TIDMRNWH

RNS Number : 8321U

Renew Holdings PLC

28 November 2023

28 November 2023

Renew Holdings plc

("Renew" or the "Group" or the "Company")

Final Results

Record financial performance with consistent year on year

growth

Renew (AIM: RNWH), the leading Engineering Services Group

supporting the maintenance and renewal of critical UK

infrastructure, announces its final results for the year ended 30

September 2023 ("the Period").

Financial Highlights

Year ended 30 September 2023 FY2023 FY2022 Change

Group revenue(1) GBP960.9m GBP849.0m +13.2%

---------- ---------- -------

Adjusted operating profit(1) GBP63.6m GBP58.8m +8.2%

---------- ---------- -------

Operating profit GBP59.0m GBP50.0m +18.0%

---------- ---------- -------

Adjusted operating margin(1) 6.6% 6.9% -31bps

---------- ---------- -------

Profit before tax GBP58.1m GBP49.5m +17.4%

---------- ---------- -------

Adjusted earnings per share(1) 63.5p 59.5p +6.7%

---------- ---------- -------

Full year dividend 18.0p 17.0p +5.8%

---------- ---------- -------

-- Record financial performance demonstrates the differentiated

qualities and resilient nature of the Group, combined with the

strong demand in our end markets

-- Group revenue increased 13% to GBP960.9m (FY2022: GBP849.0m), with organic growth of 10%

-- Group order book remained strong at GBP860m (FY2022: GBP775m)

-- Net cash position (pre-IFRS16) of GBP35.7m (FY2022: GBP20.2m)

-- Full year dividend of 18.00p (2022: 17.00p), an increase of

5.8% and reflecting the Board's confidence in the Group's trading

performance

-- Robust balance sheet and strong operational cash generation

leaves us well positioned to continue to appraise selective

value-accretive M&A opportunities

Operational Highlights

-- Entered into new business areas with a sharpened focus on

collaboration within the Group and the strategic acquisitions of

Enisca and Rail Electrification Limited

-- Largest provider of maintenance and renewals services to Network Rail nationally

-- In Water, we have successfully leveraged our Mechanical,

Electrical, Instrumentation, Control and Automation ("MEICA")

capabilities to win the Welsh Water Major Electrical and Mechanical

Framework

-- In Rail, our subsidiaries have successfully collaborated to

open up framework positions to the Group that were previously

unattainable

-- In Highways, we continue to deliver a growing work bank on

our National Highways Scheme Delivery Frameworks

-- Exceeded prior year safety comparators, ensuring that our

workplace remains a safe and secure space

-- Retained LSE Green Economy Mark as more than 50% of revenues

are contributing to environmental objectives

Current Trading & Outlook

-- Uniquely positioned to seize both organic and acquisitive

growth opportunities with attractive structural growth drivers

-- Well placed to benefit from the Government prioritising

investment in maintenance and renewals of existing infrastructure

instead of large-scale enhancement projects

-- Exciting growth prospects in Water ahead of significantly

increased sector expenditure over the next decade and beyond

-- Post period end, we announced the acquisition of T.I.S.

Cumbria Ltd, a leading nuclear manufacturing and fabrication

specialist which will strengthen our position in the growing

nuclear decommissioning and new build markets

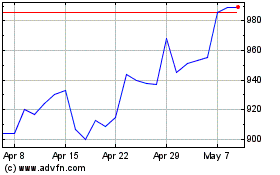

-- Trading momentum has continued into the new financial year,

and we are encouraged by the significant opportunities across the

Group

Paul Scott, CEO of Renew, commented:

"I am very pleased to report that we have once again delivered

record results despite the turbulent macroeconomic landscape.

Continued growth in revenue, profit and our solid operating cash

generation is testament to the strength of our business model and

the Group's well-established positions in attractive and

sustainable growth markets. On behalf of the Board, I would like to

sincerely thank all of our dedicated colleagues whose hard work and

commitment has enabled the Group to deliver yet another record

performance.

"Our core strengths leave us well placed to build on our strong

track record of long-term value creation as we look ahead with

impressive trading momentum and a strong forward order book. We

remain excited about the significant growth opportunities across

the Group, underpinned by the increasing national demand for the

maintenance and renewal of existing UK infrastructure, which will

continue to be a domestic priority regardless of the outcome of the

next election."

For further information, please contact:

Renew Holdings plc www.renewholdings.com

Paul Scott, Chief Executive Officer via FTI Consulting

Sean Wyndham-Quin, Chief Financial Officer 020 3727 1000

Deutsche Numis (Nominated Adviser and

Joint Broker) 020 7260 1000

Stuart Skinner / Kevin Cruickshank

Peel Hunt LLP (Joint Broker) 020 7418 8900

Mike Burke / Ed Allsopp

FTI Consulting (Financial PR) 020 3727 1000

Alex Beagley / Tom Hufton / Rafaella de Renew@fticonsulting.com

Freitas / Amy Goldup

About Renew Holdings plc

Renew is a leading UK Engineering Services business, performing

a critical role in keeping the nation's infrastructure functioning

efficiently and safely. The Group operates through independently

branded subsidiaries across its chosen markets, delivering

non-discretionary maintenance and renewal tasks through its highly

skilled, directly employed workforce.

Renew's activities are focused into two business streams:

Engineering Services, which accounts for over 98 per cent of the

Group's adjusted operating profit, focuses on the key markets of

Rail, Infrastructure, Energy (including Nuclear) and Environmental

which are largely governed by regulation and benefit from

non-discretionary spend with long-term visibility of committed

funding.

Specialist Building focuses on the High Quality Residential,

Landmark and Science markets in London and the Home Counties.

For more information please visit the Renew Holdings plc

website: www.renewholdings.com

Chairman's statement

Introduction

I am pleased to announce that the Group achieved a record

financial performance, with continued growth in revenue, profit and

strong operating cash generation. In what has been a challenging

year for the economy, these excellent results are a testament to

the Group's core strengths and well-established positions in

attractive and sustainable growth markets.

Differentiated business model

Our differentiated business model and the services we provide

continue to support key infrastructure assets in regulated markets.

Our markets enjoy committed funding which provides visible,

reliable and resilient revenues via long-term programmes.

We deliver non-discretionary maintenance and renewals tasks.

Operating in complex, challenging and highly regulated

environments, our markets have high barriers to entry, and we

directly employ a highly skilled workforce which enables us to be

extremely responsive to our clients' needs.

Results

Group revenue(1) increased to GBP960.9m (2022: GBP849.0m) with

adjusted(1) operating profit increasing to GBP63.6m (2022:

GBP58.8m) and an adjusted(1) operating margin of 6.6% (2022: 6.9%).

Statutory operating profit was GBP59.0m (2022: GBP50.0m). The

adjusted(1) EPS has increased by 6.7% to 63.5p (2022: 59.5p) and

basic earnings per share was 54.9p (2022: 47.8p). The Group had a

pre IFRS16 net cash(1) position of GBP35.7m (2022: GBP20.2m), in

line with our expectations.

During the period we were delighted to announce the acquisition

of Enisca Group Limited. This acquisition added new capabilities to

Renew's water business and forms a key part of the Group's strategy

to maximise the opportunities presented by AMP8. The acquisition

was funded out of the Group's cash and existing debt

facilities.

Post period end, we were pleased to announce the acquisition of

T.I.S. Cumbria Ltd ("TIS"), a leading nuclear manufacturing and

fabrication specialist. TIS was acquired by our existing nuclear

subsidiary business Shepley Engineers and will benefit from

synergies with our existing businesses and strengthen our position

in the growing nuclear decommissioning and new build markets. We

are delighted to welcome the management and staff of TIS to the

Renew family.

