance of US $1.6m of the consideration for the sale of

the Italian gas portfolio. Subsequent to the reporting date the

Group announced the sale of its entire investment in ion Ventures

Holdings Limited for a cash consideration of GBP1.25m, of which

GBP1m was paid immediately, as well as receiving a further advance

of EUR0.7m of the consideration for the sale of the Italian gas

portfolio.

Management have prepared a consolidated cash flow forecast for

the period to 30 September 2024 which shows that the Group has

sufficient cash headroom to meet its obligations during this

period. However, this conclusion is conditional on the Group

successfully repaying or restructuring its Eurobond obligations.

Currently, the bonds are scheduled to mature in April 2024 when

principal of EUR22.5m ($24.5m) will become repayable in full along

with accrued and not paid interest of EUR6.8m ($7.4m).

The directors have a reasonable expectation that repayment or a

debt restructuring can be achieved prior to maturity.

Negotiations with bondholders have not yet commenced, and the

ability of the Company to successfully restructure the bonds is not

guaranteed. However, based on the above, the Directors consider it

appropriate to continue to adopt the going concern basis of

accounting in preparing the Group financial statements for the

period ended 30 June 2023. Should the Group be unable to continue

trading, adjustments would have to be made to reduce the value of

the assets to their recoverable amounts, to provide for further

liabilities which might arise and to classify fixed assets as

current.

Ewen Ainsworth

Chief Financial Officer

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the Six Months Ended 30 June 2023

30 June 2023 30 June 2022

Restated

Notes $'000 $'000

-------------------------------------------------- ----- ------------ ------------

Revenue 116 -

Depreciation and amortisation expense (41) -

-------------------------------------------------- ----- ------------ ------------

Gross profit 75 -

General and administrative expenses 4 (1,633) (1,637)

Depreciation expense (6) (9)

Share of loss of associates (48) (47)

-------------------------------------------------- ----- ------------ ------------

Loss from operating activities (1,612) (1,693)

Finance income 1,273 404

Finance expense (2,203) (2,528)

-------------------------------------------------- ----- ------------ ------------

Net finance expense 4 (930) (2,124)

-------------------------------------------------- ----- ------------ ------------

Loss before income tax (2,542) (3,817)

Income tax benefit / (expense) - -

-------------------------------------------------- ----- ------------ ------------

Loss for the period from continuing operations (2,542) (3,817)

Discontinued operations

Gain for the period from discontinued operations 232 803

-------------------------------------------------- ----- ------------ ------------

Total loss for the period (2,310) (3,014)

-------------------------------------------------- ----- ------------ ------------

Other comprehensive income/loss

Items that may be reclassified to profit

and loss

Exchange differences on translation of foreign

operations (1,496) 2,124

Total comprehensive loss for the period (3,806) (890)

Loss attributable to:

Owners of the company (2,296) (3,011)

Non-controlling interests (14) (3)

Total comprehensive loss attributable to:

Owners of the company (3,792) (887)

Non-controlling interests (14) (3)

Basic loss per share from continuing operations

($) 5 (0.001) (0.002)

Diluted loss per share from continuing operations

($) 5 (0.001) (0.002)

Basic profit per share from discontinued

operations ($) 5 0.0001 0.0004

Diluted profit per share from discontinued

operations ($) 5 0.0001 0.0004

The above condensed consolidated statement of comprehensive

income should be read in conjunction with the accompanying

notes.

