TIDMECK

RNS Number : 0532U

Eckoh PLC

21 November 2023

21 November 2023

Eckoh plc

("Eckoh", the "Group", or the "Company")

Unaudited interim results for the six months ended 30 September

2023

- Cloud transition driving higher margins and quality of earnings

- North America pipeline at record levels and North America ARR up 22%

- Record level of contracted business with positive traction across our new solution set

Eckoh plc (AIM: ECK) the global provider of Customer Engagement

Data Security Solutions, is pleased to announce unaudited results

for the six months to 30 September 2023.

Period ended 30 September

GBPm (unless otherwise stated) H1 FY24 H1 FY23 Change

---------------------------------------

Revenue 18.8 19.6 -4%

-------- -------- -------

Gross profit 15.5 15.5 -

-------- -------- -------

Group ARR(1) 30.6 28.6 +7%

-------- -------- -------

North America Data Security Solutions

ARR(1) ($m) 16.8 13.8 +22%

-------- -------- -------

Adjusted EBITDA(3) 4.9 5.0 -3%

-------- -------- -------

Adjusted operating profit(4) 4.0 4.2 -4%

-------- -------- -------

Adjusted profit before taxation(4) 4.1 4.2 -1%

-------- -------- -------

Profit before taxation 1.5 2.9 -47%

-------- -------- -------

Basic earnings per share 0.43 0.77 -44%

-------- -------- -------

Adjusted diluted earnings (pence

per share)(5) 1.01 1.03 -2%

-------- -------- -------

Net cash 7.3 4.4 +2.9

-------- -------- -------

Total contracted business(6) 24.6 17.6 +40%

-------- -------- -------

Strategic highlights

-- Record levels of contracted business with a high proportion of multi-year renewals

-- Our successful drive to transition clients to cloud-based

SaaS solutions is tempering short term revenue growth but

delivering improvements in recurring revenue, operating margins and

quality of earnings

-- New global commercial strategy progressing well, with focus

on the large North America addressable market

-- Positive reception from existing clients to our new and expanded Secure Engagement Suite

-- Record North America pipeline includes several contracts

where Eckoh is selected vendor, but longer than expected sales and

contracting cycles are delaying completion and therefore

revenue

-- Cost and efficiency benefits from the transition to a SaaS

business model will deliver over GBP1m of savings in FY25

-- New updated PCI DSS v4.0 standard effective from April 2024

will increase complexity and cost of compliance for merchants,

which is likely to drive higher levels of sales engagement for

Eckoh's solutions

Financial highlights

-- Trading for the period in line with Board expectations, as

announced in the Trading Update on 1 November 2023

-- Group ARR(1) GBP30.6 million, up 7% year-on-year or 9% at constant currency

-- North America performing strongly with Security Solutions

ARR(1) up $3m or 22% to $16.8m (H1 FY23: $13.8m)

-- Record level of total contracted business(6) at GBP24.6m, up

40% (H1 FY23 GBP17.6m), driven by strong multi-year renewals and

successful cross-selling and up-selling of new products

-- Group revenue GBP18.8m, (H1 FY23: GBP19.6m), reflecting the

already announced loss of a large (non-security) UK client in FY23

and the on-going transition to cloud delivery which removes

hardware fees and reduces set up costs

-- Recurring revenue(2) increased to 83% (H1 FY23: 79%),

reflecting strong renewals and the continued shift to the cloud

-- Gross profit margin 83% (H1 FY23: 79%), an increase of 330bp

-- Adjusted operating profit(4) GBP4.0m (H1 FY23: GBP4.2m),

includes a GBP0.1m FX versus a FX gain of GBP0.7m in H1 FY23

-- Adjusted operating profit margin flat at 21.4% (H1 FY23:

21.4%), masks an underlying improvement of 410bp (excluding FX loss

in H1 FY24 21.8% and FX gain in H1 FY23: 17.7%)

-- Strong cash generation with net cash of GBP7.3m at period

end, up GBP1.6m from GBP5.7m at year end (H1 2023: GBP4.4m)

-- Eckoh's balance sheet remains robust, with no debt or drawdown on credit facilities

Current trading and Outlook

-- The Board is encouraged by the record level of business

contracted, the successful implementation of the new commercial

strategy and the sales pipeline with large deals which are in a

progressed position

-- Whilst longer than expected sales cycles have delayed revenue

progression in the year to date, the Board is confident that the

Company is on track to meet expectations for the full year (7)

-- Optimally positioned as market leader for an increased

outsourcing trend driven by regulatory change (PCI DSS v4.0),

increasing complexity and security challenges for businesses

-- It is expected that the strong positive trend of growth in

contract value and ARR will continue in the second half and with

the ongoing transition to cloud and SaaS, this underpins the

expected growth in FY25

1. ARR is the annual recurring revenue of all contracts billing

at the end of the period. Included within Group ARR is all revenue

that is contractually committed and an element of UK revenue that

has proven to be repeatable, but not contractually committed. H1

FY23 has been restated to include NA Coral revenue.

2. Recurring revenue is defined as on-going revenue, rather than

revenue derived from the set-up and delivery of a new service or

hardware.

3. Adjusted earnings before interest, tax, depreciation and

amortisation (EBITDA) is the profit before tax adjusted for

depreciation of owned and leased assets, amortisation of intangible

assets, expenses relating to share option schemes and exceptional

costs.

4. Adjusted operating profit and adjusted profit before tax are

adjusted for amortisation of acquired intangible assets, expenses

relating to share option schemes and exceptional costs.

5. Adjusted earnings pence per share - calculated using an

effective tax rate of 25% in both years.

