TIDMGUN

RNS Number : 6456X

Gunsynd PLC

21 December 2023

Gunsynd plc

("Gunsynd" or the "Company")

Final Results for the Year Ended 31 July 2023

Gunsynd (AIM: GUN, AQSE: GUN) is pleased to announce that its

Final Results for the year ended 31 July 2023 will shortly be

posted to shareholders and are available on the Company's website:

http://www.gunsynd.com/ .

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation.

The Directors of the Company are responsible for the release of

this announcement.

For further information please contact:

Gunsynd plc

Hamish Harris / Peter Ruse +44 (0) 78 7958 4153

Cairn Financial Advisers LLP (Nominated

Adviser and AQSE Corporate Adviser)

James Caithie / Liam Murray +44 (0) 20 7213 0880

Peterhouse Capital Limited (Broker)

Lucy Williams +44 (0) 20 7469 0936

CHAIRMAN'S REPORT (INCORPORATING THE STRATEGIC REVIEW)

I present the annual report and financial statements for the

year ended 31 July 2023. The Company made a loss for the year to 31

July 2023 of GBP1,706,000 (2022: loss GBP2,426,000) after taxation.

The loss was a result of unrealised losses on the value of

investments held. The Company had net assets of GBP2,145,000 (2022:

GBP3,851,000) at 31 July 2023, and cash balances of GBP164,000

(2022: GBP824,000).

Review of Investments

1. NATURAL RESOURCES INVESTMENTS

Charger Metals Limited ("Charger")

Gunsynd currently holds 2.5m shares in Charger representing

approximately 4% of Charger's issued share capital.

Charger (ASX: CHR) is a Western Australian ("WA") focussed base

metals (Ni,Cu,Co-PGE) and lithium exploration company which

currently holds three highly prospective projects in WA and the

Northern Territory ("NT") in Australia.

Highlights to 30 September 2023 for its current projects:

Bynoe Lithium Project, NT (Charger 70%)

-- Maiden reverse circulation (RC) drill programme and diamond

drill programme commenced.

-- Initial 2,000m RC drill programme completed as first-pass

test of high priority targets including the Megabucks, Old Bucks

and Enterprise prospects.

-- Assays confirm significant lithium mineralisation in

spodumene-bearing pegmatites at the Enterprise Prospect, with

results including:

- 7m @ 0.96% Li2O from 107m, including 5m @1.13% Li2O from 108m (CBYRC023); and

- 16m @ 0.65% Li2O from 185m, including 1m @1.91% Li2O from 198m (CBYRC024)

-- First hole of 1,500m diamond drill programme intersected

19.25m of spodumene-bearing pegmatite at the Enterprise Prospect -

assays pending

-- 5,000m RC drill programme commenced early July 2023 (post

reporting period) with two drill rigs operating concurrently with

the diamond rig

Lake Johnston Lithium Project, WA (Charger 70%-100%)

-- Assay results received for the maiden RC drill programme

completed at the Medcalf Spodumene Prospect, which totalled 41

holes for 7,199 metres and:

- Delineated a swarm of stacked spodumene-bearing pegmatites up

to 13m thick (down-hole) within a 100m wide corridor along 700m of

strike and 250m down-dip

- Confirmed numerous high-grade lithium results returned from spodumene-bearing pegmatites

-- Priority targets have been identified for follow-up drilling

to test for extensions to the high-grade lithium mineralisation

Rincon Resources Pty Ltd ("Rincon")

Gunsynd holds 11.1 million shares representing approximately

6.5% of Rincon's issued share capital.

Rincon (ASX: RCR) is a Western Australian ("WA") focussed gold

and base metals exploration company quoted on the ASX. It holds the

rights to three highly prospective gold and copper projects in WA,

with its main focus on the South Telfer Project, covering

50,000-hectares in Paterson province. Each project has been subject

to historical exploration, which has identified prospective

mineralised systems. Rincon is systematically exploring these

projects, aiming to delineate economic resources.

