Elementis PLC Elementis announces Personal Care acquisition

February 10 2017 - 1:00AM

UK Regulatory

TIDMELM

10 February 2017

Elementis significantly increases the scale of its personal care business with

US$360 million acquisition of SummitReheis

Acquisition adds a high quality business with significant potential for further

growth in the attractive personal care segment

Elementis plc ("Elementis" or the "Group") today announces that it has entered

into an agreement to acquire SRLH Holdings, Inc. ("SummitReheis") from an

affiliate of One Rock Capital Partners, LLC ("One Rock") for an enterprise

value of US$360 million, (the "Acquisition"). SummitReheis will become part of

an enlarged personal care business within Elementis. For the year ended 31

December 2016, SummitReheis is expected to report revenue of US$134 million and

underlying EBITDA of approximately US$28 million. The acquisition enterprise

value is equivalent to approximately 11.8x SummitReheis expected underlying

EBITDA for 2016 (including run rate cost synergies).

SummitReheis is a high quality, high margin specialty chemicals platform that

produces a range of critical active ingredients and materials tailored for use

in personal care, pharmaceutical and dental products. SummitReheis'

anti-perspirant actives business (more than 60 per cent. of its sales) is the

global leader in the manufacture and sale of active ingredients for

anti-perspirants and has long standing relationships with key consumer product

companies across the Americas, Europe and Asia.

Transaction highlights:

* Acquisition creates an enlarged personal care business with annual sales of

approximately US$200 million, significantly increasing the Group's presence

in this important end market

* Enhanced growth potential driven by the combination of complementary

products, customers and a broader geographic presence which together offer

cross-selling opportunities

* Critical components for the US$13 billion anti-perspirant market with

growth driven by increasing penetration in emerging markets and demand for

premium and higher efficacy products in established geographies

* Acquisition will be funded from cash resources and new debt facilities of

US$475 million which will be supported by the cash generation

characteristics of the enlarged Group

* Expected to deliver material earnings accretion and substantial free cash

flow accretion in the current financial year

* Return on invested capital ("ROIC") expected to be in line with Elementis'

cost of capital in the first full year of ownership

Notification of Results and Special Dividend:

* Elementis will report its Full Year Results for the year ended 31 December

2016 on 1 March 2017

* The Board of Elementis can confirm that it expects earnings per share for

the year to 31 December 2016 to be in line with current market expectations

* The Board confirms that its consideration of special dividends in respect

of 2016 will not be impacted by the Acquisition

Paul Waterman, CEO of Elementis plc, said:

"At our recent Capital Markets Day presentation, we highlighted the growth

prospects in personal care as a key opportunity for Elementis, driven by long

term positive demographic trends and an increasingly sophisticated consumer.

Our leading position with proprietary hectorite and Rheoluxe® rheology

modifiers will be augmented by SummitReheis' complementary position in

specialty additives for anti-perspirants, pharmaceuticals and dental products.

"The Group is well positioned to capitalise on this acquisition through the

enhanced geographic footprint and strong customer relationships that it brings.

Together with our existing business, the acquisition of SummitReheis is

transformative for our personal care business, creating a substantial, high

return platform that will help accelerate our Reignite Growth strategy."

Strategic rationale

* Personal care market is a significant growth opportunity for Elementis

* Anti-perspirants is a highly attractive, growing segment of the personal

care market

* Acquisition creates a US$200 million personal care business of Elementis

with critical mass and significant growth prospects

+ Combines SummitReheis' key active ingredients for anti-perspirants with

Elementis' enabling technology of hectorites and synthetic polymers

* Accelerates growth for both SummitReheis and Elementis as a result of the

expanded footprint with key customers and broader geographical reach

* Combined business has strong relationships with key consumer products

companies

* SummitReheis products differentiated by their superior quality and

certifications (for example, FDA requirements in the US and ECHA

requirements in Europe)