Dividend

The Group's strong trading performance, cash position and

positive outlook give the Board the confidence to propose a final

dividend of 12.00p (2022: 11.33p) per share. This will be paid on 8

March 2024 to shareholders on the register as at 9 February 2024,

with an ex-dividend date of 8 February 2024. This will represent a

full year dividend of 18.00p (2022: 17.00p) per share, an increase

of 5.8%.

Environmental, Social and Governance

Environmental

We are committed to achieving net zero by no later than 2040,

ahead of the 2050 target date set by the Government. During 2023,

we continued with our Climate and Nature Steering Group that

comprises representatives from all the Group's subsidiary

businesses and which focused on developing the Group's climate

opportunities and climate related financial disclosure reporting.

As part of this process, we continued to consider how we can best

support our clients in achieving their own sustainability

objectives.

We are pleased to retain our London Stock Exchange's Green

Economy Mark, which recognises those companies that derive over 50

per cent of revenue from products and services that are

contributing to environmental objectives. Renew plays an important

role in helping to achieve Government aims for greater sustainable

infrastructure.

A number of our businesses are in the process of submitting

their science-based targets to the

Science Based Targets initiative. The lessons learned from this

process will drive improvements in the collection of emissions data

from across the Group.

Social

We understand the value that businesses can provide to the wider

community and we continue to strengthen our relationships with

local schools and education providers as well as continuing to

engage with our local communities. During the year employees from

across our businesses shared their knowledge and expertise to

support young people with employment and education

opportunities.

The training and development of our colleagues remains essential

to the Group's long-term success and we now have around 330

trainees, apprentices and graduates across the business. We are

also committed to our management development programme, Renew

Inspiring Successful Executives ("RISE") which allows us to develop

leadership talent within the business and is a key element of the

Group's succession planning strategy. This programme has also

improved the levels of collaboration we are leveraging to drive

success across our brands.

As part of our commitment to ensuring Renew remains an

attractive and diverse employer, we have supported the Group and

subsidiary businesses' diversity forums which are aimed at

improving our performance in this important area and we continue to

increase the number of female participants in our graduate training

schemes.

Governance

As a Board, we are responsible for ensuring the effective

application of high levels of governance within our business,

balancing the interests of all our stakeholders. As a minimum, the

Group complies with the QCA Corporate Governance Code, more details

of which can be found in the corporate governance section of the

Group's website. Risk management is led by the Board, which reviews

the Group's risk profile on an ongoing basis alongside the Audit

and Risk Committee.

Board changes

On 1 November 2022, we were delighted to announce the

appointment of Liz Barber as a Non-executive Director. Liz has a

wealth of experience gained over 12 years in the regulated water

sector, an established growth market for Renew. Combined with her

financial background, Liz complements the Board's current skillset

which will be invaluable as we continue on our growth journey.

People and safety

As a Board we recognise the critical role our employees play in

the success of the Group and we sincerely thank all our colleagues

for their ongoing dedication and hard work. We remain focused on

the mental and physical wellbeing of all our colleagues and

continue to provide support through a number of schemes, including

our Employee Assistance Programme, on a range of topics.

We are committed to providing a safe working environment to

ensure that none of our colleagues, or those who work with us, are

injured during the conduct of our operations. The Group's health

and safety performance is discussed as a priority at each Board

meeting and during the year we continued to focus on the

behavioural science aspects of safety to further improve our safety

record.

Future focus

The delivery of our long-term strategy is built on effective

relationships with our directly employed workforce, customers,

suppliers, shareholders and wider stakeholders, and these are

critical to the ongoing success of the business. We will continue

to deliver our strategic priorities whilst focusing on our

environmental, social and governance responsibilities and on our

approach to diversity and inclusion as we move through 2024 and

beyond.

The Group's differentiated business model and the long-term

investment programmes across our UK infrastructure markets give the

Board continued confidence in delivering further growth, both

organic and through strategic earnings-enhancing acquisitions.

David Brown

Chairman

27 November 2023

Chief Executive Officer's Review

Renew continues to outperform - demonstrating our resilient and

differentiated model

In the face of an ever-changing macroeconomic backdrop, our

business has once again demonstrated its unique characteristics by

successfully navigating these challenges and delivering outstanding

trading performance for the year. I am very pleased to be reporting

another set of record results for Renew, demonstrating the

resilience and differentiated nature of our high-quality, low-risk

business model, combined with the strong demand we have seen in our

end markets. As we look forward to commencing new control periods

within the Rail and Water sectors we fully expect this growth to

strengthen further.

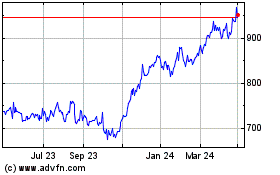

Our track record of consistent year on year growth across all of

our key financial metrics clearly illustrates the critical nature

of our work and the committed, long-term, highly visible spending

cycles that underpin our end markets. Whilst our business is not

immune from the difficulties facing the wider economy, our focus on

the maintenance and renewal of existing UK infrastructure means we

are not dependent on large, capital-intensive contract awards,

providing Renew with a significantly lower risk profile than others

operating in our sectors. Supported by the commercial terms within

our frameworks and the typically short execution periods of the

tasks we undertake, the Group has been able to successfully

alleviate UK-wide inflation challenges throughout the period,

delivering strong margins as well as operating profit and revenue

ahead of record prior year comparatives.

Further, with pressure on public expenditure as a result of the

difficult macroeconomic environment, we are seeing increased

funding being directed towards the maintenance and renewal of

existing assets and away from major infrastructure enhancement

projects which bodes well for our business. The Government

continues to confirm infrastructure investment is a national

priority and this, along with a target of net zero by 2050, will

continue to be a priority regardless of a potential change in

government in 2024.

We note the recent announcements regarding the reduction in the

HS2 programme. It is anticipated that this funding will be

reinvested into smaller, regional transportation improvement

schemes which we believe will present a range of opportunities in

our chosen markets.

There were many achievements across the Group during the year,

but I would like to highlight some key examples of how we are

delivering profitable organic growth. Some of our more recent

strategic acquisitions and our sharpened focus on collaboration

within the Group has seen us organically expand into areas where we

had not previously operated. Most notably, the acquisitions of

Enisca and Rail Electrification Limited ("REL") have added to our

capabilities and the unlocking of greater opportunities in more

frameworks. In Water, we have successfully leveraged our

Mechanical, Electrical, Instrumentation, Control and Automation

("MEICA") capabilities to win the Welsh Water Major Electrical and

Mechanical Framework, whilst in Rail, our subsidiaries have

successfully collaborated to open up framework positions to the

Group that were previously unattainable. In Highways, we continue

to deliver a growing work bank on our National Highways Scheme

Delivery Frameworks ("SDF") where there continues to be an emphasis

on asset maintenance and renewals. It has been extremely rewarding

from a management perspective to see the strategic rationale behind

our acquisitions start to come to fruition and there is still more

to come. The enhanced focus on collaboration between our brands has

contributed to a strong rate of organic growth during the period

and it will continue to be a focus going forward.

Acquisitions form a key feature of our strategic ambition to

deliver compounding shareholder returns as we have historically

demonstrated. We finished the year with a robust balance sheet and

this, together with our strong operational cash generation, leaves

us well positioned to continue to appraise selective

value-accretive M&A opportunities. We are currently seeing a

healthy pipeline of opportunities including complementary bolt-on

acquisitions as well as larger, more complex opportunities that

will grow our geographical reach and service capability in a

similar way to that achieved by our recent strategic acquisitions.

As we expand through M&A, we will continue to leverage

collaboration opportunities between our brands, providing a unique

advantage when applying for a broader range of frameworks.

