TIDMRNWH

RNS Number : 4768Z

Renew Holdings PLC

16 May 2023

16 May 2023

Renew Holdings plc

("Renew" or the "Group" or the "Company")

Half-year Report

Continued outperformance and strong organic growth; Board

confident in its full year expectations

Renew (AIM: RNWH), the leading Engineering Services Group

supporting the maintenance and renewal of critical UK

infrastructure, announces its interim results for the six months

ended 31 March 2023 ("the period").

Financial Highlights

Six months ended 31 March 2023 HY23 HY22 Change

GBPm GBPm

Group revenue [1] GBP471.8m GBP414.3m +13.9%

---------- ---------- --------

Adjusted operating profit(1) GBP28.3m GBP26.0m +9.0%

---------- ---------- --------

Operating profit GBP26.9m GBP22.1m +21.9%

---------- ---------- --------

Adjusted operating margin(1) 6.0% 6.3% -0.3bps

---------- ---------- --------

Profit before tax GBP26.3m GBP21.8m +20.9%

---------- ---------- --------

Adjusted earnings per share(1) 27.4p 26.2p +4.7%

---------- ---------- --------

Interim dividend 6.00p 5.67p +5.8%

---------- ---------- --------

-- Group order book of GBP890m (HY22: GBP771m)

-- Net cash (pre-IFRS16) of GBP17.0m (HY22: net debt GBP1.2m)

-- Delivered operating profit and revenue well ahead of strong prior half-year comparatives

-- Increased interim dividend reflects resilient trading performance, healthy cash generation

and strong forward order book

-- Strong organic revenue growth of 11.6% driven by continued focus on collaboration between

our brands

Operational Highlights

-- Successful joint venture between our brands in the Highways market and growing opportunity

for collaboration in the Water sector

-- Secured new CP7 framework positions with Wales & Western to be delivered through a unique

collaboration between our rail brands

-- Enisca continues to integrate well following its acquisition in November 2022

-- Organic growth in our aviation activities

-- Awarded Major Civils, Major Electrical and Major Mechanical frameworks for Welsh Water

Current Trading & Outlook

-- Trading has started well in the second half of the year and we remain confident that the full

year will be in line with the Board's expectations

-- Whilst we are not immune from the continuing inflationary headwinds in the economy, our business

is well placed to mitigate their impact due to the nature of our variable, cost-plus contracts

-- The Board believes that the structural growth drivers in our end markets remain extremely

attractive

Paul Scott, CEO of Renew, commented:

"We are pleased to report another period of outstanding

performance, once again illustrating the resilient and

differentiated nature of our high-quality, low-risk business model.

Supported by the commercial terms within our frameworks, the Group

has been able to successfully alleviate inflation challenges

throughout the period, delivering operating profit and revenue

ahead of strong prior half-year comparatives. Our results in a

difficult macroeconomic environment highlight the strength of our

business model, which is underpinned by committed regulatory

spending periods and long-term frameworks resulting in repeatable

revenue streams and highly visible earnings. Further, the

mission-critical nature of the work we perform fosters long-lasting

relationships with our clients illustrated through our strong track

record of repeat contract wins.

None of this success would be possible without the outstanding

work of our directly employed colleagues who continue to go above

and beyond for our clients. I would like to thank, on behalf of the

Board, all our dedicated workforce for their outstanding and

continued commitment to providing our clients with our mission

critical, highly responsive services at all times.

With ongoing strong demand in our end markets, we enter the

second half of the year confident in our full year performance and,

longer term, in the attractiveness of the structural growth

drivers. We welcomed the Government's reiterated commitment to a

record GBP600bn investment in transforming the UK's infrastructure

to meet the target of net zero carbon emissions by 2050. This has

been reinforced by the Government's announcements in March which

show it has sharpened its focus on investment in infrastructure to

improve climate resilience, which will bring significant

opportunities for the Group."

For further information, please contact:

Renew Holdings plc www.renewholdings.com

Paul Scott, Chief Executive Officer via FTI Consulting

Sean Wyndham-Quin, Chief Financial Officer 020 3727 1000

Numis Securities Limited (Nominated Adviser

and Joint Broker) 020 7260 1000

Stuart Skinner / Kevin Cruickshank

Peel Hunt LLP (Joint Broker) 020 7418 8900

Mike Burke / Harry Nicholas / Charles

Batten

FTI Consulting (Financial PR) 020 3727 1000

Alex Beagley / Sam Macpherson / Rafaella Renew@fticonsulting.com

de Freitas

About Renew Holdings plc

Renew is a leading UK Engineering Services business, performing

a critical role in keeping the nation's infrastructure functioning

efficiently and safely. The Group operates through independently

branded subsidiaries across its chosen markets, delivering

non-discretionary maintenance and renewal tasks through its highly

skilled, directly employed workforce.

Renew's activities are focused into two business streams:

Engineering Services, which accounts for over 98 per cent of the

Group's adjusted operating profit, focuses on the key markets of

Rail, Infrastructure, Energy (including Nuclear) and Environmental

which are largely governed by regulation and benefit from

non-discretionary spend with long-term visibility of committed

funding.

Specialist Building focuses on the Science, Landmark and High

Quality Residential markets in London and the Home Counties.

For more information please visit the Renew Holdings plc

website: www.renewholdings.com

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) prior to its release as part of this

announcement.

Chief Executive Officer's Review

Consistent year on year outperformance demonstrates our

differentiated model

The Group has once again delivered an outstanding trading

performance over the first six months of the financial year,

demonstrating the resilience and differentiated nature of our

high-quality, low-risk business model, combined with ongoing strong

demand we have seen in our end markets.

This consistent year on year outperformance has been achieved

despite the turbulence in the wider economy and is a result of our

unique business model which is extremely resilient because of a

number of key characteristics. We work in markets underpinned by

highly visible, reliable and repeatable committed regulatory

spending periods which are subject to long term multi-year

contracts providing our business with predictable and recurring

revenue streams.

Our brands within the Renew family have long-term relationships

in place with all our stakeholders and have a strong track record

of winning repeat contracts with our clients due to the quality of

the work performed by our directly employed workforce.

Supported by the commercial terms within our frameworks, the

Group has been able to successfully manage inflation challenges

throughout the period, delivering operating profit and revenue

ahead of strong prior half-year comparatives. Our track record of

consistent year on year growth across all our key financial metrics

clearly illustrates the critical nature of the work we do for our

clients and the committed, long-term spending cycles that underpin

our end markets. Our focus on asset maintenance and renewal means

we are not dependent on large, capital-intensive contract awards,

providing Renew with a significantly lower risk profile than others

operating in our sectors.