Highlights to 30 September 2023 for its current projects:

South Telfer Copper-Gold Project

- 3,000m reverse circulation ("RC") drilling program at Mammoth underway.

- 29m zone of quartz-sulphide mineralisation intersected

down-dip of historic 'Westin' high grade gold intercept

- Successful application for Exploration Incentive Scheme

("EIS"2) co-funding grant of up to $180,000 for Recurve RC drilling

program

- The final report for the Hasties technical review now received

with planning for next steps underway

West Arunta Project (formerly Kiwirrkurra project)

- Heritage survey completed ahead of diamond drilling program at Pokali

- 1,000m diamond drilling program at Pokali set to commence as

soon as site works are completed

- Site reconnaissance completed with a further 46 rock-chip samples collected for analysis

Laverton Project

- The final report for the Laverton Project assessment, target

generation and prioritisation process now received with planning

for next steps underway

Pacific Nickel Limited ("Pacific Nickel")

Gunsynd currently holds 2.78m shares in Pacific Nickel

representing approximately 0.66% of its issued capital.

Highlights to 30 September 2023 for its current projects:

Kolosori Nickel Project (PNM 80%)

-- Final drawdown of US$19m from the Glencore International AG

(Glencore) Financing Facility

-- Execution of a Barging Agreement with Marinepia Shipping

Company Limited for the Transfer of Nickel Ore

-- Mining Contractor HBS PNG Pty Ltd (HBS) delivered two

tranches of mining equipment to site from PNG.

-- HBS commenced major development activities (working 24 hours,

two shift operations) including:

- Construction of the haul road and access roads to the stockpile area

- Commenced major earth works and removal of overburden from the

first higher-grade ore blocks.

- Backfill for the wharf.

- Construction of site laboratory

- Construction of mining contractors workshop area

- Construction of a 250 man camp

Subsequent to the reporting period, commencement of mining and

stock piling of nickel ore for shipment forecast for November

2023.

Jejevo Nickel Project (PNM 80%)

-- Subsequent to the 30 September 2023, the company has entered

into a Surface Access Rights Agreement (SARA) for a Mining Lease

with landowners in respect of the Jejevo Nickel Project.

Corporate:

-- Cash of $23.075 million at 30 September 2023

Eagle Mountain Mining Limited ("Eagle Mountain")

Gunsynd holds 2.5 million shares in Eagle Mountain representing

approximately 1% of its issued share capital.

Eagle Mountain Mining Limited (ASX: EM2), is a copper focused

exploration and development company with a key objective of

becoming a low emission producer at its high-grade Oracle Ridge

project in Arizona, USA, to supply the rapidly growing green energy

market.

Highlights to 30 September 2023 for its current projects :

- Further positive drilling and channel sampling results

confirmed potential upside to the mineral resource estimate

(MRE)

- Underground channel sampling assays were some of the strongest

to date including:

- 15.3m at 4.02% Cu, 18.71g/t Ag and 0.14g/t Au

- 19.2m at 3.32% Cu, 37.66g/t Ag and 0.31g/t Au

- 35.7m at 2.60% Cu, 14.86g/t Ag and 0.08g/t Au

- 32.6m at 2.23% Cu, 26.13g/t Ag and 0.28g/t Au including 1.6m

at 9.47% Cu, 100g/t Ag and 1.01g/t Au

- Drill core assays are expected to increase both the resource

size and quality of the MRE. Results received during the Quarter

include: 11.4m at 2.29% Cu, 16.45g/t Ag and 0.14g/t Au; 4.4m at

2.23% Cu, 23.41g/t Ag and 0.39g/t Au; and 63.9m at 1.11% Cu,

10.14g/t Ag and 0.09g/t Au

-Various metallurgical test work programs progressed including

Ore sorting; Concentrate variability testwork including locked

cycle tests; Flash floatation testwork; High pressure grind roll

comminution tests; Mineral speciation testwork; and Magnetic

separation testwork to recover magnetite or garnets

-Assessment of sulphide leaching processes commenced which could

reduce capital and operating costs for the Project

- New MRE update on track for completion in the December 2023

quarter incorporating drilling and channel sampling undertaken

since the previous MRE in October 2022 and extensive new knowledge

gained from the underground mapping program

-$1.6 million in cash available at 30 September 2023

Aberdeen Minerals Limited ("Aberdeen")

Aberdeen Minerals Limited is a privately owned mineral

exploration company currently engaged in mineral exploration in

North East Scotland for battery raw materials.