Post-period end we were delighted to announce the acquisition of

T.I.S. Cumbria Limited, a leading nuclear manufacturing and

fabrication specialist. This acquisition represents an excellent

strategic fit, adding new capabilities to Renew's nuclear services

and immediately doubling our specialist manufacturing capacity. We

are delighted to welcome all the T.I.S. employees to the Renew

Group.

Safety is our highest priority at Renew and I would like to take

this opportunity to commend our dedicated teams for their

unwavering commitment to safety throughout the past year. Our

strong safety record stands as a testament to the collective

efforts of every individual within our organisation. Their

vigilance, adherence to protocols, and proactive approach has

fostered an environment where each employee can thrive without

compromising their well-being. I take immense pride in the fact

that we have not only met but exceeded our prior year comparators,

ensuring that our workplace remains a safe, secure and nurturing

space for all.

In summary, FY23 has been another terrific year for Renew and we

enter FY24 with confidence as we continue to see robust demand

across our end markets. By focusing on collaboration and leveraging

the unique services of each of our brands, we are growing the list

of capabilities within our business as we move through changing

control periods in our key markets. The success of Renew is due to

the outstanding work of our directly employed colleagues who

continue to go above and beyond for our clients and I would like to

thank, on behalf of the Board, all our dedicated workforce for

their outstanding work and continued commitment to providing our

clients with our mission-critical, highly responsive services at

all times.

Renew's strengths

Renew has a number of core strengths which provide distinct

competitive advantages in our chosen markets and leave us well

placed to build on our strong track record of long-term value

creation:

-- The health, safety and wellbeing of our colleagues,

and those impacted by our work, remains our number one

priority and we have implemented industry leading safe

working practices for the Group's employees and operations.

-- We operate a differentiated, diversified, low-risk,

low-capital operating model, providing critical asset

maintenance and renewals services that are not dependent

on large, high-risk, capital-intensive contract awards.

-- Our directly employed workforce enables us to provide

a more efficient and valuable service to our clients,

reducing our exposure to sub-contractor pricing volatility

and being able to deliver extremely responsive solutions.

-- The commercial terms and short project durations within

our frameworks mean we can proactively and effectively

manage cost inflation enabling us to maintain strong

margins.

-- Our businesses are well established in complex, challenging

and highly regulated markets with significant barriers

to entry, which demand a highly skilled and experienced

workforce and a proven track record of safe delivery.

-- We have consistently demonstrated performance resilience

despite significant global and macroeconomic events,

including inflation, that have had a negative impact

on the wider economy.

-- We have a proven track record of sustainable value creation,

reliable revenue growth and strong returns on capital

thanks to our highly cash generative earnings model

and clearly defined strategy.

-- We are committed to growing the business both organically

and through selective complementary acquisitions while

maintaining a disciplined approach to capital allocation

and risk underpinned by a strong balance sheet.

-- We have strong relationships in place with all our stakeholders,

from our workforce to our customers, suppliers, communities

and shareholders.

-- Our model of compounding earnings through the redeployment

of internally generated cashflows enables us to execute

on our strategy of delivering reliable and consistent

growth for all our stakeholders.

-- Our complementary services enable us to leverage the

strengths of collaboration across our brands.

Compelling market drivers

Our businesses bring exposure to attractive long-term,

non-discretionary structural growth drivers. Increasing demand for

the maintenance and renewal of existing UK infrastructure is driven

by a number of factors including:

-- a commitment by the Government to level up the economy

by investing GBP600bn 2 in an infrastructure-led recovery,

two-thirds of which will be in the transport and energy

sectors, with fiscal stimulus measures likely to flow

through to lower cost infrastructure maintenance programmes

ahead of larger, more capital-intensive enhancement

schemes;

-- greater focus on sustainability, climate change and

infrastructure resilience as part of the UK's target

of reaching net-zero carbon emissions by 2050, together

with flood risk prevention measures and investment in

nuclear projects, renewables and rail electrification

programmes;

-- population growth increasing the pressure on housing,

transport, energy, water and demand for natural resources;

-- technological innovation, including artificial intelligence,

driving a shift towards digital roads, smart infrastructure

and the transformation of transport and telecommunications

networks; and

-- increased Government regulation to improve safety, efficiency

and resilience of key infrastructure assets leading

to more demanding maintenance, renewal and upgrading

requirements.

Our track record of resilient growth and long-term value

creation

Renew has a strong track record of sustainable value creation

through the economic cycle thanks to the Group's high-quality,

value-accretive compounding earnings model. Over the past five

years, we have delivered:

-- adjusted(1) earnings per share growth of 79 per cent;

-- an increase in dividends of 80 per cent from 10.0p to

18.0p per share

-- an increase in our adjusted(1) operating margin from

5.7 per cent to 6.6 per cent;

-- Group organic revenue growth of 36 per cent and total

revenue growth of 77 per cent; and

-- five strategic acquisitions supported largely by our

strong free cash flow, deploying GBP173m.

Our track record of reliable revenue growth, cash generation and

conservative approach to gearing has resulted in our ability to

deliver highly predictable, consistent organic earnings growth as

well as funding for the acquisition of complementary businesses

that meet our strategic requirements.

Results overview

During the period, Group revenue increased to GBP960.9m (FY2022:

GBP849.0m), with organic growth of 10% and the Group achieved an

adjusted (1) operating profit of GBP63.6m (FY2022: GBP58.8m).

Statutory operating profit was GBP59.0m (2022: GBP50.0m). Adjusted

(1) operating profit margin was 6.6%. As at 30 September 2023, the

Group had pre-IFRS16 net cash of GBP35.7m (30 September 2022: net

cash GBP20.2m). The Group's order book at 30 September 2023

remained strong at GBP860m (FY2022: GBP775m) underpinned by

long-term framework positions.

Dividend

The Group's robust trading performance, cash position and strong

forward order book have given the Board the confidence to declare a

final dividend of 12.00p (FY2022: 11.33p) per share. This

represents a full year dividend of 18.00p which is a 5.8 per cent

increase over the prior year. This will be paid on 8 March 2024 to

shareholders on the register as at 9 February 2024, with an

ex-dividend date of 8 February 2024.

Engineering Services

Our Engineering Services activities account for over 98 per cent

of the Group's adjusted (1) operating profit and delivered revenue

of GBP887.5m (FY2022: GBP778.9m) with an adjusted (1) operating

profit of GBP64.3m (FY2022: GBP59.1m) resulting in an adjusted(1)

operating margin of 7.2% (FY2022: 7.6%). At 30 September 2023, the

Engineering Services order book was GBP777m (30 September 2022:

GBP717m). The Group's resilient performance was driven by continued

positive momentum across our markets. We continue to resecure

positions for CP7 in Rail, we have expanded our range of

capabilities in the Water sector and we continue to see strong

demand in our Telecoms activities.

Rail

Network Rail, a significant strategic customer for the Group, is

investing GBP53bn(3) over the current control period ("CP6"), which

runs to March 2024. With CP6 drawing to a close and CP7 scheduled

to start on 1 April 2024, the Group has been focusing efforts on

securing framework extensions and expanding framework positions for

CP7. In May 2023, Network Rail set out its Strategic Business Plan

("SBP") for CP7 which laid out a commitment of GBP44bn4 in the

operations, maintenance and renewal of the railway in England and

Wales. Whilst this spending commitment may appear to be a reduction

from the previous control period, it's important to note that CP7

doesn't allocate a separate enhancement budget so the maintenance

and renewals programme which directly supports our business is

actually 2.5% higher than the projected CP6 expenditure.5 The ORR

has since proposed that Network Rail increase the amount it spends

on renewal and maintenance of its core assets on the rail network

by a further GBP600m over the control period. As the largest

provider of multidisciplinary maintenance and renewals engineering

services to Network Rail, we support the day-to-day operation of

the rail network nationally, directly delivering essential asset

maintenance through our long-term frameworks. The Group assists the

network through mission-critical renewals and maintenance services

supporting assets including bridges, embankments, fencing,

devegetation, tunnels, drainage systems, signalling,

electrification and plant.