During the period, it was encouraging to see the Government's

Autumn Statement re-confirm a commitment to a record GBP600bn [2]

investment in transforming the UK's infrastructure to meet the

target of net zero carbon emissions by 2050. Further, in March

2023, the Government announced [3] ambitious plans to scale up

affordable, clean, homegrown power and build thriving green

industries to boost the UK's energy security and independence which

offers further opportunities for growth. With pressure on public

expenditure as a result of the difficult macroeconomic environment,

we are seeing an increased focus on maintaining and renewing

existing assets instead of major infrastructure enhancement

projects which bodes well for our business and our well-established

strategy.

We were particularly pleased with our rate of organic growth

during the period. This was understandably, in part, linked to the

current levels of inflation, but it was also driven by the

continued focus on collaboration between our brands. Over the first

half of the year, we have successfully implemented a joint venture

between our brands in the Highways market, and we are seeing a

growing opportunity for collaboration in the Water sector. This

pleasing organic growth performance combined with our strong

balance sheet and significant cash generation, gives us the

firepower and flexibility to invest in further value-accretive

M&A opportunities.

Following the successful acquisition of Enisca in November 2022,

I am pleased to report the business is integrating well into the

Renew family and is trading in line with management's expectations.

Across our sectors we continue to actively appraise M&A

opportunities that fit within our strict acquisition criteria and

will complement our existing capabilities and extend our footprint

into our target markets in the UK.

After an outstanding FY22, the first six months of FY23 clearly

demonstrate the consistent and resilient nature of our business

model. We enter the second half of the year with good momentum and

a strong forward order book which underpins our confidence in our

full year outturn. We are seeing continued demand for our services

across all our markets and that is largely due to the outstanding

work of our directly employed colleagues who continue to go above

and beyond for our clients. I would like to thank, on behalf of the

Board, all our dedicated workforce for their outstanding and

continued commitment to providing our clients with our mission

critical, highly responsive services at all times.

Renew's strengths

Renew has a number of core strengths which provide distinct

competitive advantages in our chosen markets and leave us well

placed to build on our strong track record of long-term value

creation:

-- The health, safety and wellbeing of our colleagues, and those impacted by our work, remains

our number one priority and we have implemented industry-leading safe working practices for

the Group's employees and operations.

-- We operate a differentiated, diversified, low-risk business model, providing critical asset

maintenance and renewals services that are not dependent on large, high-risk, capital-intensive

contract awards.

-- Our directly employed workforce enables us to provide a more efficient and valuable service

to our clients, reducing our exposure to sub-contractor pricing volatility and being able

to deliver extremely responsive solutions.

-- The commercial terms within our frameworks mean we are able to proactively and effectively

manage cost inflation.

-- Our businesses are well established in complex, challenging and highly regulated markets with

significant barriers to entry, which demand a highly skilled and experienced workforce and

a proven track record of safe delivery.

-- We work in markets underpinned by resilient, long-term growth dynamics and highly visible,

reliable, committed regulatory spending periods, providing predictable cashflows.

-- We have a proven track record of sustainable value creation, reliable revenue growth and strong

returns on capital thanks to our highly cash generative earnings model and clearly defined

strategy.

-- We are committed to growing the business both organically and through selective complementary

acquisitions while maintaining a disciplined approach to capital allocation and risk underpinned

by a strong balance sheet.

-- We have strong relationships in place with all our stakeholders, from our workforce to our

customers, suppliers, communities and shareholders.

-- Our model of compounding earnings through the redeployment of internally generated cashflows

enables us to execute on our strategy of delivering reliable and consistent growth for all

our stakeholders.

Compelling market drivers

Our businesses bring exposure to attractive long-term,

non-discretionary structural growth drivers. Increasing demand for

the maintenance and renewal of existing UK infrastructure is driven

by a number of factors including:

-- a commitment by the Government to level up the economy by investing GBP600bn [4] in an infrastructure-led

recovery, two-thirds of which will be in the transport and energy sectors, with fiscal stimulus

measures likely to flow through to lower cost infrastructure maintenance programmes ahead

of larger, more capital-intensive enhancement schemes;

-- greater focus on sustainability and climate change as part of the UK's target of reaching

net-zero carbon emissions by 2050, together with flood risk prevention measures and investment

in nuclear projects, renewables and rail electrification programmes;

-- population growth increasing the pressure on transportation, energy, water and demand for

natural resources;

-- technological innovation driving a shift towards digital roads, smart cities and the transformation

of transport and telecommunications networks; and

-- increased Government regulation to improve safety, efficiency and resilience of key infrastructure

assets leading to more demanding maintenance, renewal and upgrading requirements.

Results overview

During the period, Group revenue increased to GBP471.8m (HY22:

GBP414.3m), which includes a contribution from Enisca since

December as well as organic growth of 11.6%. The Group achieved an

adjusted [5] operating profit of GBP28.3m (HY22: GBP26.0m) and

adjusted(5) operating profit margin of 6.0% (HY22: 6.3%). As at 31

March 2023, the Group had pre-IFRS16 net cash of GBP17.0m (31 March

2022: net debt GBP1.2m). The Group's order book at 31 March 2023

has strengthened to GBP890m (HY22: GBP771m) underpinned by

long-term framework positions.

Dividend

The Group's resilient trading performance, cash position and

strong forward order book have given the Board the confidence to

declare an interim dividend of 6.00p (HY22: 5.67p) per share. This

represents a 5.8 per cent increase on the last interim dividend

paid. This will be paid on 12 July 2023 to shareholders on the

register as at 9 June 2023, with an ex-dividend date of 8 June

2023.

Board changes

As announced on 15 August 2022, Elizabeth (Liz) Barber, was

appointed as a Non-Executive Director effective 1 November 2022.

Liz brings a wealth of experience gained over 12 years in the

regulated water sector, an established and growing market for Renew

following the acquisition of Enisca in November. Combined with her

financial background, Liz will complement the Board's current

skillset and will be invaluable as we continue our growth

journey.

Engineering Services

Our Engineering Services activities account for over 98 per cent

of the Group's adjusted(5) operating profit and delivered revenue

of GBP435.8m (HY22: GBP377.5m) with an adjusted(5) operating profit

of GBP29.7m (HY22: GBP26.6m) resulting in an operating margin of

6.8% (HY22: 7.1%). Our Engineering Services organic growth rate in

the period was 12.9%. At 31 March 2023, the Engineering Services

order book was GBP780m (31 March 2022: GBP705m). The Group's

resilient performance was driven by continued positive momentum in

our Rail, Infrastructure and Environmental sectors.

Rail

Network Rail, a significant strategic customer for the Group, is

expected to invest GBP44bn [6] over Control Period 7 ("CP7"), which

runs from 2024 to 2029 with expenditure expected to focus on

operations, maintenance, and renewal of the national rail network.