Gunsynd subscribed for 2,000,000 shares at 7.5 pence per

ordinary share for a total consideration of GBP150,000 as part of

the fundraising announced on 16 January 2023.

Recent update from Aberdeen :

-Aberdeen has been awarded GBP294,000 in grant funding by the UK

Government through the Automotive Transformation Fund ("ATF").

-Aberdeen expects the ATF grant will meet 70% of the cost of a

feasibility study into innovative methods to process the minerals

at the company's Arthrath Nickel-Copper-Cobalt Project in

Aberdeenshire. This study will investigate the potential to

accelerate

the production of cathode raw materials in North East Scotland

for UK battery manufacturing, using more environmentally

sustainable and socially acceptable approaches than the

carbon-intensive, overseas supply chains on which UK industry

currently relies.

-Innovations to be tested include Glycine Leaching Technology, a

technique patented by Draslovka, which uses glycine, a non-toxic

amino acid often used as a food additive or nutritional supplement

in humans and animals, as an environmentally sustainable and

cost-effective way to produce critical minerals.

-The ATF is delivered by the Advanced Propulsion Centre ("APC")

in collaboration with the Department for Business and Trade and

Innovate UK to support large-scale industrialisation and the

transition to net zero. The ATF grant awarded to Aberdeen is part

of a broader package of funding announced by APC.

Omega Oil & Gas Limited ("Omega")

Gunsynd subscribed for 450,000 shares at AUD 20 cents per

ordinary share for a total consideration of AUD$90,000

(approximately GBP50,000) as part of the IPO fundraising announced

on 25 October 2022.

Omega Oil and Gas Limited ("Omega") is an ASX listed Australian

energy and resources company focused on natural gas exploration and

oil production (ASX: OMA), on its Basin-Centred Gas drilling

campaign.

Recent update from Omega:

-- Estimated maiden gross 2C contingent resources of 1.73

trillion cubic feet ("TCF") and 3C contingent resources of 4.5 TCF

across Omega Oil and Gas' 100% owned ATPs 2037 and 2038 in

Queensland's Taroom Trough.

-- Net 2C contingent resources comprise 1.51 TCF Gas and 68.6

million barrels (MMBBLS) of condensate.

-- The independent resource assessment, based on the Canyon

drilling campaign results, was conducted by Netherland, Sewell

& Associates, Inc., a global leader in petroleum property

analysis.

-- Allocated resources based on a modelled average reservoir

thickness of 27m in the Kianga Formation which is 221m thick at the

site of the Canyon 2 well.

-- Strong growth potential, with further assessment to be

considered on other hydrocarbon-bearing reservoirs within the

Kianga Formation and the Back Creek Group, which are highly

prospective.

-- The next phase of exploration and appraisal includes an

innovative horizontal well targeting the Kianga Formation and a

multi-stage stimulation.

-- The $21 million capital raising completed on 8 August 2023

fully funds the next stage of exploration and appraisal.

First Tin Limited ("First Tin")

Gunsynd currently holds 618,000 shares in First Tin representing

approximately 0.3% of its issued capital.

First Tin (LSE:1SN) successfully completed its IPO on the

Standard List of the London Stock Exchange in April 2022, raising

GBP20 million (before expenses) of new equity capital, positioning

it to invest into and add value to its advanced portfolio of tin

assets. As part of the IPO, First Tin acquired the Taronga tin

asset in NSW Australia, the 5(th) largest undeveloped tin reserve

globally. Taronga will now be developed alongside First Tin's other

lead asset of Tellerhäuser which is located in Saxony in

Germany.