CONDENSED CONSOLIDATED BALANCE SHEET

As at 30 June 2023

31 December

30 June 2023 2022

Notes $'000 $'000

--------------------------------------- ----- ------------ -----------

Non-current assets

Property, plant and equipment 6 1,802 1,854

Intangible assets 7 19,553 18,896

Investment in associates 245 259

--------------------------------------- ----- ------------ -----------

Total non-current assets 21,600 21,009

--------------------------------------- ----- ------------ -----------

Current assets

Cash and cash equivalents 651 166

Trade and other receivables 204 213

Inventory 34 34

Total current assets 889 413

--------------------------------------- ----- ------------ -----------

Assets of disposal group held for sale 8,826 9,710

--------------------------------------- ----- ------------ -----------

Total assets 31,315 31,132

--------------------------------------- ----- ------------ -----------

Liabilities and equity

Current liabilities

Trade and other payables 2,531 819

Borrowings 8 29,125 -

--------------------------------------- ----- ------------ -----------

Total current liabilities 31,656 819

--------------------------------------- ----- ------------ -----------

Non-current liabilities

Borrowings 8 - 28,183

--------------------------------------- ----- ------------ -----------

Total non-current liabilities - 28,183

--------------------------------------- ----- ------------ -----------

Liabilities of disposal group held for

sale 9,024 9,443

--------------------------------------- ----- ------------ -----------

Total liabilities 40,680 38,445

--------------------------------------- ----- ------------ -----------

Equity

Share capital 9 3,826 3,184

Share premium 9 51,762 50,862

Merger reserve 9,708 9,708

Other reserves 10 5,983 7,267

Non-controlling interests (80) (66)

Accumulated losses (80,564) (78,268)

--------------------------------------- ----- ------------ -----------

Total equity (9,365) (7,313)

--------------------------------------- ----- ------------ -----------

Total equity and liabilities 31,315 31,132

--------------------------------------- ----- ------------ -----------

The above condensed consolidated balance sheet should be read in

conjunction with the accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the Six Months Ended 30 June 2022

Share Share Merger Other Accumulated Non-controlling

capital premium Reserve Reserves Losses interest Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Balance at 1 January

2022 2,943 50,461 9,708 4,181 (72,823) - (5,531)

Total comprehensive

loss for the period:

Loss for the period - - - - (3,011) (3) (3,014)

Other comprehensive

income - - - 2,124 - - 2,124

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Total comprehensive

loss for the period - - - 2,124 (3,011) (3) (890)

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Transactions with

owners recorded directly

in equity:

Share based payments

for services rendered - - - 90 - - 90

Balance at 30 June

2022 2,943 50,461 9,708 6,395 (75,834) (3) (6,330)

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the Six Months Ended 30 June 2023

Share Share Merger Other Accumulated Non-controlling

capital premium Reserve Reserves Losses interest Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Balance at 1 January

2023 3,184 50,862 9,708 7,267 (78,268) (66) (7,313)

Total comprehensive

loss for the period:

Loss for the period - - - - (2,296) (14) (2,310)

Other comprehensive

loss - - - (1,496) - - (1,496)

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Total comprehensive

loss for the period - - - (1,496) (2,296) (14) (3,806)

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

Transactions with

owners recorded directly

in equity:

Issue of share capital 642 900 - - - - 1,542

Share based payments

for services rendered - - - 212 - - 212

Balance at 30 June

2023 3,826 51,762 9,708 5,983 (80,564) (80) (9,365)

-------------------------- -------- -------- -------- --------- ----------------- --------------- -------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the Six Months Ended 30 June 2023

30 June 2023 30 June 2022

Restated

$'000 $'000

------------------------------------------------------ ------------ ------------

Cash flows from operating activities

Receipts from customers 2,168 2,425

Payments to suppliers and employees (3,761) (3,461)

Interest paid - -

------------------------------------------------------ ------------ ------------

Net cash used in operating activities (1,593) (1,036)

------------------------------------------------------ ------------ ------------

Cash flow from investing activities

Payments for property, plant & equipment (5) (465)

Payments for intangible assets (507) (446)

Refunds related to development intangible assets 4 -

Advance receipt from sale of Italian operations 1,639 -

------------------------------------------------------ ------------ ------------

Net cash provided by / (used in) investing activities 1,131 (911)

------------------------------------------------------ ------------ ------------

Cash flows from financing activities

Net cash provided by / (used in) financing activities - -

------------------------------------------------------ ------------ ------------

Net decrease in cash and cash equivalents (462) (1,947)

------------------------------------------------------ ------------ ------------

Cash and cash equivalents brought forward 1,616 3,551

------------------------------------------------------ ------------ ------------

Effects of exchange rate changes on cash

and cash equivalents (30) 12

------------------------------------------------------ ------------ ------------

Cash and cash equivalents carried forward 1,124 1,616

------------------------------------------------------ ------------ ------------

Cash and cash equivalents carried forward at 30 June 2023

includes $473k relating to discontinued operations (2022: $1.45m)

and $651k relating to continuing operations (2022: $166k).

The above condensed consolidated statement of cash flows should

be read in conjunction with the accompanying notes.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 1: Basis of preparation of the interim financial

statements

The condensed consolidated interim financial statements of Coro

Energy plc (the "Group") for the six month period ended 30 June

2023 have been prepared in accordance with Accounting Standard IAS

34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2022, which was prepared under International

Financial Reporting Standards (IFRS) in conformity with the

requirements of the Companies Act 2006, and any public

announcements made by Coro Energy plc during the interim reporting

period.

These condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2022 prepared under IFRS have been filed

with the Registrar of Companies. The auditor's report on those

financial statements was unqualified and did not contain a

statement under Section 498(2) of the Companies Act 2006. These

condensed consolidated interim financial statements have not been

audited.

The condensed consolidated interim financial statements of the

Group are presented in United States Dollars ("USD" or "$"),

rounded to the nearest $1,000.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting period,

except as set out below.

Basis of preparation - going concern

The interim financial statements have been prepared under the

going concern assumption, which presumes that the Group will be

able to meet its obligations as they fall due for the foreseeable

future.

The Group ended the period with cash of $0.65m. During the

reporting period the Group increased its available cash resources

through an advance of US $1.6m of the consideration for the sale of

the Italian gas portfolio. Subsequent to the reporting date the

Group announced the sale of its entire investment in ion Ventures

Holdings Limited for a cash consideration of GBP1.25m, of which

GBP1m was paid immediately, as well as receiving a further advance

of EUR0.7m of the consideration for the sale of the Italian gas

portfolio.

Management have prepared a consolidated cash flow forecast for

the period to 30 September 2024 which shows that the Group has

sufficient cash headroom to meet its obligations during this

period. However, this conclusion is conditional on the Group

successfully repaying or restructuring its Eurobond obligations.

Currently, the bonds are scheduled to mature in April 2024 when

principal of EUR22.5m ($24.5m) will become repayable in full along

with accrued and not paid interest of EUR6.8m ($7.4m).

The directors have a reasonable expectation that repayment or a

debt restructuring can be achieved prior to maturity.

Negotiations with bondholders have not yet commenced, and the

ability of the Company to successfully restructure the bonds is not

guaranteed. However, based on the above, the Directors consider it

appropriate to continue to adopt the going concern basis of

accounting in preparing the Group financial statements for the

period ended 30 June 2023. Should the Group be unable to continue

trading, adjustments would have to be made to reduce the value of

the assets to their recoverable amounts, to provide for further

liabilities which might arise and to classify fixed assets as

current.

a) New and amended standards adopted by the Group

New and amended standards which became applicable on 1 January

2023 do not have a material impact on the Group, and the Group did

not have to change its accounting policies or make retrospective

adjustments as a result of adopting these standards/amendments.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

a) New accounting policies adopted by the Group

There were no new accounting policies adopted by the Group

during the period, nor any amendments to existing accounting

policies.

Note 2: Significant changes

There have been no significant changes affecting the financial

position and performance of the Group during the six months to 30

June 2023. The results of the Group for the comparative period to

30 June 2022 have been restated to classify the results of the

Italian gas portfolio as a discontinued operation. Refer to note

11.

For further discussion of the Group's performance and financial

position refer to the Chairman and CEO's Statement.

The Group's results are not materially impacted by

seasonality.

Note 3: Segment information

The Group's reportable segments as described below are based on

the Group's geographic business units. This includes the Group's

upstream gas operations in Italy, upstream gas operations and

renewable energy operations in South East Asia, along with the

corporate head office in the United Kingdom. This reflects the way

information is presented to the Group's Chief Operating Decision

Maker, which is the Executive Chair.

Italy Asia UK Total

--------------

30 June 30 June 30 June 30 June 30 June 30 June 30 June 30 June

2023 2022 Restated 2023 2022 Restated 2023 2022 Restated 2023 2022 Restated

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------- -------- -------------- -------- -------------- -------- -------------- -------- --------------

Depreciation

and

amortisation - - (41) - (6) (9) (47) (9)

Finance

expense - - - - (1,718) (2,528) (1,718) (2,528)

Share of loss

of

associates - - - - (48) (47) (48) (47)

Segment loss

before

tax from

continuing

operations - - (286) (237) (2,256) (3,580) (2,542) (3,817)

Segment profit

before

tax from

discontinued

operations

(2022

restated) 232 803 - - - - 232 803

-------------- -------- -------------- -------- -------------- -------- -------------- -------- --------------

Italy Asia UK Total

--------------

30 June 31 Dec 30 June 31 Dec 30 June 31 Dec 30 June 31 Dec

2023 2022 Restated 2023 2022 Restated 2023 2022 Restated 2023 2022 Restated

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------- -------- -------------- -------- -------------- -------- -------------- -------- --------------