This highlights and plays to our strengths as does the Government's

commitment to a rail decarbonisation programme including a

significant investment in electrification programmes, as part of

the overall UK target to deliver net zero by 2050.

As the largest provider of multidisciplinary maintenance and

renewals engineering services to Network Rail, we support the

day-to-day operation of the rail network nationally, directly

delivering essential asset maintenance through our long-term

frameworks. The Group assists Network Rail through our

mission-critical renewals and maintenance services supporting

assets including bridges, embankments, tunnels, drainage systems,

signalling, electrification, devegetation, fencing and plant.

During the period, we successfully secured new CP7 framework

positions with Wales & Western, on their Wales Structures and

Wales & Western Electrification & Plant frameworks. These

5-year frameworks will be delivered through a unique collaboration

between our rail brands and would not have been possible without

our acquisition of REL in 2021. REL is a leading provider of

high-quality services associated with the installation and

commissioning of Overhead Line Electrification (OLE) and their

capabilities, in conjunction with our existing rail brands, have

opened up framework positions to the Group that were previously

unattainable. This framework will see the Group deliver a broad

scope of Electrification & Plant rail systems, including low

and high voltage power and OLE, creating efficiencies and

developing innovation on behalf of Network Rail. Our success in

securing this long-term framework sets a platform to unlock similar

opportunities across other Network Rail regions in their ongoing

CP7 framework procurement activity.

As stated in our final results announced in November 2022 we

have secured extensions to major CP6 frameworks including in

Scotland which, in conjunction with our recent appointment in Wales

& Western, leaves the Group ideally positioned as we move into

the next control period.

Network Rail's five devolved regions recently began the process

of re-procuring their Asset Maintenance and Capital Delivery

frameworks for the next control period. Similarly, the Office of

Rail Regulation recently outlined its Statement of Funds for CP7

which sets out a comparable investment to CP6 [7] and will likely

place a greater emphasis on maintenance and renewals activities.

The final determination funding plans are expected to be confirmed

in the first half of 2024.

While we remain mindful of recent speculation that public

expenditure budgets for CP7 may be constrained, we are not

currently seeing any indication that would suggest the level of

demand for our services is reducing. In fact, we continue to see

record demand for our services which is illustrated by our trading

momentum as well as a strong forward order book. Further, recent

success stories like our framework awards in Wales & Western

demonstrate the growing capabilities within our business when we

leverage the expertise within our brands through collaboration.

The compelling maintenance-focused structural growth drivers

within this sector and Renew's high quality engineering expertise

leaves the Group ideally positioned to deliver long term,

profitable growth in Rail. Our teams remain focused on securing our

existing frameworks which are coming up for renewal while

continuously appraising other areas for organic growth. The early

stages of increased electrification on the rail network bode well

for future CP7 framework applications where our three rail brands

have formed a collaborative and unique position for OLE delivery,

another key strategic growth pillar for the Group.

Infrastructure

Highways

The Group continued to make good operational and strategic

progress within the Highways segment in the first half, delivering

essential asset maintenance and critical infrastructure renewals

underpinned by non-discretionary regulatory requirements.

The UK Government's second Road Investment Strategy ("RIS2")

(2020-2025) committed an unprecedented level of spending on

England's strategic road network. Of the GBP24bn [8] committed over

a five-year period, GBP11.9bn of this funding is ringfenced for

operations, maintenance and renewals which gives Renew a unique

advantage from which it has continued to benefit.

During the period, work continued on the National Highways

Scheme Delivery Framework ("SDF") across five framework lots,

covering civil engineering, road restraint systems and drainage

disciplines, worth GBP147m over six years. The Group operates as a

Tier 1 supplier and continues to leverage the combined expertise of

its brands, delivering the road restraint lots through a joint

venture between two subsidiary businesses, illustrating the

synergies and efficiencies that can be achieved through

collaboration. This is the only successful joint venture on the SDF

and positions the Group as the second largest supplier of road

restraint systems in the country.

As we look ahead to RIS3 (2025-2030), for which the Government

recently began a market consultation, it appears that critical

maintenance and renewals, as opposed to significant enhancement

projects, will come into even sharper focus. Emma Ward, director

general for the Roads, Places and Environment group at the

Department for Transport said on RIS3 "the headroom for enhancement

projects is likely to be less. We also have an ageing network, so

the importance of renewals and maintenance actually increases over

time." [9] This continued emphasis on renewals and maintenance

plays well into the Group's capabilities as we move into RIS3 and

Renew remains uniquely placed to seize attractive growth and market

share opportunities within Highways.

Aviation

The Group continues to see growing momentum in Aviation

following its appointment to the 5-year Manchester Airports Group

GBP700m Civils Framework to deliver medium-sized civil-engineering

projects valued between GBP3m - GBP10m. Work began at Manchester

Airport during the period where the Group undertakes

electro-mechanical and civil engineering services. With passenger

levels this summer predicted to exceed pre-Covid levels as well as

several years of underinvestment in critical assets in the

industry, the tailwinds in this sector are clear. It is

particularly pleasing to have organically grown this capability

within the Group and it is an area of increased focus as we look to

continue to grow in this segment.

Wireless Telecoms

The nation's connectivity is becoming ever more critical in the

digital age, and as a result the wireless telecoms sector contains

many attractive growth drivers. An estimated GBP30bn [10] is

required to upgrade the nation's broadband networks to

gigabit-capable speeds, which includes the UK Government's GBP5bn

investment in the roll-out of 5G, and the expansion of the Shared

Rural Network, the Government's GBP500m programme to extend 4G

mobile coverage to 95% of the UK.

As a leader in the wireless telecommunications market, we have

exposure to all of these opportunities, holding long-term

relationships, through framework agreements, with the main UK

network operators, and managed service providers.

During the period, the Group continued to broaden its customer

base and progressed well in our works with Vodafone, EE and BT to

remove Huawei equipment from UK networks by 2027, a critical

regulatory target. Strong progress was also made with the design,

construction and commissioning of both 4G and 5G technology for all

of the UK network operators.

Energy

Nuclear

Having worked for over 75 years in the UK's civil nuclear

market, we provide a multidisciplinary service through our large

complement of highly skilled employees who operate to demanding

nuclear standards, including decontamination and decommissioning

services, operational support and asset care, as well as waste

retrieval in high hazard areas such as legacy storage ponds and

silos.

The Government's total nuclear decommissioning provision is

estimated at GBP124bn [11] over the next 120 years, with around 75%

of the total spend allocated to Sellafield which is the largest of

the Nuclear Decommissioning Authority's sites and where we remain a

principal Mechanical, Electrical and Instrumentation services

provider.