During the period, we were the largest provider of maintenance

and renewals services to Network Rail nationally and achieved early

success in securing CP7 frameworks with Wales & Western on

their Wales Structures and Wales & Western Electrification

& Plant frameworks and in North West and Central on the

Reactive Maintenance Framework. It was particularly pleasing to win

the Wales & Western Electrification & Plant frameworks as

this work will be delivered through a unique collaboration between

AmcoGiffen, REL and QTS ("ARQ") and again illustrates the expanding

number of frameworks we are able to target through leveraging the

capabilities within the businesses we have recently acquired

complementing the existing Group. Elsewhere we expanded our

credentials in emergency project delivery with Network Rail through

our excellent work across the country. Throughout the year the

Group assisted on projects which included major flooding incidents

and landslides, whilst the Group's rock armour resilience work in

Wales received excellent media coverage and accolades from Network

Rail. Our early success in securing CP7 framework positions gives

us confidence that we will be able to unlock further opportunities

across other regions during the upcoming CP7 framework awards.

In our half year results, I wrote that we were mindful of

speculation regarding public expenditure budgets for CP7 being

constrained but we were continuing to see record demand for our

services internally. Following the publication of Network Rail's

SBP, it's clear there is an emphasis on driving as much value out

of investment as possible with a focus on "what customers and wider

society value most".6 This has resulted in an expanded budget in

the area of renewals and maintenance which is good news for our

Rail businesses.

The compelling maintenance-focused structural growth drivers

within this sector and Renew's high-quality engineering expertise

leaves the Group ideally positioned to deliver long-term,

profitable growth in Rail. We continue to be confident of retaining

our existing frameworks which are coming up for renewal and

expanding upon those positions in CP7. We have previously

highlighted in our results statements the opportunities we see in

electrification of the rail network so it is pleasing to see that

it has been included as one of five CP7 objectives in Network

Rail's SBP. Our three rail brands have formed a collaborative and

unique position for Overhead Line Electrification delivery, and

this will become an increasing strategic focus for the Group.

Infrastructure

Highways

The Group continued to make good operational and strategic

progress within Highways during the period, continuing work on the

National Highways Scheme Delivery Framework ("SDF") across five

framework lots, covering civil engineering, road restraint systems

and drainage disciplines, worth GBP147m over six years. This work,

delivered through a joint venture between two of our brands,

successfully completed its first projects during the year, drawing

client praise for delivery and performance. This joint venture is

only the second successful joint venture on the SDF and makes the

Group the second largest supplier of road restraint systems in the

country.

Elsewhere, we were successful in securing a position on the new

Manchester City Council Highways Framework for two years with an

option to extend for a further two. We are delighted to have made

progress in developing a work bank in Scotland which is a new

region for our Highways business. The success the Group has enjoyed

in delivering essential asset maintenance and critical

infrastructure renewals across the country's strategic road network

leaves it ideally positioned to take advantage of the increasing

focus on maintenance and renewals over significant enhancement

projects. Our innovative StoneMaster technology continued to be

successfully deployed across the national highways network.

The UK Government's second Road Investment Strategy ("RIS2")

committed an unprecedented level of spending on England's strategic

road network between 2020 and 2025. Of the GBP27.4bn committed over

a five-year period, GBP11.9bn of this funding is ringfenced for

operations, maintenance and renewals which gives Renew a unique

advantage from which it has continued to benefit. We noted in our

half year results that early market consultation for RIS3, which is

scheduled to begin in 2025, suggested that there would be a sharper

focus on critical maintenance and renewals as opposed to

significant road enhancement projects and this appears to be

correct. In May 2023, National Highways published an initial

consultation on RIS3 outlining its proposed priorities highlighting

that renewal of existing assets "is likely to be a growing element

of the roads programme"7 and recognises that users want "existing

roads in good condition before building new ones".8 Further, the

House of Commons Committee report stated "the existing Strategic

Road Network is ageing and requires significant renewal work in

places. The portfolios for RIS3, RIS4 and beyond should prioritise

investment in the maintenance, renewal and resilience of existing

assets over brand new projects."9

With a sharp focus on public expenditure in the current

macroeconomic environment it is clear the Government is

prioritising critical maintenance and renewals programmes over

significant enhancement projects. This emphasis clearly plays to

the strengths of our business and we remain uniquely positioned to

seize attractive growth and market share opportunities within

Highways through the distinctive capabilities within our Group.

Aviation

The Group continues to see growing momentum in Aviation

following its appointment to the 5-year Manchester Airports Group

("MAG") GBP700m Civils Framework to deliver medium-sized

civil-engineering projects valued between GBP3m - GBP10m. The most

pleasing part of our Aviation business is that we were able to move

into this sector organically which has been historically difficult

to do. Our early work at Manchester Airport has led to the Group

securing further frameworks with the successful procurement of

Airfield Works Phase 1 for the MAG worth up to GBP8m but more

importantly providing our team with development and growth

opportunities within the sector. We have seen demand for travel

dramatically increase since 2022 after several years of decreased

demand due to Covid-19 resulting in underinvestment in critical

assets in the sector. Aviation is becoming an area of increased

focus within the Group and we look forward to continuing to seize

opportunities as we grow our credentials in the sector.

Wireless Telecoms

The nation's connectivity is becoming ever more critical in the

digital age, and as a result the wireless telecoms sector contains

many attractive growth drivers. An estimated GBP30bn1(0) is

required to upgrade the nation's broadband networks to

gigabit-capable speeds, which includes the UK Government's GBP5bn

investment in the roll-out of 5G, the expansion of the Shared Rural

Network and the Government's GBP500m programme to extend 4G mobile

coverage to 95% of the UK.

This year was another record year for our Telecoms business as

we continued to design, build and commission infrastructure for all

the nation's major network providers including Vodafone, EE, BT,

VM02 and Three. We are particularly pleased that our recent work

for Vodafone, delivering across multiple programmes, has

established our subsidiary business as a key supplier to them

moving forwards.

We are one of a very limited number of partners responsible for

delivering the major new build sites for the Shared Rural Network,

a complex programme delivering phone and data coverage in very

remote locations driving transformational change for rural

communities. We continue to explore new opportunities in 5G private

networks after our recent completion of a 5G network for the UK

Satellite Application Catapult. Our business continues to evolve to

meet the needs of our niche target markets where we see

considerable opportunities going forward.

Continuing to establish ourselves as a trusted partner to the

nation's network providers will leave the Group well placed to

seize further growth opportunities in the future.

Energy

Nuclear

Having worked for over 75 years in civil nuclear, we provide a

multidisciplinary service through our large complement of highly

skilled employees who operate to demanding nuclear standards,

including decontamination and decommissioning services, operational

support and asset care, as well as waste retrieval in high-hazard

areas such as legacy storage ponds and silos.

The Government's total nuclear decommissioning provision is

estimated at GBP124bn(11) over the next 120 years, with around 75%

of the total spend allocated to Sellafield which is the largest of

the Nuclear Decommissioning Authority's sites and where we remain a

principal Mechanical, Electrical and Instrumentation services

contractor.