6. Total contracted business includes new business from new

clients and from existing clients as well as renewals with existing

clients.

7. Consensus market expectations for the full year is revenue of

GBP39m and Adjusted Operating Profit of GBP8.2m

Nik Philpot, Chief Executive Officer, said: "We have made

excellent progress with our strategic goals in the first half of

the year with continued improvement in the proportion of revenue

coming from cloud, increased levels of cross-selling and upselling

from our client base and higher operating margins.

Our cloud and SaaS transition journey, which is progressing

well, will continue to increase revenue visibility, improve margin

and quality of earnings, as well as giving clients easy access to

our full Secure Engagement Suite of products. While the shift to

cloud inevitably tempers revenue growth in the short-term, it

brings longer-term benefits, which we can already see with

recurring revenues up 360 basis points to 83% and underlying

operating profit margin up 410 basis points to 21.8%. It has also

been a driver behind the increase in ARR of 7% to GBP30.6m.

North America is our most significant target market, and with

such large enterprises creating significant new opportunities that

also brings longer sales cycles, which have been especially

noticeable in this period. However, North American ARR is still up

22%, validating our strategic decision to have one global

commercial team focused on this growth opportunity, and our

pipeline is at a record level here with Eckoh selected as the

preferred supplier on several deals that are expected to close in

H2.

As market leader, we are well placed to benefit from increased

outsourcing in the contact centre environment as complying with

data regulation is becoming ever more costly and challenging to

achieve, especially with a hybrid workforce. As consumers demand

greater choice across digital payment channels and artificial

intelligence enters contact centres, Eckoh's solutions will

continue to make personal data arising from customer engagement

more secure. With compelling growth drivers, a robust strategy and

a strong balance sheet, we are on track to deliver full year

expectations(7) and our growing ARR and improved total contracted

business provides further revenue visibility into FY25 and

beyond."

For more information, please contact:

Eckoh plc Tel: 01442 458 300

Nik Philpot, Chief Executive Officer

Chrissie Herbert, Chief Financial Officer

www.eckoh.com

FTI Consulting LLP Tel: 020 3727 1017

Ed Bridges / Emma Hall/ Valerija Cymbal

/ Emily Bowen

eckoh@fticonsulting.com

Singer Capital Markets (Nomad & Joint Tel: 020 7496 3000

Broker)

Shaun Dobson / Tom Salvesen / Alex Bond

www.singercm.com

Investec Bank plc (Joint Broker) Tel: 020 7597 5970

Patrick Robb / Nick Prowting / Shalin Bhamra

www.investec.com

About Eckoh plc

As a global provider of Customer Engagement Data Security

Solutions, Eckoh is all about making the world of data more

secure.

Our vision is that everyone should be able to trust every brand

and engage without risk to their personal information. We're on a

mission to set the standard for secure interactions between

consumers and the world's leading brands, and our innovative

products build trust and deliver value though exceptional

experiences.

We're trusted by many of the world's leading brands to help them

manage the personal data from customer enquiries and transactions

safely. Our solutions enable payment transactions to be performed

securely and help protect sensitive personal data across any

customer engagement channel and device the customer chooses.

Protected by multiple patents, our solutions remove sensitive

personal and payment data from contact centres and IT environments,

as the best way to secure data is not to collect it. This allows

organisations to be not just compliant but secure, increase

efficiency, lower operational costs, and provide an excellent

customer experience. This is our specialism.

Our sol utions are delivered globally through multiple cloud

platforms or can be deployed on the client's site. They offer

merchants a simple and effective way to reduce the risk of fraud,

secure sensitive data and become compliant with the Payment Card

Industry Data Security Standards ("PCI DSS") and wider data

security regulations. Eckoh has been a PCI DSS Level One Accredited

Service Provider since 2010, and our extensive portfolio of

typically large enterprise clients spans a broad range of vertical

markets including government departments, telecoms providers,

retailers, utility providers and financial services

organisations.

For more information go to www.eckoh.com or email

MediaResponseUK@eckoh.com .

Chief Executive Officer's statement

I'm pleased to report Eckoh performed in line with Board

expectations in the period and is on track to deliver to market

expectations for the full year.

We have made excellent progress with several of our key

strategic objectives during the first half of the year:

-- Cloud-first - the share of ARR in the North American (NA)

market coming from cloud deployments grew 30% year-on-year and now

represents the majority of overall NA ARR

-- Expanding existing clients - the new commercial strategy is

showing early encouraging signs with levels of cross selling and

upselling to existing clients up 40% on the previous year to

GBP4m

-- North America focus - the strategic decision to focus our

commercial resources on the NA market is validated by a 22% growth

in ARR to $16.8m and a record sales pipeline

-- Scalable growth - the cost and efficiency benefits from our

ongoing move to cloud and SaaS solutions is driving improved

adjusted operating profit margins with an underlying improvement of

410 basis points to 21.8%

Eckoh's mission is to set the standard for secure interactions

between consumers and the world's leading brands. We make that

happen through our innovative and patented suite of secure

engagement products, which are used by some of the largest brands

globally. Evolving regulatory change, notably the impending update

to the PCI DSS, is increasing compliance complexity and creating

new security challenges for businesses; Eckoh is optimally

positioned to capitalise from an increased level of outsourcing

from Enterprises with contact centre operations who are looking to

permanently address this challenge.

At the end of the period Group Annualised Recurring Revenue

(ARR) was GBP30.6 million, (H1 FY23: GBP28.6 million), with growth

being driven by our increased focus on the North America territory,

with North America Data Security Solutions ARR at $16.8 million, a

22% increase year-on-year from $13.8 million.