We continue to operate across a number of long-term frameworks

at Sellafield and during the period the Group secured further

framework positions as part of the Project Partnership Programme

("PPP") . Appointed by all four PPP Key Delivery Partners, the

framework runs for a further 17 years through to 2040 and will see

the Group deliver critical Mechanical, Electrical and HVAC

services. The main PPP framework is worth up to GBP7bn [12] over

its 20-year duration.

We continue to build relationships outside of Sellafield,

broadening opportunities for decommissioning services that are in

increasing demand at other UK nuclear facilities.

While the work we do in this sector is predominantly focused on

decommissioning and hazard waste removal, the recent Government

Energy Security Plan, Powering Up Britain, suggests that new

nuclear will offer further growth opportunities in the future. The

UK Government has committed to achieve net zero emissions by 2050,

and decarbonisation of our energy supply is a key step to achieve

carbon neutrality. The Government is delivering a radical shift in

the UK energy system towards cleaner, more affordable energy

sources of which new nuclear is an essential component. This is

underpinned by the creation of Great British Nuclear [13] and the

Government's target to commence construction of up to three new

nuclear plants in the next 10 years. [14] This provides long-term

and sustainable demand for our specialist site services as well as

our manufacturing capabilities in high grade nuclear

components.

Electric Vehicle Charging

The UK Government's commitment to ban the sale of non-electric

new cars by 2030 provides the Group with another exciting growth

opportunity. This target has been identified as a key priority in

supporting the Government's net zero emissions targets as well as

its ambition to become the fastest nation in the G7 to decarbonise

road transport. [15] Further, in the Government's Green Day

announcements, GBP381m was committed to the Local Electric Vehicle

Infrastructure fund to help install tens of thousands of new

charging points across the country [16] to add to the GBP950m

committed to the Rapid Charging Fund. During the period we

continued to design and construct charging facilities for large

fleet operators and we are exploring further opportunities in this

sector and see it as an exciting growth avenue going forward.

Environmental

Water

Following the acquisition of Enisca in November 2022 and Browne

in 2021, the Group's water division continues to go from strength

to strength. Enisca represents an excellent strategic fit, adding

new capabilities and clients to our water business and broadening

the Group's footprint in the sector. Enisca is integrating well

with the wider Group and is trading in-line with management's

expectations.

Our offer of scheduled maintenance and renewals services in

addition to extensive 24/7 emergency reactive works is further

enhanced by the addition of Enisca's Mechanical, Electrical,

Instrumentation, Controls and Automation ("MEICA") capabilities and

expands the mission-critical services we provide to our clients

around the UK.

We continue to benefit from the UK Government's commitment to

spend GBP51bn over AMP7 [17] into 2025 and have seen an expansion

in investment through our clients' operational expenditure budgets.

For the rest of AMP7 we expect to see an increasingly accelerated

programme of regulatory spend over the final years, given the lower

level of expenditure in the early part of the cycle.

We have strengthened relationships with our existing clients

which includes 12 regulated water companies.

In the period we secured places on the D r Cymru Welsh Water

Major Civils, Major Electrical and Major Mechanical frameworks,

each lasting for up to 8 years, and we renewed our Pressurised

Pipeline framework with the same client. Elsewhere we secured

places on Thames Water's Waste Network Services framework and

Severn Trent's Capital Delivery Programme.

Other highlights included the start of our work on Wessex

Water's Phosphorus Removal Programme, the award of further batches

of mains renewal works for Thames Water, and the continued success

of our Repair & Maintenance framework for Southern Water in a

joint venture.

As in other sectors, we are continuing to leverage collaborative

potential between our brands and are increasingly seeing

opportunities to combine our expertise. This will be particularly

beneficial as we move into AMP8 (2025-2030) where we expect to see

greater investment than in previous cycles. Procurement for AMP8

commenced recently and it was outlined at the 2023 Wastewater

conference that "substantial investment will be needed now and all

the way through the next few AMPs". [18] At the conference, John

Russel, Senior Director Strategy, Finance and Infrastructure at

Ofwat suggested that this level of investment will need to be two

to three times the current level to achieve the objectives they

have set out. [19] Russel also indicated that the sector needs to

focus more on asset maintenance which plays to the strengths of our

business model and leaves Renew well positioned to benefit from

these trends in the Water market as companies increase expenditure

on capital maintenance and asset optimisation.

Flood & Coastal

Changing weather conditions have highlighted the need for

investment in flood defences, and the UK Government has committed

GBP5.2bn [20] from 2021-2027 to improve flood defence

infrastructure. Of this, GBP1.6bn [21] is directed towards coastal

erosion and sea flooding projects where the Group currently

undertakes work for the Environment Agency ("EA") on the EA Flood

and Coastal Erosion Framework.

With growing investment in the segment, and increased pressure

on our Government to improve the UK's resilience for climate

change, the Group is well-positioned to expand its presence in the

sector. We also continue to work on national frameworks for the

Canal and River Trust, Scottish Canals and Natural Resources

Wales.

Land Remediation and Specialist Restoration

In Land Remediation, we have seen sustained demand for our

specialist environmental services during the period, including an

extension of our Land Regeneration framework with National

Grid.

Our specialist restoration and conservation services progressed

at Lambeth Palace, at the Edinburgh Botanical Gardens and at the

Parliamentary Estate where we continue to target long-term growth

opportunities.

Specialist Building

Our Specialist Building business focuses on the Science,

Landmark and High Quality Residential, markets in London and the

Home Counties.

Revenue was in line with expectations at GBP36.0m (HY22:

GBP36.9m), with operating profit of GBP0.5m (HY22: GBP0.6m) and

operating margin of 1.4% (HY22: 1.6%). The order book has

strengthened to GBP110m (HY22: GBP66.0m), providing good visibility

for the second half and into 2024.

ESG

It is well recognised that investment into low carbon

infrastructure will be fundamental in delivering the Government's

ambitions of delivering net zero emissions in the UK by 2050. From

the rail network and digitally assisted roads to high-speed

telecoms and clean energy, Renew has a key enabling role to play on

the frontline of efforts to decarbonise the economy.

During the period we were pleased to retain our LSE Green

Economy Mark, which recognises London-listed companies and funds

that derive more than 50% of their revenues from products and

services that are contributing to the environmental objectives such

as climate change mitigation and adaptation, waste and pollution

reduction, and the circular economy.

We continue to focus our energy on and are making progress

against our four key areas:

-- climate action;

-- operating responsibly;

-- empowering our people; and

-- building social value.

During the period, our subsidiary businesses undertook a range

of initiatives including volunteering and community support,

trialling the use of alternative, cleaner energy sources to power

our sites and the procurement of electrical and hybrid vehicles

across our businesses.