First Tin recently commenced Definitive Feasibility Studies

("DFS") at Taronga and Tellerhäuser, which are both scheduled to be

completed in Q4 2023. During the period, the management team

focused on advancing both assets through their respective DFS.

Strong operational progress was made at the Taronga asset,

successfully completing all drilling and exploration work and

publishing an updated JORC compliant Mineral Resource Estimate

("MRE") which increased the size of the Taronga resource by over

240% to 133 million tonnes. This updated JORC MRE statement

demonstrates the true scale of the Taronga asset and there remains

plenty of scope to further increase the size of total resource both

from the Taronga asset itself and from its satellite orebodies.

Oyster Oil and Gas Limited ("Oyster")

Gunsynd has a holding valued at GBP130,000, and there has been

no material change since year end. The oil price gives the Company

some confidence of restoring value to this investment. Gunsynd will

update the market as and when material developments occur.

2. OTHER INVESTMENTS

Rogue Baron PLC ("Rogue Baron")

Rogue Baron PLC (AQSE: SHNJ) is a leading company in the premium

spirit sector listed on the Access segment of the AQSE Growth

Market. Gunsynd currently holds 21,543,563 ordinary shares in Rogue

Baron, representing approximately 24% of its

issued share capital. Gunsynd also retains a balance of

GBP111,464 of Convertible Loan Notes consisting of accrued

interest.

Rogue Baron's flagship Shinju Whisky won two medals in October

2021 including a double gold with a perfect score of 100 when voted

best whisky at the 2021 Santé International Spirit Competition. In

November 2021 Shinju won another gold medal, this time at the

prestigious John Barleycorn awards.

Following the successful completion of transitioning to a new

USA distributor in September 2022, Rogue Baron resumed full-scale

sales operations in October 2022. During the fourth quarter of

2022, Rogue Baron sold around 930 cases of Shinju whisky worldwide,

marking an impressive growth of approximately 100% compared to the

corresponding period in 2021. Sales of Shinju whisky decreased

during the first quarter of 2023 as Q1 tends to be the slowest

quarter in the spirits industry. While this slowdown may impact our

short-term sales figures, Rogue Baron projects an increase in sales

as they move further into the Spring and Summer months.

Rogue Baron anticipates a favourable outlook for sales and

margins in the second half of 2023. This positive projection is

primarily attributed to the resolution of shipping issues that have

arisen in recent years, but maintaining proper inventory levels

will be necessary to continue the growth. Additionally, there is

potential for significant growth as Rogue Baron intends to launch

the 8- year-old Shinju expression into the United States market for

the first time, projected in late 2023.

With an established distribution network in both Europe and the

US, Rogue Baron is confident that securing the required capital

would enable it to achieve a substantial increase in revenue within

the short to medium term. At the time of releasing these accounts,

they are actively engaged in discussions with multiple potential

investors. There is an optimistic outlook that the necessary funds

can be raised, leading to higher levels of revenue and

profitability in the future.

Low 6 Limited ("Low6")

The Company invested approximately GBP265,000 in Low6 of which

GBP152,000 was impaired during the year to reflect the most recent

valuation of Low6 share price. We hold 0.66% of Low6's issued share

capital.

Recent update from Low6 :

Low 6 has reached a significant milestone by generating revenue

of just under GBP1m (unaudited) for the quarter ended 30 September

2023, and expects to continue its current trajectory during Q2. Its

financial year runs from 1 July 2023 to 30 June 2024. Audited

revenue for the year ended 30 June 2022 was GBP854,851 and loss

before tax was GBP18,350,342.

Low 6 was successful in a Request for Proposal (RFP) process

with 'OPTA' Stats Perform. Its work with OPTA focuses on the launch

of multiple games based on Premier League statistics. Low6 also

successfully launched products with Oddschecker for the new English

Premier League season and signed a significant contract extension

with Rush Street Interactive in North America for product

development over the next 18 months.

