NextEnergy Solar Fund Limited Interim Dividend Declaration (9375I)

August 10 2023 - 3:31AM

UK Regulatory

TIDMNESF

RNS Number : 9375I

NextEnergy Solar Fund Limited

10 August 2023

THIS ANNOUNCEMENT REPLACES RNS NUMBER 8554I RELEASED ON 10

AUGUST AT 07.00 AM. THE PREVIOUS ANNOUCEMENT INCORRECTLY RECORDED

THE EX-DIVIDEND DATE AS 18 AUGUST 2023 BUT SHOULD HAVE STATED 17

AUGUST 2023 AND INCORRECTLY RECORDED THE RECORD DATE AS 1 SEPTEMBER

2023 BUT SHOULD HAVE STATED 18 AUGUST 2023. ALL OTHER DETAIL

REMAINS THE SAME.

LEI: 213800ZPHCBDDSQH5447

10 August 2023

NextEnergy Solar Fund Limited

("NESF" or the "Company")

Interim Dividend Declaration

NextEnergy Solar Fund, the specialist solar+ fund is pleased to

announce an interim dividend of 2.08 pence per Ordinary Share for

the quarter ended 30 June 2023. The interim dividend of 2.08 pence

will be paid on 29 September 2023 to shareholders on the register

as at the close of business on 18 August 2023. The ex-dividend date

is 17 August 2023.

The Company continues to offer shareholders a Scrip Dividend

alternative to this interim dividend as detailed in the Scrip

Circular dated 19 July 2023, a copy of which can be viewed and / or

downloaded from 'Circulars' in the Investor Relations part of the

Company website ( nextenergysolarfund.com ). The Scrip Share

reference price will be announced on 24 August 2023, with elections

to be made by 1 September 2023.

For further information:

NextEnergy Capital 020 3746 0700

Michael Bonte-Friedheim ir@nextenergysolarfund.com

Ross Grier

Stephen Rosser

Peter Hamid (Investor Relations)

RBC Capital Markets 020 7653 4000

Matthew Coakes

Elizabeth Evans

Kathryn Deegan

Cenkos Securities 020 7397 8900

James King

William Talkington

H/Advisors Maitland 020 7379 5151

Neil Bennett

Finlay Donaldson

Ocorian Administration (Guernsey) Limited 014 8174 2642

Kevin Smith

Notes to Editors(1) :

About NextEnergy Solar Fund

NESF is a specialist solar+ fund listed on the premium segment

of the London Stock Exchange and is a constituent of the FTSE 250.

NESF's investment objective is to provide ordinary shareholders

with attractive risk-adjusted returns, principally in the form of

regular dividends, by investing in a diversified portfolio of

utility-scale solar energy and energy storage infrastructure

assets. The majority of NESF's long-term cash flows are

inflation-linked via UK government subsidies.

The NESF portfolio has a combined installed power capacity of

865MW (excluding NextPower III MW on an equivalent look-through

basis). NESF may invest up to 30% of its gross asset value in

non-UK OECD countries, 15% in solar-focused private infrastructure

funds, and 10% in energy storage assets. As at 31 March 2023, the

Company had an audited gross asset value of GBP1,218m. For further

information on NESF please visit www. nextenergysolarfund.com

Article 9 Fund

NESF is classified under Article 9 of the EU Sustainable Finance

Disclosure Regulation and EU Taxonomy Regulation. NESF's

sustainability-related disclosures in the financial services sector

in accordance with Regulation (EU) 2019/2088 can be accessed on the

ESG section of both the NESF & NEC website.

About NextEnergy Group

NESF is managed by NextEnergy Capital, part of the NextEnergy

Group. NextEnergy Group was founded in 2007 to become a leading

market participant in the international solar sector. Since its

inception, it has been active in the development, construction, and

ownership of solar assets across multiple jurisdictions. NextEnergy

Group operates via its three business units: NextEnergy Capital

(Investment Management), WiseEnergy (Operating Asset Management),

and Starlight (Asset Development).

-- NextEnergy Capital: Ha s over 16 years specialist solar

expertise having invested in over 375 individual solar plants

across the world. NextEnergy Capital currently manages four

institutional funds with a total capacity in excess of 2.4GW+ and

has asset under management of $3.7bn. www.nextenergycapital.com

-- WiseEnergy(R): Provides solar asset management, monitoring

and technical due diligence services to over 1,350 utility-scale

solar power plants with an installed capacity in excess of 1.8GW.

WiseEnergy clients comprise leading banks and equity financiers in

the energy and infrastructure sector. www.wise-energy.com

-- Starlight: H as d eveloped over 100 utility-scale projects

internationally and continues to progress a large pipeline of

c.10GW of both green and brownfield project developments across

global geographies.

Notes:

(1:) All financial data is audited at 31 March 2023, being the

latest date in respect of which NESF has published financial

information .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVGPURPRUPWURU

(END) Dow Jones Newswires

August 10, 2023 04:31 ET (08:31 GMT)

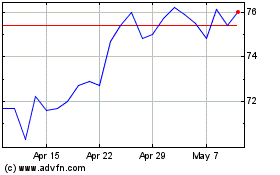

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2023 to Apr 2024