Picton Prop Inc Ltd Trading Update and Net Asset Value as at 30 June 2022

July 27 2022 - 1:00AM

UK Regulatory

TIDMPCTN

27 July 2022

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Trading Update and Net Asset Value as at 30 June 2022

Picton announces a 2.0% increase in Net Asset Value for the quarter ended 30

June 2022.

Financial Highlights

* Net assets of £670.0 million (31 March 2022: £657.1 million).

* NAV/EPRA NTA per share increased by 2.0% to 122.9 pence (31 March 2022:

120.4 pence).

* Total return for the quarter of 2.8% (31 March 2022: 7.6%).

* LTV of 22.3% (31 March 2022: 21.2%).

Operational Highlights

* Like-for-like portfolio valuation uplift of 1.9% over the quarter.

* Completed three small lettings, in the office and retail sectors, and

renewed / regeared three leases, all in the industrial sector, with a

combined annual rent of £0.3 million, 6% ahead of the March 2022 ERV.

* Secured an average increase of 12% against the previous passing rent from

four rent reviews in the industrial and retail sectors, with a combined

annual rent of £0.3 million, which was 14% ahead of the March 2022 ERV.

* Purchased a multi-let mixed use London asset for £13.7 million.

* Occupancy of 91%, principally reflecting the existing vacancy in the above

acquisition (31 March 2022: 93%).

Dividend

* Interim dividend of 0.875 pence per share declared in respect of the period

1 April 2022 to 30 June 2022 and to be paid on 31 August 2022 (1 January

2022 to 31 March 2022: 0.875 pence per share).

* Annualised dividend equivalent to 3.5 pence per share, delivering a

dividend yield of 3.8%, based on 25 July 2022 share price.

* Dividend cover for the quarter of 103% (31 March 2022: 103%).

Lena Wilson CBE, Chair of Picton, commented:

"It is encouraging to have delivered yet another quarter of positive NAV

growth. Looking ahead, our conservative balance sheet and predominately fixed

long-term debt facilities put us in a favourable position to take advantage of

opportunities arising from current market conditions."

Michael Morris, Chief Executive of Picton, commented:

"We have seen valuation gains across each sector of the portfolio. Whilst we

recognise that macro events are leading to a slowing of capital growth in many

markets, both asset management initiatives and rental growth in a number of

subsectors have contributed to the overall positive result. We continue to

watch the market carefully for opportunities to grow the portfolio."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE UK MARKET

ABUSE REGULATION

For further information:

Tavistock

James Verstringhe, 020 7920 3150, james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a £879

million diversified UK commercial property portfolio, invested across 48 assets

and with around 400 occupiers (as at 30 June 2022).

Through an occupier focused, opportunity led approach to asset management,

Picton aims to be one of the consistently best performing diversified UK

focused property companies listed on the main market of the London Stock

Exchange.

For more information please visit: www.picton.co.uk

NET ASSET VALUE

The unaudited Net Asset Value ('NAV') of Picton as at 30 June 2022 was £670.0

million, reflecting 122.9 pence per share, an increase of 2.0% over the quarter

or 2.8% on a total return basis.

The NAV attributable to the ordinary shares is calculated under IFRS and

incorporates the independent market valuation as at 30 June 2022, including

income for the quarter, but does not include a provision for the dividend this

quarter, which will be paid in August 2022.

30 Jun 2022 31 Mar 2022 31 Dec 2021 30 Sept 2021

£million £million £million £million

Investment properties* 863.2 834.2 774.2 730.2

Other assets 25.5 24.2 25.3 26.2

Cash 22.4 38.5 17.7 16.7

Other liabilities (22.6) (21.0) (19.3) (20.0)

Borrowings (218.5) (218.8) (182.2) (179.5)

Net Assets 670.0 657.1 615.7 573.6

Net Asset Value per share 122.9p 120.4p 112.8p 105.0p

*The investment property valuation is stated net of lease incentives and

includes the value of owner-occupied property.

The movement in Net Asset Value can be summarised as follows:

Total Movement Per share

£million % Pence

NAV at 31 March 2022 657.1 120.4

Movement in property values 13.3 2.0 2.5

Net income after tax for 4.9 0.7 0.9

the period

Dividends paid (4.8) (0.7) (0.9)

Other (0.5) - -

NAV at 30 June 2022 670.0 2.0 122.9

DIVID DECLARATION

A separate announcement has been released today declaring a dividend of 0.875

pence per share in respect of the period 1 April 2022 to 30 June 2022 (1

January 2022 to 31 March 2022: 0.875 pence).

Dividend cover over the quarter was 103% (31 March 2022: 103%).