Segment assets 8,826 9,710 21,133 20,129 1,356 1,293 31,315 31,132

Segment

liabilities (9,024) (9,548) (352) (182) (31,304) (28,715) (40,680) (38,445)

-------------- -------- -------------- -------- -------------- -------- -------------- -------- --------------

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 4: Profit and loss information

a) General and administrative expenses

General and administrative expenses in the income statement

includes the following significant items of expenditure:

30 June 30 June

2023 2022

Restated

$'000 $'000

------------------------------------ ------- ---------

Employee benefits expense 514 592

Business development 418 309

Corporate and compliance costs 222 297

Investor and public relations 42 135

Other G&A 158 101

G&A - non-operated joint operations 67 112

Share based payments (note 9) 212 91

1,633 1,637

------------------------------------ ------- ---------

b) Finance income / expense

30 June 30 June

2023 2022

Restated

$'000 $'000

------------------------------------ ------- ---------

Finance income

Foreign exchange gains 1,273 404

Finance expense

Interest on borrowings 1,718 1,982

Other finance charges 3 -

Unrealised loss on foreign exchange - 34

Foreign exchange losses 482 512

Net finance income / (expense) (930) (2,124)

------------------------------------ ------- ---------

Note 5: Loss per share

30 June

30 June 2022

2023 Restated

------------------------------------------------------ ------- ---------

Basic loss per share from continuing operations

($) (0.001) (0.002)

Diluted loss per share from continuing operations

($) (0.001) (0.002)

Basic profit per share from discontinued operations

($) 0.0001 0.0004

Diluted profit per share from discontinued operations

($) 0.0001 0.0004

------------------------------------------------------ ------- ---------

The calculation of basic loss per share from continuing

operations was based on the loss attributable to shareholders of

$2.5m (2022: $3.8m) and a weighted average number of ordinary

shares outstanding during the half year of 2,348,242,699 (2022:

2,124,035,967).

Diluted loss per share from continuing operations for the

current and comparative periods is equivalent to basic loss per

share since the effect of all dilutive potential ordinary shares is

anti-dilutive.

Basic profit per share from discontinued operations was based on

the profit attributable to shareholders from discontinued

operations of $0.2m (2022: $0.8m).

Diluted profit per share from discontinued operations for the

current and comparative periods include the potential dilutive

effect of all share options and warrants that were "in the money"

as at the reporting date. The potential dilutive shares includes

options issued to Directors and management.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 6: Property, plant and equipment

30 June 31 December

2023 2022

$'000 $'000

------------------------------- -------- -----------

Office furniture and equipment 7 3

Solar assets 1,795 1,851

1,802 1,854

------------------------------- -------- -----------

Reconciliation of the carrying amounts for each material class

of intangible assets for the six months ended 30 June 2023 are set

out below:

Solar assets:

30 June

2023

$'000

Carrying amount at beginning of period 1,851

Depreciation and amortisation (41)

Retranslation differences (15)

----------------------------------------

Carrying amount at end of period 1,795

---------------------------------------- ---------

Solar assets comprise of the Group's 3-megawatt pilot rooftop

solar project in Vietnam.

Note 7: Intangible assets

30 June 31 December

2023 2022

$'000 $'000

---------------------------------- -------- -----------

Exploration and evaluation assets 18,214 17,707

Intangible development assets 436 428

Software 4 7

Goodwill 899 754

---------------------------------- -------- -----------

19,553 18,896

---------------------------------- -------- -----------

Reconciliation of the carrying amounts for each material class

of intangible assets for the six months ended 30 June 2023 are set

out below:

Exploration and evaluation assets :

30 June

2023

$'000

Carrying amount at beginning of period 17,707

Additions 507

Carrying amount at end of period 18,214

---------------------------------------- ---------

Exploration and evaluation assets relate to the Group's interest

in the Duyung PSC. No indicators of impairment of these assets were

noted.

Intangible development assets comprise expenditure directly

attributable to the design and development of identifiable and

unique renewables projects controlled by the Group in the

Philippines. No indicators of impairment of these assets were

noted.