Revenue for the first half was GBP18.8 million (H1 FY23: GBP19.6

million), the decrease reflecting the loss of a large

(non-security) UK client, which we disclosed in our FY23 final

results, together with the on-going transition to cloud-based

delivery of our solutions and the successful renewal of a number of

large North American clients. These North America contracts were

for solutions deployed on-premise, where the hardware revenue and

implementation fees typically represent typically 25-35% of

contract value and are, fully recognised at the point of the

initial renewal. This transition to cloud-based solutions has the

effect of tempering revenue growth in the short term but is

increasing the quality and visibility of future earnings. Almost

all new client contracts are now for cloud delivery and the element

of non-recurring charges in this model drops to only 10-15%.

The on-going shift of our new business and existing clients to

the data security solutions that comprise our cloud-based Secure

Engagement Suite continues to improve the strength of our business

model, with improving recurring revenue margins in the North

America Territory and on a Group basis an improving operating

profit margin. Adjusted operating profit was GBP4.0 million, which

includes an FX loss of GBP0.1m (H1 FY23: GBP4.2 million, included a

FX gain of GBP0.7 million), with underlying operating profit margin

of 21.8%, an underlying improvement of 410bp on last year when

excluding the respective FX movements. As most new business is now

expected to be deployed in the cloud on a SaaS basis (we expect 90%

of new North America business to be cloud), these key performance

indicators will continue to improve.

The split of ARR between on-premise and cloud delivery has for

the first time seen cloud become the largest share at 52%, which is

a threefold rise over 3 years (H1 FY21 17%). We would expect this

cloud share to continue rising, but some of the largest North

America clients continue to choose to have on premise solutions and

it may take them several years to migrate, therefore we continue to

support both deployment methods and will continue to do so for the

foreseeable future.

At the start of the year, we implemented a new commercial

strategy by unifying the UK and US commercial teams (sales,

technical pre-sales, marketing, account management and client

success), into a single global team focused predominantly on the

largest market of North America. There are no US-based competitors

for Eckoh's software solutions and by allocating more resource to

the North American market, we have been able to identify and target

potential new clients more effectively and set ourselves up to

maximise the cross-selling and upselling opportunity within

existing accounts by segmenting them into tiers of opportunity

value. Whilst it is still only a short time since this commercial

strategy was implemented, the early signs are encouraging. Total

Contract Value (the combined value of both new contracts and

renewals) was at an all-time high for a single period at GBP24.6m,

a 40% increase on the previous year and the level of cross-selling

and upselling in the period was GBP4m, also some 40% higher than

the previous year. The strength of the order level is expected to

continue in the second half, with the North America new business

pipeline at a record level. Encouragingly, the number of

opportunities that have been identified with existing clients since

the start of the year is also at a level never seen before.

In the half, strong levels of both cross-sell and up-sell

initiatives to existing clients has been executed through our new

global commercial team but supported by our enhanced Secure

Engagement Suite and the ongoing shift to cloud. Recent new product

additions such as Secure Call Recording and our updated Secure

Digital Payments platform have been extremely well received and we

expect several clients to go live with these and other additional

products from our Suite in the second half.

Our record pipeline of new business opportunities in the North

American market validates the strategic decision to move to a

single global commercial team that focuses on this market, where

the scale of opportunity for Eckoh's solutions is most compelling.

The Company is, like others, experiencing a lengthening of sales

cycles with new clients, especially in the contracting phase,

driven by increased levels of management oversight and more onerous

budgetary approval processes. Consequently, the completion of

contracts is taking longer, and has meant that several sizeable

enterprise deals where Eckoh is the chosen supplier, which were

expected to close in the period, will now shift to the second

half.

Operational Review

North America (NA) Territory (47% of group revenues)

The North American territory continues to deliver growth and the

Data Security Solutions ARR(1) at the end of the first half was

$16.8 million, a year-on-year increase of 22% (H1 FY23 $13.8

million). This represents a CAGR of 44% over the past 2 years.

Revenue for the period was $11.2 million. At a total revenue

level this is an increase year-on-year of 5% (H1 FY23: $10.6

million), however, recurring revenue has increased by 18%

year-on-year and is now 82% of revenue (H1 FY23 73%). This increase

is as expected and comes from new contracts being delivered through

the cloud with a higher recurring revenue percentage than for an

on-premise solution.

During the first half several clients with large enterprise

deals have renewed their contracts for the first time. At the point

of renewal, the hardware fees and implementation fees from the

initial term of the contract are fully recognised. This combination

of new cloud deals and large renewals in the first half has seen a

21% decline in this one-off revenue year-on-year.

Despite this shift in revenue the North America territory has

continued to grow and increase its share of Group revenue and now

accounts for a 47% share (H1 FY23: 44%). In FY24, we expect North

American revenue will be of equal size to revenue from the UK and

Ireland territory.

Total and New Contracted Business

-- The total contracted orders for the first half is $14.7

million (H1 FY23: $9.8 million), a 50% increase year-on-year

-- Data Security Solutions new contracted business of $4.1

million (H1 FY23: $7.1 million) with 56% of this coming from

existing clients

Contract Renewals

-- Seven clients have renewed their contracts in the first half,

these include Costco, Lowes, Conifer, TDS and Deluxe. These

renewals underpin the future ARR. Five of the contracts were

renewed for multi-year contracts, which provides far better

opportunity for developing the client relationship and enabling

cross-selling.