In the period, we successfully signed four long-term frameworks

as part of Sellafield's Project Partnership Programme ("PPP"),

which was mobilised in 2019 with GBP7bn of capital projects planned

for the next 20 years1(2) . We will be delivering the frameworks

alongside the PPP's Key Delivery Partners for Heating Ventilation

Air Conditioning ("HVAC"), Electrical and Mechanical Fabrication

and Installation Services.

We continue to operate across a number of other long-term

frameworks at Sellafield, where works include the manufacture of

the first of the Hybrid 2 fuel racks. These enable Sellafield to

safely store all the spent fuel it receives from operating reactors

in its existing storage pond without the need for new facilities.

This further supports the UK decommissioning programme and delivers

significant time and cost savings. Elsewhere at Sellafield, we

continue to make good progress on the Magnox Swarf Storage Silo

programme, one of the UK's most critical decommissioning projects

and our work to decontaminate the first part of the recently closed

Thermal Oxide Reprocessing Plant ("THORP") is progressing at

pace.

Expanding our nuclear capabilities, the Group has been awarded a

place to support a new six-year framework for Nuclear Restoration

Services (formerly Magnox), for mechanical decommissioning and

decontamination services. The programme of work covers 11 sites and

will contribute to the clean-up of the UK's nuclear waste whilst

reducing the environmental impact of the sites and helping to

deliver the Nuclear Decommissioning Authority's strategic

goals.

Post-period end we completed the acquisition of T.I.S. Cumbria

Limited, strengthening our position in nuclear decommissioning and

new build markets. In line with the Group's strategy, the

acquisition enhances Renew's nuclear services offering by

immediately doubling our specialist manufacturing capacity.

While the work we do in this sector is predominantly focused on

decommissioning and waste retrieval in high-hazard areas such as

legacy storage ponds and silos, the budget from the UK Government,

announced earlier this year, suggests that new nuclear will offer

further growth opportunities in the future. The UK Government has

committed to achieving net zero emissions by 2050, and

decarbonisation of our energy supply is a key step to achieving

carbon neutrality. The Government is delivering a radical shift in

the UK energy system towards cleaner, more affordable energy

sources of which new nuclear is an essential component. This is

underpinned by the creation of Great British Nuclear1(3) and the

Government's target to commence construction of up to three new

nuclear plants in the next 10 years. This provides long-term and

sustainable demand for our specialist manufacturing capabilities in

high grade nuclear components which we are investing in and seeing

record demand for.

Electric Vehicle Charging

The transition to Electric Vehicles ("EV") plays a key role in

supporting the UK's ambition of achieving net zero emissions by

2050 and zero vehicle emissions by 2035. A collaboration between

two of our subsidiaries has delivered EV charging solutions to

Network Rail and Volvo Trucks and we continue to grow our services

in this area, having recently been awarded significant UK wide

roll-out projects for two major charge point operators.

Environmental

Water

The Group continues to expand its capabilities in Water and to

grow its network in the sector. The UK's water companies', through

their latest AMP8 business plans, are proposing to almost double

their spending over the next five year control period compared with

that determined in AMP7. With a strengthened position in the

market, we are well positioned to benefit from this increased water

investment. As we prepare for the AMP8 cycle beginning in April

2025, we have taken significant steps to secure our long-term

future with framework proposals for each of our key clients. We

have already received Early Contractor Involvement ("ECI") awards

from Thames Water for three packages of mains renewals works worth

up to GBP200m, which are planned to start in 2024 and run well into

AMP8.

Building on momentum following the acquisition of Enisca in

November 2022 and Browne in 2021, we are making significant strides

in broadening our capabilities and growing our customer network. In

addition, we have secured a new client in South West Water, which

will drive significant organic growth and is testament to the

strength of our strategic and value-add acquisitions and growing

reputation in this sector.

In the period, we have progressed works for Severn Trent Water

and secured places on both Dw r Cymru Welsh Water's Major

Electrical & Mechanical Frameworks and Major Civils Framework,

as well as a further 5-year extension to our Thames Water Area-Wide

Capital Delivery Framework.

With our work for Southern Water, priority compliance and work

completions are at their highest levels for the last 9 years. We

are also setting a new standard for how work is managed and

delivered for Thames Water; from getting onto site within 9 weeks

of receiving an order on design and build for multi-million-pound

packages of works, to handover within 9 days of construction

completion.

We are supporting Yorkshire Water with the delivery of their

storm tank capacity schemes which are needed to satisfy new

increased capacity obligations for storm storage on their

wastewater treatment works. As part of the Water Industry National

Environment Programme, these new consent capacities are spread

across 3 years of delivery up to March 2025.

Further developing the synergies between our brands, the Enisca

Browne joint project has delivered its first works in the Essex and

Suffolk region for Northumbrian Water as the Low Complexity MEICA

Framework commenced, and has seen growth in the value of work

delivered for key client South East Water.

Flood and Coastal

Changing weather conditions continue to highlight the need for

investment in flood defences and we see an increasing focus on

climate and weather resilience. The UK Government has committed

GBP5.2bn1(4) from 2021-2027 to improve flood defence

infrastructure. Of this, GBP1.6bn1(5) is directed towards coastal

erosion and sea flooding projects where the Group currently

undertakes work for the Environment Agency ("EA") on the EA Flood

and Coastal Erosion Framework.

In the period, we secured and delivered our first projects under

the Canal & River Trust Minor Civils Framework and have been

awarded the Leeds City Council Watercourse Maintenance Framework, a

single source direct award maintenance framework supporting our

growth in the Environmental sector.

Land Remediation and Specialist Restoration

In Land Remediation, we continue to see demand for our

specialist environmental services during the period. We continue to

further leverage the synergies of Renew's businesses, including the

unlocking of long-term opportunities at the Palace of

Westminster.

Specialist Building

Our Specialist Building business focuses on the High Quality

Residential, Landmark and Science markets in London and the Home

Counties.

The ultra-high quality residential sector remains resilient with

a number of new projects awarded in the year. Work continues to

progress at Lambeth Palace and the Natural History Museum in our

Landmark sector.

In Science we have been awarded a new framework for the Medical

Research Council at Harwell following the successful delivery of a

new laboratory complex at Hammersmith. In addition, we have

received a number of new awards through our existing Defra

frameworks.

ESG

The Group continues to progress its ESG strategy and, in the

period, has focused on developing reporting disclosures in line

with Climate Related Financial Disclosure regulations, which are

included as part of the 2023 Annual Report & Accounts.

With quantitative targets in place, we continue to focus our

energy on and are making significant progress against our four key

areas:

-- climate action;

-- operating responsibly;

-- empowering our people; and

-- building sustainable social value.

During the period we were pleased to retain our LSE Green

Economy Mark, which recognises London-listed companies and funds

that derive more than 50% of their revenues from products and

services that are contributing the environmental objectives such as

climate change mitigation and adaptation, waste and pollution

reduction, and the circular economy.

It is well recognised that investment into low-carbon

infrastructure will be fundamental in delivering the Government's

ambition to reach net zero by 2050. From the rail network and

digitally assisted roads to high-speed telecoms and clean energy,

Renew has a key enabling role to play on the frontline of efforts

to decarbonise the economy. Alongside our role in progressing the

net zero transition, the Group has committed to reaching net zero

emissions by 2040.

Health and Safety

The health, safety and wellbeing of our colleagues, and those

impacted by our work, is our highest priority and at the heart of

everything we do, and we take seriously our responsibility to

provide a safe workplace for our employees.

We are proud to have in place industry-leading safe working

practices for the Group's employees and operations and are pleased

to be able to report an improved safety performance over the

previous comparative period.

Outlook - outstanding FY23 gives further confidence in the year

ahead

The outstanding trading result achieved in FY23 is testament to

the strength of our business model and the people we employ. To

once again report record results despite the continually shifting

macroeconomic landscape illustrates quite clearly the

differentiated qualities and resilient nature of Renew.