* Benefits expected from the realisation of additional growth opportunities

Financial highlights

* Enterprise value of US$360 million on a cash free, debt free basis

* Immediate adjusted earnings per share accretion expected in the current

financial year and double digit adjusted earnings per share accretion in

2018

* Expected to enhance Elementis' group margin in the current financial year

* Run rate cost synergies of up to US$3 million per annum identified

* ROIC expected to be in line with Elementis' cost of capital in the first

full year of ownership

* Funded through Elementis' existing cash resources and US$475 million of new

debt facilities

* Elementis to remain prudently financed post acquisition

SummitReheis and Elementis

SummitReheis operates in a highly attractive, growing segment of the personal

care market. Anti-perspirant products are experiencing growing demand in

developed markets, particularly the US, driven by demand for premium and higher

efficacy products. In emerging markets, particularly Latin America, India and

South East Asia, anti-perspirant products are benefitting from increasing

market penetration driven by changing lifestyle trends and increased

discretionary income. SummitReheis' primary manufacturing operations are in

North America and Europe with approximately 70% of revenue from these markets.

The combination of SummitReheis with Elementis' global distribution networks

creates the opportunity to drive growth in emerging markets.

As the leading global producer of active ingredients for anti-perspirants,

SummitReheis has built long-term relationships with key consumer product

companies. Elementis' existing personal care business is part of its Specialty

Products division and supplies hectorite and Rheoluxe® rheology modifiers that

enhance the effectiveness of SummitReheis' products. SummitReheis will be

merged with Elementis' existing personal care activities, creating a business

with approximately US$200 million of annual sales, representing approximately

25 per cent. of Elementis' pro forma combined sales and in excess of 30 per

cent. of Elementis' pro forma combined operating profit before amortisation.

Information regarding SummitReheis

SummitReheis' primary focus is the manufacture and sale of aluminium and

zirconium based active ingredients for anti-perspirant products to global

consumer products companies. It is the global leader in the fast growing

anti-perspirant actives ("AP actives") market with locations in the US, Europe

and Asia. Its technologies provide the base ingredients providing

sweat-blocking characteristics in all types of anti-perspirant products such as

aerosols, sticks and roll-ons. Over 60 per cent. of SummitReheis' sales are

from its AP actives business.

SummitReheis' Pharma Actives business is a leading European producer of the

active ingredients for indigestion and heartburn remedies. These products have

similar chemistry and manufacturing processes to the core business and

long-term customer relationships in the pharmaceutical industry. SummitReheis'

Specialty Dental business manufactures dental plasters, alloys, discs and

moulding materials that are used to make dental crowns, bridges, replacement

teeth and in other applications and has a leading position in Germany.

SummitReheis is headquartered in Huguenot, New York. In June 2015, SummitReheis

acquired the European AP actives, pharma and dental businesses of B.K. Giulini.

SummitReheis' financial profile

For the year ended 31 December 2015, SummitReheis reported revenue of US$103

million, EBITDA of US$15 million and operating income of US$8 million. Pro

forma for a full year contribution from the acquired B.K. Giulini businesses,

SummitReheis would have reported underlying EBITDA of approximately US$25

million in the year ended 31 December 2015. As at 31 December 2015,

SummitReheis had total assets of US$208 million and net assets of US$12

million.

For the year ended 31 December 2016, SummitReheis is expected to report revenue

of US$134 million and underlying EBITDA of approximately US$28 million.

Transaction details and timing

Completion of the acquisition is expected to take place in the second quarter

of 2017 following receipt of anti-trust clearances in the US and Germany.

Elementis intends to fund the acquisition through existing cash resources and

US$475 million of new debt facilities which will also be used to refinance

Elementis' existing debt facilities. The new debt will be provided through a

new fully underwritten US$275 million revolving credit facility and US$200

million term loan facility. The new debt facilities have a 5 year term and are

on terms in line with the Group's existing facilities. Elementis will remain

prudently financed post acquisition.

Conference call

Paul Waterman, Chief Executive Officer, and Ralph Hewins, Chief Financial

Officer, will hold an analyst and investor call today at 08:30a.m. UK time to

discuss this announcement. To participate in the conference call, please dial:

UK +44 (0)20 3139 4830; UK toll free 0808 237 0030 or click here for

international numbers: http://events.arkadin.com/ev/docs/

NE_FEL_Events_International_Access_List.pdf.

