Foresight Solar Fund Limited Posting of Circular and Notice of General Meeting (1682A)

September 07 2018 - 8:22AM

UK Regulatory

TIDMFSFL

RNS Number : 1682A

Foresight Solar Fund Limited

07 September 2018

THIS ANNOUNCEMENT, INCLUDING THE APPENDIX, IS RESTRICTED AND IS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO U.S. PERSONS, OR IN OR INTO,

THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR INTO ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OR BREACH

OF ANY APPLICABLE LAW. PLEASE SEE THE IMPORTANT NOTICE AT THE END

OF THIS ANNOUNCEMENT.

This announcement does not constitute an offer to sell, or the

solicitation of an offer to subscribe for, or to buy shares in any

jurisdiction. This announcement is an advertisement and not a

prospectus.

Foresight Solar Fund Limited

LEI: 213800VO4O83JVSSOX33

7 September 2018

Foresight Solar Fund Limited

(the "Company")

Posting of Circular and Notice of General Meeting

Further to the Company's announcement on 4 September 2018

regarding publication of a Circular, and a potential Acquisition

and Placing, the Company has today posted the Circular convening a

general meeting (the "General Meeting") to be held at 10 a.m. on 24

September 2018 at 28 Esplanade, St Helier, Jersey JE2 3QA.

Unless otherwise defined, the terms used in this Announcement

shall have the same meaning as set out in the Circular.

As previously announced, the board of directors of Foresight

Solar Fund Limited (the "Board") is seeking authority to issue

ordinary shares in the capital of the Company (the "Ordinary

Shares") on a non pre-emptive basis to allow the Company to fund

the acquisition of a portfolio of 10 ground-based, solar power

assets in the UK with a total installed capacity of 72MW (the

"Target Portfolio") for an aggregate consideration of GBP30.1

million (the "Acquisition"), to reduce the Company's gearing and to

be in a position to raise additional capital when it identifies

solar power assets that are suitable for acquisition in accordance

with the Company's investment policy. The Board is therefore

seeking shareholder approval to disapply the pre-emption rights on

the issue of Ordinary Shares in the capital of the Company

("Resolution 1").

The Board further announces that it is also seeking shareholder

approval to be able to issue shares to BlackRock Inc.

("BlackRock"), a substantial shareholder in the Company and as a

result a related party under the Listing Rules ("Resolution

2").

The Related Party Transaction

BlackRock is a related party to the Company, pursuant to the

Listing Rules, having been a substantial shareholder of the Company

in the past 12 months. As part of the placing and share issue on 4

July 2018, BlackRock subscribed for an additional 22 million Shares

for a consideration of GBP23.54 million, which constituted a

smaller related party transaction under the Listing Rules and, as a

result, did not require shareholder approval. BlackRock may wish to

make further investment(s) in the Company by participating in the

Placing and/or any further share issuances under the authority of

Resolution 1.

Given BlackRock is a related party, the Listing Rules require

that any such further investment by BlackRock be conditional upon

the approval of the Independent Shareholders (being, in relation to

Resolution 2, Shareholders other than BlackRock). BlackRock will

not vote on Resolution 2 and has undertaken to take all reasonable

steps to ensure that its Associates will not vote on that

resolution.

Should BlackRock choose to participate in the Placing or any

other further share issuance under the authority of Resolution 1

then its participation will be on the same terms as any other

investor. In the event that applications under the Placing or any

fundraising cannot be satisfied in full, applications from

BlackRock will be scaled back under the same methodology as is

applicable to other investors in that fundraising.

On the assumption that all of the Shares available to be issued

by the Company under the Placing are issued and on the assumption

that 53,994,250 Shares (the maximum amount permitted) are issued to

BlackRock, BlackRock would own approximately 25.6 per cent. of the

enlarged issued share capital of the Company. However, it should be

noted that BlackRock has made no commitment to subscribe for Shares

and even if Resolution 2 is passed, may not subscribe at all.

Recommendation

The Board, which has been so advised by Stifel as Sponsor,

considers that the proposed Related Party Transaction is fair and

reasonable so far as Shareholders are concerned. In providing its

advice, Stifel has taken into account the Board's commercial

assessments.

The Board also considers that the passing of each of the

Resolutions is in the best interests of the Company and its

Shareholders as a whole. Accordingly, the Board unanimously

recommends that Shareholders vote in favour of the Resolutions at

the General Meeting. The Directors intend to vote in favour of each

of the Resolutions in respect of their own beneficial holdings of

Ordinary Shares (amounting to 93,954 Ordinary Shares, representing

approximately 0.02 per cent. of the issued share capital of the

Company) as at today's date.

A copy of the circular will be available for inspection on the

Company's website at www.foresightgroup.eu.fsfl-home.

The circular will be also available for inspection on the

National Storage Mechanism which is located at

http://www.morningstar.co.uk/uk/nsm.do.

All enquiries:

Foresight Group

Joanna Andrews InstitutionalIR@foresightgroup.eu +44 (0)20 3762 6951

Stifel Nicolaus Europe Limited +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Gaudi Le Roux

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NOGEADNXEAEPEFF

(END) Dow Jones Newswires

September 07, 2018 09:22 ET (13:22 GMT)

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Apr 2024 to May 2024

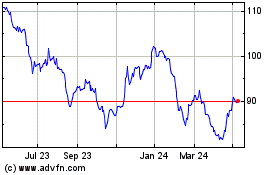

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From May 2023 to May 2024