TIDMD4T4

RNS Number : 3898G

D4T4 Solutions PLC

25 November 2020

25 November 2020

D4t4 Solutions plc

Half-year results for the six months to 30 September 2020

D4t4 Solutions Plc (AIM: D4t4, "the Group", "D4t4"), the

AIM-listed data solutions provider, announces its half year results

for the six months to 30 September 2020 (H1 2021).

Financial highlights

-- Group revenue and adjusted profit in line with management expectations

-- Revenue of GBP5.09m (H1 2019-20: GBP8.84m)

-- Annual recurring revenue (ARR [1] ) increased 27.4% to GBP10.09m (H1 2019-20: GBP7.92m)

-- Adjusted loss before tax [2] GBP0.92m (H1 2019-20: profit GBP0.74m)

-- Adjusted EPS [3] of -1.57p (H1 2019-20: 1.76p)

-- Net cash position of GBP12.08m (FY 2019-20: GBP11.24m) with no debt

-- Interim dividend of 0.81p per share, up 5% (H1 2019-20: 0.77p)

Operational highlights

-- H1 contract wins extend global reach in retail and financial

services sectors and expand into US healthcare market

-- Ongoing investment in R&D - new US and European patents granted

-- Completion and delivery of version 9.2 of our Celebrus

Customer Data Platform (CDP) software, which includes embedded

machine learning capabilities and Natural Language Processing

-- D4t4 has continued to strengthen its relationships with

Teradata, Pegasystems, Dell Technologies and SAS.

o The Celebrus Customer Data Platform (CDP) products are central

to Teradata's "Vantage Ignite" programme, a major product

initiative into its global installed base enterprise accounts

Geographic and industry expansion

-- Continued investment in India, Europe and North America in

product management, pre-sales, technical

support and service delivery to support growing global presence

-- Ongoing focus on existing and new strategic partnerships

continues to grow our increasing pipeline of opportunities across

the business

-- APAC expansion underpinned by high level of opportunities in

that region driven by the Teradata "Vantage Ignite" programme

-- New opportunities in the risk and fraud area, particularly in

the financial services vertical, are driving the requirement for

new strategic partnerships

Post period end

-- Four new contract wins announced on 5 November 2020

o These add c. GBP5.5m revenue in the 2020-21 financial year

Peter Kear, CEO of D4t4 Solutions, commented:

"As we said in our October trading update, we have made good

progress with many of our strategic initiatives and secured some

excellent contract wins in the first six months, notably in new

markets including a large South American retailer and our first US

healthcare company. Our focus remains on growing revenues from our

Celebrus family of products, expanding our international offering

and investing in our technology and our people.

"We delivered a solid first half, underpinned by our continued

shift towards a recurring revenue model, with ARR up 27%. We are in

a strong position with a number of contract discussions outstanding

at the end of the first half closing in early November 2020 and an

excellent pipeline with a healthy increase in new opportunities.

Our opportunity for growth in the Customer Data Platform and

Customer Data Management markets is being amplified by

the increased pressure on enterprises to accelerate their digital transformation ."

Enquiries

D4t4 Solutions Plc +44 (0) 1932 893333

Peter Kear, Chief Executive Officer moreinfo@d4t4solutions.com

Charles Irvine, Chief Financial

Officer

finnCap (Nominated Adviser & Joint

Broker)

Julian Blunt / Emily Watts, Corporate

Finance

Alice Lane, ECM +44 (0) 20 7220 0500

Canaccord Genuity (Joint Broker)

Simon Bridges / Andrew Potts +44 (0) 20 7523 8000

Instinctif Partners

Adrian Duffield / Kay Larsen / D4t4Solutions@instinctif.com

Chantal Woolcock

About D4t4 Solutions plc

D4t4 Solutions plc (www.d4t4solutions.com) provides data

solutions through its Celebrus suite of products and services,

which is comprised of two distinct complementary offerings - its

proprietary Customer Data Platform (CDP) and Customer Data

Management (CDM) solution. The Celebrus family of products offer

data capture, data migration, data synchronization, data management

and data monitoring.

Celebrus CDP is an enterprise software product which captures

customer behaviour in real time across digital channels to enable a

range of applications including customer analytics, personalised

marketing, risk, fraud detection and compliance.

Celebrus CDM is an integrated platform that automates the

ingestion, integration, transformation, and delivery of customer

data from streaming, persisted or historical sources, whether as an

appliance on-premises or in the cloud, to deliver real-time,

unified, and trusted multidimensional views of customer data for

personalisation, risk, fraud, analytics, and recommendation

applications.