The participant PIN code is 33260441#.

A copy of the presentation slides will be available at:

https://arkadin-event.webex.com/arkadin-event/onstage/g.php?MTID=

e4da989b68546419fb2a9e73a4634bb83

The event password is: 682839.

Press releases can also be found on the website www.elementisplc.com

For further information on this release please contact:

Financial Advisers

Gleacher Shacklock LLP

Edward Cumming Bruce / Mark Hammond / Tom Quinn

T: +44 (0)20 7484 1120

Natrium Capital

Alasdair Nisbet

T: +44 (0)20 3574 4635

Media Contacts

FTI Consulting

Deborah Scott / Matthew Cole

T: +44 (0)20 3727 1000

Editor's notes

SummitReheis is a leading global specialty chemicals platform that produces a

range of critical active ingredients and materials tailored for use in personal

care, pharmaceutical and dental products. The company was founded in 1940 and

is headquartered in Huguenot, New York, US.

* SummitReheis' AP actives business is the global leader in the production of

active ingredients in anti-perspirant products and accounted for 62% of

SummitReheis' pro forma revenue for the year ended 31 December 2015

* SummitReheis' Pharma actives business produces sucralfate, antacid pastes

and powders which are critical components of regulated pharmaceutical

products sold both over-the-counter and with prescription. The Pharma

actives business provides ingredients used in antacids and gastrointestinal

remedies utilising similar chemistry and manufacturing plant as the AP

actives business in Germany. It generated 18% of SummitReheis' pro forma

revenue for the year ended 31 December 2015

* SummitReheis' Specialty Dental business manufactures dental plasters alloys

/discs and moulding materials that are used to make dental crowns, bridges

and replacement teeth and in other applications. It generated 20% of

SummitReheis' pro forma revenue for the year ended 31 December 2015

Anti-perspirants reduce sweat by a significant amount and deodorants use

biocides and scent to mask the effects of sweating. SummitReheis' AP active

ingredients are based on either ACH (Aluminium Chlorohydrate) or ZAG (Zirconium

Aluminium Glycine). They are used in all of the key types of anti-perspirant

products: sticks, roll-ons and aerosols. In the US the preferred

anti-perspirants are sticks whilst in Europe they are aerosols. ACH and ZAG are

used in most products however ZAG is not used in aerosols.

Elementis' hectorite clays or gels are used in anti-perspirants in conjunction

with SummitReheis' products. Specifically, the hectorite clays enable the

effective use of ACH in aerosols, the highest growth application. Hectorite

acts as a rheology modifier, providing uniformity in application and aiding in

the suspension of aluminium salts within aerosol anti-perspirants. As well as

acting as an in-process suspension aid, the use of hectorite also reduces the

undesirable appearance of armpit staining on shirts.

SummitReheis has strong and long-standing relationships with the top global

manufacturers of anti-perspirants and deodorants. The AP actives business

serves a broad customer base from small, regional suppliers to some of the

leading global personal care manufacturers. The Pharma actives business

supplies both multinational pharmaceutical companies and regional

pharmaceutical suppliers selling OTC and prescription antacids. For Specialty

Dental the business supplies a range of direct customers, distributors and

agents across varied markets, including dental laboratory equipment, medical

bandages and 3D printing.

SummitReheis supplies its customers globally. Its revenue is well diversified,

with 41% in Europe, 33% in North America and 26% in the rest of the world (for

the year ended 31 December 2015). Its manufacturing operations are in the US,

Germany, UK and China. It also has plans to build a manufacturing capability in

Brazil and Thailand. SummitReheis' geographical spread of operations is

complementary to that of Elementis. SummitReheis employs approximately 270

people.

END

(END) Dow Jones Newswires

February 10, 2017 02:00 ET (07:00 GMT)

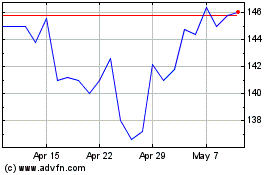

Elementis (LSE:ELM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Elementis (LSE:ELM)

Historical Stock Chart

From Apr 2023 to Apr 2024