-- In the second half we have a further five sizeable renewals,

one of which has already been completed successfully with the

others due in our final quarter of the year. Of these five clients

due for renewal, four of the clients are looking to migrate to the

cloud and two are actively considering additional products as part

of this transition

Coral

In the period, Coral had revenue of $1.1 million (H1 FY23: $1.0

million Coral & third-party Support). Coral is a browser-based

agent desktop for contact centres, that aids the following:

-- to increase efficiency by bringing all the contact centre

agent's communication tools onto a single screen;

-- to enable organisations, particularly those grown by

acquisition, to standardise their contact centre facilities;

and

-- to be implemented in environments that operate on entirely different underlying technology

Coral contracts are few but high in value when they occur, and

they have a very long sales cycle (usually years) as the decision

has long term implications for the client. This makes the timing of

any new agreements both lumpy and hard to predict. There is a proof

of concept planned with a large global financial services company,

however, this is currently on hold.

UK & Ireland (UK & I) Territory, and Rest of World (ROW)

Territory (53% of group revenues)

The UK & Ireland and Rest of World territories are reported

on a combined basis due to the small proportion of ROW revenue at

this stage. Over time and as the new global strategy drives more

international mandates and activity arising from new markets, this

share will be large enough to report separately.

ARR at the end of the period was GBP16.4 million (H1 FY23:

GBP16.5 million), with growth hindered by the loss of a significant

(non-security) client in the first half last year. During the first

half of FY24 a non-security client entered administration, the full

year impact will be GBP0.5 million.

The business continues to transition to a Data Security

Solutions only proposition, with 91% of revenue now coming from

clients who take these solutions as part of their overall

proposition. We continue to see churn levels in this base of

clients to be extremely low.

Total revenue for the period was GBP9.9 million, a decrease of

10% (H1 FY23: GBP10.9 million), recurring revenue remains high at

83% (H1 FY23:84%). The UK & I territory's revenue in the period

has been impacted by the loss of the two non-security clients and

the growth going forward is expected to be modest, with the global

commercial team's focus on the more lucrative and larger North

America market. We will, however, continue to look to grow and

expand in our existing client base and compete for the largest new

enterprise contracts in the region.

Gross profit in the period was GBP8.4 million, (H1 FY23: GBP8.9

million) and gross margin was 85%, an increase of 4%, with Security

Solutions driving a higher margin.

New contracted business

-- Total contracted business was GBP12.8 million up 32% compared

to GBP9.7 million in the prior year, largely due to high conversion

of renewals and timing of large renewals

-- New contracted business was GBP2.4 million (H1 FY23: GBP2.5 million)

Contract renewals

-- Total contracted business was driven by the four largest

renewals in H1 FY24 worth a combined GBP6.9 million all containing

Data Security Solutions and all multi-year. These were Capita O2,

Tenpin, Premier Inn and Vanquis (through Maintel)

Growth Drivers - new PCI DSS standard

One of the key drivers for the adoption of our solutions is the

Payment Card Industry Data Security Standard ('PCI DSS'), which all

merchants need to comply with to help protect their customer's

data, to avoid higher payment processing charges and to reduce the

risk of substantial fines. Eckoh has maintained continual PCI DSS

compliance at level 1, the highest level, since 2010.

The Standard has evolved over time to try and address the

ever-increasing threat of fraud and hacking and the most meaningful

change to the standard since 2016 comes into force from April 2024,

when v4.0 becomes applicable. From this date any organisation who

is audited for compliance with the Standard will be expected to

comply with the new regulations that were first published in March

2022.

There are 60 new requirements that have been added, and 71 that

have been changed in v4.0 and the implications for merchants who

are currently compliant is that these changes are numerous and

complex and will drive up compliance costs and increase the

resources required to complete 'business as usual' processes. It is

also probable that a percentage of companies will fail their audits

due to the scale and challenge of the changes. With PCI DSS still

being the regulatory standard that drives most sales conversations

for Eckoh, it is anticipated that the challenges (and increased

risk) associated with implementing v4.0 by merchants will lead to

an increase in sales opportunities for Eckoh's solutions.

Secure Engagement Suite

Since acquiring Syntec two years ago we have consolidated our

products into a suite that is delivered through a common cloud

platform (our Secure Voice Cloud), that is based on a new, more

powerful and proprietary Secure Voice Appliance.

Eckoh's Secure Engagement Suite comprises several complementary

data security products that can be delivered to a client either

individually or as a solution set. Over time it is expected that

more new clients will take multiple products as part of their

initial contract and that existing clients will add further

products because of our cross-selling initiatives. This is already

beginning to bear fruit in the results we have seen in the period

and the pipeline that is building.

It is our intention and strategy to continue to grow our Secure

Engagement Suite over time, and at the beginning of the financial

year, we launched our new Secure Call Recording product. In

contrast with aging contact centre technology that only enables

calls to be recorded for compliance and quality purposes, our new

product automatically secures sensitive customer data and

incorporates the ability to transcribe calls into text at a highly

accurate level, unlocking the business intelligence and insight

that these conversations contain. The reception to the product has

been excellent and we already have clients deployed and live, with

an increasing number expected to take the service over time as

their existing call recording contracts come up for renewal, or

they move to the cloud.

Shortly after period end, we launched a significant update to

our Secure Digital Payments product, offering enhanced digital

payment choice and convenience within contact centres. Via the

updated product, customers now have the freedom to combine their

preferred contact channel with their favourite payment method:

Apple Pay over WhatsApp, Pay by Bank via live chat, pay-later apps

over the phone, or a wide variety of other combinations. In

particular, the Secure Digital Payments product will enable contact

centres to better serve customer needs, extend their services to

social media and third-party channels, increase payment volumes and

speed, provide greater choice with pay-now or pay-later options and

provide stronger authenticated security through methods such as

fingerprint or facial recognition.