With a heightened focus on public expenditure as a result of the

weak economic landscape, it is clear that the Government is

prioritising investment in maintenance and renewals of existing

infrastructure instead of large-scale enhancement projects. This

plays to the Group's strengths and we have seen evidence of this in

Network Rail's Strategic Business Plan1(6) and the Transport

Committee's Strategic Road Investment report1(7) . We also remain

excited about the growth prospects in Water, a market that is

likely to benefit from significantly increased expenditure over the

next decade and beyond.

To this end, the structural growth drivers in our end markets

have never been more attractive and we remain uniquely positioned

to seize both organic and acquisitive growth opportunities. Our

trading momentum has continued into the new financial year, and we

are excited by the significant opportunities across the Group.

Paul Scott

Chief Executive Officer

27 November 2023

1 Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance

of the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory

performance measures, are included in Note 9.

2 HM Treasury, Autumn budget and spending review 2022 - November

2022

3 Network Rail Delivery Plan, Control Period 6, High Level

Summary - 26 March 2020

4 Network Rail Strategic Business Plan, Control Period 7

- 19 May 2023 Available at:

https://www.networkrail.co.uk/wp-content/uploads/2023/05/England-and-Wales-CP7-Strategic-Business-Plan.pdf

5 Network Rail Strategic Business Plan, Control Period 7

- 19 May 2023, Page 6 Available at:

https://www.networkrail.co.uk/wp-content/uploads/2023/05/England-and-Wales-CP7-Strategic-Business-Plan.pdf

6 Network Rail Strategic Business Plan, Control Period 7

- 19 May 2023, Page 7 Available at:

https://www.networkrail.co.uk/wp-content/uploads/2023/05/England-and-Wales-CP7-Strategic-Business-Plan.pdf

7 Transport Committee, Strategic Road Investment (HC), 2022-23,

HC 904, 27 July 2023 (paragraph 34) Available at:

https://committees.parliament.uk/publications/41071/documents/199999/default/

8 Transport Committee, Strategic Road Investment (HC), 2022-23,

HC 904, 27 July 2023 (paragraph 34) Available at:

https://committees.parliament.uk/publications/41071/documents/199999/default/

9 Transport Committee, Strategic Road Investment (HC), 2022-23,

HC 904, 27 July 2023 (paragraph 35) Available at:

https://committees.parliament.uk/publications/41071/documents/199999/default/

10 UK Government Department for Digital, Culture, Media &

Sport, Future Telecoms Infrastructure Review - 23 July

2018

11 UK Government Nuclear Decommissioning Authority, Nuclear

Provision: the cost of cleaning up Britain's historic nuclear

sites - 4 July 2019

12 The appeal of a 20-year pipeline, (2023). Construction

News. Available at:

https://www.constructionnews.co.uk/partnership-publishing/the-appeal-of-a-20-year-pipeline-02-10-2023/

13 Press statement by The RT Hon Grant Shapps MP, Shapps sets

out plans drive multi-billion pound investment in energy

revolution, (2023). Available at:

https://www.gov.uk/government/news/shapps-sets-out-plans-to-drive-multi-billion-pound-investment-in-energy-revol

ution

14 Lovell, A. 2023. EA Chair says collaboration needed to

protect local economies and nature on the coast. Annual

Coastal Futures Conference, 26 January, London.

15 Lovell, A. 2023. EA Chair says collaboration needed to

protect local economies and nature on the coast. Annual

Coastal Futures Conference, 26 January, London.

16 Network Rail Strategic Business Plan, Control Period 7

- 19 May 2023 Available at:

https://www.networkrail.co.uk/wp-content/uploads/2023/05/England-and-Wales-CP7-Strategic-Business-Plan.pdf

17 Transport Committee, Strategic Road Investment (HC), 2022-23,

HC 904, 27 July 2023 Available at: https://committees.parliament.uk/publications/41071/documents/199999/default/

Group income statement

for the year ended 30 September

Before Exceptional Before Exceptional

exceptional items and exceptional items and

items and amortisation items and amortisation

amortisation of intangible amortisation of intangible

of intangible assets of intangible assets

(see Note (see Note

assets 3) Total assets 3) Total

2023 2023 2023 2022 2022 2022

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue: Group including

share of joint ventures* 960,937 - 960,937 849,048 - 849,048

Less share of joint

ventures' revenue* (39,383) - (39,383) (32,772) - (32,772)

---------------------------- ---- ------------- ------------- --------- ------------- ------------- ---------

Group revenue from

continuing activities 2 921,554 - 921,554 816,276 - 816,276

Cost of sales (786,503) - (786,503) (693,336) - (693,336)

------------- ------------- --------- ------------- ------------- ---------

Gross profit 135,051 - 135,051 122,940 - 122,940

Administrative expenses (75,384) (4,413) (79,797) (68,184) (8,527) (76,711)

Other operating income 3,865 - 3,865 3,655 - 3,655

Share of post-tax

result of joint ventures 77 (231) (154) 362 (267) 95

------------- --------- ------------- ---------

Operating profit 2 63,609 (4,644) 58,965 58,773 (8,794) 49,979

Finance income 360 - 360 16 - 16

Finance costs (1,285) - (1,285) (573) - (573)

Other finance income

- defined benefit

pension schemes 66 - 66 33 - 33

------------- ------------- --------- ------------- ------------- ---------

Profit before income

tax 62,750 (4,644) 58,106 58,249 (8,794) 49,455

Income tax expense 5 (12,600) 1,554 (11,046) (11,330) 1,782 (9,548)

------------- ------------- --------- ------------- ------------- ---------

Profit for the year

from continuing activities 50,150 (3,090) 47,060 46,919 (7,012) 39,907

------------- ------------- ------------- -------------

Loss for the year

from discontinued

operations 4 (3,676) (2,242)

Profit for the year 43,384 37,665

--------- ---------

Basic earnings per share from continuing

activities 7 63.47p (3.91)p 59.56p 59.52p (8.89)p 50.63p

Diluted earnings per share from

continuing activities 7 63.28p (3.90)p 59.38p 59.30p (8.87)p 50.43p

--- ------ --------- ------ ------ --------- ------

Basic earnings per share 7 63.47p (8.56)p 54.91p 59.52p (11.74)p 47.78p

Diluted earnings per share 7 63.28p (8.54)p 54.74p 59.30p (11.70)p 47.60p

--- ------ --------- ------ ------ --------- ------

* Alternative performance measure, please see Note 9 for further

details.

