Halfords Group PLC Trading Statement (7768X)

September 02 2015 - 1:00AM

UK Regulatory

TIDMHFD

RNS Number : 7768X

Halfords Group PLC

02 September 2015

Halfords Group plc

Trading Update

Halfords Group plc ("the Group"), the UK's leading retailer of

automotive and leisure products and services and a leading

independent operator in garage servicing and auto repair, today

updates the market on its trading performance for the 8-week period

4 July 2015 to 28 August 2015 (also referred to as "Q2 to

date").

Following the first quarter trading update issued on 15 July,

Cycling sales in Q2 to date have decreased against tough

comparatives and, as such, are expected to be below current market

expectations for the quarter. Trading in all other categories

remains robust.

The table below presents the Retail like-for-like (LfL) revenue

performance:

LIKE-for-LIKE (LfL) REVENUE FY16 Q2 to date FY16 Q1 FY15 H1

% change (8 weeks) (13 weeks) (26 weeks)

-------------------------------- ----------------- ------------- -------------

Retail -1.3 +3.5 +6.8

-------------------------------- ----------------- ------------- -------------

Cycling -11.0 +2.0 +16.0

-------------------------------- ----------------- ------------- -------------

Car Maintenance +7.3 +5.9 +3.7

-------------------------------- ----------------- ------------- -------------

Car Enhancement +4.7 -0.3 -1.4

-------------------------------- ----------------- ------------- -------------

Travel Solutions +1.8 +9.2 +3.9

-------------------------------- ----------------- ------------- -------------

The disappointing Cycling performance was primarily driven by

mainstream bikes, as well as associated parts and accessories. We

consider this to be principally market-driven, reflecting greater

levels of discounting as well as poor weather deterring casual

cyclists. Cycle Repair LfL growth remained strong at +27.6%.

As we exit the peak season for mainstream bikes we will launch a

complete refresh of children's bikes and accessories alongside a

series of compelling offers for customers, underpinned by continued

product and service training for colleagues. Looking further ahead,

we have an exciting pipeline of innovation for bikes and

accessories and we remain confident in the medium and long-term

growth opportunities in the cycling market.

Trading in all other areas of Halfords Retail remains strong and

in line with, or above, expectations, particularly Car Maintenance

where Parts was a standout performer. Customer service metrics

continue to improve. Actions in Autocentres continue to drive

profitable growth.

Financial outlook

For the first half, management anticipates Retail gross margin

to be at the better end of the previous full year guidance range

(-25 to -75 basis points year-on-year decline) and Retail operating

cost growth of circa 3% (previous full year guidance: 4 to 5%).

Through mix benefits in margin and prudent cost control in line

with the first half, management anticipates full year Group profit

before tax to be broadly in line with prevailing market

consensus.

Jill McDonald, Chief Executive, commented:

"In my first three months at Halfords I have reviewed all

aspects of the Group and it is clear to me that Halfords is a

strong business with a well-balanced portfolio of product and

service categories, talented colleagues and considerable growth

potential. This recent weakness in our Cycling sales is

disappointing, but it comes after two years of very strong growth

in the category and has been partly offset by strong growth in both

Car Maintenance and Car Enhancement sales, which is a testament to

the balanced nature of the business."

"Looking ahead, we remain confident in the long-term growth

opportunities in Cycling and I will talk more about our plans for

Cycling and across the broader Group at our interim results in

November."

Halfords will report its interim results, for the period ending

2 October 2015, and second-quarter trading performance on 12

November 2015, together with a strategy update.

Enquiries

Halfords +44 (0) 1527 513 113

Andrew Findlay, Chief Financial Officer

Adam Phillips, Head of Investor Relations

Maitland (Media) +44 (0) 207 379 5151

Neil Bennett

Andy Donald

Conference Call

There will be a conference call for investors and sell-side

analysts at 8.15am today.

Halfords Group plc

Halfords is the UK's leading retailer of automotive, cycling and

leisure products and, through Halfords Autocentres, also one of the

UK's leading independent car servicing and repair operators.

Halfords customers shop at 470 stores in the UK and Republic of

Ireland, including seven Halfords 'Cycle Republic' shops, and at

halfords.com for pick-up at their local store or direct home

delivery. Halfords Autocentres operates from 306 sites nationally

and offers motorists dealership-quality MOTs, repairs and car

servicing at affordable prices.

Cautionary Statement

This report is based on information from unaudited management

accounts and contains certain forward-looking statements with

respect to the financial condition, results of operations, and

businesses of Halfords Group plc. These statements and forecasts

involve risk, uncertainty and assumptions because they relate to

events and depend upon circumstances that will occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. These forward-looking

statements are made only as at the date of this announcement.

Nothing in this announcement should be construed as a profit

forecast. Except as required by law, Halfords Group plc has no

obligation to update the forward-looking statements or to correct

any inaccuracies therein.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBFLLBEKFFBBX

(END) Dow Jones Newswires

September 02, 2015 02:00 ET (06:00 GMT)

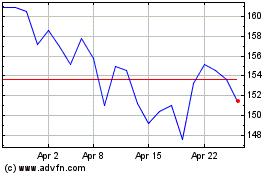

Halfords (LSE:HFD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Halfords (LSE:HFD)

Historical Stock Chart

From Jan 2024 to Jan 2025