TIDMGHT

RNS Number : 2531M

Gresham Technologies PLC

04 January 2019

RNS

4 January 2019

Gresham Technologies plc

Clareti contract signed and trading update

Gresham Technologies plc (LSE: "GHT", "Gresham" or the "Group"),

the leading software and services company that specialises in

providing real-time transaction control and enterprise data

integrity solutions, provides the following trading update for the

year ended 31 December 2018 ("FY 2018").

As noted at the time of the interim results and the trading

updates in October and December 2018, the Group's ability to win

and recognise revenue from a small number of competitive Clareti

opportunities, each carrying significant, immediately recognisable

license fees, before the end of the 2018 year-end was key to

achieving full year forecasts.

Of the significant deals within its pipeline, the Group is

pleased to confirm it has been selected for two strategic

high-value projects for its Clareti platform, further illustrating

the Board's view that there is a significant market opportunity for

the Clareti platform to replace legacy vendor solutions and become

the new industry standard for enterprise reconciliations in capital

markets.

In late 2018, following a competitive process, a leading global

investment bank selected the Clareti platform, together with one of

Gresham's strategic alliance partners, to deliver a reconciliations

managed service to replace legacy vendor technology and also

address new data integrity and control requirements across the

bank. The licence contract, the single largest in Gresham's

history, was signed on 31 December 2018 and becomes unconditional

on the signing of the partner's related services agreement now

expected to be executed in early 2019.

Also in December 2018, contract terms were finalised with

another global investment bank to migrate a legacy vendor

implementation to the Clareti platform, with the agreement now

expected to be executed in early 2019.

In light of these developments, the Company now expects to start

recognising revenue from both projects in early 2019 and

consequently has taken the opportunity to re-profile both

agreements on an annuity subscription basis in order to provide

higher levels of revenue visibility and earnings quality for future

years. The total software value of both agreements over a five-year

period is expected to be in excess of GBP7 million, of which GBP1.8

million is expected to be recognised in early 2019. Further details

on these projects will be provided in due course.

The delay in recognising revenue from these projects, and

specifically the lower than expected initial license fees secured

in the year, has negatively impacted FY 2018 results. The Group now

expects to report:

-- Group revenues for the year down 8% to GBP20.0 million*

-- Total Clareti revenues up 8% to GBP11.9 million*

-- Clareti Annualised Recurring Revenue** up 30% to GBP7.4 million

-- Other (non-Clareti) revenues down 24% to GBP8.1 million

-- Group adjusted EBITDA* down 83% to GBP0.8 million

-- The Group closed the year with cash at GBP5.3 million and remains debt free

*Includes a contribution of GBP0.7 million from the B2 Group

acquired on 4 July 2018.

**The Group's closing contracted annualised run-rate of

recurring Clareti revenues at 31 December 2018 is GBP7.4 million up

30% from GBP5.7 million at the end of the previous period. This

includes GBP1.1 million from B2 Group.

***Earnings Before Interest, Taxation, Depreciation and

Amortisation adjusted to add back share-based payment charges and

exceptional items.

The Group's financial position is expected to remain strong

throughout 2019 and beyond. The Board retains its confidence in the

market opportunity for its Clareti platform and once revenue from

the two deals expected imminently becomes recognisable, the Group's

annual recurring revenue run-rate ("ARR") is anticipated to improve

significantly to GBP8.8 million, from a 2018 closing ARR positon of

GBP7.4 million. Gresham's sub-contracting business exited 2018 with

a strong order book and is expected to grow positively in 2019,

whilst the Group's residual legacy software business continues to

steadily decline, as expected.

The Group anticipates that the results for FY 2018 will be

announced on 12 March 2019.

Ian Manocha, CEO, commented:

"We are delighted to have won major competitive bids with two of

the world's largest banks right at the end of the year, one of

which will become the Group's largest Clareti win in its history,

although we are naturally disappointed that timing issues have

negatively impacted our full year results.

We enter 2019 with a stronger Clareti recurring revenue base and

a focussed plan to build more predictable subscription-based

business. The investments that we made during 2018 have positioned

us well to capitalise on the opportunity in the market and we

remain confident in the profitable growth prospects of the

Group."

Enquiries

+44 (0) 207 653

Gresham Technologies plc 0200

Ian Manocha

Tom Mullan

+44 (0) 207 496

N+1 Singer (Joint Broker) 3000

Shaun Dobson / Lauren Kettle (Corporate Finance)

Tom Salvesen (Corporate Broking)

+44 (0) 207 894

Cantor Fitzgerald Europe (Joint Broker) 7000

Philip Davies

Catherine Leftley

Inside information

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

Note to editors

Gresham Technologies plc is a leading software and services

company that specialises in providing real-time data integrity and

control solutions. Listed on the main market of the London Stock

Exchange (GHT.L) and headquartered in the City of London, its

customers include some of the world's largest financial

institutions, all of whom are served locally from offices located

in Europe, North America and Asia Pacific.

Gresham's award-winning Clareti software platform has been

designed to provide financial institutions with complete certainty

in their data processing. Clareti is a highly flexible and fully

scalable platform for ensuring the integrity of data across an

enterprise. It is designed to address today's most challenging

financial control, risk management, data governance and regulatory

compliance problems.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTCKQDNDBKDADK

(END) Dow Jones Newswires

January 04, 2019 07:00 ET (12:00 GMT)

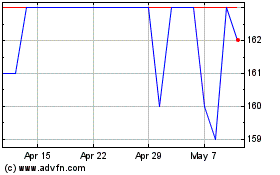

Gresham Technologies (LSE:GHT)

Historical Stock Chart

From Apr 2024 to May 2024

Gresham Technologies (LSE:GHT)

Historical Stock Chart

From May 2023 to May 2024