We have established quantitative sustainability targets in our

four key areas to embed our ESG strategy across the business and it

is the Board's ambition that the Group will achieve net zero by no

later than 2040. We look forward to providing a more detailed

update on progress against these targets at our Final Results in

November 2023.

Health & Safety

Health and safety is at the heart of everything that we do and

the Group remains dedicated to ensuring safe working practices for

all employees and those who work with us. Our SHEQ performance in

the first half was strong and ahead of the targets we set

ourselves.

Outlook - strong momentum entering H2; confidence in full year

outturn

After an outstanding FY22, the first six months of FY23 again

reiterate the differentiated qualities and resilient nature of our

business model, and we have once again grown against record prior

half-year comparatives.

Whilst we are not immune from the continuing inflationary

headwinds in the economy, our business is well placed to mitigate

their impact due to the nature of our variable, cost-plus

contracts. Trading has started well in the second half of the year

and our strong forward order book underpins our confidence that the

full year will be in line with the Board's expectations.

In addition to the Government's GBP600bn [22] commitment to

transform the UK's infrastructure, we read with interest the

Government's announcements in March which show it has sharpened its

focus on investment in infrastructure to improve climate resilience

and energy self-sufficiency, investing in renewable sources and

nuclear capabilities [23] . Consequently, longer term we also

believe the structural growth drivers in our end markets are

extremely attractive and we remain well positioned to seize both

organic and acquisitive growth opportunities in line with our

strategic priorities and ambitions.

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months ended 31 March

2023

Exceptional

items Exceptional

Before and Before items

exceptional amortisation exceptional and

items of items amortisation

and intangible and of

amortisation assets amortisation intangible Year

of (see Six months of assets ended

intangible Note ended intangible (see Note 30

assets 3) 31 March assets 3) September

2023 2023 2023 2022* 2022 2022 2022

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue: Group

including

share of joint

ventures 2 471,823 - 471,823 414,343 849,048 - 849,048

Less share of

joint

ventures'

revenue (18,138) - (18,138) (15,228) (32,772) - (32,772)

---------------- ----- ------------- ------------- ----------- ----------- ------------- -------------- ----------

Group revenue

from

continuing

activities 2 453,685 - 453,685 399,115 816,276 - 816,276

Cost of sales (387,229) - (387,229) (342,373) (693,336) - (693,336)

------------- ------------- ----------- ----------- ------------- -------------- ----------

Gross profit 66,456 - 66,456 56,742 122,940 - 122,940

Administrative

expenses (39,822) (1,266) (41,088) (36,559) (68,184) (8,527) (76,711)

Other operating

income 1,695 - 1,695 1,665 3,655 - 3,655

Share of

post-tax

result of

joint

ventures 6 (133) (127) 250 362 (267) 95

------------- ------------- ----------- ----------- ------------- -------------- ----------

Operating

profit 2 28,335 (1,399) 26,936 22,098 58,773 (8,794) 49,979

Finance income 52 - 52 3 16 - 16

Finance costs (666) - (666) (329) (573) - (573)

Other finance

income

- defined

benefit

pension

schemes - - - - 33 - 33

------------- ------------- ----------- ----------- ------------- -------------- ----------

Profit before

income

tax 2 27,721 (1,399) 26,322 21,772 58,249 (8,794) 49,455

Income tax

expense 5 (6,096) 657 (5,439) (4,158) (11,330) 1,782 (9,548)

------------- ------------- ----------- ----------- ------------- -------------- ----------

Profit for the

period from

continuing

activities 21,625 (742) 20,883 17,614 46,919 (7,012) 39,907

------------- ------------- ------------- --------------

Loss for the

period

from

discontinued

operations 4 (920) (1,103) (2,242)

----------- ----------- ----------

Profit for the

period

attributable

to equity

holders

of the parent

company 19,963 16,511 37,665

----------- ----------- ----------

Basic earnings

per share

from

continuing

operations 6 27.41p (0.94)p 26.47p 22.37p 59.52p (8.89)p 50.63p

Diluted

earnings

per share from

continuing

operations 6 27.33p (0.94)p 26.39p 22.23p 59.30p (8.87)p 50.43p

------------- ------------- ----------- ----------- ------------- -------------- ----------

Basic earnings

per

share 6 27.41p (2.10)p 25.31p 20.97p 59.52p (11.74)p 47.78p

Diluted

earnings

per share 6 27.33p (2.10)p 25.23p 20.84p 59.30p (11.70)p 47.60p

------------- ------------- ----------- ----------- ------------- -------------- ----------

Proposed

dividend 7 6.00p 5.67p 17.00p

----------- ----------- ----------

*Operating profit for the six months ended 31 March 2022 is

stated after charging GBP3,561,000 of amortisation cost and

GBP335,000 aborted acquisition cost (see Note 3).

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31 March 2023

Six months ended Year ended

31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Profit for the period attributable

to equity holders of the parent company 19,963 16,511 37,665

------------- ------------- ---------------

Items that will not be reclassified

to profit or loss:

Movement in actuarial valuation of

the defined benefit pension schemes - - 347

Movement on deferred tax relating

to the defined benefit pension schemes - - (240)

------------- ------------- ---------------

Total items that will not be reclassified

to profit or loss - - 107

------------- ------------- ---------------

Items that are or may be reclassified

subsequently to profit or loss:

Exchange movement in reserves - 1 -

Total items that are or may be reclassified

subsequently to profit or loss - 1 -

------------- ------------- -----------

Total comprehensive income for the

period attributable to equity holders

of the parent company 19,963 16,512 37,772

------------- ------------- -----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 31 March 2023

Share Capital Cumulative Share Total

based

Share premium redemption translation payments Retained equity

capital account reserve adjustment reserve earnings Unaudited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2021 7,868 66,378 3,896 1,308 1,079 44,290 124,819

Transfer from income

statement for the period 16,511 16,511

Dividends paid (8,809) (8,809)

New shares issued 18 1,451 1,469

Recognition of share

based payments (32) (32)

Exchange differences 1 1

Cumulative translation

reclassification (1,309) 1,309 -

At 31 March 2022 7,886 66,378 3,896 - 1,047 54,752 133,959

Transfer from income

statement for the period 21,154 21,154

Dividends paid (4,472) (4,472)

LTIP share issue reclassification (1,451) (1,451)

Recognition of share

based payments 690 690

Vested share option transfer (362) 362 -

Reclassification on closure

of overseas subsidiaries (1,309) (1,309)

Actuarial movement recognised

in the pension schemes 347 347

Movement on deferred

tax relating to the pension

schemes (240) (240)

