TIDMRR.

RNS Number : 2064S

Rolls-Royce Holdings plc

06 July 2015

6 July, 2015

ROLLS-ROYCE UPDATES 2015 GUIDANCE AND IMPLICATIONS FOR 2016

We are today updating our 2015 guidance, including a preview of

our expected half-year results, and at the same time identifying a

number of market developments in 2015 that are now expected to have

a more significant impact in 2016. These primarily relate to Civil

Aerospace markets, particularly for our Trent 700 engines during

their transition to the new Trent 7000, business and regional jets,

and in the offshore markets for our Marine business.

Significant market pressures in 2015 and 2016

-- 2015: Civil Aerospace guidance unchanged - Trent 700,

business jet and regional aftermarket headwinds offset by

higher-than-expected benefits from contract provision releases and

widebody aftermarket growth

-- 2016: Civil Aerospace net headwinds of around GBP300m due to

Trent 700, business jet and regional jet aftermarket weakness

-- 2015 and 2016: Offshore markets continue to weaken, reducing

our Marine profit by around GBP85m in both years

Notwithstanding these expected headwinds we continue to believe

that the Group can achieve significant improvements to returns and

cash flow, albeit later than previously indicated.

2015 Full Year

Overall, performance for 2015 for the bulk of our business is

expected to be broadly in line with previous guidance. However,

further deterioration in the offshore market is now expected to

impact full year profit for Marine.

Guidance for 2015 revenue is unchanged for the full year. Group

underlying profit before tax is now expected to be between

GBP1,325m to GBP1,475m, compared to previous guidance of GBP1,400m

to GBP1,550m, reflecting the deterioration in offshore. Free cash

flow for 2015 is now expected to be between GBP(150)m and GBP150m,

compared to previous guidance of between GBP50m and GBP350m. Given

the weaker near-term cash outlook, we will discontinue the current

share buyback programme, having completed GBP500m of the planned

GBP1bn programme in the first half of the year.

In Civil Aerospace, we continue to expect 2015 underlying

revenue and profit within the guided range provided in February of

GBP7,000m to GBP7,300m and GBP800m to GBP900m respectively.

However, we now expect the impact of reduced Trent 700 deliveries

to be greater than initial estimates, reflecting further adverse

developments in the demand for OE and spare engines and related

pricing. In addition, lower-than-expected demand for engines to

power business jets and a softening regional aftermarket will also

adversely impact profit. These market headwinds should be balanced

by good growth in our widebody aftermarket and a

larger-than-expected benefit from the reversal of a balance sheet

provision on the Trent 1000 launch, as a result of an expected

significant improvement in operating performance, and by improved

retrospective TotalCare contract profitability. The value of the

provision release and contract profitability are expected together

to contribute around GBP200m, somewhat more than previously

expected.

We now expect our Marine underlying profit to be between break

even and GBP40m, compared to previous guidance of between GBP90m

and GBP120m. We are reviewing further cost reduction and

restructuring activities in Marine to improve performance which,

including asset impairments, is expected to result in an

exceptional charge of GBP70m to GBP100m which will be recognised

outside underlying profit.

2015 Half Year

As outlined in May, we continue to expect 2015 underlying profit

before tax to be phased more to the second half than in 2014, led

principally by Civil Aerospace and Power Systems. As a result,

first half underlying profit before tax is expected to be between

GBP390m and GBP430m, or around 30% of the full year, compared with

roughly 40% in 2014. Free cash flow is expected to be between

GBP(570)m to GBP(620)m compared with GBP(347)m in the first half of

2014.

We will provide full details of our Interim results on 30

July.

Implications for 2016

Taken together, the recent changes in demand and pricing for our

Trent 700 programme, which is transitioning to Trent 7000, combined

with the reduced demand for our business jet engines and a softer

regional aftermarket, are expected to create a GBP300m net Civil

Aerospace profit headwind into 2016. An improving large engine

aftermarket, led by our higher installed base, and the net GBP90m

benefit of restructuring should largely offset the likely lower

level of TotalCare and other adjustments in 2016. Many of the

changes will not impact cash flows and as a result cash conversion

is expected to improve.

Looking Further Ahead

The successful roll-out of new engines, led in particular by the

Trent XWB, 1000 and 7000, together with a growing aftermarket, is

expected to drive significant revenue growth over the next ten

years as we build toward a 50% share of the installed wide-bodied

passenger market. While the impact of the transition to the Trent

7000 has reduced Trent 700 deliveries, and held back Civil

Aerospace profit in the near term, we are confident that the

important investments we are making to transition our production

will create a strong platform to drive customer service, improved

margins and strong cash flows. In addition, initiatives to reduce

cost and increase focus within the Marine and Power Systems

businesses should help drive good performance improvements and

support a growing profit contribution from our Land & Sea

division as the company continues to reinforce its role as a

leading provider of Better Power for a Changing World.