Oscillate plc ("Oscillate"; formerly DiscovOre plc)

Oscillate is an investment company listed on the AQSE Growth

Market Exchange with the ticker, AQSE: MUSH. In April 2021, Gunsynd

invested GBP200,000 into Oscillate being 10 million shares at 2p

representing circa 4.5% of Oscillate. Oscillate underwent internal

repositioning and restructuring during what has been a difficult

year.

Other unlisted investments

The Company has various other minor stakes in unlisted public

company investments totalling GBP124,000. These have been impaired

by GBP62,000 during the year to reflect the downturn in economic

markets.

Finance Review

As noted above, the Company made a loss for the year of

GBP1,706,000 (2022: loss GBP2,426,000) after taxation. Most of the

loss generated was from decrease in value of the Company's

investment portfolio. The Company had net assets of GBP2,145,000

(2022: GBP3,851,000) at 31 July 2023, and cash balances of

GBP164,000 (2022: GBP824,000).

Outlook

Whilst good progress was made by a number of companies in our

portfolio this unfortunately hasn't been as yet reflected in their

share price performance. The board took the decision to take

profits on some of our listed investments at prices much higher

than they are today which has allowed the Company to maintain a

healthy cash balance. Gunsynd has not raised money since 2020.

Gunsynd maintains a low fixed cost structure and this will continue

through volatile and uncertain conditions across global

markets.

We maintain a level of diversification in our portfolio with

positions in natural resources, gaming and beverages.

The Board continues to look at investments in line with its

investment policy as highlighted on the Company's website. This

could potentially include increasing a stake(s) in investments

already held. Such investment(s) may or may not lead to a reverse

takeover.

The Board would also like to take this opportunity to thank

shareholders for their continued support.

Hamish Harris

Chairman

20 December 2023

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 31 JULY

2023

2023 2022

GBP000 GBP000

------------------------------------------------ --------- ---------

Continuing operations

Income

Unrealised (loss) on financial investments (1,043) (2,168)

Realised (loss)/gain on financial investments (35) 221

(1,078) (1,947)

Administrative expenses

Salaries and other staff costs (305) (300)

Other costs (263) (224)

Total administrative expenses (568) (524)

Impairment of financial investments (212) -

Other income 149 15

Finance income 3 30

(Loss) before tax (1,706) (2,426)

Taxation - -

------------------------------------------------- --------- ---------

(Loss) for the period attributable to equity

shareholders of the Company (1,706) (2,426)

------------------------------------------------- --------- ---------

Other comprehensive income / (expenditure) - -

for the period net of tax

Total comprehensive earnings for the period

attributable to shareholders (1,706) (2,426)

------------------------------------------------- --------- ---------

Earnings per ordinary share

Basic (pence) (0.379) (0.540)

Diluted (pence) (0.379) (0.540)

------------------------------------------------- --------- ---------

STATEMENT OF FINANCIAL POSITION AS AT 31 JULY 2023

2023 2022

GBP000 GBP000

----------------------------------------------- ---------- ----------

ASSETS

Non-current assets

Financial investments at fair value through

profit or loss 1,891 2,944

Total non-current assets 1,891 2,944

------------------------------------------------ ---------- ----------

Current assets

Trade and other receivables 194 163

Cash and cash equivalents 164 824

------------------------------------------------ ---------- ----------

Total current assets 358 987

------------------------------------------------ ---------- ----------

Total assets 2,249 3,931

------------------------------------------------ ---------- ----------

Current liabilities

Trade and other payables (104) (80)

Total current liabilities (104) (80)

------------------------------------------------ ---------- ----------

Total liabilities (104) (80)

------------------------------------------------ ---------- ----------

Net assets 2,145 3,851

------------------------------------------------ ---------- ----------

Equity attributable to equity holders of the

company

Ordinary share capital 382 382

Deferred share capital 2,299 2,299

Share premium reserve 13,459 13,459

Investment in own shares (26) (26)

Share based payments reserve 24 39

Retained earnings (13,993) (12,302)

Total equity 2,145 3,851

------------------------------------------------ ---------- ----------

The financial statements were approved and authorised for issue

by the Board of Directors on 20 Dec ember 2023 and were signed on

its behalf by:

Hamish Harris Donald Strang

Chairman Director

Company number: 05656604

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31 JULY 2023

Deferred Share Investment Share-based

Share Share premium in own payments Retained

capital capital reserve shares reserve earnings Total

GBP000 GBP 000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

At 31 July 2021 382 2,299 13,459 - 131 (9,968) 6,303

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

Loss for the

year - - - - - (2,426) (2,426)

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

Total comprehensive

Loss for the

period - - - - - (2,426) (2,426)

Transactions

with owners:

Adjustment for

shares held in

Trust - - - (26) - - (26)

Transfer within

Equity on lapse

of share options - - - - (92) 92 -

At 31 July 2022 382 2,299 13,459 (26) 39 (12,302) 3,851

Loss for the

year - - - - - (1,706) (1,706)

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

Total comprehensive

Loss for the

period - - - - - (1,706) (1,706)

Transactions

with owners:

Transfer within

Equity on lapse

of share options - - - - (15) 15 -

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

At 31 July

2023 382 2,299 13,459 (26) 24 (13,993) 2,145

---------------------- --------- ---------- --------- ------------ ------------- ---------- ---------

STATEMENT OF CASH FLOWS FOR THE YEARED 31 JULY 2023

2023 2022

GBP000 GBP000

---------------------------------------------------------- --------- ---------

Cash flow from operating activities

(Loss) after tax (1,706) (2,426)

Tax on losses - -

Finance income net of finance costs (3) (10)

Unrealised loss on revaluation of financial investments 1,043 2,168

Realised loss/(gain) on sale of financial investments 35 (221)

Other income (124) -

Impairment provision 212 -

Adjustment for issue of own shares - (26)

Foreign exchange movements 1 1

Changes in working capital:

Decrease in trade and other receivables 4 11

Increase in trade and other payables 24 14

Cash outflow from operations (514) (489)

Taxation received - -

----------------------------------------------------------- --------- ---------

Net cash outflow from operating activities (514) (489)

----------------------------------------------------------- --------- ---------

Cash flow from investing activities

Payments for financial investments (405) (158)

Disposal proceeds from sale of financial investments 294 400

Unsecured loans to investee company (35) -

Net cash inflow/(outflow) from investing activities (146) 242

----------------------------------------------------------- --------- ---------

Cash flows from financing activities

Proceeds on issuing of ordinary shares - -

Cost of issue of ordinary shares - -

----------------------------------------------------------- --------- ---------

Net cash inflow from financing activities - -

----------------------------------------------------------- --------- ---------

Net decrease in cash and cash equivalents (660) (247)

Cash and cash equivalents at the beginning of the year 824 1,071

Cash and cash equivalents at the end of the year 164 824

----------------------------------------------------------- --------- ---------

During the year, there were share for share exchanges involving

Pacific Nickel Limited that resulted in additional non cash

investment of GBP124,154.

NOTES TO THE FINANCIAL STATEMENTS

1 Presentation of the financial statements

Description of business & Investing Policy

Gunsynd plc is public limited company domiciled in the United

Kingdom. The Company's registered office is 78 Pall Mall, London

SW1Y 5ES.

Basis of preparation - Going concern

The financial statements have been prepared on a going concern

basis. This basis assumes that the company will have sufficient

funding to enable it to continue to operate for the foreseeable

future and the Directors have taken steps to ensure that they

believe that the going concern basis of preparation remains

appropriate.

The Company made a loss for the year of GBP1,706,000 (2022: loss

GBP2,426,000) after taxation. The Company had net assets of

GBP2,145,000 (2022: GBP3,851,000) and cash balances of GBP164,000

(2022: GBP824,000) at 31 July 2023. The Directors have prepared

financial forecasts which cover a period of at least 12 months from

the date that these financial statements are approved to 31

December 2024. These forecasts show that the Company expects to

have sufficient financial resources to continue to operate as a

going concern.