The Real-time Transcription and AI product which was originally

scheduled for the end of this financial year has been split into

two separate phases. The first phase (which we still expect to be

delivered in that time frame) will see the release of the insight

tool which will allow our client real-time visibility of their

agent activity across their contact centre facilities and agent's

home locations. Monitoring performance of a hybrid agent workforce

is challenging, and security concerns are heightened, so this tool,

which can be used in combination with the Voice Security, Secure

Call Recording or the Real-time Transcription & AI products

will be a valuable addition to our clients' ability to drive both

service quality and security. Phase two, which we expect to launch

in the first half of FY25, will deliver real-time transcription and

sentiment analysis to enable managers or supervisors to view active

conversations between agents and customers to aid or assess

performance. The AI engine will be able to guide the agent to the

next best action, based on its knowledge of previous historic

outcomes, enabling less experienced agents to perform at a higher

standard increasing both customer and agent satisfaction.

Outlook and financial position

The Board is very encouraged by the continued cloud transition,

the record level of business contracted in the first half and the

successful implementation of our new commercial strategy. Whilst

the shift to cloud and longer than expected sales cycles marginally

impacted top line growth, Eckoh enters the second half with a

strong sales pipeline which includes some large deals which are in

a progressed position. This gives us the confidence that the strong

positive trend of growth in total contract value will continue in

the second half and the Board is confident that the Company is on

track to meet market expectations for the full year and the growth

expectations for FY25.

Financial Review

Overall the Group continues to progress with its cloud-based

SaaS transition and the progress made, particularly in the North

America Territory, can be seen in the improvements in annualised

recurring revenue, recurring revenue % and for the Group in the

Operating profit margin.

Revenue for the period was GBP18.8 million (H1 FY23: GBP19.6

million), a decrease year-on-year of 4% or at constant exchange

rates a 3% decrease year-on-year. Group recurring revenue was

GBP15.5 million level year-on-year, with recurring revenue 83% an

increase year-on-year of 360 basis points, the increase being

driven by the North America territory.

Adjusted operating profit was GBP4.0 million, which includes a

foreign currency loss in the period of GBP0.1m, this is compared to

an adjusted operating profit last year of GBP4.2 million, which

includes a FX gain of GBP0.7 million. The operating profit margin

for the period was 21.4%, level with the same period last year, but

an underlying improvement of 410 basis points excluding the

year-on-year net FX movement of GBP0.8 million. In the period there

is an exceptional cost of GBP0.9 million for legal fees and

restructuring costs.

Group ARR was GBP30.6 million, an increase of 7% on prior year

or at constant exchange rates an improvement of 9% (H1 FY23 GBP28.6

million).

Total contracted business for the period at the Group level was

GBP24.6 million, (H1 FY23: GBP17.6 million), a year-on-year

increase of 40% or an increase of 41% at constant exchange rates.

New contracted business was GBP5.7 million (H1 FY23: GBP8.2

million).

Basic earnings per share for the period was 0.43 pence per share

(H1 FY23: 0.77 pence per share). Adjusted earnings per share for

the period was 1.01 pence per share (H1 FY23 1.03 pence per

share).

Territory performance - NA, UK&I, & ROW

North America revenue represented 47% (H1 FY23: 44%) of total

group revenues and revenues increased in the period by 3% to GBP8.9

million (H1 FY23: GBP8.7 million), revenues in local currency

increased by 5% to $11.2 million (H1 FY23: $10.6 million).

Recurring revenue increased by 18% in the period to 82% of revenue

(H1 FY23: 73%). UK&I and ROW represented 53% of total group

revenues at GBP9.9 million, a decrease year-on-year of 10% and

recurring revenue of 83%.

Further explanations of movements in revenue between the North

America, UK & Ireland and ROW territories have been addressed

in the Operational Review above.

Gross profit

The Group's gross profit was GBP15.5 million level year-on-year,

with gross profit margin increasing by 330 basis points to 83% (H1

FY23: 79%). The UK & Ireland and ROW gross profit margin

increased to 85% year-on-year (H1 FY23: 81%). In the North America

territory, the margin in the period increased to 80% (H1 FY23:

77%). This increase in margin as previously indicated is as a

result of the continued deployment of the new Customer Engagement

Data Security Solutions in the cloud environment together with the

successful renewals of the earlier contracted on-premise solution

deployments, where the lower margin hardware component becomes

fully recognised at the point of renewal.

In the UK & Ireland and ROW territories, as the service is

hosted on an Eckoh platform, there is typically no hardware

provided to clients and the gross profit margin is expected to

remain at approx. 84 - 85%. In the North America territory, we

would expect the gross profit margin to continue to marginally

increase from 80% to approximately 81% - 82% over the next two

years. This is driven by the continued growth of the Security

Solutions being deployed as cloud solutions coupled with a small

number of clients with on-premise solutions who are due to renew

their contracts without additional significant hardware.

Administrative expenses

Total administrative expenses for the period were GBP14.0

million (H1 FY23: GBP12.6 million). Adjusted administrative

expenses for the period were GBP11.5 million, an increase

year-on-year of 4% (H1 FY23: GBP11.3 million). Exceptional costs in

the period were GBP0.9 million (H1 FY23 GBPnil million). Included

in administrative expenses is a trading FX loss of GBP0.1 million

(H1 FY23: GBP0.7 million gain).

Profitability Measures

Adjusted Operating profit(4) for the period was GBP4.0 million

(H1 FY23: GBP4.2 million). Included in the first half profit for

the current period was a FX loss of GBP0.1 million (H1 FY23: GBP0.7

million). Adjusted EBITDA(3) for the period was GBP4.9 million (H1

FY23: GBP5.0 million).

