India Capital Growth Fund Limited Net Asset Value(s) (8415Y)

December 08 2017 - 6:55AM

UK Regulatory

TIDMIGC

RNS Number : 8415Y

India Capital Growth Fund Limited

08 December 2017

8 December 2017

India Capital Growth Fund Limited (the "Company" or "ICGF")

Net Asset Value statement at 30 November 2017

Net Asset Value

The Company announces its Net Asset Value per share as at 30

November 2017 was 123.09 pence.

In November the Net Asset Value (NAV) was up 1.3% in Sterling

terms, whilst the BSE Mid Cap TR Index was up 0.6%, delivering an

out performance against the notional benchmark of 0.7%. In local

currency terms, the NAV was up 2.8% for the month.

Portfolio update

Positive attribution to the portfolio's performance came from

Sobha (up 22.8%), Balkrishna Industries (up 25.9%), Indian Bank (up

24.7%) and Radico Khaitan (up 30.2%). Negative attribution came

from Federal Bank (down 9.1%), Dewan Housing (down 4.1%) and

Manpasand Beverages (down 10.3%).

Market and economic update

India's equity market performance was mixed this month with the

BSE Sensex down 0.2%, whilst the BSE Mid Cap Index was up 2.0%.

This was on the back of the reduction of GST rates from 28% to 18%

on a large number of items, providing greater benefits to the SME

sector and reducing the inflationary impact on consumers. Only 50

items, mostly "demerit" goods & services and luxuries will

continue to be taxed at 28%.

In November, Foreign and Domestic Institutions were both net

buyers at US$3.0bn and US$1.4bn respectively, whilst INR

appreciated 0.4% against USD but fell 1.4% against GBP.

India's third quarter GDP accelerated to 6.3% from 5.7% in the

second quarter due to stronger growth in mining and manufacturing

as companies built inventories and restored supply chains,

following the disruption caused by the introduction of GST. On the

expenditure side both private and government consumption

expenditure growth fell (owing to the high base effect), whilst

gross fixed capital formation growth recovered, supported by

ongoing government spending on roads and railways.

Consumer Price Inflation accelerated in October to 3.6% from

3.3% in September, led mainly by rising food prices. Wholesale

Price Inflation also increased to 3.6% from 2.6% on the back of

rising crude oil prices. Any further increase could put pressure on

India's macro economy, which in turn would pressurise the

currency.

Moody upgraded India's government bond rating from positive

(Baa3) to stable (Baa2), reaffirming the long-term benefit of

recent reforms, whilst India shot up 30 places into the top 100 in

the World Bank's "ease of doing business".

Portfolio analysis by sector as at 30 November

2017

Sector No. of Companies % of Portfolio

Financials 8 25.5%

Materials 9 21.2%

Consumer Discretionary 8 17.5%

Industrials 4 10.0%

Consumer Staples 4 9.2%

IT 2 5.9%

Real Estate 2 3.6%

Healthcare 2 3.3%

Total Equity Investment 39 96.2%

Net Cash 3.8%

Total Portfolio 39 100.0%

Top 20 holdings as at 30 November 2017

Holding Sector % of Portfolio

Dewan Housing Finance Financials 6.4%

Federal Bank Financials 4.6%

Motherson Sumi Systems Consumer Discretionary 4.5%

Ramkrishna Forgings Materials 4.4%

Sobha Developers Real Estate 3.4%

Kajaria Ceramics Industrials 3.3%

Jyothy Laboratories Consumer Staples 3.3%

NIIT Technologies IT 3.3%

Finolex Cables Industrials 3.1%

Skipper Materials 3.0%

City Union Bank Financials 2.9%

Balkrishna Industries Consumer Discretionary 2.7%

PI Industries Materials 2.7%

Tech Mahindra IT 2.7%

Indusind Bank Financials 2.6%

Yes Bank Financials 2.6%

Indian Bank Financials 2.5%

Sagar Cements Materials 2.4%

The Ramco Cements Materials 2.4%

Capital First Financials 2.3%

Portfolio analysis by market capitalisation

size as 30 November 2017

Market capitalisation No. of Companies % of Portfolio

size

Small Cap (M/Cap < US$2bn) 25 54.2%

Mid Cap (US$2bn < M/Cap

< US$7bn) 10 29.7%

Large Cap (M/Cap > US$7bn) 4 12.3%

Total Equity Investment 39 96.2%

Net Cash 3.8%

Total Portfolio 39 100.0%

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVUGGPAPUPMGPR

(END) Dow Jones Newswires

December 08, 2017 07:55 ET (12:55 GMT)

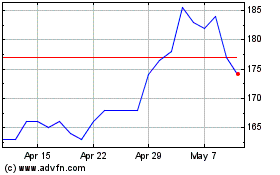

India Capital Growth (LSE:IGC)

Historical Stock Chart

From Apr 2024 to May 2024

India Capital Growth (LSE:IGC)

Historical Stock Chart

From May 2023 to May 2024