Goodwill was initially recognised following the acquisition of

the renewables projects in the Philippines. During the six months

ended 30 June 2023, the Group acquired an additional entitlement to

dividends from its partners in these projects for a consideration

of $145k, which was paid by issuing new ordinary shares in the

Company (note 9). The Group's dividend entitlement increased from

80% to 88%. No impairment of goodwill was noted following testing

performed at 31 December 2022.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 8: Borrowings

30 June 31 December

2023 2022

$'000 $'000

------------ -------- -----------

Current

Eurobond 29,125 -

------------ -------- -----------

29,125 -

------------ -------- -----------

Non-current

Eurobond - 28,183

------------ -------- -----------

- 28,183

------------ -------- -----------

Borrowings relates to EUR22.5m Eurobonds with attached warrants

which were issued in 2019 to institutional investors. The bonds

were issued in two equal tranches A and B, ranking pari passu, with

Tranche A paying an annual 5% cash coupon and Tranche B accruing

interest at 5% payable on redemption. The bonds were scheduled to

mature on 12 April 2022 at 100% of par value plus any accrued and

unpaid coupon. However, in April 2022 the Group completed a

restructuring of the Eurobonds which extended the maturity date by

two years to 12 April 2024, removed all cash interest payment

obligations prior to the maturity date, and increased the coupon

interest rate from 5% to 10%. In the event of a sale of the Group's

interest in the Duyung PSC, the net cash proceeds of such

disposal(s) will be utilised to first repay the capital and rolled

up interest on the Eurobonds and thereafter to distribute 20% of

remaining net proceed(s) to holders of the Eurobonds. The remaining

net proceeds of any sales will be retained and/or distributed to

shareholders by the Company.

The restructured bonds were initially recognised at fair value

and subsequently are recorded at amortised cost, with an average

effective interest rate of 12.10%. The contingent payment upon the

sale of the Company's interest in the Duyung PSC has not been

considered in the estimate of the effective interest rate as it

meets the definition of a contingent liability.

Loan interest for quarters ended 12 October 2022, 12 January

2023 and 12 April 2023 were settled by newly issued ordinary shares

of the Company (note 9).

Note 9 : Share capital and share premium

30 June 30 June

2023 Nominal 2023

Number value Share Premium Total

000's $'000 $'000 $'000

---------------------------------- ---------- ------- ------------- -------

As at 1 January 2023 2,339,977 3,184 50,862 54,046

---------------------------------- ---------- ------- ------------- -------

Shares issued during the period:

Proceeds from share issuance for

Eurobond interest 486,882 594 804 1,398

Consideration for increase in

Philippines dividend entitlement

(note 7) 40,000 48 96 144

---------------------------------- ---------- ------- ------------- -------

Closing balance at 30 June 2023 2,866,859 3,826 51,762 55,588

---------------------------------- ---------- ------- ------------- -------

31 December 31 December

2022 Nominal Share 2022

Number value Premium Total

000's $'000 $'000 $'000

--------------------------------- ----------- ------- -------- -----------

As at 1 January 2022 2,124,036 2,943 50,461 53,404

--------------------------------- ----------- ------- -------- -----------

Shares issued during the period:

Proceeds from share issuance for

Eurobond interest 215,941 241 401 642

--------------------------------- ----------- ------- -------- -----------

Closing balance - 31 December

2022 2,339,977 3,184 50,862 54,046

--------------------------------- ----------- ------- -------- -----------

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 10: Reserves

a) Other reserves

Share based payments reserve

The Group issued 70,000,000 options as a standalone award during

the period to directors and management. The options vest on the

third anniversary of the grant date and are subject to the

achievement of certain performance criteria, being a final

investment decision being taken by the partners to the Duyung PSC

or the successful sale of the Company's interest in the Duyung PSC.

Should the performance criteria not be met as it is no longer

relevant, the Remuneration Committee may permit the options to vest

it is deemed appropriate to do so. Vested options will be

exercisable at 0.255 British pence per ordinary share.

The options have been valued on the grant date using a Black

Scholes model, resulting in a valuation of GBP0.0013 per award. The

total value of the awards will be expensed over the vesting period

in line with the requirements of IFRS 2.

Functional currency translation reserve

The translation reserve comprises all foreign currency

differences arising from translation of the financial position and

performance of the parent company and certain subsidiaries which

have a functional currency different to the Group's presentation

currency of USD. The total loss on foreign exchange recorded in

other reserves for the period was $1.5m (2022: $2.1m gain).