DEBT

Total borrowings at 30 June 2022 were £218.5 million, with £4.9 million drawn

under the revolving credit facility and the balance drawn under long-term fixed

rate facilities. The net loan to value ratio, calculated as total debt less

cash, as a proportion of gross property value, is 22.3% (31 March 2022:

21.2%).

The weighted average debt maturity profile of the Group is approximately 9.3

years and the weighted average interest rate is 3.7%.

Picton has £45.1 million available through its undrawn revolving credit

facility.

PORTFOLIO UPDATE

Like-for-like, the portfolio valuation increased over the quarter by 1.9% or £

16.2 million, with £1.1 million of capital expenditure incurred across the

portfolio during the period. The valuation movements over the quarter are shown

below:

Sector Portfolio Like-for-like

Allocation Valuation Change

Industrial 59.3% 2.3%

South East 43.1%

Rest of UK 16.2%

Offices 30.3% 0.7%

London City and West End 7.0%

Inner and Outer London 5.2%

South East 8.7%

Rest of UK 9.4%

Retail and Leisure 10.4% 2.8%

Retail Warehouse 6.8%

High Street - Rest of UK 2.1%

Leisure 1.5%

Total 100% 1.9%

Against a backdrop of rising inflation and financing costs, there was some

upward pressure on yields in certain subsectors, albeit this was offset through

rental growth and portfolio activity.

The retail and leisure element of the portfolio saw the strongest growth,

principally reflecting lower yields for retail warehouse assets. On a

like-for-like basis the valuation of our office portfolio increased by 0.7%

over the quarter, principally reflecting investment into the assets.

Occupational demand in the industrial sector remains strong with associated

rental growth and this led to positive performance and a capital value uplift,

despite some small outward yield adjustments for lower yielding assets.

Charlotte Terrace, Hammersmith Road, London, W14 was acquired for £13.7

million. This mixed use London block comprises four adjoining buildings, which

total 28,500 sq ft of office space and 4,400 sq ft of retail space, arranged

over five floors. The property was redeveloped behind the façade in 1990 and is

Grade II listed, meaning there are no business rates payable on void units. The

purchase price reflects a net initial yield of 3.3%, rising to over 8% once

fully let and reflecting a low capital value of £417 per sq ft, which is below

its estimated replacement cost. In order to assist the leasing process, works

are underway to improve the occupier amenities.

As at 30 June 2022, the portfolio had a net initial yield of 4.1% (allowing for

void holding costs) or 4.3% (based on contracted net income) and a net

reversionary yield of 5.4%. The weighted average unexpired lease term, based on

headline rent, was 4.9 years.

Occupancy reduced to 91%, principally reflecting the existing vacancy in the

above recent acquisition.

The top ten assets, which represent 55% of the portfolio by capital value, are

detailed below.

Asset Sector Location

Parkbury Industrial Estate, Radlett Industrial South East

River Way Industrial Estate, Harlow Industrial South East

Datapoint, Cody Road, E16 Industrial London

Lyon Business Park, Barking Industrial Outer

London

Stanford Building, Long Acre, WC2 Office London

Shipton Way, Rushden, Northants Industrial East

Midlands

Angel Gate, City Road, EC1 Office London

Tower Wharf, Cheese Lane, Bristol Office South West

Sundon Business Park, Luton Industrial South East

50 Farringdon Road, EC1 Office London

MARKET BACKGROUND

According to the MSCI Monthly UK Property Index, the All Property total return

was 3.6% for the quarter to June 2022, compared to 5.5% for the previous

quarter.

Capital growth was 2.5% (March 2022: 4.3%) and rental growth was 1.1% for the

quarter (March 2022: 1.3%). A more detailed breakdown of the MSCI Monthly

Digest is shown below:

MSCI capital growth

Number of MSCI segments

Quarterly growth Positive growth Negative growth

Industrial 4.1% 7 0

Office 0.6% 5 5

Retail 2.2% 11 8

All Property 2.5% 23 13

MSCI rental growth

Number of MSCI segments

Quarterly growth Positive growth Negative growth

Industrial 2.7% 7 0

Office 0.1% 5 5

Retail 0.2% 10 9

All Property 1.1% 22 14

ENDS

END

(END) Dow Jones Newswires

July 27, 2022 02:00 ET (06:00 GMT)

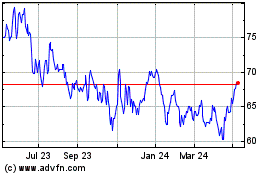

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

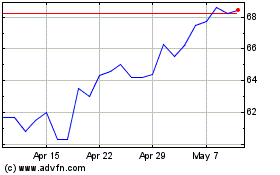

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Apr 2023 to Apr 2024