TIDMHE1

RNS Number : 5622S

Helium One Global Ltd

07 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019.

07 November 2023

Helium One Global Ltd

("Helium One" or "the Company")

Tai-3 well successfully reached TD

Helium One Global (AIM: HE1), the primary helium explorer in

Tanzania, is pleased to provide the following update on the

drilling of the Tai-3 well.

Highlights

-- Tai-3 well has successfully reached a TD of 1,448m measured

depth ("MD") having encountered weathered crystalline Basement

-- Elevated helium shows, up to six times above background, have

been identified in the Lower Karoo Group and Basement targets

-- Helium shows increased in frequency and quality with depth, as anticipated

-- Whilst drilling into Basement, a fracture zone was

encountered, which yielded elevated helium readings at the top of

the Basement and led to partial losses of drilling mud

-- Forward plan, following maintenance and safety checks, is to

pull out of hole and rig up to run wireline for formation

evaluation and downhole gas sampling

Details

The component to the iron rough neck was repaired and

reinstalled, enabling the Company to drill ahead over the weekend

and Basement has now been reached at 1,448m MD. Whilst drilling

into the fractured Basement, comprised of metamorphic gneissic

rock, the well encountered elevated helium shows up to six times

above background. These readings were measured from the drilling

mud using the Micro Gas Chromatograph and validated using the

onsite portable Mass Spectrometer. This fractured Basement was

anticipated, and was one of the Company's primary reservoir

targets, therefore encountering elevated helium shows in this zone

is very encouraging.

Upon drilling into crystalline Basement, the fracture zone led

to partial losses of drilling mud. In order to stop these losses,

which are not uncommon in fracture zones, lost circulation material

was successfully added to the drilling mud. The decision was then

made to call well TD at this stage, whilst the wellbore remains in

good condition, and to run wireline logs and take downhole gas

samples.

Before wireline operations commence, maintenance and safety

checks on rig equipment will be completed to enable the drill

string to be pulled out of hole safely and efficiently. The Company

will then rig up for wireline and aims to complete all wireline

operations, along with preliminary interpretations, before making

any further announcements.

The timetable regarding a second well at Itumbula will be

determined following the results of the wireline operations at

Tai-3.

Lorna Blaisse, Chief Executive Officer, commented:

"We are delighted with the initial results at Tai-3 and it was

extremely encouraging to see the helium shows increase with depth,

as we had anticipated. We are pleased to have successfully TD'd

safely, and managed to address the minor issues with the rig

quickly and efficiently.

Given the mud losses encountered once we had reached the

fractured Basement, we've decided to TD now so we can minimise any

risk to wellbore stability and ensure that we can obtain successful

logs and downhole gas samples. We're very much looking forward to

commencing wireline operations and further evaluating the

well."

For further information please visit the Company's website:

www.helium-one.com

Contact

Helium One Global Ltd +44 20 7920

Lorna Blaisse, CEO 3150

Liberum Capital Limited (Nominated Adviser

and Joint Broker)

Scott Mathieson

Ed Thomas +44 20 3100

Nikhil Varghese 2000

Peterhouse Capital Limited (Joint Broker) +44 20 7220

Lucy Williams 9792

Tavistock (Financial PR)

Nick Elwes +44 20 7920

Tara Vivian - Neal 3150

Notes to Editors

Helium One Global, the AIM-listed Tanzanian explorer, holds

prospecting licences totalling more than 2,965km(2) across three

distinct project areas, with the potential to become a strategic

player in resolving a supply-constrained helium market.

The Rukwa, Balangida, and Eyasi projects are located within rift

basins on the margin of the Tanzanian Craton in the north and

southwest of the country. The assets lie near surface seeps with

helium concentrations ranging up to 10.6% He by volume. All Helium

One's licences are held on a 100% equity basis and are in close

proximity to the required infrastructure.

The Company's flagship Rukwa Project is located within the Rukwa

Rift Basin covering 1,900km(2) in south-west Tanzania. The project

is considered to be an advanced exploration project with leads and

prospects defined by a subsurface database including multispectral

satellite spectroscopy, airborne gravity gradiometry, 2D seismic

data, and QEMSCAN analysis. The Rukwa Project has been de-risked by

the 2021 drilling campaign, which identified reservoir and seal

with multiple prospective intervals from basin to near surface

within a working helium system.

Helium One is listed on the AIM market of the London Stock

Exchange with the ticker of HE1 and on the OTCQB in the United

States with the ticker HLOGF.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFVLLSLRIIV

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

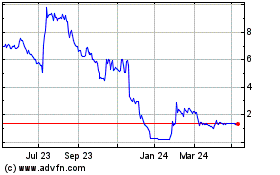

Helium One Global (LSE:HE1)

Historical Stock Chart

From Nov 2024 to Dec 2024

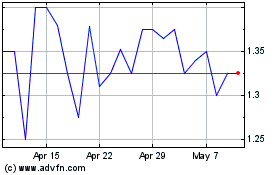

Helium One Global (LSE:HE1)

Historical Stock Chart

From Dec 2023 to Dec 2024