Warren East, Chief Executive, said:

"I have joined Rolls-Royce because I recognise the fundamental

strength of the business and the scale of the opportunities

available to it. This is a company with exceptional technology and

outstanding long-term prospects. However, I am clearly disappointed

by today's announcement and the impact this will have on our

investors and employees. Notwithstanding the market developments,

it is our responsibility to build a business that is sustainable

and resilient no matter what is thrown at us and this will be my

fundamental priority for the next few years."

"In the near term we have to manage the important transition

from the Trent 700 to the new Trent 7000 and build our capacity to

service the Trent 1000 and XWB programmes. In addition, our Marine

business needs to overcome its offshore market headwinds and

rebuild a consistent trend of improving revenues and margins. Our

immediate priority is to find the performance improvements needed

to deliver these goals and ensure that this world-class business

continues to meet the needs of its customers and shareholders

alike."

Investor Briefing and Conference Call: 8:30 (UK) 6 July

Warren East, CEO, and David Smith, CFO, will host a conference

call and Q&A from 8:30 to 9:30am UK. Please find details of our

conference call below:

Participant dial in details

UK Standard: +44 (0)20 3364 5937

UK Toll free: 0808 2389714

Participant PIN: 694230#

Please access the WebEx via the following link using the event

password: 368540

https://arkadin-event.webex.com/arkadin-event/onstage/g.php?d=708568114&t=a

Interim Results

We will issue our 2015 Interim results on 30 July, with an

investor briefing and live webcast beginning at 8:30am UK.

For further information, please contact:

Investors: Media:

John Dawson Richard Wray

Director - Investor Relations Director of External Communications

Rolls-Royce plc Rolls-Royce plc

Tel: +44 (0)20 7227 9237 Tel: +44 (0)7974 918416

jcdawson@rolls-royce.com richard.wray@rolls-royce.com

Further information about today's call:

Prior to the call, you may test the link for WebEx as

follows:

Test My System Now

Please note that you will need to join the WebEx and dial in to

the call in order to simultaneously see the slides being used and

hear the speakers. Anyone wishing to ask a question will be given

instructions on how to do this once dialled in.

For those who cannot join the call live, a replay is available

via:

Audio Playback Numbers: UK Toll Number: +44 (0)207 075 6589

UK Toll-Free Number: 0800 376 5689

Audio Playback Reference: 368540#

About Rolls-Royce Holdings plc:

1. Rolls-Royce's vision is to create better power for a changing

world via two main business divisions, Aerospace and Land &

Sea. These business divisions address markets with two strong

technology platforms, gas turbines and reciprocating engines.

Aerospace comprises Civil Aerospace and Defence Aerospace. Land

& Sea comprises Marine, Nuclear and Power Systems.

2. Rolls-Royce has customers in more than 120 countries,

comprising more than 380 airlines and leasing customers, 160 armed

forces, 4,000 marine customers including 70 navies, and more than

5,000 power and nuclear customers.

3. Our business is focused on the 4Cs:

-- Customer - placing the customer at the heart of our business

-- Concentration - deciding where to grow and where not to

-- Cost - continually looking to increase efficiency

-- Cash - improving financial performance.

4. Annual underlying revenue was GBP14.6 billion in 2014, around

half of which came from the provision of aftermarket services. The

firm and announced order book stood at GBP73.7 billion at the end

of 2014.

5. In 2014, Rolls-Royce invested GBP1.2 billion on research and

development. We also support a global network of 31 University

Technology Centres, which position Rolls-Royce engineers at the

forefront of scientific research.

6. Rolls-Royce employs over 54,000 people in more than 50

countries. Over 15,500 of these are engineers.

7. The Group has a strong commitment to apprentice and graduate

recruitment and to further developing employee skills. In 2014 we

employed 354 graduates and 357 apprentices through our worldwide

training programmes. Globally we have over 1,000 Rolls-Royce STEM

ambassadors who are actively involved in education programmes and

activities; we have set ourselves a target to reach 6 million

people through our STEM outreach activities by 2020.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTZMGGNZKNGKZZ

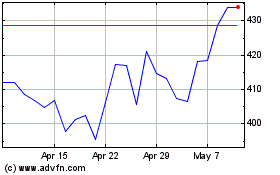

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Dec 2024 to Jan 2025

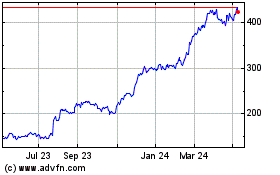

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Jan 2024 to Jan 2025