Group statement of comprehensive

income

for the year ended 30 September

2023 2022

GBP000 GBP000

Profit for the year 43,384 37,665

Items that will not be reclassified to profit or loss:

Movement in actuarial valuation of the defined

benefit pension schemes 387 347

Movement on deferred tax relating to the pension

schemes (106) (240)

------ ------

Total items that will not be reclassified to profit or loss 281 107

------ ------

Total comprehensive income for the year net of tax 43,665 37,772

------ ------

Group statement of changes in equity

for the year ended 30

September

Share Capital Cumulative Share based

Share premium redemption translation payments Retained Total

capital account reserve adjustment reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2021 7,868 66,378 3,896 1,308 1,079 44,290 124,819

Transfer from income statement

for the year 37,665 37,665

Dividends paid (13,281) (13,281)

New shares issued 18 18

Recognition of share based

payments 658 658

Vested share option transfer (362) 362 -

Reclassification on closure

of overseas subsidiaries (1,308) (1,308)

Actuarial movement recognised

in pension schemes 347 347

Movement on deferred tax

relating

to the pension schemes (240) (240)

------- ------- ---------- ----------- ----------- -------- --------

At 30 September 2022 7,886 66,378 3,896 - 1,375 69,143 148,678

Transfer from income statement

for the year 43,384 43,384

Dividends paid (13,683) (13,683)

New shares issued 27 41 68

Recognition of share based

payments 669 669

Vested share option transfer (777) 777 -

Actuarial movement recognised

in pension schemes 387 387

Movement on deferred tax

relating

to the pension schemes (106) (106)

At 30 September 2023 7,913 66,419 3,896 - 1,267 99,902 179,397

------- ------- ---------- ----------- ----------- -------- --------

Group balance sheet

At 30 September

2023 2022*

GBP000 GBP000

Non-current assets

Intangible assets - goodwill 148,805 138,445

- other 27,869 22,385

Property, plant and equipment 19,400 17,834

Right of use assets 19,174 15,519

Investment in joint ventures 3,979 5,538

Retirement benefit asset 2,456 2,230

Deferred tax assets - 2,899

221,683 204,850

------------- ------------

Current assets

Inventories 4,169 2,613

Assets held for resale - 1,250

Trade and other receivables 187,311 164,590

Current tax assets 814 -

Cash and cash equivalents 35,657 27,559

------------

227,951 196,012

------------- ------------

Total assets 449,634 400,862

------------- ------------

Non-current liabilities

Lease liabilities (10,733) (8,640)

Retirement benefit obligation (822) (1,049)

Deferred tax liabilities (7,363) (7,568)

Provisions (338) (338)

------------

(19,256) (17,595)

------------- ------------

Current liabilities

Borrowings - (7,341)

Trade and other payables (228,677) (212,684)

Lease liabilities (6,945) (5,884)

Current tax liabilities - (595)

Provisions (15,359) (8,085)

------------- ------------

(250,981) (234,589)

------------- ------------

Total liabilities (270,237) (252,184)

------------- ------------

Net assets 179,397 148,678

------------- ------------

Share capital 7,913 7,886

Share premium account 66,419 66,378

Capital redemption reserve 3,896 3,896

Share based payments reserve 1,267 1,375

Retained earnings 99,902 69,143

------------- ------------

Total equity 179,397 148,678

------------- ------------

*reclassification between cash and borrowings (please see accounting policy

note 1)

Group cashflow statement

for the year ended 30 September

2023 2022

GBP000 GBP000

Profit for the year from continuing operating

activities 47,060 39,907

Share of post-tax trading result of joint

ventures 154 (95)

Impairment and amortisation of intangible

assets 6,014 8,109

Gain on remeasurement of existing equity

asset (2,164) -

Research and development expenditure credit (1,249) (1,353)

Depreciation of property, plant and equipment

and right of use assets 10,688 10,136

Profit on sale of property, plant and equipment (822) (830)

Increase in inventories (1,348) (534)

Increase in receivables (14,060) (7,455)

Increase in payables and provisions 11,247 10,986

Current and past service cost in respect

of defined benefit pension scheme - 23

Cash contribution to defined benefit pension

schemes - (315)

Charge in respect of share options 669 657

Finance income (360) (16)

Finance expense 1,219 540

Interest paid (1,285) (573)

Income taxes paid (11,767) (7,595)

Income tax expense 11,046 9,548

-------- --------

Net cash inflow from continuing operating

activities 55,042 61,140

Net cash outflow from discontinued operating

activities (1,265) (3,977)

Net cash inflow from operating activities 53,777 57,163

-------- --------

Investing activities

Interest received 360 16

Dividend received from joint venture - 265

Proceeds on disposal of property, plant and

equipment 1,251 1,514

Purchases of property, plant and equipment (5,509) (5,056)

Acquisition of subsidiaries net of cash acquired (13,324) -

-------- --------

Net cash outflow from investing activities (17,222) (3,261)

-------- --------

Financing activities

Dividends paid (13,683) (13,281)

Issue of share equity 68 18

New loan 23,000 18,000

Loan repayments (23,000) (22,373)

Repayments of obligations under lease liabilities (7,501) (6,693)

-------- --------

Net cash outflow from financing activities (21,116) (24,329)

-------- --------

Net increase in continuing cash and cash

equivalents 16,704 33,550

Net decrease in discontinued cash and cash

equivalents (1,265) (3,977)

-------- --------

Net increase in cash and cash equivalents 15,439 29,573

Cash and cash equivalents at beginning of

year 20,218 (9,355)

Cash and cash equivalents at end of year 35,657 20,218

-------- --------

Bank balances and cash 35,657 27,559

Bank overdraft - (7,341)

-------- --------

Cash and cash equivalents at end of year 35,657 20,218

-------- --------

Notes

1 Basis of preparation

The consolidated financial statements for the year ended 30

September 2023 have been prepared in accordance with International

Financial Reporting Standards ("IFRS"). These preliminary results

are extracted from those financial statements.

Going concern

The Board has concluded that it is appropriate to adopt the

going concern basis, having undertaken a rigorous review of

financial forecasts and available resources. The Directors have

robustly tested the going concern assumption in preparing these

financial statements, taking into account the Group's liquidity

position at 30 September 2023. The Directors have considered the

results of the stress testing of key assumptions and consider the

likelihood of events or circumstances that would impact the going

concern assessment as collectively remote. The Directors have

reviewed the period to 31 December 2024.

Prior year restatement

In the prior year, the Group incorrectly offset a net

GBP7,341,000 overdraft balance with one financial institution

against a positive cash balance with another financial

institution.

However, since the cash balance was with a different

institution, there was no legal right of offset. As a result of the

error, a restatement has been recorded to increase Cash and cash

equivalents by GBP7,341,000 to GBP27,559,000 and Bank overdraft,

disclosed within Borrowings, has also increased by GBP7,341,000

from GBPNil. The restatement does not impact net assets, nor any

other primary statement.

2 Segmental analysis

The Group is organised into two operating business segments plus

central activities which form the basis of the segment information

reported below. These segments are:

Engineering Services, which comprises the Group's engineering

activities which are characterised by the use of the Group's

skilled engineering workforce, supplemented by specialist

subcontractors where appropriate, in a range of civil, mechanical

and electrical engineering applications;

Specialist Building, which comprises the Group's building

activities which are characterised by the use of a supply chain of

subcontractors to carry out building works under the control of the

Group as principal contractor; and

Central activities, which include the leasing and sub-leasing of

some UK properties and the provision of central services to the

operating subsidiaries.

Group Group Group

including Less revenue revenue

share share

of joint of joint from continuing from continuing

ventures ventures activities activities

Revenue is analysed as

follows: 2023 2023 2023 2022

GBP000 GBP000 GBP000 GBP000

Engineering Services 887,541 (39,383) 848,158 746,145

Specialist Building 73,375 - 73,375 70,125

---------------- ----------------

Segment revenue 960,916 (39,383) 921,533 816,270

Central activities 21 - 21 6

----------- ---------- ----------------

960,937 (39,383) 921,554 816,276

----------- ---------- ---------------- ----------------

Analysis of profit on ordinary activities before taxation from

continuing activities

Before Before

exceptional Exceptional exceptional Exceptional

items and items and items and items and

amortisation amortisation amortisation amortisation

of intangible of intangible of intangible of intangible

assets assets assets assets

2023 2023 2023 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Engineering Services 64,275 (4,084) 60,191 59,123 (8,376) 50,747

Specialist Building 1,269 - 1,269 1,679 - 1,679

Segment operating

profit 65,544 (4,084) 61,460 60,802 (8,376) 52,426

Central activities (1,935) (560) (2,495) (2,029) (418) (2,447)

