Mineral & Financial Invest. Limited Net Asset Value Update (0544J)

September 06 2016 - 2:59AM

UK Regulatory

TIDMMAFL

RNS Number : 0544J

Mineral & Financial Invest. Limited

06 September 2016

MINERAL & FINANCIAL INVESTMENTS LIMITED

("Mineral & Financial", "MAFL", or the "Company")

NET ASSET VALUE UPDATE

MAFL, the AIM quoted resources investment specialist, today

announces an NAV and operations update on its activities for the

period ended 30 June 2016.

-- Net Asset Value of 7.45p per share (unaudited)

-- Profitable disposal of Zinc ETF

-- New position in silver

-- Progress continues on TH Crestgate Iberian asset portfolio

-- Continuing to seek further strategic investments

CHAIRMAN'S STATEMENT

The UK capital markets were initially thrown into a maelstrom of

uncertainty due to the unexpected "Exit" Brexit vote. The most

notable impact on Metals & Mining markets and M&FI is that

the weaker British Pound has buoyed upwards commodity prices in

GBP.

We believe that precious metals appear to have found their lows

in the first few weeks of 2016 but that base metals are a little

more mixed. We believe that bulk commodities continue to be guided

by currency movements, while long neglected commodities such as

zinc and lead continue to find new believers in the strong

fundamentals underpinning their supply/demand relationship.

There is a lot of industry interest in battery technology,

specifically lithium. We agree that portable electric power is to

be a dominant theme in the metals market for the next few years. We

are, however, seeking to find alternative paths to benefit from

these very real and dominant trends.

Our weighting between tactical holdings and strategic holdings

is likely to change over time. We have invested our liquid capital

prudently in the metals and mining equities to ensure that

investors continue to benefit from exposure to the sector.

Now that we have begun our programme of strategic investments

our tactical weighting is likely to diminish. Accordingly the

strategic element of our portfolio is likely to make up more of our

net asset value on a percentage basis in the future.

We believe that there will be opportunities to invest in the

precious metals cycle taking shape over the next few months. We are

currently evaluating a few opportunities for your benefit and hope

to report some progress on this front.

Jacques Vaillancourt

CHIEF INVESTMENT OFFICER'S STATEMENT

During the period the mining equity markets continued with their

modest recovery and it was pleasing to see zinc in the forefront of

this. The Company has significant exposure to zinc through its

minority holding in TH Crestgate, the Swiss company which owns

polymetallic projects in the Iberian pyrite belt.

With this exposure in mind, and in the context of continuing

strength in the zinc price, the directors decided to take profits

on the Zinc ETF which the company had held for a couple of years

now.

The rise in Net Asset Value to 7.45p came largely as a result of

a revaluation of our investment in Cap Energy, undertaken as part

of an annual review of our unquoted holdings.

The directors have opted to apply a highly conservative discount

to the price at which Cap last raised money in valuing our own

holding, but were nonetheless pleased to see the uplift that the

revaluation generated.

Some of the proceeds from this sale were then used to purchase a

new silver ETF ahead of the timely run on silver that took place in

the later part of June. This position is already showing a

significant profit.

The values of our gold and platinum positions also improved

during the period.

The Company also disposed of its residual stake in ISDX-quoted

Milamber holdings for cash.

While remaining cautious, it is encouraging to see markets

continuing to open up, particularly the high levels of activity in

Canada, which have not abated over the summer.

Finally, we note that TH Crestgate has agreed to an extension of

the option agreement it signed with Ferrum Crescent on its Spanish

portfolio suite.

We continue to assess opportunities at all levels, both in terms

of the strategic and the tactical portfolio.

Alastair Ford

For more information:

Katy Mitchell, WH Ireland +44 161 832 2174

Laurence Read, Director +44 20 3289 9923

Notes: The net asset value calculation is subject to audit and

is made on the basis that the Company has 24,034,562 shares in

issue. All listed investments, including investments on ISDX, are

valued at the closing bid price as at 30 June March 2016. The

Company has an investment in one unquoted gold company that is

currently valued at the price at which the gold company in question

last raised money, although this is subject to review. The Company

also has an investment in one unquoted zinc and base metals

company, the valuation of which is subject to quarterly review and

is currently recognized at cost.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVUNVBRNNAKRRR

(END) Dow Jones Newswires

September 06, 2016 03:59 ET (07:59 GMT)

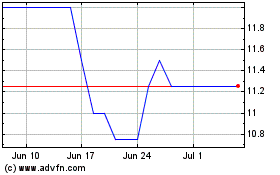

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From Apr 2024 to May 2024

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From May 2023 to May 2024