The Group has offices in the UK, USA and India with employees

across the UK, US, Europe and India. D4t4's blue chip global

customers are largely within the financial services, retail and

consumer sectors.

Celebrus is fully compliant with all major data privacy

regulations and the Group is accredited to ISO27001: Information

Security Management.

Operational review

Overview

During the period we experienced a healthy increase in new

business pipeline and converted opportunities in both the retail

and US healthcare sectors. We have also seen volume increases in

licences from existing customers, across both our CDP and CDM

solutions, who realise the benefit from the use of our Celebrus

product family. Although a number of contracts slipped past the

half year end by a few weeks they have since closed and we now have

exceptional revenue visibility for this financial year.

We have continued to invest in people, with ongoing investment

in R&D and product innovation. We have also grown out project

management and pre-sales teams.

We have continued to work closely with industry analysts such as

Forrester and the CDP Institute and we continue to feature actively

in their research and reports. We have produced several exceptional

customer video testimonials along with a number of customer and

partner led webinars. Since the close of the half year we have also

delivered our first virtual Capital Markets Day, which can be

viewed on our website.

Strategy

In 2019 we made the strategic decision to move from a perpetual

licence (capital expenditure) based sales model to a predominantly

term / annual recurring revenue model, providing more visibility

and better-quality earnings. This shift continues as can be seen by

the increase in our annual recurring revenue (ARR) up to GBP10.09m

at the end of H1 from GBP7.92m at the same point last year.

At the same time, we are focused on increasing revenues from our

Celebrus software family of products by extending the vertical

market focus for our products and services.

Our strategic commitment to international expansion, the growth

of our partner sales model and product innovation continues and we

see evidence of good success in each of these areas.

Recurring revenues

We have continued to drive the expansion of our annual recurring

revenue licence model, although the pace of the shift is ultimately

driven by customer requirements. We still experience reticence

among some customer groups particularly where they require on

premise deployment over multiple years. We continue to be flexible

in our licencing approach and offer the appropriate licence model

based on individual customer needs whilst driving the move to

ARR.

International expansion

Leveraging our enterprise partner model, we have further

extended our international reach as can be evidenced by new

contract wins in South America and mainland Europe. We have grown

our international pre-sales and support teams as well as our

partnership specialists to support our international expansion.

Notably, we are focusing our attention on our Asia Pacific

capabilities to ensure coverage for this fast-growing region.

Leveraging our existing partnerships enables us to find new

opportunities in the region, in particular the Teradata "Vantage

Ignite" programme has provided a strong pipeline in this

region.

Partnerships

D4t4's focus on selling with and via partners that have global

reach and penetration continues to provide us with increasing

numbers of new opportunities in a wide range of enterprise class

customers across our target markets.

Our channel partner sales continue to contribute a major

proportion of our revenues and as can be seen in recent

announcements we are working ever more closely with our partner

base.

We have recently commenced work on a number of new partner

initiatives which should provide significant sales leads over the

coming one to two years. One of these is the Teradata "Vantage

Ignite" programme, a major product initiative into Teradata's

global installed base enterprise accounts where D4t4's Celebrus

Customer Data Platform (CDP) products are central to the

programme.

We have been presented with a number of new opportunities for

our data in the risk and fraud area, particularly in the financial

services vertical. Working closely with our existing partners and

customers, who rely on the depth and quality of our data, we are

being introduced to different user groups within those accounts

where new opportunities have emerged. These opportunities are

driving both new development of our software and the requirement

for new strategic partnerships to exploit the use of our data.

Product innovation - Celebrus

We remain a leader in both real time digital data collection and

customer data management and our products and services are used by

many of the world's largest financial services and consumer

organisations. With the launch of V9.2 of our Celebrus CDP we

introduced, unique to our industry, newly embedded machine learning

(ML) capabilities and natural language processing (NLP)

capabilities.

We use machine learning to deliver Automated Marketing Signals.

Automated Marketing Signals enable enterprises to better understand

customer interest, life events, subscriptions and customer

experience in real time. These preconfigured signals reveal new

revenue generating opportunities and dramatically limit customer

churn.

The value of the new NLP functionality lies in the ability for

enterprises to immediately understand 'customer sentiment' in all

digital channels including online chatbots, complaints feedback and

product review forums. This speed is significant because it allows

clients to make meaningful interventions 'in the moment' to

safeguard customer relationships and reinforce their brand

values.