Note 11: Restatement of comparative period in relation to

Italy

On 7 March 2022 the Group announced that having completed a full

review of the Italian assets it was decided that, despite the Group

remaining focused on South East Asia, to maximise shareholder

value, the Italian assets would no longer be marketed for sale and

would instead be managed for value and cash flow. As such the

Italian business temporarily did not qualify as a disposal group or

discontinued operation under IFRS 5 from this date and at 30 June

2022 and for the six months then ended.

The Group, in common with other European gas producers,

experienced a significant increase in wholesale gas prices since

March 2022, which resulted in a materially positive impact on the

value of the Italian operations. In August 2022, following

unsolicited approaches, the Group entered into an option agreement

with Zodiac Energy plc ("Zodiac") whereby Zodiac acquired the right

to acquire 100% of the issued share capital of Coro Energy Europe

Ltd, the wholly owned subsidiary holding the Groups Italian gas

portfolio, for a total consideration of up to EUR7.5m (the "Option

Agreement"). As announced by the Company on 24 August 2022, Zodiac

paid a non-refundable deposit of EUR0.3m with a further EUR5.7m to

be paid in cash on completion and further contingent payments up to

an aggregate of EUR1.5m through a net profit interest. A definitive

Sale and Purchase Agreement ("SPA") was executed on 27 March 2023

and an initial cash payment of EUR1.5m was received on 4 April

2023. The shareholders of the Company approved the disposal on 25

April 2023 and the disposal remains dependent only on customary

regulatory consents. The Group expects the disposal to complete

during Q4, 2023.

The Board of Directors are committed to the disposal of the

Italian operation under the terms of the SPA, and resultantly the

Group classified the assets and liabilities of its Italian business

as a disposal group held for sale, as well as a discontinued

operation, as at 31 December 2022 and as at 20 June 2023.

The comparative figures in these condensed consolidated

financial statements have been restated to show the Italian

business as discontinued operations. The table below set out the

impact of this restatement on the comparative figures.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 11: Restatement of comparative period in relation to Italy

(continued)

Effect on the condensed consolidated statement of comprehensive

income for the six months ended 30 June 2022:

Figure

previously

reported Adjustment Restated

$'000 $'000 $'000

Revenue 2,639 (2,639) -

Operating Costs (1,133) 1,133 -

Depreciation and amortisation expense (212) 212 -

========================================= ============ =========== =========

Gross profit loss 1,294 (1,294) -

General and administrative expenses (2,059) 422 (1,637)

Depreciation expense (20) 11 (9)

Impairment losses (1) 1 -

Share of loss of associates (47) - (47)

=========================================

Loss from operating activities (833) (860) (1,693)

Finance income 404 - 404

Finance expense (2,585) 57 (2,528)

----------------------------------------- ------------ ----------- ---------

Net finance income expense (2,181) 57 (2,124)

Loss before income tax expense (3,014) (803) (3,817)

Income tax benefit/(expense) - - -

----------------------------------------- ------------ ----------- ---------

Loss for the period from continuing

operations (3,014) (803) (3,817)

Loss for the period from discontinued

operations - 803 803

Total loss for the period (3,014) - (3,014)

Other comprehensive income/loss

Exchange differences on translation of

foreign operations 2,124 - 2,124

Total comprehensive loss for the period (890) - (890)

Loss attributable to:

Owners of the company (3,011) - (3,011)

Non-controlling interests (3) - (3)

Total comprehensive loss attributable

to:

Owners of the company (887) - (887)

Non-controlling interests (3) - (3)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 12: Interests in other entities

Asia

The Group's wholly owned subsidiary, Coro Energy Duyung

(Singapore) Pte Ltd, is the owner of a 15% interest in the Duyung

Production Sharing Contract ("PSC").

The Duyung PSC partners have entered into a Joint Operating

Agreement ("JOA"), which governs the arrangement. Through the JOA,

the Group has a direct right to the assets of the venture, and

direct obligation for its liabilities. Accordingly, Coro accounts

for its share of assets, liabilities and expenses of the venture in

accordance with the IFRSs applicable to the particular assets,

liabilities and expenses.

The operator of the venture is West Natuna Exploration Ltd

("WNEL"). WNEL is a company incorporated in the British Virgin

Islands and its principal place of business is Indonesia.

The Group's wholly owned subsidiary Coro Asia Renewables Ltd,

has a 88% economic interest in the Philippines company, Coro Clean

Energy Vietnam Inc, which owns 100% of three Philippines

incorporated subsidiaries that hold the Group's intangible

development assets in this country.

