Keras Resources PLC Issue of Equity and Total Voting Rights (4082X)

February 21 2017 - 2:15AM

UK Regulatory

TIDMKRS

RNS Number : 4082X

Keras Resources PLC

21 February 2017

Keras Resources plc / Index: AIM / Epic: KRS / Sector:

Mining

21 February 2017

Keras Resources plc ('Keras' or 'the Company')

Issue of Equity and Total Voting Rights

Keras Resources plc announces that following the passage of all

resolutions at the Company's Annual General Meeting on 10 February

2017, it has issued the second tranche of 44,610,827 Loan

Conversion Shares as detailed in the Company's announcement of 3

February 2017.

Application has been made for the admission of the second

tranche of Loan Conversion Shares to trading on the AIM Market of

the London Stock Exchange ('Admission') and Admission is expected

to occur on 24 February 2017. These Loan Conversion Shares will

rank pari passu with the existing Ordinary Shares, which are

currently traded on AIM.

Total Voting Rights

Following the Admission of the second tranche of Loan Conversion

Shares there will be 1,719,209,021 Ordinary Shares in issue with

each share carrying the right to one vote. There are no shares

currently held in treasury. The total number of voting rights in

the Company will therefore be 1,719,209,021 and this figure may be

used by shareholders as the denominator for the calculations by

which they determine if they are required to notify their interest

in, or a change to their interest in, the Company under the

Financial Conduct Authority's Disclosure Rules and Transparency

Rules.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Unless otherwise indicated, all defined terms in this

announcement shall have the same meaning as described in the

Company's announcement of 3 February 2017.

**ENDS**

For further information please visit www.kerasplc.com, follow us

on Twitter @kerasplc or contact the following:

Dave Reeves Keras Resources plc dave@kerasplc.com

Nominated Adviser

Gerry Beaney/David Hignell Northland Capital Partners Limited +44 (0) 20 3861 6625

Broker

Elliot Hance/Jonathon Belliss Beaufort Securities Limited +44 (0) 20 7382 8415

Financial PR

Susie Geliher/Charlotte Page St Brides Partners Limited +44 (0) 20 7236 1177

Notes

Keras has a portfolio of owner-operated gold interests and cash

generative joint venture gold projects. The Company's strategy is

focussed on advancing its owner-operator gold interests towards

production whilst concurrently identifying and assessing low risk,

high margin joint venture operations to enable continuing cash

flows. The Company benefits from an experienced management team,

which has extensive gold experience and is based in Perth, reducing

execution risk.

Gold Projects

Warrawoona Gold Project - Western Australia

-- Contains the primary Klondyke Gold Project and the Copenhagen

Gold Deposit

-- Total Inferred Mineral Resource Inventory of 5.8Mt @ 2.2g/t

Au for 410,000oz

-- Active growth strategy - continue to assess additional

opportunities in the project area to add contiguous lease areas to

the critical mass that has been consolidated

Tribute Gold Projects

Keras has a portfolio of tribute mining agreements in the

Kalgoorlie Goldfield, Australia and is targeting 20,000-30,000oz

gold per annum from these assets.

Wider Portfolio

Keras is currently awaiting a mining permit for its Nayega

Manganese Project in Togo. Once received it will look to develop

the asset into a low-cost export mining operation.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPGUGUPUPMURG

(END) Dow Jones Newswires

February 21, 2017 03:15 ET (08:15 GMT)

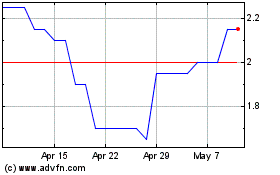

Keras Resources (LSE:KRS)

Historical Stock Chart

From Apr 2024 to May 2024

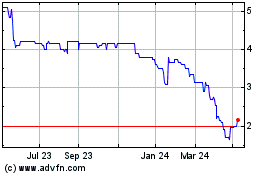

Keras Resources (LSE:KRS)

Historical Stock Chart

From May 2023 to May 2024