Six months Year

ended Six months ended

30 Sept ended 31 March

2023 30 Sept 2022 2023

GBP'000 GBP'000 GBP'000

---------------------------------- ----------- -------------- ----------

Profit from operating activities 1,455 2,958 5,020

Amortisation of acquired

intangible assets 1,237 1,237 2,473

Expenses relating to share

option schemes 412 (6) 40

Exceptional legal costs,

settlement agreements and

restructuring costs 916 - 203

Adjusted operating profit(4) 4,020 4,189 7,736

----------- -------------- ----------

Amortisation of intangible

assets 220 195 398

Depreciation of owned assets 316 354 643

Depreciation of leased assets 326 289 617

---------------------------------- ----------- -------------- ----------

Adjusted EBITDA(3) 4,882 5,027 9,394

---------------------------------- ----------- -------------- ----------

Adjusted profit before tax was GBP4.1 million (H1 FY23: GBP4.2m)

and is after including in the adjusted operating profit, the net

interest income of GBP93k in the current period and the net

interest charge of GBP18k in H1 FY23 adjusted operating profit.

Finance charges

For the financial period ended 30 September 2023, the net

interest income was GBP93k (H1 FY23: GBP18k charge). The interest

income is made up of bank interest receivable of GBP111k (H1 FY23:

GBP11k), offset by interest on leased assets of GBP18k (H1 FY23:

GBP29k).

Taxation

For the financial period ended 30 September 2023, there was a

tax charge of GBP0.3 million (H1 FY23: GBP0.7 million), an

effective tax rate of 18% (H1 FY23: 23%).

Earnings per share

Basic earnings per share was 0.43 pence per share (H1 FY23: 0.77

pence per share). Diluted earnings per share was 0.42 pence per

share (H1 FY23: 0.74 pence per share). Adjusted diluted earnings

per share was 1.01 pence per share (H1 FY23: 1.03 pence per share

(restated to use a tax rate of 25%)).

Client contracts

Client contracts are typically multi-year in length and have a

high proportion of fixed recurring revenues from the software

licences for our products. There are a smaller and declining number

of UK contracts that are underpinned by transactional minimum

commitments. In the NA territory we now have a greater proportion

of contracts being delivered through the cloud, so the initial set

up fees and hardware costs associated with larger customer premise

deployments have reduced. This has led to total revenue growth

being lower than recurring revenue growth. Recurring revenue as a

percentage of regional revenue in the NA territory has increased

from 52% in FY21 to 82% in the first half and gross profit margin

has increased in the same period from 71% to 80%. This trend is

also driving the improved Operating profit margin we are seeing at

a Group level. This has resulted in a reduction in contract

liabilities held on the Group's balance sheet and a net cash

outflow for working capital, this is expected to normalise in the

current year and onwards into FY25.

Contract liabilities and contract assets

Contract liabilities and contract assets relating to IFRS 15

Revenue from Contracts with Customers continue to decrease,

principally as new contracted business in North America has been

predominantly for cloud-based solutions. Where clients contract for

their services to be provided in the cloud or on our internal cloud

platforms, the level of hardware is significantly reduced and

implementation fees are typically lower. This reduces the level of

upfront cash received but drives a greater level of revenue

visibility and earnings quality. Total contract liabilities were

GBP8.4 million (H1 FY23: GBP11.9 million) included in this balance

are GBP5.1 million of IFRS 15 contract liabilities relating to the

Secure Payments product, hosted platform product or Syntec's

CardEasy Secure Payments product, a decrease of GBP1.8 million from

March 2023. Contract assets as at 30 September 2023 were GBP1.7

million compared to GBP2.4 million at March 2023 (H1 FY23: GBP3.3

million).

Cashflow and liquidity

Net cash at 30 September 2023 was GBP7.3 million, an increase of

GBP1.6 million from the year end at 31 March 2023 and an increase

of GBP2.9 million to the previous year. The GBP1.6 million cash

inflow from 31 March 2023 includes a net cash outflow for trade

debtors, trade creditors, inventory and tax of GBP1.6 million (H1

FY23: cash outflow GBP1.9 million), in principle due to the

unwinding of deferred revenue on the large enterprise on-premise

solutions.

Consolidated statement of comprehensive income

for the six months ended 30 September 2023

Six months Six months

ended 30 ended 30 Year ended

September September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 18,772 19,590 38,821

Cost of sales (3,268) (4,059) (7,578)

----------------------------------------------- ----------- ----------- -----------

Gross profit 15,504 15,531 31,243

Administrative expenses (14,049) (12,573) (26,223)

----------------------------------------------- ----------- ----------- -----------

Operating profit 1,455 2,958 5,020

----------------------------------------------- ----------- ----------- -----------

Adjusted operating profit 4,019 4,189 7,736

Amortisation of acquired intangible

assets (1,237) (1,237) (2,473)

Expenses relating to share option

schemes (411) 6 (40)

Exceptional costs - legal fees and

restructuring costs (916) - (203)

----------------------------------------------- ----------- ----------- -----------

Profit from operating activities 1,455 2,958 5,020

----------------------------------------------- ----------- ----------- -----------

Finance charges (18) (29) (53)

Finance income 111 11 53

----------------------------------------------- ----------- ----------- -----------

Profit before taxation 1,548 2,940 5,020

Taxation (274) (682) (383)

-----------

Profit for the period 1,274 2,258 4,637

=============================================== =========== =========== ===========

Other comprehensive income/(expense)

---------------------------------------------- ----------- ----------- -----------

Items that will be reclassified subsequently

to profit or loss:

Foreign currency translation differences

- foreign operations 83 (32) (389)

----------------------------------------------- ----------- ----------- -------------