-------------- -------------- -------- -------------- -------------- --------

Operating profit 63,609 (4,644) 58,965 58,773 (8,794) 49,979

Net financing

costs (859) - (859) (524) - (524)

-------------- -------- -------------- -------------- --------

Profit on ordinary

activities before

income tax 62,750 (4,644) 58,106 58,249 (8,794) 49,455

-------------- -------------- -------- -------------- -------------- --------

3 Exceptional items and amortisation of

intangible assets 2023 2022

GBP000 GBP000

Acquisition costs/aborted acquisition costs 560 418

-------- --------

Total losses arising from exceptional

items 560 418

Amortisation of intangible assets 6,245 7,123

Gain on remeasurement of existing equity

interest (2,161) -

Impairment of intangible asset - 1,253

-------- --------

Total exceptional items and amortisation

charge before income tax 4,644 8,794

Taxation credit on exceptional items

and amortisation (1,554) (1,782)

-------- --------

Total exceptional items and amortisation

charge 3,090 7,012

-------- --------

During the year the Company incurred GBP560,000 of costs on

acquiring Enisca Group Ltd. Prior year's

acquisition costs related to an unsuccessful acquisition

opportunity.

On 25 November 2022, the Company acquired the whole of the

issued share capital of Enisca Group Limited which resulted in the

Group owning 100% of Enisca Browne Ltd. The Group previously owned

50% of this Company and accounted for it as a joint venture using

the equity method of accounting. As a result, under IFRS 3 this is

treated as a step acquisition where the previously held equity

interest is remeasured at its acquisition-date fair value with the

resulting gain recognised in the income statement. Further

information on this acquisition can be found in Note 10.

GBP000

Remeasured value 3,566

Less equity interest (previously included

in investments in joint ventures) (1,405)

--------

Gain on remeasurement of existing equity interest 2,161

--------

The Directors in the comparative year made a full provision

of GBP 1,253,000 against Britannia's goodwill carrying value

following the decision to wind down that company's operations.

4 Loss for the year from discontinued operations 2023 2022

GBP000 GBP000

Revenue - -

Expenses (3,676) (2,242)

-------- --------

Loss before income tax (3,676) (2,242)

Income tax charge - -

-------- --------

Loss for the year from discontinued

operations (3,676) (2,242)

-------- --------

On 31 October 2014, the Board reached an agreement to sell

Allenbuild Ltd to Places for People Group Ltd. As a term of the

disposal Renew Holdings plc retained both the benefits and the

obligations associated with a number of Allenbuild contracts. At

the time of the disposal, the sale of this business was accounted

for as a discontinued operation.

During the year an additional provision of GBP3,676,000 (2022:

GBP3,353,000) has been recognised, and because this adjustment

relates to uncertainties directly related to the operations of

Allenbuild before its disposal, this has been classified within

discontinued operations. This additional provision was as a result

of the settlement of historical claims during the financial year

and a subsequent internal reassessment of the likely costs required

to settle other known contractual disputes. The comparative figure

comprised GBP3,353,000 in relation to increases in the provision

partially offset by GBP1,308,000 which related to the recycling of

the foreign currency reserve.

5 Income tax expense

(a) Analysis of expense in

year 2023 2022

GBP000 GBP000

Current tax:

UK corporation tax on profits

of the year (12,447) (10,692)

Adjustments in respect of previous

period 1,164 (193)

---------

Total current tax (11,283) (10,885)

--------- ---------

Deferred tax - defined benefit pension

schemes (29) (87)

Deferred tax - other temporary

differences 266 1,424

--------- ---------

Total deferred tax 237 1,337

--------- ---------

Income tax expense in respect of

continuing activities (11,046) (9,548)

--------- ---------

(b) Factors affecting income tax expense

for the year 2023 2022

GBP000 GBP000

Profit before income

tax 58,106 49,455

--------- ---------

Profit multiplied by standard rate

of corporation tax in the UK of 22%

(2022: 19%) (12,783) (9,396)

Effects of:

Expenses not deductible for

tax purposes (620) (1,705)

Timing differences not provided in

deferred tax - 1,721

Non-taxable income 696 -

Change in tax rate 640 25

Adjustment in respect of tax

losses (143) -

1,164 (193)

--------- ---------

Adjustments in respect of previous

period (11,046) (9,548)

--------- ---------

Corporation tax rate increased from 19% to 25% from April 2023

so profits for the year are subject to a blended rate of 22% (2022:

19%).

Deferred tax has been provided at a rate of 25% (2022: 25%)

following the decision that the UK corporation tax rate should

increase to 25% (effective from 1 April 2023) and substantively

enacted on 24 May 2021. The deferred tax asset and liability at 30

September 2023 has been calculated based on these rates, reflecting

the expected timing of reversal of the related temporary timing

differences (2022: 25%).

The Group has available further unused UK tax losses of GBP23.1m

(2022: GBP23.7m) to carry forward against future taxable profits. A

substantial element of these losses relates to activities which are

not forecast to generate the level of profits needed to utilise

these losses. A deferred tax asset has been provided to the extent

considered reasonable by the Directors, where recovery is expected

to be recognisable within the foreseeable future. The unrecognised

deferred tax asset in respect of these losses amounts to GBP5.8m

(2022: GBP5.9m).

6 Dividends 2023 2022

Pence/share Pence/share

Interim (related to the year ended 30 September

2023) 6.00 5.67

Final (related to the year ended 30 September

2022) 11.33 11.17

------------ ------------

Total dividend

paid 17.33 16.84

------------ ------------

GBP000 GBP000

Interim (related to the year ended 30 September

2023) 4,748 4,472

Final (related to the year ended 30 September

2022) 8,935 8,809

------------ ------------

Total dividend

paid 13,683 13,281

------------ ------------

Dividends are recorded only when authorised and are shown as a

movement in equity rather than as a charge in the income statement.

The Directors are proposing that a final dividend of 12.00p per

Ordinary Share be paid in respect of the year ended 30 September

2023. This will be accounted for in the 2023/24

financial year.

7 Earnings per share

2023 2022

Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence

Earnings before exceptional

items and amortisation 50,150 63.47 63.28 46,919 59.52 59.30

Exceptional items

and amortisation (3,090) (3.91) (3.90) (7,012) (8.89) (8.87)

--------- ------- ------- --------- ------- -------

Basic earnings per share

- continuing activities 47,060 59.56 59.38 39,907 50.63 50.43

Loss for the year from discontinued

operations (3,676) (4.65) (4.64) (2,242) (2.85) (2.83)

--------- ------- ------- ---------

Basic earnings

per share 43,384 54.91 54.74 37,665 47.78 47.60

--------- ------- ------- --------- ------- -------

Weighted average number of

shares ('000) 79,011 79,253 78,825 79,125

------- ------- ------- -------

The dilutive effect of share options is to increase the number

of shares by 242,000 (2022: 299,750) and reduce basic earnings per

share by 0.17p (2022: 0.18p).

8 Preliminary financial information

The financial information set out above does not constitute the

company's statutory accounts for the years ended 30 September 2023

or 2022. Statutory accounts for 2022 have been delivered to the

registrar of companies. The auditor has reported on those accounts;

his reports were (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act 2006.

The statutory accounts for 2023 will be finalised on the basis of

the financial information presented by the Directors in this

preliminary announcement and will be delivered to the Registrar of

Companies in due course.

9 Alternative performance measures

Renew uses a variety of alternative performance measures ('APM')

which, although financial measures of either historical or future

performance, financial position or cash flows, are not defined or

specified by IFRSs. The Directors use a combination of APMs and

IFRS measures when reviewing the performance, position and cash of

the Group.

The Directors believe that APMs provide a better understanding