Oxford Tech 2 VCT 3rd Quarter Results

December 19 2023 - 3:59AM

UK Regulatory

TIDMOXH

19 December 2023

Oxford Technology 2 VCT Plc (the "Company")

Legal Entity Identifier: 2138002COY2EXJDHWB30

3rd Quarter Results

Oxford Technology 2 VCT Plc presents its quarterly update for

the 3 month period ending 30 November 2023. The Directors have

reviewed the valuation of its entire portfolio as at that date. The

unaudited net asset value (NAV) per share for each Class (and other

associated data) as at 30 November 2023 is shown in the table

below:

The primary drivers of these changes are movements in valuations

of Scancell Holdings Plc ("Scancell"), STL Management Limited

("Select Technology") and Diamond Hard Services Ltd ("DHS") and

three months of running costs. The share price of Scancell has

increased from 9.5p at 31 August to 10.75p at 30 November 2023.

Scancell has announced a successful placing raising GBP10.7m and

increasing its institutional shareholder base; a further GBP1.2m

was raised through a concurrent retail offer, both at 11p per

share.. The share price of Arecor Therapeutics Plc ("Arecor") has

remained at 185p. Both companies have announced exciting and

significant clinical and commercial news in the period. However it

is disappointing that their share prices do not yet reflect the

clear potential of these businesses. The valuation of Select

Technology has been slightly increased in line with recent sales

performance. Conversely, sales at DHS have seen a slight reduction

in period, leading to a lower company valuation. The valuation of

all the other investments in the unquoted portfolios remain

unchanged from those at 31 August 2023.

No dividends were paid during the period. under review. As

foreshadowed in the half year report issued on 19 September 2023,

our investment in Dynamic Extractions Ltd was sold at its 31 August

2023 valuation. No other shares were bought or sold in any the

portfolio companies in any of the four Share Classes.

The Board has completed its remaining discussions with potential

new managers and it is not now expected that the Company will raise

any further funds from investors. Over the course of the next 18

months, based on the expected income and cost base, the Directors

believe it will be necessary to realise investments to generate

disposal proceeds of approximately GBP200k for working capital

purposes. Whilst it is possible this can be raised from one of the

unquoted stocks, it is more likely that some small disposals of

Scancell and/or Arecor will be necessary. For shareholder

information, the Company currently holds 11.3m Scancell shares and

1.6m Arecor shares.

The Directors are not aware of any other events or transactions

which have taken place between 30 November 2023 and the publication

of this statement which have had a material effect on the financial

position of the Company.

At 30 November 2023, the Company's issued share capital by Share

Class is shown in the table above. The Company holds no shares in

treasury and the total voting rights in the Company are 27,844,888.

This figure of 27,844,888 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

Enquiries: Lucius Cary Oxford Technology Management 01865

784466

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement via

a Regulatory Information Service, this information is now

considered to be in the public domain.

(END) Dow Jones Newswires

December 19, 2023 04:59 ET (09:59 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

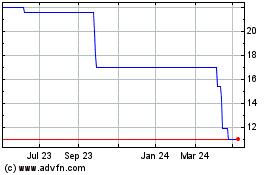

Oxford Technology 2 Vent... (LSE:OXH)

Historical Stock Chart

From Dec 2024 to Jan 2025

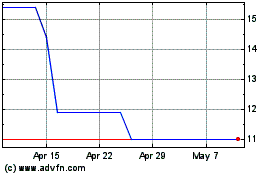

Oxford Technology 2 Vent... (LSE:OXH)

Historical Stock Chart

From Jan 2024 to Jan 2025