Draper Esprit PLC Zynga Inc enters agreement to acquire Peak Games (5870O)

June 01 2020 - 10:05AM

UK Regulatory

TIDMGROW

RNS Number : 5870O

Draper Esprit PLC

01 June 2020

Draper Esprit plc

("Draper Esprit", "the Group" or the "Company")

Z ynga Inc ("Zynga") enters into agreement to acquire 100% of

Peak Games for $1.8 billion

Draper Esprit (LSE: GROW, Euronext Growth: GRW), a leading

venture capital firm investing in and developing high growth

digital technology businesses, notes the announcement released by

Zynga to enter into an agreement to acquire Istanbul-based mobile

games developer Peak Games for $1.8 billion, comprised of approx.

$900 million in cash and approx. $900 million of Zynga common

stock. The acquisition is expected to close in Q3 2020.

In January 2019, Draper Esprit announced that it had furthered

its strategic partnership with Earlybird Digital West

("Earlybird"), a German Venture Capital firm with a focus on early

stage investments in Europe, by acquiring a 27% interest in

Earlybird's EB IV fund for approx. EUR63 million (approx. GBP55

million).

As a result of this investment in the EB IV fund, Draper Esprit

acquired underlying holdings in nine high growth technology

companies including Istanbul-headquartered games developer Peak

Games.

The agreement for Zynga to acquire Peak Games will, once closed,

indicate a fair value holding for Draper Esprit in Peak of approx.

GBP80 million (depending upon the Zynga share price at the time),

which is a GBP12 million (approx. 10p NAV per share) uplift to the

fair value referenced in the recent trading statement.

Peak Games has successfully built a global user base for its

community-based, multiplayer board and card games as well as its

innovative casual puzzle games. Over 275 million users around the

world have now installed at least one of the company's products.

Its most popular games, Toon Blast and Toy Blast, have more than 12

million average mobile DAUs (Daily Active Users).

The proposed sale is the first realisation of this financial

year to 31 March 2021, and follows total exits realised in the 12

months to 31 March 2020 of GBP40 million (2019: GBP16 million).

As announced on 28 May 2020, prior to the proposed sale of Peak

Games, the Group already had available cash resources of GBP39

million at the plc (including GBP5 million undrawn debt) and GBP50

million within our EIS/VCT funds.

Commenting on the transaction, Martin Davis, Draper Esprit Chief

Executive Officer, said:

"The sale of Peak Games to Zynga represents a significant return

on our original investment in the EB IV fund and underlines the

benefits of delivering both primary and secondary transactions as

part of our broader strategy. Deals of this nature typically

encompass a shorter timescale from investment to realisation and

allow us to invest at attractive entry points. This, combined with

our evergreen balance sheet, means that the realised capital can be

redeployed to ensure that Draper Esprit is able to continue to

invest through the cycle.

"The fact that this transaction has been executed against the

current backdrop of wider economic uncertainty is testament to the

attractiveness of Peak's proposition, its strong recent trading

performance following increased demand for its games and the

immense potential the business has to build on its existing

position as one of Europe's most attractive, high growth video

games developers.

Adding more detail on Peak and Earlybird, Simon Cook, Draper

Esprit Founding Partner, said:

"Peak's acquisition represents an exciting next chapter for

Sidar and the incredible team at Peak Games and is testimony to

what they have achieved on a global scale with a small team from

Istanbul in a just few short years. True global entrepreneurs can

be found everywhere today and we are excited to be able to help

them achieve their ambitions. Our partners at Earlybird deserve all

the recognition for leading the series A and B rounds and in

spotting the potential for the Peak team almost 10 years ago. Our

partnership with Earlybird continues to generate significant

returns, enabling us to reinvest in the best European technology

companies on behalf of our shareholders.

-ENDS-

Draper Esprit plcMartin Davis (Chief Executive

Officer)

Ben Wilkinson (Chief Financial

Officer) +44 (0)20 7931 8800

Numis Securities

Nominated Adviser & Joint Broker

Simon Willis

Richard Thomas

Jamie Loughborough +44 (0)20 7260 1000

Goodbody Stockbrokers

Euronext Growth Adviser & Joint

Broker

Don Harrington

Charlotte Craigie +44 (0) 20 3841

Dearbhla Gallagher 6202

Powerscourt

Public relations

James White

Elly Williamson

Jessica Hodgson +44 (0)20 7250 1446

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGREFLFBBQLBBBF

(END) Dow Jones Newswires

June 01, 2020 11:05 ET (15:05 GMT)

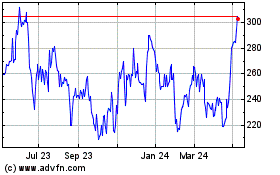

Molten Ventures (LSE:GROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

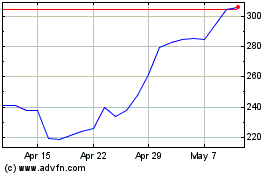

Molten Ventures (LSE:GROW)

Historical Stock Chart

From Jan 2024 to Jan 2025