Other comprehensive (expense)/ income

for the period, net of income tax 83 (32) (389)

----------------------------------------------- ----------- ----------- -----------

Total comprehensive income for the

period attributable to the equity

holders of the Company 1,357 2,226 4,248

=============================================== =========== =========== ===========

Profit per share expressed in pence

---------------------------------------------- ----------- ----------- -----------

Basic earnings per 0.25p share 0.43 0.77 1.58

Diluted earnings per 0.25p share 0.42 0.74 1.55

----------------------------------------------- ----------- ----------- -----------

Consolidated statement of financial position

as at 30 September 2023

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------- ------------- ------------- ---------

Assets

Non-current assets

Intangible assets 36,497 38,860 37,500

Property, plant and equipment 3,945 4,433 4,181

Right -of-use leased assets 668 1,282 995

Deferred tax asset 156 1,535 129

-------------------------------- ------------- ------------- ---------

41,266 46,110 42,805

------------------------------- ------------- ------------- ---------

Current assets

Inventories 223 295 254

Trade and other receivables 10,238 13,556 11,778

Cash and cash equivalents 7,278 4,358 5,740

-------------------------------- ------------- ------------- ---------

17,739 18,209 17,772

------------------------------- ------------- ------------- ---------

Total assets 59,005 64,319 60,577

-------------------------------- ------------- ------------- ---------

Liabilities

Current liabilities

Trade and other payables (13,294) (18,036) (16,190)

Lease liabilities (482) (609) (482)

-------------------------------- ------------- ------------- ---------

(13,776) (18,645) (16,672)

------------------------------- ------------- ------------- ---------

Non-current liabilities

Lease liabilities (231) (740) (569)

Deferred tax liabilities (1,535) (3,014) (1,528)

-------------------------------- ------------- ------------- ---------

(1,766) (3,754) (2,097)

------------------------------- ------------- ------------- ---------

Net assets 43,463 41,920 41,808

-------------------------------- ------------- ------------- ---------

Shareholders' equity

Called up share capital 732 732 732

Share premium account 22,180 22,180 22,180

Capital redemption reserve 198 198 198

Merger reserve 2,697 2,697 2,697

Currency reserve 815 1,089 732

Retained earnings 16,841 15,024 15,269

-------------------------------- ------------- ------------- ---------

Total equity 43,463 41,920 41,808

-------------------------------- ------------- ------------- ---------

Consolidated interim statement of changes in equity

as at 30 September 2023

Called Capital

up share Share redemption Merger Currency Retained Total Shareholders'

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2023 732 22,180 198 2,697 732 15,269 41,808

Total comprehensive

income for the period

Profit for the period - - - - - 1,274 1,274

Other comprehensive

expense for the period - - - - 83 - 83

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Contributions by and

distributions to owners - - - - 83 1,274 1,357

Shares transacted

through

Employee Benefit Trust - - - - - - -

Shares issued under

the share option scheme - - - - - - -

Shares purchased for

share ownership plan - - - - - (104) (104)

Share based payment

charge - - - - - 402 402

Transactions with

owners recorded

directly

in equity - - - - - 298 298

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance as at 30

September

2023 732 22,180 198 2,697 815 16,841 43,463

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Called Capital

up share Share redemption Merger Currency Retained Total Shareholders'

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance at 1 April

2022 732 22,180 198 2,697 1,121 12,815 39,743

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Total comprehensive

income for the period

Profit for the period - - - - - 2,258 2,258

Other comprehensive

expense for the period - - - - (32) - (32)

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Contributions by and

distributions to owners - - - - (32) 2,258 2,226

Shares transacted

through

Employee Benefit Trust - - - - - - -

Shares issued under

the share option schemes - - - - - - -

Shares purchased for

share ownership plan - - - - - (72) (72)

Share based payment

charge - - - - - 23 23

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Transactions with

owners recorded

directly

in equity - - - - - (49) (49)

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance at 30 September

2022 732 22,180 198 2,697 1,089 15,024 41,920

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Consolidated statement of cash flows

for the six months ended 30 September 2023

Six months Six months

ended ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

--------------------------------------- -------------- -------------- -----------

Profit after taxation 1,274 2,258 4,637

Interest income (111) (11) (53)

Interest payable 18 29 53

Taxation 274 682 383

Depreciation of property, plant

and equipment 316 354 643

Depreciation of leased assets 326 289 617

Amortisation of intangible assets 1,457 1,432 2,871

Share based payments 412 26 40

Exchange differences 67 (719) (516)

--------------------------------------- -------------- -------------- -----------

Operating profit before changes

in working capital and provisions 4,033 4,340 8,675

--------------------------------------- -------------- -------------- -----------

Decrease/ (Increase) in inventories 31 (27) 14

Decrease/ (Increase) in trade and

other receivables 1,540 (1,273) 505

Decrease in trade and other payables (2,908) (252) (2,238)

--------------------------------------- -------------- -------------- -----------

Net cash generated from operating

activities 2,696 2,788 6,956

--------------------------------------- -------------- -------------- -----------

Taxation paid (292) (335) (178)

Interest paid on lease liability (18) (29) (53)

--------------------------------------- -------------- -------------- -----------

Net cash from continuing operating

activities 2,386 2,424 6,725

--------------------------------------- -------------- -------------- -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (76) (501) (613)

Purchase of intangible fixed assets (408) (164) (570)

Interest received 111 11 53

Net cash utilised in continuing

investing activities (373) (654) (1,130)

--------------------------------------- -------------- -------------- -----------

Cash flows from financing activities

Dividends paid - - (1,959)

Principal elements of lease payments (338) (188) (564)

Shares purchased for share ownership

plan (103) (72) (120)