-------- -------- ----------- ------------ --------- --------- ----------

At 30 September 2022 7,886 66,378 3,896 - 1,375 69,143 148,678

Transfer from income

statement for the period 19,963 19,963

Dividends paid (8,936) (8,936)

New shares issued 27 41 68

Recognition of share

based payments 336 336

Vested share option transfer (777) 777 -

At 31 March 2023 7,913 66,419 3,896 - 934 80,947 160,109

-------- -------- ----------- ------------ --------- --------- ----------

CONDENSED CONSOLIDATED BALANCE SHEET

at 31 March 2023

31 March 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-current assets

Intangible assets -

goodwill 148,805 139,698 138,445

- other 30,849 25,814 22,385

Property, plant and

equipment 18,291 15,154 17,834

Right of use assets 17,414 16,037 15,519

Investment in joint

ventures 4,009 5,560 5,538

Retirement benefit

assets 2,230 761 2,230

Deferred tax assets 3,095 1,861 2,899

----------------------- ---------- -------------

224,693 204,885 204,850

----------------------- ---------- -------------

Current assets

Inventories 3,566 2,061 2,613

Assets held for resale - 1,250 1,250

Trade and other receivables 168,267 166,812 164,590

Current tax assets 1,266 1,316 -

Cash and cash equivalents 17,012 - 20,218

----------------------- ---------- -------------

190,111 171,439 188,671

----------------------- ---------- -------------

Total assets 414,804 376,324 393,521

----------------------- ---------- -------------

Non-current liabilities

Lease liabilities (9,554) (8,542) (8,640)

Retirement benefit

obligation (1,049) - (1,049)

Deferred tax liabilities (11,360) (8,219) (7,568)

Provisions (338) (441) (338)

----------------------- ---------- -------------

(22,301) (17,202) (17,595)

----------------------- ---------- -------------

Current liabilities

Borrowings - (1,211) -

Trade and other payables (217,788) (215,320) (212,684)

Lease liabilities (6,521) (5,871) (5,884)

Current tax liabilities - - (595)

Provisions (8,085) (2,761) (8,085)

----------------------- ---------- -------------

(232,394) (225,163) (227,248)

----------------------- ---------- -------------

Total liabilities (254,695) (242,365) (244,843)

----------------------- ---------- -------------

Net assets 160,109 133,959 148,678

----------------------- ---------- -------------

Share capital 7,913 7,886 7,886

Share premium account 66,419 66,378 66,378

Capital redemption

reserve 3,896 3,896 3,896

Share based payments

reserve 934 1,047 1,375

Retained earnings 80,947 54,752 69,143

----------------------- ---------- -------------

Total equity 160,109 133,959 148,678

----------------------- ---------- -------------

CONDENSED CONSOLIDATED CASHFLOW STATEMENT

for the six months ended 31 March 2023

Six months ended Year ended

31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Profit for the period from continuing

operating activities 20,883 17,614 39,907

Share of post-tax trading result of

joint venture 127 (250) (95)

Amortisation of intangible assets and

goodwill remeasurement 712 3,561 8,109

Research and development expenditure

credit (725) - (1,353)

Depreciation 5,129 4,978 10,136

Profit on sale of property, plant and

equipment (302) (561) (830)

Decrease/(increase) in inventories 505 17 (534)

Decrease/(increase) in receivables 3,734 (9,637) (7,455)

(Decrease)/increase in payables (4,940) 7,191 10,986

Current and past service cost in respect

of defined benefit pension scheme - 25 23

Cash contribution to defined benefit

pension schemes - (252) (315)

Charge/(credit) in respect of share

options 336 (32) 657

Finance income (52) (3) (16)

Finance expense 666 329 540

Interest paid (666) (329) (573)

Income taxes paid (6,136) (3,500) (7,595)

Income tax expense 5,439 4,158 9,548

Net cash inflow from continuing operating

activities 24,710 23,309 61,140

Net cash outflow from discontinued operating

activities (611) (424) (3,977)

----------- ---------- -------------

Net cash inflow from operating activities 24,099 22,885 57,163

----------- ---------- -------------

Investing activities

Interest received 52 3 16

Dividend received from joint venture - 264 265

Proceeds on disposal of property, plant

and equipment 422 1,116 1,514

Purchases of property, plant and equipment (1,979) (814) (5,056)

Acquisition of subsidiaries net of cash

acquired (13,334) - -

----------- ---------- -------------

Net cash (outflow)/inflow from investing

activities (14,839) 569 (3,261)

Financing activities

Dividends paid (8,936) (8,809) (13,281)

Issue of Ordinary Shares 68 1,469 18

New loan 23,000 18,000 18,000

Loan repayments (23,000) (22,375) (22,373)

Repayment of obligations under finance

leases (3,598) (3,598) (6,693)

----------- ---------- -------------

Net cash outflow from financing activities (12,466) (15,313) (24,329)

Net (decrease)/increase in continuing

cash and cash equivalents (2,595) 8,565 33,550

Net decrease in discontinued cash and

cash equivalents (611) (424) (3,977)

----------- ---------- -------------

Net (decrease)/increase in cash and

cash equivalents (3,206) 8,141 29,573

Cash and cash equivalents at the beginning

of the period 20,218 (9,355) (9,355)

Effect of foreign exchange rate changes

on cash and cash equivalents - 3 -

Cash and cash equivalents at the end

of the period 17,012 (1,211) 20,218

----------- ---------- -------------

Bank balances and cash 17,012 - 20,218

Bank overdraft - (1,211) -

----------- ---------- -------------

Cash and cash equivalents at end of

period 17,012 (1,211) 20,218

----------- ---------- -------------

NOTES TO THE CONDENSED CONSOLIDATED ACCOUNTS

1 Basis of preparation

(a) The condensed consolidated interim financial report for the

six months ended 31 March 2023

and the equivalent period in 2022 has not been audited or

reviewed by the Group's auditor.

It does not comprise statutory accounts within the meaning of

Section 435 of the Companies Act 2006. It has been prepared under

the historical cost convention and on a going concern basis in

accordance with applicable law and international accounting

standards in conformity with the requirements of the Companies Act

2006 ("Adopted IFRSs"). The report does not comply with IAS 34

"Interim Financial Reporting" which is not currently required to be

applied for AIM companies and it was approved by the Directors on

16 May 2023.

(b) The accounts for the year ended 30 September 2022 were

prepared under IFRS and have been delivered to the Registrar of

Companies. The report of the auditor on those accounts was

unqualified, did not contain an emphasis of matter paragraph and

did not contain any statement under Section 498(2) or (3) of the

Companies Act 2006. In this report, the comparative figures for the

year ended 30 September 2022 have been audited. The comparative

figures for the period ended 31 March 2022 are unaudited.

