Dekeloil Public Limited Investments to Increase Profitability at Ayenouan (0285P)

November 14 2016 - 1:00AM

UK Regulatory

TIDMDKL

RNS Number : 0285P

Dekeloil Public Limited

14 November 2016

DekelOil Public Limited / Index: AIM / Epic: DKL / Sector: Food

Producers

14 November 2016

DekelOil Public Limited ('DekelOil' or the 'Company')

Investments to Increase Profitability at Ayenouan

DekelOil Public Limited, operator and 85.75% owner of the

profitable and vertically integrated Ayenouan palm oil project in

Côte d'Ivoire (the 'Project'), is pleased to announce three key

capital investments focused on increasing the Project's

profitability and further de-risking its operations ahead of the

peak harvesting season expected to run from March - June 2017.

-- Acquisition of an Empty Fruit Press to extract additional

crude palm oil ("CPO") from empty fruit bunches - expected to

increase the total CPO extraction rate by at least 0.5 percentage

points, thereby improving the Project's margins

o Capital investment of EUR485,000 - order placed with Modipalm

and Sri Sinaco Engineering Works and the press expected to be

operational in time for the peak harvesting period

o Anticipated payback of under a year

-- Construction of an additional 3,000t tank to increase overall

CPO storage capacity to 8,000 tn - gives the Company flexibility to

choose when to sell its CPO enabling achieved sales prices to be

maximised

o Capital investment of EUR390,000 - civil work to commence

imminently and take approximately 5 months to complete ahead of

2017 peak harvesting season (March - June 2017)

-- Investment in an additional back up boiler for the Project's

60 tn per hour CPO extraction mill (the 'Mill') to minimise

downtime in the event of a break-down. While this is unlikely given

the existing machinery is new and state of the art, the Board deems

it prudent to de-risk this component

o EUR0.2 million deposit paid on EUR1.25 million capital

investment - anticipated to be operational within 17 months

All investments will be funded internally from excess funds

following the recent debt refinance and internal cash resources of

the Project.

DekelOil Executive Director Lincoln Moore said, "These capital

investments, which have been in our sights since the Mill became

operational, are expected to improve operating margins, de-risk

operations and provide more flexibility with sales pricing going

forward. We look forward to benefitting operationally and

financially from these initiatives in the near future. Our ability

to make these investments, while preserving our ability to return

capital to our shareholders in the form of dividends, is reflective

of our strong balance sheet and our commitment to proactively

managing our operations to improve performance and potential risks

on behalf of shareholders."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website or

contact:

DekelOil Public Limited

Youval Rasin

Shai Kol +44 (0) 207

Lincoln Moore 236 1177

Cantor Fitzgerald Europe

(Nomad and Broker)

Andrew Craig +44 (0) 207

Richard Salmond 894 7000

Beaufort Securities Limited

(Broker)

Zoe Alexander +44 (0) 207

Elliot Hance 382 8300

Optiva Securities Limited

(Broker)

Christian Dennis +44 (0) 203

Jeremy King 137 1903

St Brides Partners Ltd (Investor

Relations)

Elisabeth Cowell +44 (0) 207

Frank Buhagiar 236 1177

Notes:

DekelOil Public Limited is a low cost producer of palm oil in

West Africa, which it is focused on rapidly expanding. To this end,

it has an 85.75% interest in one of the largest oil processing

mills based in Côte d'Ivoire, which has a capacity of 70,000 tons

of CPO. Feedstock for the Mill comes from several co-operatives and

thousands of smallholders, however it also has nearly 1,900

hectares of its own plantations. Furthermore, it has a world-class

nursery with a 1 million seedlings a year capacity.

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDUAUBRNVAAAAA

(END) Dow Jones Newswires

November 14, 2016 02:00 ET (07:00 GMT)

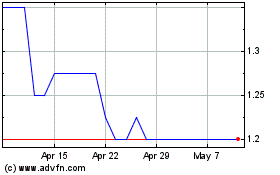

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Apr 2024 to May 2024

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From May 2023 to May 2024