Our solutions provide our customers with confidence in the depth

and quality of their data, safe in the knowledge that they can

collect all relevant data from every customer interaction across

all digital channels in real time.

Our customer data management (CDM) technology ensures that

digital channel data can be easily combined with any other customer

data that exists in their environment - enabling customer

analytics, optimised customer experiences and more accurate

targeted marketing, all in real time.

During the period we have committed our development resources to

ensure that we are on target for the next release of our Celebrus

CDP software which contains many new features developed in

conjunction with both customer and partner requirements which will

take us into new areas beyond our traditional customer experience

offerings.

We have also continued our focus on enhancing the value of the

Group's enterprise software technology with the recent award of new

US and European patent grants.

People

This year has seen many new challenges in the way that we work

and it has been reassuring to see the diligence that our people

have applied to the new working conditions we all now experience

and I am grateful to our global workforce for the manner in which

they have responded to these challenges.

Our customers value not just our technology but also our people

who bring that technology to life in their environment and provide

them with the ingredients that make our customers successful.

I would like to take this opportunity to thank all our

management and staff for their hard work and commitment which has

enabled us to continue to service our clients and win new business

throughout. This has also meant we have not had to claim from any

of the taxpayer funded furlough or other business support

schemes.

Financial review

Revenue

Revenue for the period was GBP5.09m (H1 2019-20: GBP8.84m).

Driving the reduction versus the same period last year was a delay

in signing of a number of key contracts, due largely to the

COVID-19 pandemic and its repercussions. Support & maintenance

revenues in the period were less impacted at GBP3.21m, an increase

of 7% (H1 2019-20: GBP3.00m). As mentioned above, a number of

contracts have been successfully concluded since the period end and

as announced on 5 November, will deliver approximately GBP5.5m of

revenue in the current year.

2020 2019

GBP'000 GBP'000

-------- --------

Products - Own IP 263 1,812

Products - 3(rd) party 343 2,205

Delivery services 1,272 1,825

Support & maintenance 3,209 2,998

======== ========

Revenue 5,087 8,840

Annually Recurring Revenue (ARR) at the end of the period was

GBP10.09m, an increase of GBP2.17m - or 27.4% - versus the same

period in the prior year (H1 2019-20: GBP7.92m). Driving the

increase in ARR were a number of Celebrus recurring term licence

deals signed in the second half of 2019-20. ARR at 30 September

reflects a GBP0.54m increase on the prior year-end (2019-20:

GBP9.55m) and the intention is to continue to increase this over

the next 2-3 years although the level of increase will ultimately

be driven by customer requirements.

Profit before Tax

Gross Margin as a percentage of sales reduced slightly to 48.6%

(H1 2019-20: 51.8%) which was due to the lower level of product

sales in the period. Administration expenses were in line with the

same period last year at GBP3.84m with savings in travel and events

continuing. It is still expected that over the full year,

administration expenses will increase versus 2019-20 as a result of

continued investment in future growth.

Adjusted Profit before Tax was a loss of (GBP0.92m), a reduction

of GBP1.66m versus the same period in the prior year (H1 2019-20:

GBP0.74m). This was primarily driven by the reduction in sales

mentioned above. Had the contract wins announced since the period

end been secured in the first half the Group would have made a

reasonable profit during H1.

Balance Sheet & Cash Position

The net cash balance at 30 September was GBP12.08m, an increase

of GBP0.84m on the same period last year (H1 2019-20: GBP11.24m).

During H1, net cash reduced by GBP0.69m, partly as a result of the

dividend paid in August. Net cash from operating activities was

positive at GBP0.40m, with the reduction in working capital more

than offsetting the operating loss as a result of the high level of

invoicing from the final quarter of 2019-20 being collected in the

period.

The Group remains debt-free although there are plans to lease a

number of hardware assets to support upcoming Platform as a Service

style Customer Data Management contracts where the client often

requires the Group to maintain the IT infrastructure on their

behalf. At 30 September, net assets stood at GBP27.39m (H1 2019-20:

GBP25.81m).

Dividend

As a Company, we are committed to a progressive dividend policy

and rewarding our shareholders whilst at the same time balancing

our investment in the business for future growth.

Given the confidence outlined above the Board is pleased to

declare an interim dividend of 0.81p per share, a 5% increase over

the comparative period last year. This will be paid on 11 January

2021 to Members on the Register as at 11 December 2020. The shares

will become ex-dividend on 10 December 2020.