The Group's wholly owned subsidiary Coro Clean Energy Vietnam

Ltd, is the owner of a 85% interest in the Vietnamese company, Coro

Renewables VN1 Joint Stock Company, which owns 100% of Coro

Renewables VN2 Company Limited, which in tun owns 100% of Coro

Renewables Vietnam Company Limited ("CRVCL"). CRVCL is the operator

of a 3-megawatt pilot rooftop solar development in Vietnam.

Italy

The Group's Italian subsidiary, Apennine Energy SpA, is the

owner of the Group's Italian gas portfolio which is in the process

of being sold (note 11).

ion Ventures

In 2020, the Company acquired a 20.3% interest in ion Ventures

Holdings Limited which is treated as an associate and accounted for

under the equity method. The Group disposed of its entire

shareholding in August 2023 (note 14).

The Group's share of loss of associates for the 6 months ended

30 June 2023 was $48k (2022: loss $47k). There were no dividends

declared or paid by associates during the period.

Note 13: Contingencies and commitments

Commitments

Coro's share of the 2023 Duyung Work Programme and Budget is

estimated at $1.2m, which will be allocated between items of

capital expenditure and joint venture G&A. The Group had no

capital committed work programmes in its Philippine or Vietnam

operations.

Contingencies

The Company undertook to the Noteholders that in the event of a

sale of the Company's interest in the Duyung PSC to utilise the net

cash proceeds of such disposal(s) to first repay the capital and

rolled up interest on the Notes and thereafter to distribute 20% of

remaining net proceed(s) to Noteholders. The remaining net proceeds

of any sales would be retained and/or distributed to shareholders

by the Company. Due to its nature, it is not possible to quantify

the financial impact of this contingent liability.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Six Months Ended 30 June 2023

Note 14: Subsequent events

On 3 August 2023, the Company received an indicative funding

proposal from and is in advanced talks with Capton Energy regarding

possible co-investment solutions for the Company's Vietnamese

rooftop solar projects. Capton Energy, based in Dubai, is a joint

venture between Siemens Financial Services and Desert Technologies.

The funding proposal received is for Capton to buy into the

Company's current Vietnamese solar projects and provide investment

in the project pipeline of up to 50 megawatts. The Company has

committed to a four-month period of exclusivity for the parties to

conclude the transaction.

On 10 August 2023 the Company announced that it had signed an

Addendum to the Sale and Purchase Agreement ("SPA") in relation to

the Group's Italian gas portfolio, as previously announced on 27

March 2023. The buyer, Zodiac Energy plc ("Zodiac") has made a

further cash advance of EUR0.7m (the "Additional Advance") which

will bring the total advanced to Coro to date to EUR2.5m. The

Company has agreed to reduce the sum due at completion by the

Additional Advance and an additional EUR0.14m. Furthermore the

longstop date under the SPA has been extended to the 31 December

2023, and the requirement for the Company to settle the EUR1.86m

intercompany loan from Apennine Energy SpA has been replaced with

an assignment of the loan directly to Zodiac. Consequently the

residual amount expected to be received on completion is now

EUR1.36m with a further EUR0.14m to be received as soon as

practicable after completion.

On 24 August 2023 the Company announced that it has agreed to

sell its entire shareholding in ion Ventures Holdings Ltd ("ion")

to SLT1 LLC, a privately owned entity based in the USA, for a cash

consideration of GBP1.25m ($1.59m), of which GBP1m will be paid

immediately, and the remaining GBP250k will be paid by 31 March

2024. The shareholding was acquired by Coro for GBP500k ($662k) in

2020.

On 12 September 2023 the Company announced that the operator of

the Duyung PSC had signed a non-binding Term Sheet with Sembcorp

Gas Pte. Ltd. for a long-term gas sales agreement for the Mako gas

field. The Term Sheet has been endorsed by the Indonesian petroleum

upstream regulator (SKK Migas). The Operator has indicated

finalisation of a GSA and FID before the end of Q4 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR USUWROVUKUAR

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

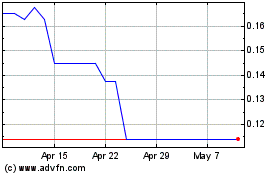

Coro Energy (LSE:CORO)

Historical Stock Chart

From Apr 2024 to May 2024

Coro Energy (LSE:CORO)

Historical Stock Chart

From May 2023 to May 2024