(c) The accounting policies applied in preparing the condensed

consolidated interim financial information are the same as those

applied in the preparation of the annual financial statements for

the year ended 30 September 2022 as described in those financial

statements.

(d) The principal risks and uncertainties affecting the Group

are unchanged from those set out in the Group's Accounts for the

year ended 30 September 2022. The Directors have reviewed financial

forecasts and are satisfied that the Group has adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Group continues to adopt the going concern basis

in preparing the condensed consolidated interim financial

report.

This condensed consolidated interim financial report is being

sent to all shareholders and is also available upon request from

the Company Secretary, Renew Holdings plc, 3175 Century Way, Thorpe

Park, Leeds, LS15 8ZB, or via the website, www.renewholdings.com

.

2 Segmental analysis

Operating segments have been identified based on the internal

reporting information provided to the Group's Chief Operating

Decision Maker. From such information, Engineering Services and

Specialist Building have been determined to represent operating

segments.

Group revenue

from continuing

activities

Six months ended

31 March

Group revenue

Group from

including Less Group Less continuing

share share including share activities

of joint of joint share of of joint Year ended

ventures ventures joint ventures ventures 30 September

2023 2023 2023 2022 2022 2022 2022

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Analysis of

revenue

Engineering

Services 435,828 (18,138) 417,690 362,232 778,917 (32,772) 746,145

Specialist

Building 35,995 - 35,995 36,882 70,125 - 70,125

Segment revenue 471,823 (18,138) 453,685 399,114 849,042 (32,772) 816,270

Central

activities - - - 1 6 - 6

----------- ----------- ----------- ----------- --------------- ----------- ---------------

Group revenue

from continuing

operations 471,823 (18,138) 453,685 399,115 849,048 (32,772) 816,276

----------- ----------- ----------- ----------- --------------- ----------- ---------------

Six months

ended

31 March

Before

exceptional Exceptional Before Exceptional

items items exceptional items

and and items and and

amortisation amortisation amortisation amortisation

of of of of Year ended

intangible intangible intangible intangible 30

assets assets assets assets September

2023 2023 2023 2022* 2022 2022 2022

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Analysis of

operating

profit

Engineering

Services 29,697 (845) 28,852 23,062 59,123 (8,376) 50,747

Specialist

Building 517 - 517 585 1,679 - 1,679

------------- ------------- ----------- ----------- ------------- ------------- -----------

Segment

operating

profit 30,214 (845) 29,369 23,647 60,802 (8,376) 52,426

Central

activities (1,879) (554) (2,433) (1,549) (2,029) (418) (2,447)

------------- ------------- ----------- ----------- ------------- ------------- -----------

Operating profit 28,335 (1,399) 26,936 22,098 58,773 (8,794) 49,979

Net financing

expense (614) - (614) (326) (524) - (524)

------------- ------------- ----------- ----------- ------------- ------------- -----------

Profit before

income tax 27,721 (1,399) 26,322 21,772 58,249 (8,794) 49,455

------------- ------------- ----------- ----------- ------------- ------------- -----------

* Operating profit for the six months ended 31 March 2022 is

stated after charging GBP3,561,000 of amortisation cost and

GBP335,000 aborted acquisition cost (see Note 3).

3 Exceptional items and amortisation of intangible assets

Six months ended Year ended

31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Aborted acquisition costs/acquisition costs 554 335 418

Total charges arising from exceptional items 554 335 418

Amortisation of intangible assets 2,999 3,561 7,123

Goodwill remeasurement (2,154) - -

Impairment of intangible asset - - 1,253

---------- ---------- -------------

Total exceptional items and amortisation charge before income tax 1,399 3,896 8,794

Taxation credit on exceptional items and amortisation (657) (890) (1,782)

---------- ---------- -------------

Total exceptional items and amortisation charge 742 3,006 7,012

---------- ---------- -------------

During the period the Company incurred GBP554,000 of costs

acquiring Enisca Group Limited.

On 25 November 2022 the Company acquired the whole of the issued

share capital of Enisca Group Limited which resulted in the Group

owning 100% of Enisca Browne Limited. Under IFRS 3 this is treated

as a step acquisition where the previous held equity interest is

remeasured at its acquisition date fair value with the resulting

gain recognised in the income statement.

GBP000

Remeasured value 3,556

Less equity interest (previously included in Investments in

joint ventures) (1,402)

--------

Goodwill remeasurement 2,154

--------

4 Loss for the period from discontinued operations

Six months ended Year ended

31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Revenue - - -

Expenses (920) (1,103) (2,242)

---------- ---------- -------------

Loss before income tax (920) (1,103) (2,242)

Income tax charge - - -

---------- ---------- -------------

Loss for the period from discontinued

operations (920) (1,103) (2,242)

---------- ---------- -------------

The Group has increased accruals as a result of the settlement

of Allenbuild Limited historic claims during the period and an

internal reassessment of the likely costs required to settle other

known contractual disputes.

5 Income tax expense

Six months ended Year ended

31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Current tax:

UK corporation tax on profit

for the period (4,676) (3,566) (10,692)

Adjustments in respect of previous

periods - - (193)

---------- ---------- -------------

Total current tax (4,676) (3,566) (10,885)

Deferred tax (763) (592) 1,337

---------- ---------- -------------

Income tax expense (5,439) (4,158) (9,548)

---------- ---------- -------------

6 Earnings per share

Six months ended 31 March Year ended 30 September

2023 2022 2022

Unaudited Unaudited Audited

Earnings EPS DEPS Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence GBP000 Pence Pence

Earnings

before

exceptional

items and

amortisation 21,625 27.41 27.33 20,620 26.19 26.02 46,919 59.52 59.30

Exceptional

items and

amortisation (742) (0.94) (0.94) (3,006) (3.82) (3.79) (7,012) (8.89) (8.87)

--------- ---------- ------- ---------- ------------ --------- ------ ----------- -------------------- ---------

Basic

earnings

per share

- continuing

activities 20,883 26.47 26.39 17,614 22.37 22.23 39,907 50.63 50.43

Loss for

the period

from

discontinued

activities (920) (1.16) (1.16) (1,103) (1.40) (1.39) (2,242) (2.85) (2.83)

--------- ---------- ------- ---------- ------------ --------- ------ ----------- -------------------- ---------

Basic

earnings

per share 19,963 25.31 25.23 16,511 20.97 20.84 37,665 47.78 47.60

--------- ---------- ------- ---------- ------------ --------- ------ ----------- -------------------- ---------

Weighted

average

number

of shares 78,888 79,130 78,727 79,234 78,825 79,125

---------- ------- ------------ --------- -------------------- ---------

The dilutive effect of share options is to increase the number

of shares by 242,160 (March 2022: 507,000; September 2022: 299,750)

and reduce the basic earnings per share by 0.08p (March 2022:

0.13p; September 2022: 0.18p).