Current Trading & Outlook

The Board remains confident in delivering a strong finish to

2020-21 with second half prospects well underpinned by:

-- New contract wins announced on 5 November 2020 set to deliver

revenue of c.GBP5.5m in H2

-- High level of annual recurring revenue from new licences

signed during the second half of last year

and Support and maintenance revenues

-- Strong visibility on new contracts due to initiate during H2

-- Significant pipeline of business in negotiation with new & existing clients

We continue to invest in our international markets, product

innovation and strengthening our partner relationships in line with

the substantial market opportunity that is presented to us.

Overall, we are in a good position. The strength of the Group's

balance sheet and excellent short, mid and long-term prospects

provides the Board with significant comfort and a high level of

confidence in prospects for the current financial year and

beyond.

Consolidated income statement

for the period ended 30 September 2020 (unaudited)

Six months ended Year ended

30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

---------------------- -------------- ---- ---- ----------------------- -------- -------------

Continuing operations

Revenue 5,087 8,840 21,748

Cost of sales (2,616) (4,265) (8,537)

====================== ==================== ==== ======================= ======== =============

Gross Profit 2,471 4,575 13,211

Administration

expenses (3,838) (3,776) (8,343)

Other operating

income 29 28 58

==================== =========================== ======================= ======== =============

(Loss) / Profit from operations (1,338) 827 4,926

Finance income 10 20 43

Finance costs - - -

====================== ==================== ==== ======================= ========

(Loss) / Profit before tax (1,328) 847 4,969

Tax 370 (52) (522)

====================== ============== ==== ==== ======================= ======== =============

Attributable to equity holders of the

parent (958) 795 4,447

-------------------------------------------------- ----------------------- -------- -------------

(Loss) / Earnings per share from continuing operations attributable

to the equity holders of the parent

Basic (2.38p) 2.00p 11.12p

Diluted (2.38p) 1.98p 11.04p

====================== ============== ==== ==== ======================= ======== =============

Consolidated statement of comprehensive income

for the period ended 30 September 2020 (unaudited)

Six months ended Year ended

30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

------- ------------------------------- ---- ---- --------- -------- -------------

Attributable to equity holders

of the parent (958) 795 4,447

Other comprehensive income:

Items that will not be reclassified

to profit or loss

Gains on property

revaluation - - 71

Exchange differences

on translation

of foreign operations (11) 29 24

===================================== ============ ========= ======== === =============

Total comprehensive (loss) /

income for the period attributable

to equity holders of the parent (969) 824 4,542

---------------------------------------- ---- ---- --------- -------- --- -------------

Consolidated statement of changes in equity attributable to

Equity Holders of the Parent

for the period ended 30 September 2020 (unaudited)

Share Share Merger Revaluation Own Equity Retained Total

capital premium reserve reserve shares reserve earnings GBP'000

---------------- ------------------------------------------------------------------------------------------------------------------- ------- ------- ----------- ------- -------- ---------- -------

Balance at 1

April

2019 794 2,624 5,977 1,099 (1,127) 10 15,463 24,840

Dividends paid - - - - - - (925) (925)

Purchase of

own shares - - - - (23) - - (23)

Issue of new

shares

- exercise of

share

options 14 741 - - - - - 755

Settlement of

share

based

payments - - 4 - 738 (3) (457) 282

Share-based

payment

charge - - - - - - 60 60

Deferred tax

on

outstanding

share options - - - - - (7) - (7)

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Transactions

with

equity

holders 14 741 4 - 715 (10) (1,322) 142

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Profit for the

period - - - - - - 795 795

Other

comprehensive

income - - - - - - 29 29

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Total

comprehensive

income - - - - - - 824 824

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Balance at 30

Sept

2019 808 3,365 5,981 1,099 (412) - 14,965 25,806

Dividends paid - - - - - - (310) (310)

Purchase of

own shares - - - - (46) - - (46)

Settlement of

share

based

payments - - - - 118 - (59) 59

Share-based

payment

charge - - - - - - 37 37

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Transactions

with

equity

holders - - - - 72 - (332) (260)

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Profit for the

period - - - - - - 3,652 3,652

Other

comprehensive

income - - - 71 - - (5) 66

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Total

comprehensive

income - - - 71 - - 3,647 3,718

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Balance at 1

April

2020 8 08 3,365 5,981 1,170 (340) - 18,280 29,264

Dividends paid - - - - - - (764) (764)

Purchase of

own shares - - - - (326) - - (326)