Net cash utilised in continuing

investing activities (441) (260) (2,643)

Increase in cash and cash equivalents 1,572 1,510 2,952

Cash and cash equivalents at the

start of the period 5,740 2,840 2,840

Effect of exchange rate fluctuations

on cash held (34) 8 (52)

--------------------------------------- -------------- -------------- -----------

Cash and cash equivalents at the

end of the period 7,278 4,358 5,740

--------------------------------------- -------------- -------------- -----------

Notes to the condensed consolidated interim financial

statements

For the six months ended 30 September 2023

GENERAL INFORMATION

Eckoh plc is a public Company limited by shares and is

incorporated in the United Kingdom and registered in England under

the Companies Act 2006 (Company Registration number 03435822). The

address of the Company's registered office is Telford House, Corner

Hall, Hemel Hempstead, HP3 9NH.

Eckoh plc is a global provider of Customer Engagement Data

Security Solutions.

These condensed consolidated interim financial statements for

the six months ended 30 September 2023 comprise the Company and its

subsidiaries (together the "Group").

1. Basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 September 2023 have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted for

use in the UK. This report does not include all of the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

as at and for the year ended 31 March 2023, which have been

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards,

comprising FRS 101 "Reduced Disclosure Framework" and applicable

law).

The unaudited condensed consolidated interim financial

information for the period ended 30 September 2023 does not

constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The comparative figures for the year ended 31

March 2023 are extracted from the statutory financial statements

which have been filed with the Registrar of Companies, on which the

auditor gave an unqualified report, which made no statement under

section 498(2) or (3) respectively of the Companies Act 2006 and

did not draw attention to any matters of emphasis.

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

March 2023.

In reporting financial information, the Group presents

alternative performance measures ("APMs"). The Directors consider

that disclosing alternative performance measures enhances

Shareholders' ability to evaluate and analyse the underlying

financial performance of the Group. They have identified adjusted

operating profit and adjusted EBITDA as measures that enable the

assessment of the performance of the Group and assists in

financial, operational and commercial decision-making. In adjusting

for these measures, the Directors have sought to eliminate those

items of income and expenditure that do not specifically relate to

the underlying operational performance of the Group in a specific

year.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 20 November 2023.

The accounting policies adopted in these interim financial

statements are consistent with those of the previous financial year

and the corresponding interims period.

Going concern

The Directors have, at the time of approving the condensed

consolidated interim financial statements, a reasonable expectation

that the Company and the Group have adequate resources to continue

in operational existence for the foreseeable future. Thus, they

continue to adopt the going concern basis of accounting in

preparing the financial statements.

New standards and interpretations not yet adopted

Amended standards and interpretations not yet effective are not

expected to have a significant impact on the Group's consolidated

financial statements.

2. Dividends

The proposed dividend of GBP2.2m for the year ended 31 March

2023 of 0.74p per share was paid on 20 October 2023.

3. Earnings per share

The basic and diluted earnings per share are calculated on the

following profit and number of shares. Earnings for the calculation

of earnings per share is the net profit attributable to equity

holders of the parent.

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- -------------- ----------

Earnings for the purposes of basic

and diluted earnings per share 1,274 2,258 4,637

------------------------------------------ -------------- -------------- ----------

Earnings for the purposes of adjusted

basic and diluted earnings per share(1) 3,084 3,128 5,802

------------------------------------------ -------------- -------------- ----------

1. Calculated using tax rate of 25% in all years

Reconciliation of earnings for the purposes of adjusted basic

and diluted earnings per share

H1 FY24 H1 FY23 FY23

GBP'000 GBP'000 GBP'000

------------------------------------------- -------- -------- --------

Earnings for the purposes of basic and

diluted earnings per share 1,274 2,258 4,637

Taxation 274 682 383

Amortisation of acquired intangible

assets 1,237 1,237 2,473

Expenses relating to share option schemes 412 (6) 40

Exceptional legal and restructuring

costs 916 - 203

------------------------------------------- -------- -------- --------

Adjusted profit before tax 4,112 4,171 7,736

Tax charge based on standard corporation

tax rate of 25% (2023: 25%) (1,028) (1,043) (1,934)

------------------------------------------- -------- -------- --------

Earnings for the purposes of adjusted

basic and diluted earnings per share 3,084 3,128 5,802

------------------------------------------- -------- -------- --------

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Denominator '000 '000 '000

---------------------------------------- -------------- -------------- ----------

Weighted average number of shares in

issue in the period 292,909 292,893 292,893

Shares held by employee ownership plan (2,608) (2,062) (2,338)

---------------------------------------- -------------- -------------- ----------

Number of shares used in calculating

basic earnings per share 290,302 290,831 290,555

Dilutive effect of share options 13,819 12,428 9,210

Number of shares used in calculating

diluted earnings per share 304,121 303,259 299,765

----------

H1 FY23 H1 FY22 FY23

Profit per share pence Pence Pence

Basic earnings per 0.25p share 0.43 0.77 1.58

Diluted earnings per 0.25p share 0.42 0.74 1.55

Adjusted earnings per 0.25p share 1.05 1.07 1.98

Adjusted diluted earnings per 0.25p

share 1.01 1.03 1.94

4. Subsequent events to 30 September 2023

As at the date of these statements there were no such events to

report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KBLFLXFLFFBB

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

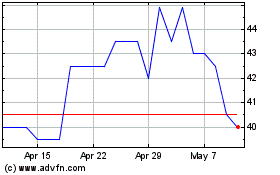

Eckoh (LSE:ECK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eckoh (LSE:ECK)

Historical Stock Chart

From Apr 2023 to Apr 2024