TIDMCRPR

RNS Number : 9155Z

Cropper(James) PLC

17 January 2024

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT CONSTITUTES

INSIDE INFORMATION AS STIPULATED UNDER THE UK'S MARKET ABUSE

REGULATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, SUCH INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

James Cropper plc

("James Cropper", the "Company" or the "Group")

Trading Update

Based on third quarter trading to 31 December 2023, and early

indications in January 2024 for the fourth quarter, James Cropper,

the leading advanced materials and paper & packaging group,

today issues an update on trading for FY2024.

Introduction

As announced on 9 November 2023 in its interim results for the

six months ended 30 September 2023 ("Interim Results") , the Group

saw half-year revenue broadly in line with the Board's

expectations, with strong gross margins and an improvement in the

cost landscape leading to operating profit in line with

expectations. The final two months of 2023 have, however, presented

trading challenges in the Paper and Packaging business and a

slowdown in the pace at which customers expect their revenues to

increase in the Future Energy hydrogen sector of the Advanced

Material business.

Advanced Materials

At the time of the Interim Results, the Group noted that it was

scaling additional capacity for its Future Energy hydrogen offer

and investing in the next phase of expansion in UK electrolyser

manufacturing operations to position the Advanced Materials

business to benefit from growing demand in these markets. However,

since the announcement of the Group's Interim Results, the Advanced

Materials business has seen expected projects in hydrogen being

delayed, partly as a result of inflation and higher interest rates

feeding through to higher project costs. In addition, funding

decisions by governments have impacted end customer project plans

and scheduling. As a result, customer expansion plans saw a

noticeable change with major market growth now expected to be

pushed back to calendar years 2026 to 2028.

The Advanced Materials divisions' revenue trajectory will be

impacted in FY2024 as a result and the Board now anticipates a

slower ramp-up in demand than previously expected across calendar

years 2024 and 2025. Nevertheless, the longer-term outlook for the

hydrogen business remains strong, with the company continuing to

acquire new customers and working on trials and specifications with

proton exchange membrane ("PEM") electrolyser OEMs. Pricing across

the business has been resilient, underpinned by strong customer

relationships which has protected margins.

Growth in the aerospace and automotive sectors continues to

underpin the core Advanced Materials business where we are

executing against accelerated market growth opportunities.

Paper Products

As a direct result of ongoing high inflation impacting consumer

confidence, compounded by supply chain destocking, demand in the

Paper Products business continued to soften to an even greater

extent during Q3.

Despite volume pressures, customer retention has remained high,

supported by strong relationships, and pricing has been resilient.

Lower input costs (energy, carbon, pulp), mix improvements and

productivity initiatives have protected margins and our

restructuring activity is now complete, with continuous running in

production and a reduction in assets since January 2024 allowing

headcount to be reduced by 15%.

Whilst near-term revenues have been affected, the future project

pipeline remains strong and in the meantime the Group will aim to

keep efficiency high through tactical use of free capacity.

The final quarter of the year is expected to show some recovery

in volumes in Paper & Packaging and demand is expected to

further recover throughout FY2025.

Group

As a result of the above trends, the Group now expects full year

FY2024 revenues to be not lower than GBP103m. FY2024 adjusted PBT

is expected to be materially below prior management expectations,

with the Board now expecting to report a small adjusted profit

before tax for the year.

Working capital has been well controlled and the Group's capital

expenditure plans reflect the slower revenue trajectory in Advanced

Materials. As a result, net debt at the year-end is anticipated to

be slightly better than previously expected notwithstanding the

reduced PBT outlook.

Investment in new capacity for hydrogen electrolysers is

continuing at our Launceston site as we gain more specification

work and accelerate trials with a growing number of PEM

electrolyser OEMs.

Steve Adams, CEO of James Cropper, said: "The pressure on volume

from inflation and global uncertainty has, regrettably, resulted in

us revising our profit expectations, despite us continuing to have

a strong future growth plan in place.

The Advanced Materials business saw higher revenues for the

first half but now faces a clear hiatus in the hydrogen sector as

investment decisions are deferred or delayed beyond FY2025.

The Paper & Packaging business division has been hit the

hardest by the drop in demand but continues to focus on mitigating

activities whilst driving productivity and efficiency savings in

line with our restructuring plan.

Overall, despite the setback in profitability, we remain

steadfast in focusing on our strategy for accelerated growth and

the Board is confident that the growth prospects of the Group as a

whole remain significant in the coming years."

Enquiries:

James Cropper plc

Steve Adams, CEO

Andrew Goody, CFOO

Via Buchanan: tel: +44 (0) 207 466 5000

Shore Capital - (NOMAD and Broker)

Robert Finlay, Henry Willcocks, Lucy Bowden

Tel: +44 (0) 7601 6100

Buchanan Communications - Financial PR

Chris Lane, Charles Ryland, Jamie Hooper, Verity Parker

jamescropper@buchanancomms.co.uk

Tel: +44 (0) 207 466 5000

Notes for editors:

James Cropper is a market leader in Advanced Materials and Paper

Products, centred around four market audiences: Future Energy,

Technical Fibres, Luxury Packaging and Creative Papers.

A purpose-led business, built upon six generations of the

Cropper family, James Cropper has a 600+ international workforce

and an operational reach in over 50 countries.

Established in 1845, the Group manufactures creative papers,

luxury packaging and advanced materials incorporating pioneering

non-wovens and electrochemical coatings.

James Cropper is a specialist provider of niche solutions

tailored to a unique customer specification, ranging from

substrates and components in hydrogen electrolysis and fuel cells

to bespoke colours and textures in paper and moulded fibre

packaging designed to replace single use plastics.

The Group operates across multiple markets from luxury retail to

renewable energy. It is renowned globally for service, capability,

pioneering and multi award-winning commitment to the highest

standards of sustainability.

James Cropper's goal is to be operationally net zero by 2030 and

to reduce carbon through its entire supply chain to net zero by

2050.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQKABNDBKBADD

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

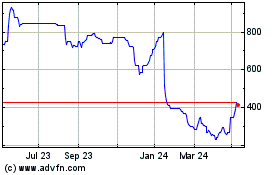

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

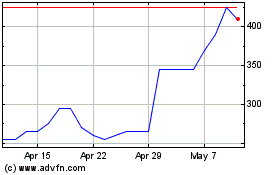

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Nov 2023 to Nov 2024