Settlement of

share

based

payments - - - - 246 - (132) 114

Share-based

payment

charge - - - - - - 68 68

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Transactions

with

equity

holders - - - - (80) - (828) (908)

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Profit for the

period - - - - - - (958) (958)

Other

comprehensive

income - - - - - - (11) (11)

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Total

comprehensive

income - - - - - - (969) (969)

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Balance at 30

Sept

2020 8 08 3,365 5,981 1,170 (420) - 16,483 27,387

================ =================================================================================================================== ======= ======= =========== ======= ======== ========== =======

Consolidated statement of financial position

as at 30 September 2020 (unaudited)

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

------------------------------------------ ---- ----- --------- ------------- ---------

Non-current assets

Goodwill 8,696 8,696 8,696

Other intangible assets 920 891 956

Property, plant and equipment 3,954 3,981 4,099

Deferred tax assets 686 772 283

================================================= ===== ========= ============= =========

14,256 14,340 14,034

===================================================== ========= ============= =========

Current assets

Trade and other receivables 2,857 4,292 10,137

Tax receivables 396 - 649

Inventories 1,649 3 1,266

Cash and cash equivalents 12,082 11,241 12,772

================================================= ===== ========= ============= =========

16,984 15,536 24,824

================================================= ===== ========= ============= =========

Total assets 31,240 29,876 38,858

================================================= ===== ========= ============= =========

Current liabilities

Trade and other payables (3,622) (3,822) (9,377)

================================================= ===== ========= ============= =========

(3,622) (3,822) (9,377)

Non-current liabilities

Deferred tax liabilities (231) (188) (217)

================================================= ===== ========= ============= =========

(231) (188) (217)

Total liabilities (3,853) (4,070) (9,594)

================================================= ===== ========= ============= =========

Net assets 27,387 25,806 29,264

Equity

Share capital 808 808 808

Share premium account 3,365 3,365 3,365

Merger reserve 5,981 5,981 5,981

Revaluation reserve 1,170 1,099 1,170

Own shares (420) (412) (340)

Retained earnings 16,483 14,965 18,280

================================================= ===== ========= ============= =========

Attributable to equity holders

of the parent 27,387 25,806 29,264

------------------------------------------------- ----- --------- ------------- ---------

Consolidated cash flow statement

for the period ended 30 September 2020 (unaudited)

Six months ended Year ended

30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------- ------ ------------- ------------- -----------

Operating activity

(Loss)/Profit before tax (1,328) 847 4,969

Adjustments for:

Depreciation of property, plant

and equipment 169 155 327

Amortisation of intangible assets 136 123 246

Finance income (10) (20) (43)

Share-based payments 68 60 97

Operating cash flows before movements

in working capital (965) 1,165 5,596

=========================================================== ============= ============= ===========

Decrease / (increase) in receivables 7,280 1,983 (3,862)

(Increase) / decrease in inventories (383) 42 (1,221)

(Decrease) / increase in payables (5,770) (2,846) 2,603

=================================================== ====== ============= ============= ===========

Cash generated from operations 162 344 3,116

Income taxes refunded / (paid) 238 (177) (738)

Net cash generated from operating activities 400 167 2,378

=========================================================== ============= ============= ===========

Investing activities

Interest received 10 20 43

Purchase of property, plant and

equipment (24) (31) (249)

Capitalisation of development costs (100) - (188)

Net cash used in investing activities (114) (11) (394)

Equity

Dividends paid (764) (925) (1,235)

Purchase of own shares (326) (23) (69)

Exercise of share options 114 1,037 1,096

=================================================== ====== ============= ============= ===========

Net cash (used) / generated in

financing activities (976) 89 (208)

Net (decrease) / increase in cash

and cash equivalents (690) 245 1,776

Cash and cash equivalents at start

of period 12,772 10,996 10,996

=================================================== ====== ============= ============= ===========

Cash and cash equivalents at end

of period 12,082 11,241 12,772

--------------------------------------------------- ------ ------------- ------------- -----------

Notes to the financial statements

1. Basis of preparation

The financial information in these interim results is that of

the Group. It has been prepared in accordance with the recognition

and measurement requirements of International Financial Reporting

Standards (IFRS) but does not include all of the disclosures that

would be required under IFRS. The interim financial information for

the six months ended 30 September 2020 (HY 2020-21) and comparative

interim figures for 2019 (HY 2019-20) have been neither audited nor

reviewed by the Group's auditors.

The financial statements for the year ended 31 March 2020 have

been filed with the Registrar of Companies and contained an

unqualified audit opinion.