7 Dividends

The proposed interim dividend is 6.00p (2022: 5.67p) per share.

This will be paid out of the Company's available distributable

reserves to shareholders on the register on 9 June 2023, payable on

12 July 2023. The ex-dividend date will be 8 June 2023. In

accordance with IAS 1 "Presentation of Financial Statements",

dividends are recorded only when paid and are shown as a movement

in equity rather than as a charge in the income statement.

8 Acquisition of subsidiary undertaking - Enisca Group Limited

On 25 November 2022 the Company acquired the whole of the issued

share capital of Enisca Group Limited ("Enisca") for a cash

consideration of GBP14.6m together with a GBP3.6m IFRS 3 step

remeasurement of the 50% Enisca Browne Limited joint venture

originally acquired with J Browne Group Limited (now 100% owned by

the Group). The net acquisition cost was funded by a combination of

cash and the Group's existing revolving credit facility provided by

HSBC Bank plc, National Westminster Bank plc and Lloyds Bank

plc.

The provisional value of the assets and liabilities of Enisca at

the date of acquisition were:

Book value Adjustments Fair value

GBP000 GBP000 GBP000

Non-current assets

Intangible assets -

goodwill 1,805 8,555 10,360

- other - 11,330 11,330

Property, plant and

equipment 496 - 496

Right of use assets - 501 501

Investment in joint

ventures 66 (66) -

2,367 20,320 22,687

----------------- ------------------ ----------------

Current assets

Inventories 208 - 208

Trade and other receivables 7,411 - 7,411

Cash and cash equivalents 1,264 - 1,264

8,883 - 8,883

----------------- ------------------ ----------------

Total assets 11,250 20,320 31,570

----------------- ------------------ ----------------

Non-current liabilities

Lease liabilities - (403) (403)

Deferred tax liabilities - (2,833) (2,833)

- (3,236) (3,236)

----------------- ------------------ ----------------

Current liabilities

Trade and other payables (9,735) - (9,735)

Lease liabilities (23) (98) (121)

Current tax liability (324) - (324)

(10,082) (98) (10,180)

----------------- ------------------ ----------------

Total liabilities (10,082) (3,334) (13,416)

----------------- ------------------ ----------------

Net assets 1,168 16,986 18,154

----------------- ------------------ ----------------

Goodwill of GBP10,360,000 arose on acquisition and is attributed to the expertise and workforce of

the acquired

business. Other intangible assets provisionally valued at GBP11,330,000, which represent customer

relationships

and contractual rights, were also acquired and will be amortised over their useful economic lives

in accordance

with IAS 38. Deferred tax has been provided on this amount. Amortisation of this intangible asset

commenced

from December 2022.

Right of use assets and obligations under finance leases

Enisca's statutory accounts are prepared under FRS 102. The Group has made an adjustment for

operating leases obtained on acquisition whereby the leases are capitalised based on discounted

future lease payments together with an equivalent leasing liability to be consistent with Group

reporting under IFRS 16 "Leases".

Fair value adjustments arising from the acquisition

In accordance with IFRS 3, the Board will review the fair value of assets and liabilities using

information

available up to 12 months after the date of acquisition. Fair value has been calculated using Level

3

inputs as defined by IFRS 13.

[1] Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance of

the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory performance

measures, are included in note 30 of the 2022 Annual Report &

Accounts.

[2] HM Treasury, Autumn Statement 2022 - November 2022

[3] Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi billion pound investment in energy

revolution, (2023). [online] Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revolution

[4] HM Treasury, Autumn Statement 2022 - November 2022

[5] Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance of

the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory performance

measures, are included in note 30 of the 2022 Annual Report &

Accounts.

[6] UK Government Department for Transport Policy paper,

Railways Act 2005 statement of funds available 2022 - 1 December

2022

[7] Smith, K. (2023) 'Britain outlines GBP44bn maintenance and

renewals spending plan for 2024-2029', International Rail Journal.

Available at:

https://www.railjournal.com/financial/britain-outlines-44bn-maintenance-and-renewals-plan-for-2024-2029/

[8] UK Government Department for Transport, Planning ahead for

the Strategic Road Network - December 2021

[9] Knott, J. (2023) 'Very limited budget for new road projects,

senior civil servant says', Construction News. Available at:

https://www.constructionnews.co.uk/civils/very-limited-budget-for-new-road-projects-senior-civil-servant-says-02-02-2023/

[10] UK Government Department for Digital, Culture, Media &

Sport, Future Telecoms Infrastructure Review - 23 July 2018

[11] UK Government Nuclear Decommissioning Authority, Nuclear

Provision: the cost of cleaning up Britain's historic nuclear sites

- 4 July 2019

[12] UK Government Corporate report, The Programme and Project

Partners Supply Chain Strategy - 14 September 2021

[13] Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi billion pound investment in energy

revolution, (2023). [online] Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revolution

[14] Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi billion pound investment in energy

revolution, (2023). [online] Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revolution

[15] UK Government Policy paper, Taking Charge: the electric

vehicle infrastructure strategy - March 2022

[16] Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi billion pound investment in energy

revolution, (2023). [online] Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revolution

[17] Ofwat PR19 final determinations, Overview of companies'

final determinations - December 2019

[18] Russell, J. 2023. Balancing investment leading up to AMP8,

and beyond . Wastewater 2023 Conference, 25 January, London.

[19] Russell, J. 2023. Balancing investment leading up to AMP8,

and beyond . Wastewater 2023 Conference, 25 January, London.

[20] Lovell, A. 2023. EA Chair says collaboration needed to

protect local economies and nature on the coast. Annual Coastal

Futures Conference, 26 January, London.

[21] Lovell, A. 2023. EA Chair says collaboration needed to

protect local economies and nature on the coast. Annual Coastal

Futures Conference, 26 January, London.

[22] HM Treasury, Autumn Statement 2022 - November 2022

[23] Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi billion pound investment in energy

revolution, (2023). [online] Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revolution

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFFRESIELIV

(END) Dow Jones Newswires

May 16, 2023 02:00 ET (06:00 GMT)

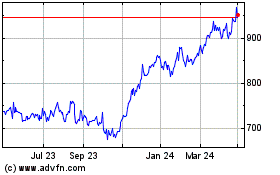

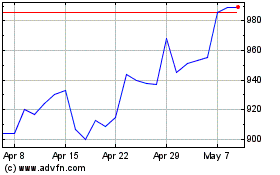

Renew (LSE:RNWH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Renew (LSE:RNWH)

Historical Stock Chart

From Nov 2023 to Nov 2024