In forming the conclusion that it is appropriate to prepare the

financial statements on a going concern basis the Directors have

made the following assumptions that are relevant to the next twelve

months:

- In the event that the Company's investments require further

funding, sufficient funding can be obtained by the various investee

companies; and

- In the event that operating expenditure increases

significantly as a result of successful progress with regards to

the Company's investments, sufficient funding can be obtain by

selling level 1 investments.

The cost structure of the Company comprises a high proportion of

discretionary spend and therefore in the event that cash flows

become constrained, costs can be quickly reduced to enable the

Company to operate within its available funding. As a junior

investment company, the Directors are aware that the Company must

go to the marketplace to raise cash to meet its investment plans,

and/or consider liquidation of its investments and/or assets as is

deemed appropriate. The Company has previously constantly

demonstrated its ability to raise further cash by way of completing

placings during the prior years, and are confident of further

equity fund raising should the company require such cash injection.

Therefore, they are confident that existing cash balances, along

with the any new funding would be adequate to ensure that costs can

be covered.

Consequently, the Directors have a reasonable expectation that

the Company has adequate resources to continue to operate for the

foreseeable future and that it remains appropriate for the

financial statements to be prepared on a going concern basis.

Financial period

These financial statements cover the financial year from 1

August 2022 to 31 July 2023, with comparative figures for the

financial year from 1 August 2021 to 31 July 2022.

Accounting principles and policies

The preparation of the financial statements in conformity with

generally accepted accounting principles requires management to

make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

The financial statements have been prepared in accordance with

the Company's accounting policies approved by the Board and signed

on their behalf by Hamish Harris and Donald Strang.

2 Earnings per share

(Loss)/profit attributable to ordinary shareholders 2023 2022

The calculation of ( loss) per share is based

on the loss after taxation divided by the weighted

average number of shares in issue during the period:

(Loss) from operations (GBP000) (1,706) (2,426)

Total (GBP000) (1,706) (2,426)

--------- ---------

Number of shares

Weighted average number of ordinary shares for

the purposes of basic (loss) per share (millions) 449.80 449.80

Weighted average number of ordinary shares for

the purposes of diluted (loss) per share (millions) 475.30 533.84

Basic (loss) per share (expressed in pence) (0.379) (0.540)

Diluted (loss) per share (expressed in pence) (0.379) (0.540)

--------- ---------

3 Events after the end of the reporting period

On 16 November 2023, the Company advised it had made payment of

the first tranche of GBP250,000 to Metals One as referenced in Note

20.

On 5 December 2023, the Company advised it had raised gross

proceeds of GBP210,000 through the issue of 105 million shares at

0.2p each.

Forward-looking statements

These forward-looking statements are not historical facts but

rather are based on the Company's current expectations, estimates,

and projections about its industry; its beliefs; and assumptions.

Words such as 'anticipates,' 'expects,' 'intends,' 'plans,'

'believes,' 'seeks,' 'estimates,' and similar expressions are

intended to identify forward-looking statements. These statements

are not a guarantee of future performance and are subject to known

and unknown risks, uncertainties, and other factors, some of which

are beyond the Company's control, are difficult to predict, and

could cause actual results to differ materially from those

expressed or forecasted in the forward-looking statements. The

Company cautions security holders and prospective security holders

not to place undue reliance on these forward-looking statements,

which reflect the view of the Company only as of the date of this

announcement. The forward-looking statements made in this

announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFVLFSLLFIV

(END) Dow Jones Newswires

December 21, 2023 06:38 ET (11:38 GMT)

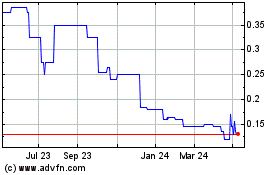

Gunsynd (LSE:GUN)

Historical Stock Chart

From Apr 2024 to May 2024

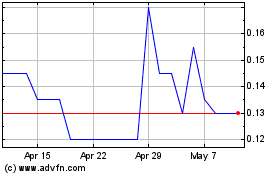

Gunsynd (LSE:GUN)

Historical Stock Chart

From May 2023 to May 2024