2. Business and geographical segments

Six months ended Year ended

Business Segments 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

--------- -------- -------------

Products - Own IP 263 1,812 7,658

Products - 3(rd) party 343 2,205 4,362

Delivery services 1,272 1,825 3,629

Support & maintenance 3,209 2,998 6,099

========= ======== =============

Revenue 5,087 8,840 21,748

Cost of sales (2,616) (4,265) (8,537)

========= ======== =============

Gross profit 2,471 4,575 13,211

Other operating costs and income (3,809) (3,748) (8,285)

Investing and financing activity 10 20 43

========= ======== =============

(Loss) / Profit before tax (1,328) 847 4,969

--------- -------- -------------

Six months ended Year ended

Geographical information 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

--------- -------- -------------

United Kingdom 1,564 1,840 4,158

Rest of Europe 847 942 3,162

United States of America 2,061 5,423 13,327

Others 615 635 1,101

========= ======== =============

5,087 8,840 21,748

--------- -------- -------------

The geographical revenue segment is determined by the domicile

of the external customer.

Non-current assets, including Property, Plant & Equipment,

Goodwill and Intangibles, are predominantly located in the United

Kingdom.

3. Earnings per share

Six months ended Year ended

30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

----------- ----------- -------------

(Loss) / Profit attributable to owners

of the parent (958) 795 4,447

Amortisation of intangible assets 136 123 246

Share-based payments 68 60 97

Net foreign exchange differences 161 (293) (362)

Restructuring costs 39 - 96

Tax on the adjustments (77) 21 (15)

=========== =========== =============

Adjusted (Loss) / Profit attributable

to owners of the parent (631) 706 4,509

----------- ----------- -------------

2020 2019 2020

No. No. No.

----------- ----------- -------------

Basic weighted average number of shares,

excluding own shares, in issue 40,242,293 39,695,986 39,976,957

Dilutive effect of share options - 358,036 299,994

Diluted weighted average number of shares,

excluding own shares, in issue 40,242,293 40,054,022 40,276,951

----------- ----------- -------------

Six months ended Year ended

30 September 31 March

2020 2019 2020

Pence Pence Pence per

per share per share share

----------- ----------- -------------

Basic (Loss) / Earnings per share (2.38) 2.00 11.12

Diluted (Loss) / Earnings per

share (2.38) 1.98 11.04

Adjusted Basic (Loss) / Earnings

per share (1.57) 1.78 11.28

Adjusted Diluted (Loss) / Earnings

per share (1.57) 1.76 11.19

4. Dividends

Six months ended Year ended

30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

--------- -------- -------------

Amounts recognised as distributions

to equity holders

Final dividend for the year ended

31 March 2020 of 1.9p (2019:

2.3p) 764 - -

Final dividend for the year ended

31 March 2019 of 2.3p (2018:

1.875p) - 925 925

Interim dividend for the year

ended 31 March 2020 of 0.77p

(2019: 0.7p) - - 310

764 925 1,235

--------- -------- -------------

An interim dividend of 0.81p per share will be paid in the week

commencing 11 January 2021 to Members on the Register as at 11

December 2020. The share will become ex-dividend on 10 December

2020.

[1] ARR (Annual Recurring Revenue) is the amount of revenue at a

point in time that is expected to recur within the next twelve

months.

[2] Adjusted (loss) / profit before tax is calculated before

amortisation of intangibles, one-off reorganisation costs, foreign

exchange gains/(losses) and share based payment charges.

[3] Adjusted EPS is calculated before amortisation of

intangibles, one-off reorganisation costs, foreign exchange

gains/(losses) and share based payment charges.

Forward-Looking Statements

This document contains certain forward-looking statements. The

forward-looking statements reflect the knowledge and information

available to the Group up to the publication of this document. By

their very nature, these statements depend upon circumstances and

relate to events that may occur in the future and thereby involve a

degree of uncertainty. Therefore, nothing in this document should

be construed as a profit forecast by the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VZLFLBFLFFBQ

(END) Dow Jones Newswires

November 25, 2020 02:00 ET (07:00 GMT)

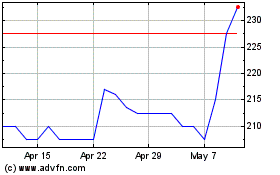

Celebrus Technologies (LSE:CLBS)

Historical Stock Chart

From Apr 2024 to May 2024

Celebrus Technologies (LSE:CLBS)

Historical Stock Chart

From May 2023 to May 2024