TIDMMAFL

RNS Number : 3484F

Mineral & Financial Invest. Limited

07 July 2023

MINERAL AND FINANCIAL INVESTMENTS LIMITED

Unaudited Quarterly Net Asset Value per Share was 22.5p (as @ 31

March 2023, Q3-2023), up 14.9% year on year

Highlights

-- NAVPS (FD) was 22.5p as at 31 March 2023, an increase of 14.9% yr/yr

-- NAV at 31 March 2023, was up to GBP8,394,069 or up 20.9% yr/yr from GBP6,940,482

-- Unaudited EPS (FD) was 2.20p for the 9 months to 31 March 2023

-- M&FI's total investable capital rose 21.8% to GBP8.71M;

Working Capital is strong at GBP8.53M, with over GBP2.0m of cash

and no long term debt

-- M&F continues to outperform comparable yardsticks in a challenging environment

Camana Bay, Cayman Islands - 7 July 2023 - Mineral and Financial

Investments Limited (LSE-AIM: MAFL) ("M&F" "MAFL" or the

"Company") is pleased to provide an unaudited quarterly update of

its financial performance and its Net Asset Value for the quarter

ending 31 March 2023. At the end of the third quarter, the NAV was

GBP8,394,069 an increase of 20.9% from GBP6,940,482 achieved in the

same period one year ago.The Net Asset Value Per Share (FD) was

22.5p at the end of the Q3-2023 period, up 14.9% year on year.

Unaudited gross profit for the 9 months was GBP808,002 and the net

profit was GBP838,065 with earnings per share of 2.20p fully

diluted and 2.38p basic. The Company's working capital at the

period end was GBP8,535,569 [1] . The following is a summary of the

NAV, updated to include this unaudited NAV calculation:

SUMMARY OF HISTORICAL PERFORMANCE

(Table 1)

31 March 31 March 31 March 31 March 31 March 31 March 2023 2023/

/ 2018

2018 2019 2020 2021 2022 2023 2022 CAGR

%

Ch.

Net Asset

Value

(NAV) GBP2,536,875 GBP4,832,434 GBP5,333,187 GBP6,011,884 GBP6,940,482 GBP8,394,069 20.9% 27.0%

------------- ------------- ------------- ------------- ------------- ------------- --------- -------

NAVPS [2]

(FD) 7.2p 13.6p 15.1p 17.1p 19.6p 22.5p 14.9% 25.4%

------------- ------------- ------------- ------------- ------------- ------------- --------- -------

FTSE 350

Mining

Index 17,259 20,000 13,373 21,911 10,926 10,161 -7.0% -10.1%

------------- ------------- ------------- ------------- ------------- ------------- --------- -------

GS

Commodity

Index 452.9 434.1 261.5 467.4 724.2 574.0 -20.7% 4.9%

------------- ------------- ------------- ------------- ------------- ------------- --------- -------

Baker

Steel

Natural

Resource

Trust 56.95 57.90 67.30 97.40 97.50 76.80 -21.2% 6.2%

------------- ------------- ------------- ------------- ------------- ------------- --------- -------

M&F's year-on-year NAVPS (FD) growth of 14.8%, was lower

than our average 5 year NAVPS growth of 25.4% (CAGR) since March

2018. The lower growth rate on a per share FD basis is due to the

issuance of management incentive options and RSU's. The period was

made more challenging by broadly rising interest rates. During the

12 month period ending 31 March, 2023, US 10 year Treasury yields

were up to 3.47%, a 48.3% increase year on year. During this same

period many equity markets were weak, notably the the S&P 500

was down 9.3% on year on year. basis, this coupled with soft metal

commodity pricing made the period challenging for all in the

sector.

PORTFOLIO COMPOSITION

(Table 2)

INVESTMENT COMMODITY Q3-2023 Q3-2023 Q3-2022 Q3-2022

CLASSES

(GBP) (%) (GBP) (%)

Cash GBP2,060,653 23.7% GBP90,204 1.3%

-------------- --------- ------------- ---------

Precious Metal GBP3,899,904 44.8% GBP3,564,886 49.8%

-------------- --------- ------------- ---------

Base Metals GBP1,768,681 20.3% GBP3,004,643 42.0%

-------------- --------- ------------- ---------

Food, Energy & Tech GBP922,756 10.6% GBP404,790 5.7%

-------------- --------- ------------- ---------

Diamonds GBP59,208 0.7% GBP88,811 1.2%

-------------- --------- ------------- ---------

Total Investable Capital GBP8,711,203 100% GBP7,153,334 100%

-------------- --------- ------------- ---------

During this 12 month period ending 31 March 2023 precious metals

held their own, while base metals were generally weaker. The

following is a selected summary of metals performance during the 12

month period ended March 31, 2023: Gold was up 1.55%; Silver was

down 3.5%; Copper was down 14.4%; Nickel was down 29.4%; Zinc was

down 29.9%. s can be seen in Table 2 M&F is cash rich and

overweighted in precious metals. Our cash holdings increased due to

the receipt of a payment of US$2.5M in December 2022 from our

partner Ascendant Resources ("Ascendant") as part of the earn-in

agreement on Redcorp Empreedimentos Lda. ("Redcorp"), this

increased Ascendant's ownership of Redcorp to 50%.

The Company's reduced weighting in base metals is in part a

conscious positioning and amplified by the reduced ownership of

Redcorp. There has been an anticipation of an upcoming economic

slowdown. Most central banks are increasing interest rates, in

conjunction with the US Federal Reserve Board. Increasing borrowing

rates are an attempt to confront and curtail inflation.

Historically, increasing interest rates will have a slowing effect

on economic activity and overall valuations.

Our most recent significant strategic investment of 5.7 million

shares of Luca Mining was made in the first week of April 2023 at

C$0.35 for a unit composed of 1 share and 1/2 warrant exerciseable

at C$0.50. Luca is not part of the current NAV performance, as the

investment was made after the end of the current period under

review. Luca shares, as at 5 July 2023 were trading at C$0.51 per

share. The Company also received shares from the spin-out of

Terrasun shares from Golden Sun Resources. Terrasun which holds 17

exploration projects, several of which have historical resources,

also owns owns a mill and 6 drill rigs. The Company owns a little

over 5% of Terrasun and internally values this investment at

GBP197,000.

FOR MORE INFORMATION:

Jacques Vaillancourt, Mineral & Financial Investments Ltd. +44 780 226 8247

Katy Mitchell and Sarah Mather, WH Ireland Limited +44 207 220 1666

Jon Belliss, Novum Securities Limited +44 207 382 8300

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

[1] Current Assets of GBP8,741,442 less Current Liabilities of

GBP205,852 = Working Capital of GBP8,535,569

[2] The NAV calculation is subject to audit and is made on the

basis that the Company has 35,465,395 shares. O/S (basic and

38,365,395 FD) in issue.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVVDLBBXDLLBBK

(END) Dow Jones Newswires

July 07, 2023 04:30 ET (08:30 GMT)

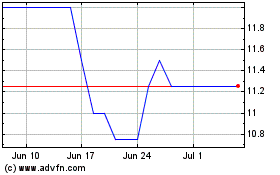

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From Apr 2024 to May 2024

Mineral & Financial Inve... (LSE:MAFL)

Historical Stock Chart

From May 2023 to May 2024